October 30, 2025

Welcome Back,

Happy Thursday, everyone! ☕💪

Good morning! I hope your day’s off to a smooth start — maybe with a warm cup of something good and a moment to breathe before the world speeds up. Thursdays are that funny in-between day — you’ve built momentum, the weekend’s in sight, and it’s the perfect time to think about the little adjustments that make a big difference.

Speaking of adjustments… today’s topic might just save your wallet and your caffeine budget. 😄

We’re diving into how to protect your money from inflation (without just cutting back on coffee). Because real financial strategy isn’t about giving up the small joys — it’s about making smart, intentional moves that keep your lifestyle sustainable and your money growing.

So grab that latte (guilt-free), take a sip, and let’s make sure your wealth plan can handle whatever the economy throws your way. 🌤️

— Ryan Rincon, Founder at The Wealth Wagon Inc.

If you subscribed by accident or wish to no longer receive The Wealth Wagon content click here to un-subscribe →

Quote of The Day

“In the middle of every difficulty lies opportunity.”

— Albert Einstein

Market Update

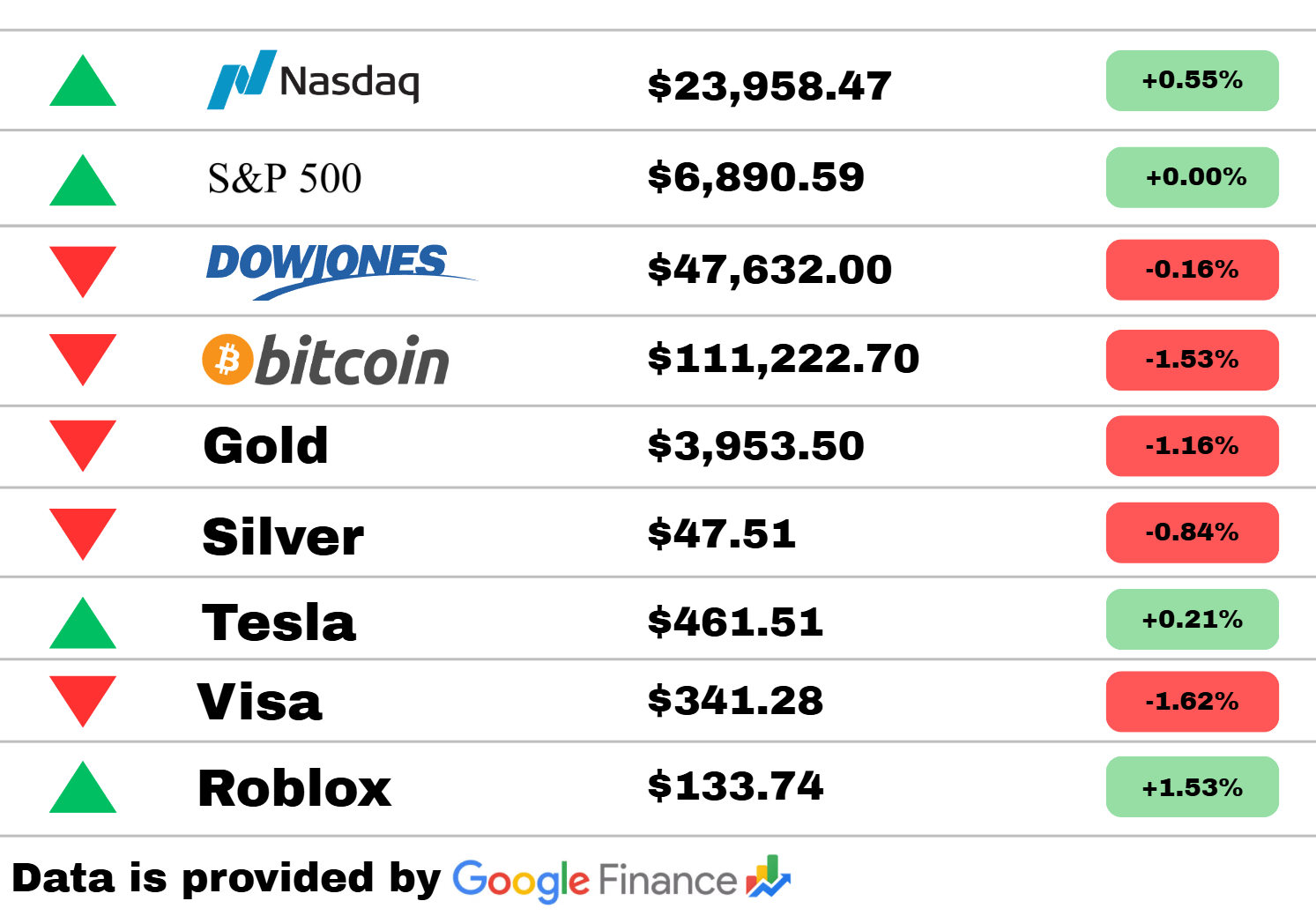

*Market data represents the most recent market close at 5:00pm ET

Market Update: The Nasdaq led the market higher once again, rising +0.55% to $23,958.47, as tech stocks continued to show resilience. The S&P 500 held steady at $6,890.59 with no major change, while the Dow Jones slipped slightly -0.16% to $47,632.00, reflecting a modest rotation away from industrials.

Bitcoin fell -1.53% to $111,222.70, extending its recent pullback amid waning risk appetite in crypto markets. Safe-haven assets didn’t fare much better — Gold dropped -1.16% to $3,953.50, and Silver dipped -0.84% to $47.51, as traders continued to favor equities over metals.

On the corporate front, Tesla nudged up +0.21% to $461.51, showing modest strength ahead of new product updates, while Visa declined -1.62% to $341.28 following a slowdown in spending data. Roblox stood out, jumping +1.53% to $133.74, boosted by optimism in the gaming and digital entertainment space.

