October 9, 2025

Welcome Back,

Happy Thursday, everyone! 🌤️

Good morning! I hope you’re stepping into the day with energy (and maybe a strong cup of coffee in hand ☕). Thursdays always feel like the moment before momentum — you’re close enough to the weekend to feel it, but there’s still time to make meaningful moves.

Speaking of meaningful moves, here’s a thought: in a world where the economy can shift overnight, how do you protect and grow what you’ve worked so hard for? It’s not just about making money — it’s about keeping it safe, making it work for you, and staying calm while everyone else panics. 💡

Today’s post dives into how to protect and grow your capital in a changing economy — practical steps to stay steady when markets get shaky, and to position yourself to thrive while others are just surviving.

So take a deep breath, stay focused, and remember: real wealth isn’t built in calm times — it’s built by staying smart when things get unpredictable. 🌱

— Ryan Rincon, Founder at The Wealth Wagon Inc.

If you subscribed by accident or wish to no longer receive The Wealth Wagon content click here to un-subscribe →

Quote of The Day

“You can’t use up creativity. The more you use, the more you have.”

— Maya Angelou

Market Update

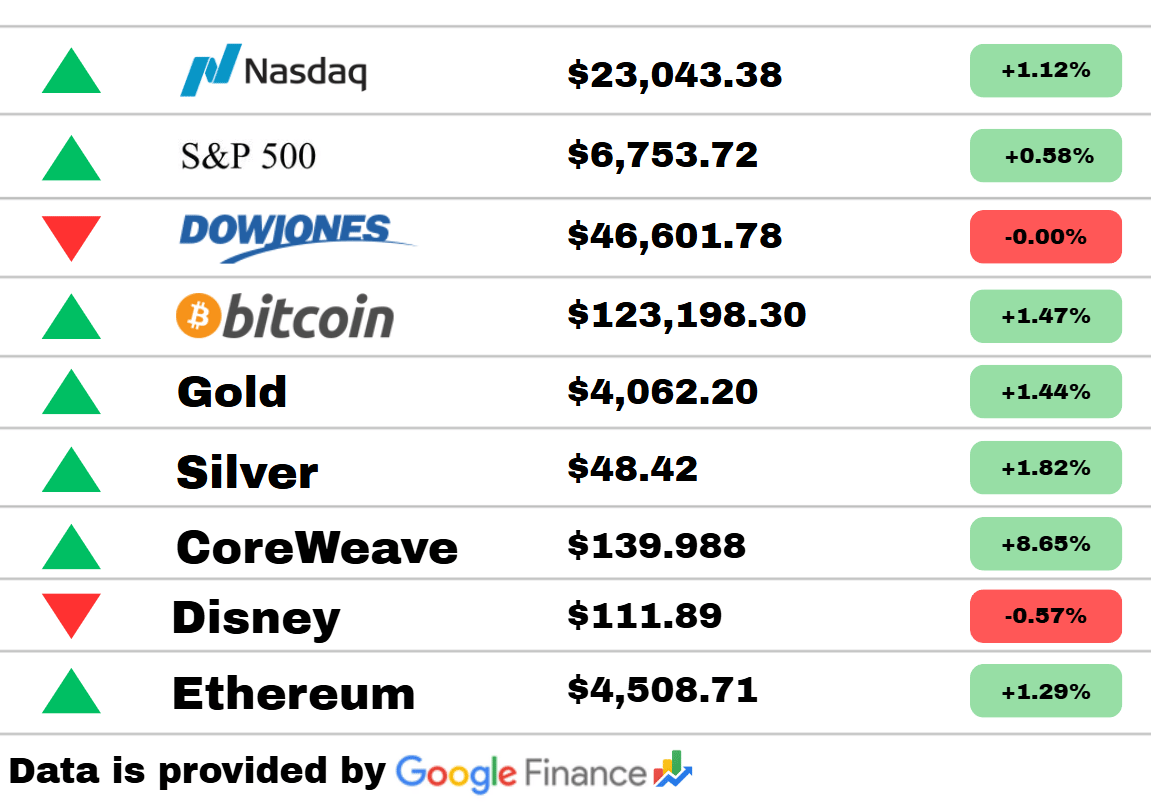

*Market data represents the most recent market close at 5:00pm ET

Market Update: The Nasdaq lit up the scoreboard, rising +1.12% to $23,043.38, while the S&P 500 followed suit with a +0.58% boost to $6,753.72. The Dow Jones? Well, it decided to take the day off — holding flat at $46,601.78, not moving an inch.

