November 24, 2025

Welcome Back,

Happy Monday, everyone! 🌤️💪

Good morning! I hope you’re stepping into this new week feeling refreshed, focused, and maybe even a little excited about what’s ahead. Mondays get a bad reputation, but honestly? They’re kind of magical — a clean slate wrapped in a calendar page.

Let me ask you something fun to kick us off today:

If your personal finances were a business… would you invest in you?

Most people manage their money like a messy junk drawer — a little bit here, a little bit there, and a couple of mystery subscriptions nobody remembers signing up for. But the truth is…

your money has way more potential when you treat it like an operation instead of an accident.

And here’s the cool part:

When you look at your finances the way a business owner or CFO would — with clarity, intention, and a simple system — you almost always find hidden money you didn’t even realize was there.

— Ryan Rincon, Founder at The Wealth Wagon Inc.

Quote of The Day

“The future depends on what you do today.”

— Mahatma Gandhi

PRESENTED BY MASTERWORKS

Crash Expert: “This Looks Like 1929” → 70,000 Hedging Here

Mark Spitznagel, who made $1B in a single day during the 2015 flash crash, warns markets are mimicking 1929. Yeah, just another oracle spouting gloom and doom, right?

Vanguard and Goldman Sachs forecast just 5% and 3% annual S&P returns respectively for the next decade (2024-2034).

Bonds? Not much better.

Enough warning signals—what’s something investors can actually do to diversify this week?

Almost no one knows this, but postwar and contemporary art appreciated 11.2% annually with near-zero correlation to equities from 1995–2024, according to Masterworks Data.

And sure… billionaires like Bezos and Gates can make headlines at auction, but what about the rest of us?

Masterworks makes it possible to invest in legendary artworks by Banksy, Basquiat, Picasso, and more – without spending millions.

23 exits. Net annualized returns like 17.6%, 17.8%, and 21.5%. $1.2 billion invested.

Shares in new offerings can sell quickly but…

*Past performance is not indicative of future returns. Important Reg A disclosures: masterworks.com/cd.

Media

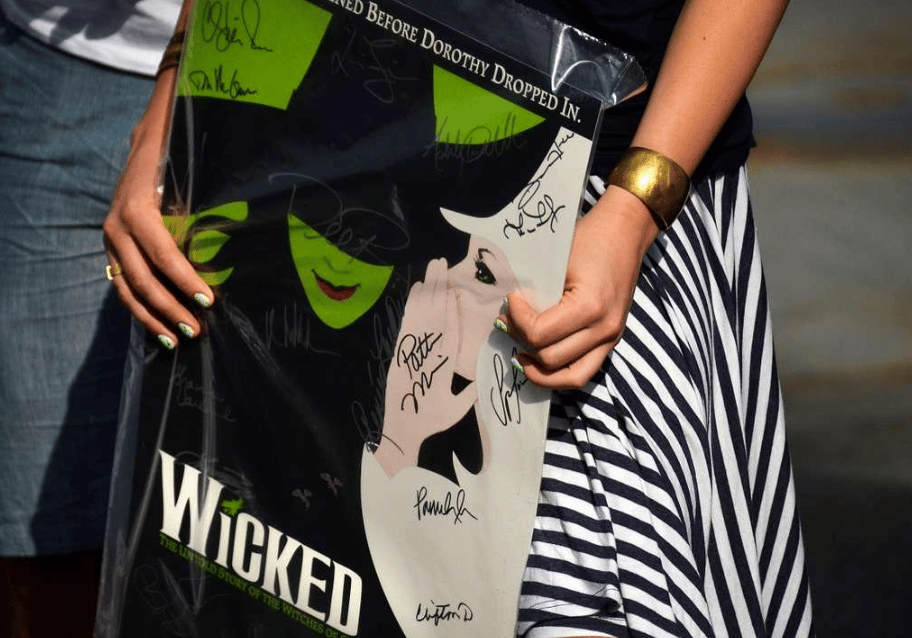

“Wicked: For Good” smashed expectations at the box office, delivering the biggest opening day reported for any film in 2025 so far. Industry analysts say the combination of a dedicated fan base, premium theater formats, and strong early reviews helped propel the surge. The massive turnout suggests the musical adaptation could dominate the holiday movie season.