📈 The takeaway: A steady Nasdaq and gains in growth names like Roblox offset weakness in metals and crypto. The market mood remains constructive — but investors are keeping one eye on inflation data and rate signals before the next big move.

PRESENTED BY LONG ANGLE

A Private Circle for High-Net-Worth Peers

Long Angle is a private, vetted community for HNW entrepreneurs and executives. No membership fees. What’s inside:

Self-made professionals, 30-55 years old, $5M-$100M net worth

Confidential discussions, peer advisory groups, live meetups

Institutional-grade investments, $100M+ invested annually

Economy

Why the US-China trade deal still matters

Forex Factory reports that the ongoing U.S.-China trade negotiations continue to shape global financial markets, influencing commodity prices and supply chains. Economists note that even limited cooperation between the two powers could stabilize trade routes and restore investor confidence amid geopolitical tensions.

Powell reassures on U.S. economic outlook

Federal Reserve Chair Jerome Powell stated that he does not see “significant deterioration” in the U.S. economy, citing steady job growth and moderate inflation. However, he acknowledged lingering uncertainty surrounding global trade and fiscal policy as potential headwinds.

Fears over “Great Wealth Transfer” taxation

According to Fortune, governments worldwide are expected to target the estimated $80 trillion generational wealth transfer as a new tax source. Analysts predict this could reshape inheritance planning and wealth management strategies for affluent families.

Crypto

Ethereum’s Fusaka upgrade goes live

CoinDesk reports that Ethereum has successfully launched its Fusaka upgrade, introducing major performance and security improvements to the blockchain. Developers say it sets the stage for the upcoming “Hoodi” mainnet rollout, which could further reduce transaction fees.

Western Union enters the stablecoin space

Decrypt confirms that Western Union plans to issue its own stablecoin, USDPt, on the Solana blockchain. The move aims to modernize its remittance network, allowing faster, cheaper international money transfers.