Crypto came out swinging! 💎 Bitcoin surged +1.47% to $123,198.30, and Ethereum joined the rally with a solid +1.29% climb to $4,508.71. The digital gold rush continues as both coins flex their muscles.

Speaking of shine — Gold added +1.44% to $4,062.20, and Silver sparkled brightest with a +1.82% jump to $48.42, proving that the metals market still knows how to dazzle.

But the day’s real star? 🌟 CoreWeave, which skyrocketed a massive +8.65% to $139.99 — easily the MVP of the market. On the flip side, Disney lost a bit of its magic, dipping -0.57% to $111.89, perhaps weighed down by some investor concerns.

📈 Market Vibe: Risk-on energy is back! Tech and crypto are leading the charge, metals are glittering, and a few household names are catching their breath. It’s the kind of day that makes traders smile — unless they’re holding Disney stock. 🎢

PRESENTED BY PEAK BANK

Peak Bank’s High-Yield Savings Helps You Reach New Heights

Peak Bank’s high-yield accounts offer intrepid savers the opportunity to maximize the mileage of every dollar, giving you a more solid foothold on your way to the top. Take advantage of rates as high as 4.35% APY* and convenient digital tools with Peak Bank.

Member FDIC

World

Macron expected to appoint new French prime minister within 48 hours

French President Emmanuel Macron may announce his next prime minister soon as he seeks to stabilize his government after political turbulence. The new PM will be tasked with rebuilding public confidence and navigating domestic unrest. Analysts say Macron’s choice could shape France’s political tone heading into 2026.

Trump anticipates Gaza ceasefire deal, may travel to Egypt for signing

Donald Trump expects a Gaza peace deal could be finalized soon, with Egypt serving as the signing location. Sources suggest the framework involves regional security guarantees and humanitarian provisions. The visit, if confirmed, would mark a high-profile diplomatic moment ahead of U.S. elections.

South Sudan “love triangle” dispute leaves at least 14 soldiers dead

A deadly confrontation within South Sudan’s army has claimed at least 14 lives. Authorities describe the clash as sparked by a personal dispute that escalated into widespread violence. The incident underscores persistent instability within the country’s armed forces.

Economy

Ohio soybean farmers reeling as tariffs squeeze exports and profits

Midwestern farmers are struggling under renewed trade tensions. Trump’s new tariffs have slashed soybean sales abroad, leaving warehouses full and cash flow thin. Agricultural groups are pressing for relief measures before harvest season peaks.

IMF chief warns of uncertainty, urges nations to stabilize economies

At a recent forum, the IMF’s managing director cautioned that global growth remains fragile amid inflation and geopolitical strain. She urged governments to prioritize fiscal discipline and sustainable investment. The message highlights worries that major economies may not be ready for another shock.

Mexico braces for U.S. tariff threat on $15B in truck exports

Mexico faces fresh tariff risks on cross-border freight shipments. The proposed measures could hit the auto and logistics sectors hardest, with ripple effects across North America. Trade officials are pushing urgent talks to avoid escalation.

Digital Currencies

Gold outshines Bitcoin, but crypto markets await bullish catalyst

Gold’s surge has overshadowed Bitcoin’s performance as investors flock to traditional safe havens. However, analysts point to upcoming regulatory approvals and ETF inflows as potential crypto tailwinds. Many believe Bitcoin could rebound once risk appetite returns.

Square debuts AI-powered voice ordering and integrated Bitcoin payments

Fintech firm Square is rolling out an AI voice ordering system tied directly to its Bitcoin payment features. The update blends automation with crypto commerce, aimed at small businesses. It signals a growing convergence of AI and blockchain in retail technology.