A second suspect has been identified in connection with the death of Celeste Rivas, the teen found dead inside another teen’s vehicle. Investigators say new evidence has surfaced that ties the suspect to the events leading up to the homicide. The case has drawn widespread attention as authorities continue piecing together the timeline.

Jellybean Johnson, renowned musician and key figure in the Minneapolis Sound movement, has died at 69. Known for his work with the Time and numerous influential funk and R&B artists, Johnson shaped an entire era of modern music. Tributes from across the industry highlight his legacy as both a groundbreaking guitarist and a celebrated collaborator.

Economy

Analysts reviewing the September jobs report say the economy is showing mixed signals, with strong hiring in some sectors and slowing growth in others. Wage gains continue but remain uneven across industries, adding to uncertainty about long-term momentum. Economists warn that policymakers will need to navigate carefully to avoid triggering instability.

Japan has approved a sweeping new stimulus package aimed at boosting spending and stabilizing growth, but markets are reacting with concern. Investors fear the bold measures could deepen the country’s already significant debt burden. The plan includes subsidies, infrastructure spending, and targeted consumer incentives meant to lift demand heading into 2026.

Holiday discounts may not be as deep this year, according to new retail analysis, largely due to persistent tariffs raising costs for imported goods. Retailers are trying to balance demand with tighter margins, limiting how aggressively they can slash prices. Shoppers may still find deals — but not the dramatic markdowns seen in previous holiday seasons.

Science

SpaceX successfully launched another batch of Starlink satellites, marking its 150th Falcon 9 mission of the year — a record-breaking pace for the company. The launch underscores SpaceX’s continued dominance in the commercial launch market. Engineers say the increasing cadence demonstrates improved reliability and operational efficiency.

This week’s top science developments include major updates from NASA, new images from Comet 3I/ATLAS, and internal turbulence within the CDC. Researchers have also highlighted notable breakthroughs across astronomy and biology. The wide range of discoveries reflects a rapidly accelerating period of scientific progress.

Scientists are tracking significant solar-flare-induced disruptions in Earth’s ionosphere, raising concerns for aviation, GPS navigation, and communications systems. The disturbances were caused by a cluster of unusually strong flares over several days. Researchers are monitoring conditions closely as the Sun approaches a peak in its activity cycle.

Today’s Snapshot

How to Audit Your Personal Finances Like a Business (And Find Hidden Money You Didn’t Know You Had)

Most people track their finances emotionally — not strategically.

Businesses don’t do that.

They run audits, review expenses, analyze ROI, adjust budgets, and optimize for profit.

If you start treating your personal finances like a business, you’ll uncover money, remove waste, and create clarity almost instantly.

Here’s a straightforward, practical process your readers can actually apply today.

1. Start With a 90-Day Financial Snapshot

Think of this as your “quarterly report.”

Pull the last 90 days of transactions from:

bank account

credit cards

digital wallets

subscriptions

business expenses (if you're self-employed)

Put everything into a simple spreadsheet with four columns:

Date

Vendor / Category

Amount

Frequency

Why 90 days?

It’s recent enough to reflect your actual habits, but long enough to show patterns.

2. Categorize Every Expense Into Only 3 Groups

Do NOT make 30 categories like budgeting apps do.

It creates confusion, not clarity.

Use only these three:

A) Essentials

Things you must pay to live and work:

rent/mortgage

insurance

groceries

utilities

transportation

childcare

debt minimums

B) Productivity / Investment Expenses

Expenses that improve skills, energy, or earning ability:

courses

tools

fitness

therapy

software you use for work

anything that makes you money or makes you better

C) Lifestyle / Discretionary

Everything else.

Streaming, eating out, convenience purchases, random Target hauls, hobbies, luxury, alcohol, travel, etc.

Once everything is tagged, the truth becomes obvious.

