November 25, 2025

Welcome Back,

Happy Tuesday, everyone! 🌞✨

Good morning! I hope you’re waking up feeling energized, grateful, and maybe even just a little curious about what the day might bring. There’s something special about a Tuesday — it’s calm, steady, and quietly powerful… kind of like the financial concept we’re diving into today.

Let me ask you this to start your morning:

How different would your life feel if you chose your work, instead of needing your work?

Most people don’t think about this until stress, burnout, or a surprise life event forces them to. But the smartest people — the ones who always seem one step ahead — build something called career optionality long before they ever need it.

— Ryan Rincon, Founder at The Wealth Wagon Inc.

Quote of The Day

“You become what you give your attention to.”

— Epictetus

Market Update

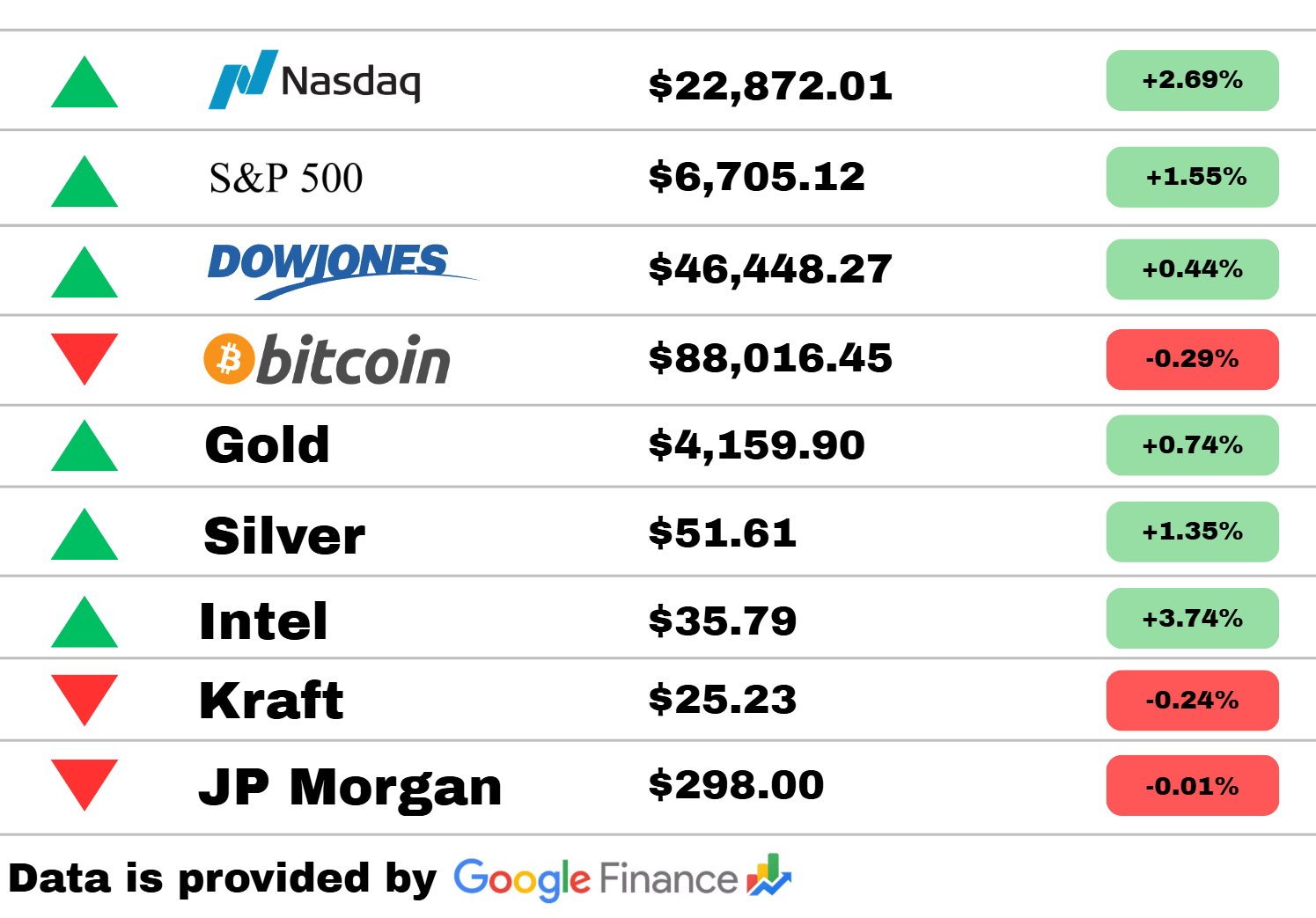

*Market data represents the most recent market close at 5:00pm ET

Market Update: Markets surged across the board today as all three major U.S. indexes closed in the green. The Nasdaq led the rally, jumping +2.69% to $22,872.01, boosted by strength in growth and semiconductor names. The S&P 500 followed with a solid +1.55%, while the Dow Jones added +0.44%, signaling broad optimism across sectors.