Walmart’s OnePay expands into crypto; Lloyds leverages tech for cash efficiency

Walmart’s OnePay platform now integrates crypto payment functionality, offering faster and more flexible checkout options. Lloyds Bank is also using automation tools to streamline cash management. Both moves highlight how traditional finance is adapting to digital currency innovations.

Travel

Disney boosts ticket prices for U.S. theme parks again

Disney World and Disneyland will see ticket price hikes this season. The company cites inflation and infrastructure costs, though guests are frustrated by rising vacation expenses. Analysts say Disney’s pricing strategy bets on strong post-pandemic demand to offset declines in attendance.

Guest dies after medical emergency on Disneyland’s Haunted Mansion ride

A visitor suffered a fatal medical episode while riding the Haunted Mansion attraction. Park officials immediately closed the ride and called emergency responders. The tragic incident has prompted Disney to review on-site medical readiness.

Zootopia-themed Disney Vacation Club previews draw positive reactions

Early guests at Disney’s Zootopia DVC preview praised the immersive set design and character integration. The expansion aims to blend storytelling with interactive attractions. Insiders say it’s part of Disney’s broader effort to reinvigorate park experiences with fresh IP.

Business/Retail

Tesla’s cheaper EV models draw lukewarm reactions from reviewers

Tesla’s newly released lower-priced vehicles have hit the market—but reactions are mixed. While affordability improves accessibility, early testers say build quality and features lag behind expectations. The muted response could test Tesla’s brand dominance in the expanding EV field.

Gold prices hit record highs amid growing investor anxiety

Gold’s rally has extended as global tensions and inflation fears drive safe-haven demand. Analysts point to central bank buying and currency volatility as catalysts. The metal’s run underscores a shift toward defensive asset positioning.

GM ends $7,500 EV tax credit but unveils new discount strategy

General Motors is discontinuing its direct federal tax credit program but offering competitive dealer discounts instead. The move aims to keep EV prices attractive while simplifying consumer incentives. Analysts say it could pressure rivals to follow suit as the market matures.

PRESENTED BY PEAK BANK

Bank Boldly. Climb Higher.

Peak Bank offers an all-digital banking experience, providing all the tools and tips you need to make your way to the top. Take advantage of competitive rates on our high-yield savings account and get access to a suite of smart money management tools. Apply online and start your journey today.

Member FDIC

Today’s Snapshot

How to Protect and Grow Your Capital in a Changing Economy

If you’ve been paying attention lately, you’ve probably noticed something: the economy doesn’t “behave” like it used to.

Rates are higher, debt is more expensive, and market volatility feels like the new normal.

And that’s exactly why this is the perfect time to learn how to protect and grow your capital intelligently — without gambling or guessing.

Because building wealth isn’t just about making money — it’s about keeping it, multiplying it, and positioning it safely for the next 10 years.

Here’s how to think about that.

1. Build a Cash Reserve — But Don’t Hoard It

The first rule of smart wealth building is simple: never get caught without liquidity.

In any market, cash buys flexibility.

It lets you:

Weather income fluctuations

Take advantage of opportunities (when others can’t)

Sleep at night without worrying about emergencies

But here’s the nuance:

Too much cash is just slow erosion. Inflation eats away at it.

The sweet spot?

3–6 months of expenses in a high-yield savings account (for security)

Everything else working — in investments, businesses, or assets that beat inflation

Cash is your safety net — not your growth engine.

2. Allocate Based on Risk, Not Emotion

When the market’s up, everyone feels like a genius.

When it’s down, everyone wants to run for the hills.

Smart investors ignore both extremes.

Instead of reacting, they allocate based on risk exposure — not market mood.

A simple approach that works at almost any income level:

30% long-term equities (broad index funds, dividend stocks, etc.)

20% cash & bonds (stability + optionality)

20% alternatives (real estate, private credit, etc.)

20% business or skill investments (your best ROI is usually you)

10% speculative or high-growth (crypto, startups, small caps — optional)

This balance gives you growth without fragility.

The key is flexibility — rebalancing once or twice a year and adjusting as your goals evolve.

3. Use Debt Strategically (Not Emotionally)

Debt isn’t the enemy. Misused debt is.

Used correctly, leverage accelerates wealth creation — especially when the borrowed money buys cash-flowing or appreciating assets.

