November 1, 2025

Welcome Back,

Happy Saturday, everyone! ☀️

Good morning! I hope your weekend is off to a calm and cozy start — maybe with an extra hour of sleep, your favorite breakfast, or that long-overdue slow sip of coffee. Saturdays are for recharging and refocusing — the perfect combo.

Now, here’s a little mindset shift to kick off November strong: what if you ran your personal finances like a business? 📊

Think about it — businesses track cash flow, manage expenses strategically, and reinvest profits to grow. But most people? They just wing it.

Today’s post is all about how to manage your personal finances like a business — without making your life feel like a spreadsheet. Because the truth is, financial freedom starts when you stop thinking like an “earner” and start thinking like a CEO of your own money. 💼

So grab that coffee, pull up your “financial dashboard” (or just your notes app — no judgment here), and let’s get your money working smarter, not harder.

— Ryan Rincon, Founder at The Wealth Wagon Inc.

If you subscribed by accident or wish to no longer receive The Wealth Wagon content click here to un-subscribe →

Quote of The Day

“Don’t wait. The time will never be just right.”

— Napoleon Hill

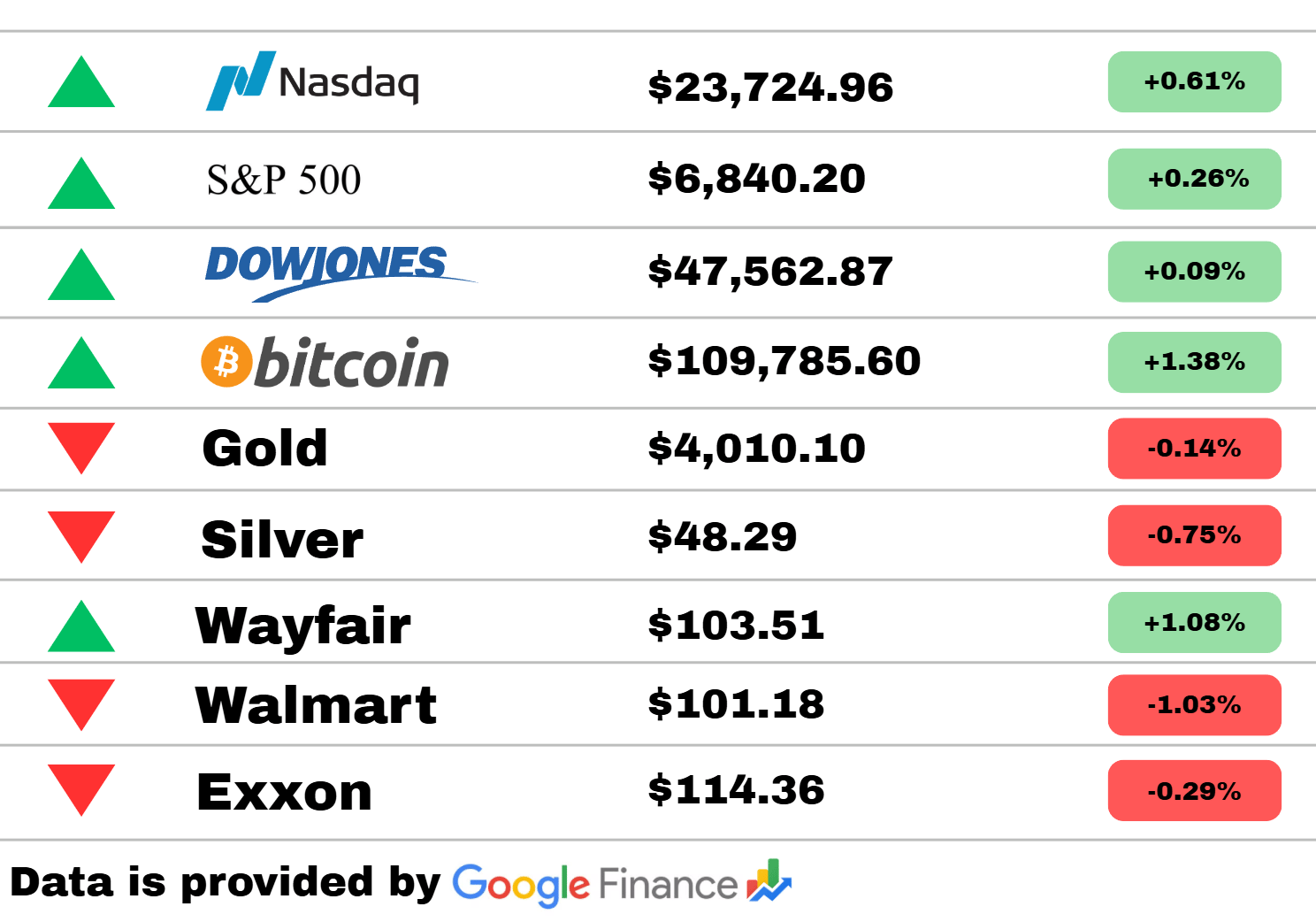

Market Update

*Market data represents the most recent market close at 5:00pm ET

Market Update: The Nasdaq climbed +0.61% to $23,724.96, leading the charge as tech stocks found their rhythm again. The S&P 500 added +0.26% to $6,840.20, while the Dow Jones squeaked out a modest +0.09% to $47,562.87 — small gains, but enough to keep the week’s momentum alive.

Crypto investors smiled as Bitcoin surged +1.38% to $109,785.60, showing resilience after recent volatility. But in the metals pit, things looked a little duller — Gold dipped -0.14% to $4,010.10, and Silver slipped -0.75% to $48.29, as investors rotated back into equities.