In crypto, Bitcoin slipped slightly, down -0.29% to $88,016.45, cooling off after yesterday’s momentum. Gold continued to grind higher, up +0.74%, and Silver outperformed with a strong +1.35%, showing renewed interest in defensive metals.

On the equity side, Intel stood out, soaring +3.74% as investors piled back into chipmakers. Meanwhile, Kraft dipped -0.24%, and JP Morgan hovered essentially flat at -0.01%, suggesting a quiet day for financials.

Overall, today’s moves highlight a market leaning risk-on, but still keeping one eye on safety assets like metals.

PRESENTED BY FISHER INVESTMENTS

7 Actionable Ways to Achieve a Comfortable Retirement

Your dream retirement isn’t going to fund itself—that’s what your portfolio is for.

When generating income for a comfortable retirement, there are countless options to weigh. Muni bonds, dividends, REITs, Master Limited Partnerships—each comes with risk and oppor-tunity.

The Definitive Guide to Retirement Income from Fisher investments shows you ways you can position your portfolio to help you maintain or improve your lifestyle in retirement.

It also highlights common mistakes, such as tax mistakes, that can make a substantial differ-ence as you plan your well-deserved future.

World

The U.S. administration confirmed that Trump has accepted an invitation from President Xi to visit Beijing in April, signaling a major step toward easing recent diplomatic tensions. The visit is expected to address trade, defense communication, and regional security. Analysts believe the meeting could either stabilize relations or introduce new uncertainties depending on outcomes.

Australian senator Pauline Hanson faced intense backlash after wearing a burqa into parliament as part of a demand to ban the garment. Critics called the act inflammatory and disrespectful, accusing her of using shock tactics to push her political agenda. The incident has reignited debate in Australia over religious freedom and cultural expression.

A volcano in Ethiopia has erupted for the first time in 12,000 years, astonishing geologists and raising concerns for nearby communities. Early seismic readings suggest the eruption could continue for several days, though officials report limited population impact so far. Scientists say the event may offer rare insights into long-dormant volcanic systems.

Digital Currencies

A major analysis suggests Bitcoin’s crash may have been driven by a combination of tightening Federal Reserve policy, large-scale whale sell-offs, and heightened political scrutiny from Congress. Deutsche Bank notes that recent volatility reflects both structural fragility and speculative excess in the crypto ecosystem. Traders remain cautious as liquidity conditions worsen.

Michael Saylor dismissed fears related to the widely discussed DAT crash, calling Bitcoin’s extreme volatility “Satoshi’s gift” and a natural part of decentralized market discovery. He argued that rapid price swings create long-term buying opportunities for committed holders. The broader market, however, remains rattled by cascading liquidations.

Analysts are split on the future of Bitcoin mining giant MARA as the company faces rising energy costs and falling token prices. Some believe its scale and infrastructure position it well for a rebound, while others warn that profit margins could collapse if the market downturn persists. Investors are watching closely to see whether MARA can adapt to harsher conditions.

Business/Corporate

A major landlord has agreed to settle with the state of California after being accused of colluding with other property owners to artificially inflate rents in Los Angeles and several other markets. The settlement includes financial penalties and new oversight requirements aimed at preventing future manipulation. Housing advocates say the case highlights growing concerns about price coordination in tight rental markets.

Tyson is preparing to shut down a large meat-processing plant just weeks after claims of industry collusion surfaced in national political discussions. The closure is expected to impact hundreds of workers and disrupt regional supply chains. Company officials cite shifting market conditions, though critics argue broader competitive pressures may be at play.

A lawsuit alleges that defects in a Tesla vehicle triggered a fiery crash that killed a woman in Tacoma, prompting renewed scrutiny of the company’s safety systems. Attorneys claim the vehicle malfunctioned moments before impact, causing a catastrophic failure. Regulators may investigate whether the incident reflects isolated error or indicates deeper engineering concerns.

Today’s Snapshot

The Financial Impact of “Career Optionality” and Why You Should Build It Before You Need It

Most people think about money strictly in terms of income, budgeting, and investing.

But there’s a silent wealth factor almost nobody talks about — and it affects your lifetime earnings more than the stock market, inflation, or even your job title.

It’s called career optionality.

And if you don’t intentionally build it, you eventually hit a ceiling — either in income, lifestyle, or freedom.