3. Identify “Recurring Leaks” That Don’t Actually Improve Your Life

There are four types of recurring leaks:

Subscriptions you forgot exist

Convenience costs that quietly add up

Upgraded lifestyle purchases you no longer notice

Duplicate services (two gyms, multiple cloud storage plans, etc.)

Most people find between $150–$600/month they didn’t realize they were spending.

That’s $1,800–$7,200 per year.

This money can be redirected to investing, building a cash buffer, or paying debt.

4. Analyze Your “Happiness-to-Cost Ratio”

This part is surprisingly eye-opening.

For every discretionary category, ask:

“How much do I spend here?”

“How much joy does this give me?”

“If I cut this in half, would my quality of life change?”

You’ll find categories where you're overspending just out of habit, not enjoyment.

Example:

Most people don’t actually love their weekly DoorDash habit — they just default to it.

Cutting emotional autopilot spending increases your savings without feeling deprived.

5. Audit Your Income Streams the Same Way

Instead of only auditing expenses, evaluate how stable and scalable your income is.

Break your income into three buckets:

A) Primary Income

What you earn from your job or business.

B) Secondary Income

Side gigs, freelance work, commissions, bonuses.

C) Passive / Investment Income

Dividends, real estate income, interest, digital products, royalties, etc.

Then ask:

Which income stream is the most reliable?

Which has the highest potential upside?

Which should I develop over the next 12 months?

Is my primary income capped?

What skills would increase it?

You’ll start to notice income blind spots you weren’t aware of.

6. Create a 3-Level Action Plan Based on Findings

Your finance audit is useless unless you turn it into a plan.

Use this simple three-tier system:

1. Easy Wins (do within 24–48 hours)

cancel subscriptions

renegotiate bills

switch to cheaper alternatives

automate savings

lower unnecessary recurring purchases

2. Medium Wins (1–4 weeks)

optimize your tax strategy

consolidate debt

set up a proper emergency fund

improve credit score

update insurance

refine budgeting system

3. High-Impact Wins (3–12 months)

develop a new income stream

upgrade a high-value skill

pursue promotion

pivot into a higher-paying role

start a small side-business

increase investment contributions

This transforms your audit into an actual roadmap.

Final Thought

Most people believe they need to make more money to improve their financial life.

But the truth is:

You can create more financial stability, clarity, and momentum simply by treating your personal finances like a business.

Thought Of The Day

Sometimes the biggest breakthroughs come from simply changing your environment. When you shift your surroundings, your perspective, energy, and ambition expand with it.

The Wealth Wagon’s Other Newsletters:

The Wealth Wagon – Where it all began, from building wealth to making money – Subscribe

The AI Wagon – AI trends, tools, and insights – Subscribe

The Economic Wagon – Global markets and policy shifts – Subscribe

The Financial Wagon – Personal finance made simple – Subscribe

The Investment Wagon – Smart investing strategies – Subscribe

The Marketing Wagon – Growth and brand tactics – Subscribe

The Sales Wagon – Selling made strategic – Subscribe

The Startup Wagon – Build, scale, and grow – Subscribe

The Tech Wagon – Latest in tech and innovation – Subscribe

Side Hustle Weekly - Actionable side-hustle ideas and income tips - Subscribe

That’s All For Today

I hope you enjoyed today’s issue of The Wealth Wagon. If you have any questions regarding today’s issue or future issues feel free to reply to this email and we will get back to you as soon as possible. Come back tomorrow for another market update, and snapshot. I hope to see you. 🤙

— Ryan Rincon, CEO and Founder at The Wealth Wagon Inc.

Disclaimer: This newsletter is for informational and educational purposes only and reflects the opinions of its editors and contributors. The content provided, including but not limited to real estate tips, stock market insights, business marketing strategies, and startup advice, is shared for general guidance and does not constitute financial, investment, real estate, legal, or business advice. We do not guarantee the accuracy, completeness, or reliability of any information provided. Past performance is not indicative of future results. All investment, real estate, and business decisions involve inherent risks, and readers are encouraged to perform their own due diligence and consult with qualified professionals before taking any action. This newsletter does not establish a fiduciary, advisory, or professional relationship between the publishers and readers.