Ask yourself before taking on any debt:

“Will this debt increase my future cash flow or my lifestyle?”

If it’s the latter, you’re just renting tomorrow’s comfort at today’s cost.

Examples of productive debt:

Real estate that cash flows

A business loan that increases revenue

Equipment that expands capacity

Examples of unproductive debt:

Car loans for luxury vehicles

Credit card balances for convenience

Personal loans for consumption

Use leverage to grow, not to feel richer.

4. Protect the Downside Before Chasing the Upside

The wealthy don’t think in terms of “How much can I make?”

They think, “How much can I lose — and still be fine?”

That’s risk management in one line.

You don’t need to be paranoid, but you do need to:

Diversify across industries, not just asset classes

Keep a clear stop-loss plan for speculative assets

Avoid overexposure to illiquid investments

Get proper insurance (especially for business owners)

One financial shock shouldn’t erase years of work.

If it can, you’re playing offense without defense.

5. Make Your Capital Work in Layers

Think of your money like employees.

Some should work daily, some strategically, and some long-term.

For example:

Short-term capital: High-yield savings, money markets, T-bills

Mid-term capital: Real estate, dividend stocks, or ETFs

Long-term capital: Index funds, private equity, or retirement accounts

Infinite-term capital: Businesses, brand equity, or ownership stakes

Each layer serves a different purpose. Together, they create a resilient portfolio that earns income, compounds value, and withstands shocks.

6. Don’t Outsource Understanding

You don’t need to be a financial expert — but you do need to understand what your money is doing.

You’d be shocked how many people invest for years without ever learning how the thing actually works.

Before you invest in anything, make sure you can clearly explain it to someone else in one sentence.

If you can’t, you’re not investing — you’re speculating blindly.

And that never ends well.

7. Invest in Financial Intelligence

Finally — never stop learning.

The ROI on improving your financial literacy is absurdly high.

Every book, podcast, conversation, or course that deepens your understanding of capital allocation makes you more dangerous (in a good way).

You’ll start recognizing opportunities others miss. You’ll see traps before you step into them.

And you’ll build wealth that doesn’t rely on luck or timing.

Bottom line:

Building and protecting capital isn’t about being smarter — it’s about being more intentional.

You don’t need to predict the market. You just need to prepare for it.

Focus on liquidity, balance, risk management, and understanding — and you’ll be in the top 5% of investors and business owners who actually sleep well and build real wealth over time.

Fun Stuff

😂 Funny Joke

Why did the economist bring a ladder to work?

Because the markets were looking up! 📈😆

💰 Financial History – On This Day (October 9th)

In 2007, the Dow Jones hit a record high of 14,164.53 before the 2008 crash. It was the calm before the economic storm — a classic example of how booms breed bubbles.

🤯 Wild & Wacky Business Fact

In 2020, a company sold “pet rocks” for $25 each… and made millions. The kicker? The rocks came in cardboard boxes with breathing holes. 🪨💸

💡 Would You Rather

Would you rather…

💼 Have the ability to see 10 years into market trends

OR

🧠 Have the power to predict one major innovation each decade?

Thought of The Day

Every challenge hides a seed of opportunity sometimes disguised as frustration. What feels like a roadblock today might be your training ground for greatness tomorrow.

That’s All For Today

I hope you enjoyed today’s issue of The Wealth Wagon. If you have any questions regarding today’s issue or future issues feel free to reply to this email and we will get back to you as soon as possible. Come back tomorrow for another market update, and snapshot. I hope to see you. 🤙

— Ryan Rincon, CEO and Founder at The Wealth Wagon Inc.

Disclaimer: This newsletter is for informational and educational purposes only and reflects the opinions of its editors and contributors. The content provided, including but not limited to real estate tips, stock market insights, business marketing strategies, and startup advice, is shared for general guidance and does not constitute financial, investment, real estate, legal, or business advice. We do not guarantee the accuracy, completeness, or reliability of any information provided. Past performance is not indicative of future results. All investment, real estate, and business decisions involve inherent risks, and readers are encouraged to perform their own due diligence and consult with qualified professionals before taking any action. This newsletter does not establish a fiduciary, advisory, or professional relationship between the publishers and readers.