Today, let’s unpack what career optionality actually is, why it matters, and how to build it no matter where you are in your life.

This is real, practical, strategic financial leverage that applies to employees, entrepreneurs, investors, and beginners.

1. What Is Career Optionality?

Career optionality is your ability to pivot — into higher income, better environments, new industries, or more autonomy — without your financial life collapsing.

It’s the difference between:

someone who must stay at their job,

and someone who can walk away tomorrow and land something equal or better.

Optionality gives you:

higher earning power

negotiation leverage

reduced stress

more opportunity

more control

more upside with less risk

It’s a wealth multiplier because the more options you have, the less you tolerate low-value situations — and the faster your income grows.

2. Why Most People Have Zero Optionality (Even High Earners)

Here’s the uncomfortable truth:

A 6-figure salary doesn’t mean you have options.

You might be highly paid but:

locked into a single specialized skill

dependent on one employer

invisible outside your company

unable to market yourself

lacking a network

underdeveloped in contemporary skills

tied to a lifestyle inflated by your paycheck

This means one bad reorganization, one market shift, one new technology, one toxic boss — and your income (and stress level) can collapse overnight.

In contrast, someone with strong optionality has built a buffer of career momentum that no company can take away.

3. The Hidden Financial Benefits No One Talks About

Career optionality increases wealth in three ways:

A) Negotiation Power

If your employer knows you have options, you negotiate:

higher salary

better benefits

flexibility

promotions

project selection

People without optionality negotiate from fear.

People with optionality negotiate from power.

B) Risk-Free Upside

You can pursue:

new roles

new industries

side businesses

freelance work

investment opportunities

…without risking financial collapse.

4. The 3 Levers of Career Optionality (You Only Need Two to Transform Your Life)

Most people think they need to quit their job or become an entrepreneur.

Not true.

Build any two of these levers and your optionality skyrockets.

1. Marketable Skills That Travel

Skills that are useful across industries and economic cycles:

sales

copywriting

data analysis

systems thinking

project management

leadership

technical literacy

AI-assisted work efficiency

If your skills work in multiple markets, you never get stuck.

2. Public Proof of Competence

This might be the most underrated career asset today.

Examples:

content

portfolio

case studies

GitHub

writing

a professional website

documented results

published insights

This makes opportunities find you — and gives you leverage in any negotiation.

3. A Network That Actually Knows You

Not 2,000 LinkedIn connections.

10–50 people who:

have seen your work

trust your skillset

would refer you

would hire you

would collaborate with you

This is the real safety net.

And it’s also the biggest income multiplier.

5. Final Thought

Money alone doesn’t create freedom.

Options create freedom.

Options create confidence.

Options create upward mobility.

Career optionality is the wealth-building strategy behind every high-income professional, every successful entrepreneur, and every person who seems “lucky” when opportunities come their way.

Build optionality now — before you need it — and your income, your security, and your opportunities will all expand.

Thought Of The Day

Your life changes the moment you decide to upgrade your standards. When you expect more from yourself, your habits, opportunities, and results rise to match.

The Wealth Wagon’s Other Newsletters:

The Wealth Wagon – Where it all began, from building wealth to making money – Subscribe

The AI Wagon – AI trends, tools, and insights – Subscribe

The Economic Wagon – Global markets and policy shifts – Subscribe

The Financial Wagon – Personal finance made simple – Subscribe

The Investment Wagon – Smart investing strategies – Subscribe

The Marketing Wagon – Growth and brand tactics – Subscribe

The Sales Wagon – Selling made strategic – Subscribe

The Startup Wagon – Build, scale, and grow – Subscribe

The Tech Wagon – Latest in tech and innovation – Subscribe

Side Hustle Weekly - Actionable side-hustle ideas and income tips - Subscribe

That’s All For Today

I hope you enjoyed today’s issue of The Wealth Wagon. If you have any questions regarding today’s issue or future issues feel free to reply to this email and we will get back to you as soon as possible. Come back tomorrow for another market update, and snapshot. I hope to see you. 🤙

— Ryan Rincon, CEO and Founder at The Wealth Wagon Inc.

Disclaimer: This newsletter is for informational and educational purposes only and reflects the opinions of its editors and contributors. The content provided, including but not limited to real estate tips, stock market insights, business marketing strategies, and startup advice, is shared for general guidance and does not constitute financial, investment, real estate, legal, or business advice. We do not guarantee the accuracy, completeness, or reliability of any information provided. Past performance is not indicative of future results. All investment, real estate, and business decisions involve inherent risks, and readers are encouraged to perform their own due diligence and consult with qualified professionals before taking any action. This newsletter does not establish a fiduciary, advisory, or professional relationship between the publishers and readers.