Cathie Wood ramps up crypto investments

Yahoo Finance highlights that ARK Invest CEO Cathie Wood has been buying a range of digital assets, including Bitcoin and Solana-based tokens. Analysts view this as a signal of renewed institutional confidence in the crypto sector.

Travel

Air traffic controllers warn of safety risks

As the U.S. government shutdown delays federal paychecks, The Hill reports that air traffic controllers are expressing concern about system safety. Staffing shortages and stress are prompting warnings of potential disruptions during the upcoming holiday season.

Roller coaster incident leads to lawsuit

A Florida woman has filed a $50,000 lawsuit after being struck unconscious by a flying duck while riding a SeaWorld roller coaster. New York Post reports the victim alleges inadequate safety protections from wildlife hazards.

Houses collapse along North Carolina coast

According to The New York Times, five beachfront homes in the Outer Banks have collapsed due to coastal erosion and rising sea levels. Local officials are urging federal aid for property stabilization and shoreline protection efforts.

Politics

Millions face food aid cuts as benefits expire

The BBC reports that American families are bracing for the expiration of emergency food assistance programs, a change expected to hit low-income households hardest. Lawmakers remain deadlocked over extending funding.

Shutdown negotiations stall

The New York Times notes that efforts to end the ongoing government shutdown have failed again as Democrats rejected a last-minute proposal by federal unions. Pressure continues to mount with critical services facing delays.

Diplomatic spat with Canada intensifies

CBC News reports that the U.S. ambassador to Canada was recorded delivering an expletive-laden outburst at a trade event. The incident has sparked diplomatic unease as both nations navigate escalating trade disputes.

Corporate/Business

Meta’s mixed results unsettle investors

According to Investor’s Business Daily, Meta’s latest earnings report showed strong sales growth but a significant tax hit that dragged profits down 26%. Shares fell as analysts weighed slowing ad revenue growth against robust AI investments.

Nvidia becomes world’s first $5 trillion company

NBC News confirms that Nvidia has reached a $5 trillion market capitalization, cementing its dominance in the AI and semiconductor industries. The milestone reflects massive investor optimism surrounding AI adoption across sectors.

Starbucks faces declining sales amid turnaround

Financial Times reports that Starbucks’ efforts to reverse declining sales have yet to deliver results, with revenue slipping in key markets. The company remains focused on cost-cutting measures and expanding its digital loyalty program.

Today’s Snapshot

How to Protect Your Money from Inflation (Without Just Cutting Back on Coffee)

Let’s get real for a second.

Inflation isn’t just an economic buzzword — it’s the quiet thief in everyone’s wallet.

Every year, your money buys you slightly less than it did before. The latte that cost $4.50 two years ago is $6 now. Your rent creeps up. Your groceries stretch thinner.

And if your money isn’t working harder than inflation, it’s actually losing value while you sleep.

So how do you protect yourself? Let’s break it down.

Step 1: Understand the Real Threat

Inflation is the rate at which prices rise — usually measured by the Consumer Price Index (CPI). But what really matters is your personal inflation rate — the rate at which your lifestyle costs go up.

For example:

You might spend more on housing than the average person — so your inflation rate is higher.

If you travel a lot or eat out frequently, again, higher inflation impact.

Here’s the takeaway:

The “official” inflation rate doesn’t matter if your personal spending outpaces it.

That means your defense strategy needs to be custom to your lifestyle.

Step 2: Don’t Let Cash Sit Too Long

We’ve all been told to “save more money.”

And yes — emergency savings are essential. But too much idle cash is a problem.

When inflation is 3–4% (or more), your savings account paying 0.5% is quietly shrinking in real value.

So here’s the balance:

Keep 3–6 months of expenses in cash (your safety net).

Everything above that? Put it to work.

Where?

High-yield savings or money market funds (short-term, low-risk)

Treasury bills (T-bills) — safe, government-backed, and currently paying decent returns

Short-term bond ETFs — moderate risk, steady yield

Even earning 4–5% instead of 0.5% makes a noticeable difference over time.

Step 3: Invest in Real Assets

If cash loses value, you need assets that rise with inflation — or faster.

Here are a few categories that tend to outperform when prices climb:

🏠 Real Estate

Property values and rents typically rise with inflation.

If you can buy property or invest through REITs (real estate investment trusts), it’s a powerful inflation hedge.

🪙 Commodities

Gold, silver, and energy (like oil) tend to spike when inflation is high.

You can invest through ETFs or mutual funds if you don’t want to buy physical assets.

📊 Stocks (Equities)

Good companies raise prices when costs rise — protecting profits and shareholders.

Look for:

Dividend-paying companies (steady income stream)

Sectors with pricing power: energy, consumer staples, healthcare

🌍 Alternative Assets

Think farmland, fine art, or even fractional ownership platforms (if you’re diversified enough).

These don’t move with traditional markets and can buffer against inflation swings.

Step 4: Rethink Your Debt

Inflation isn’t always bad — especially if you owe money.

Here’s a fun fact:

Inflation actually makes fixed-rate debt cheaper over time.

If you borrowed $300,000 at a 3% fixed mortgage rate, inflation is eroding the real cost of that debt. You’re paying it back in “cheaper” dollars.

So while paying off high-interest debt is smart (credit cards, personal loans), fixed low-interest debt can actually work in your favor.

That’s why some investors keep good debt as part of their wealth strategy — it’s leveraged money that becomes cheaper as inflation rises.

Step 5: Grow Faster Than Inflation

Ultimately, your best defense is to outpace it.

That means growing your income faster than prices.

Here’s how:

Invest in skills — courses, certifications, or learning that boosts your earning power.

Build side income — a freelance gig, consulting, or online business adds flexibility.

Negotiate raises strategically — your employer likely budgets for inflation too.

You can’t always control inflation — but you can control how fast you grow past it.

Step 6: Keep Adjusting

Inflation isn’t a one-time event — it’s a moving target.

Smart investors and business owners adjust as conditions change:

Revisit your budget every 6 months.

Rebalance your investments once a year.

Shift toward higher-yield or inflation-protected options when the economy heats up.

And don’t underestimate your mental flexibility — staying informed and adaptable beats trying to “time” markets or trends.

Real-World Example

Let’s say you’ve got:

$20,000 sitting in a checking account

Inflation running at 4%

Your savings earning 0.5%

That’s an annual loss of about $700 in real value — just by standing still.

Now, move half of it into a 5% high-yield money market account or short-term T-bill ladder — and you’re no longer losing ground.

Small moves. Big impact.

The Bottom Line

Inflation punishes the passive.

But it rewards those who move early and think strategically.

So instead of cutting back on $5 coffees, focus on this:

Keep only necessary cash.

Invest in assets that beat inflation.

Use debt and income growth to your advantage.

That’s how you stop inflation from silently robbing your future — and start using it as the tailwind for your financial growth.

Thought of The Day

Success doesn’t chase speed — it rewards endurance. The ones who keep showing up after failure, fatigue, and fear are the ones who finish first.

That’s All For Today

I hope you enjoyed today’s issue of The Wealth Wagon. If you have any questions regarding today’s issue or future issues feel free to reply to this email and we will get back to you as soon as possible. Come back tomorrow for another market update, and snapshot. I hope to see you. 🤙

— Ryan Rincon, CEO and Founder at The Wealth Wagon Inc.

Disclaimer: This newsletter is for informational and educational purposes only and reflects the opinions of its editors and contributors. The content provided, including but not limited to real estate tips, stock market insights, business marketing strategies, and startup advice, is shared for general guidance and does not constitute financial, investment, real estate, legal, or business advice. We do not guarantee the accuracy, completeness, or reliability of any information provided. Past performance is not indicative of future results. All investment, real estate, and business decisions involve inherent risks, and readers are encouraged to perform their own due diligence and consult with qualified professionals before taking any action. This newsletter does not establish a fiduciary, advisory, or professional relationship between the publishers and readers.