Among individual movers, Wayfair was the day’s standout, jumping +1.08% to $103.51 on consumer strength and upbeat home spending data. On the flip side, Walmart slid -1.03% to $101.18, while Exxon edged down -0.29% to $114.36, dragged by softer oil prices.

📊 The takeaway: The bulls are still steering, with tech and crypto leading the pack. Metals lost a bit of shine, but shoppers and digital traders kept the market mood upbeat. A steady climb — not a sprint — is shaping the week’s narrative.

PRESENTED BY LONG ANGLE

A Private Circle for High-Net-Worth Peers

Long Angle is a private, vetted community for HNW entrepreneurs and executives. No membership fees. What’s inside:

Self-made professionals, 30-55 years old, $5M-$100M net worth

Confidential discussions, peer advisory groups, live meetups

Institutional-grade investments, $100M+ invested annually

Economy

Eurozone inflation has slowed for a second consecutive month, providing reassurance to policymakers at the European Central Bank. The decline suggests that recent rate hikes are taking effect, easing pressure on consumers and businesses. Analysts say the ECB is now in a favorable position to maintain stability while monitoring growth risks.

China has agreed to purchase 25 million metric tons of U.S. soybeans annually, marking a major boost for American farmers and trade relations. The agreement is expected to stabilize agricultural prices after months of market volatility. Officials from both countries have described the deal as a step toward rebuilding trust following years of trade tension.

Banks and retailers across the U.S. are experiencing a shortage of pennies after the U.S. Mint halted production. Many stores have begun rounding transactions or offering digital payment incentives to manage the shortfall. Economists say the move could save millions in minting costs annually but may cause small inconveniences for cash customers.

Digital Currencies

Bitcoin prices are holding steady as investors brace for upcoming shifts in the Federal Reserve’s balance sheet policy. Analysts warn that tighter liquidity could weigh on risk assets, but long-term holders remain optimistic. The move comes amid renewed debate over crypto’s role in macroeconomic cycles.

Coinbase has surpassed market expectations, driven by a sharp increase in trading activity and institutional investment. The surge reflects growing interest in cryptocurrencies as investors seek alternatives during traditional market uncertainty. Executives say the company plans to expand global operations and strengthen its regulatory footing.

Wall Street sentiment toward digital assets is improving, with renewed optimism for companies like Carvana, Coinbase, and Meta. Analysts attribute the momentum to improved earnings, strong user engagement, and the broader rebound in technology stocks. Investors are watching closely to see whether the rally can extend into the final quarter of the year.

World

Authorities have captured several suspects involved in the high-profile Louvre heist following an extensive international manhunt. Investigators recovered part of the stolen jewelry and art, though several priceless pieces remain missing. The case has reignited debate over museum security and cross-border art trafficking.

Tensions are mounting in Cameroon as protests erupt over allegations of vote manipulation in the presidential election. Opposition groups claim widespread irregularities, while government forces have been deployed to contain demonstrations. International observers are urging transparency and restraint to prevent further escalation.

Israel’s top military lawyer has resigned after approving the release of a controversial detainee abuse video. The decision has sparked heated debate within the government and armed forces about accountability and transparency. Human rights organizations are calling for a broader inquiry into detainee treatment.

U.S.

The U.S. is preparing potential military strikes against Venezuelan targets amid escalating tensions with the Maduro regime. Defense officials say the response would focus on deterring further human rights abuses and regional destabilization. Washington continues to push for diplomatic solutions but has not ruled out limited military action.

Trade negotiations between the U.S. and China are intensifying as both nations use tariffs and rare earth exports as bargaining tools. The talks aim to reduce trade imbalances while safeguarding national security interests. Analysts believe progress in these discussions could ease global supply chain pressures.

The U.S. has announced plans to cap annual refugee admissions at 7,500, sparking intense domestic and international criticism. Advocates say the policy unfairly prioritizes certain nationalities and undermines the country’s humanitarian commitments. The government argues the decision reflects a need to reform and streamline the immigration process.

Finance

Japan’s yen has posted its steepest monthly drop since July, disappointing markets hoping for intervention by the Bank of Japan. The currency’s weakness has fueled concerns about inflation and import costs, particularly for energy. Economists expect policymakers to face mounting pressure to stabilize the exchange rate.

Health insurance premiums for millions of Californians are set to rise sharply as federal subsidies expire. State officials warn that without renewed support, coverage could become unaffordable for many middle-class families. Consumer advocates are urging Congress to act before open enrollment closes.

The euro continues to trade within a narrow range, holding steady against the dollar as investors await fresh data on inflation and growth. Analysts say the currency’s resilience reflects cautious optimism about Europe’s economic outlook. However, uncertainty surrounding central bank policy remains a key risk factor.

Today’s Snapshot

How to Manage Your Personal Finances Like a Business

Here’s something most people never think about:

Your personal finances are basically a business — whether you realize it or not.

You have revenue (your income).

You have expenses (your bills and spending).

You have profit (what’s left over).

And you have assets and liabilities (your investments vs. your debts).

The only difference between people who get ahead and those who don’t?

The successful ones treat their personal finances like a business they actually care about growing.

Let’s walk through how to do that — step by step.

1. Start by Knowing Your “Numbers”

No business survives without understanding its numbers — and neither can you.

At a minimum, you should know:

Monthly revenue (your after-tax income)

Monthly expenses (every recurring and variable cost)

Net profit margin (how much is left after you pay for life)

If your monthly income is $8,000 and you spend $5,500, your profit margin is roughly 31% — not bad.

Now ask yourself:

“Would I invest in a business that spends 95% of what it earns?”

Probably not. Yet that’s how most people live.

Knowing your “numbers” is step one in gaining control.

2. Separate Personal and Business Finances (Even if You Don’t Own a Business)

It’s shocking how many people blend everything together — one checking account for everything.

Here’s what the wealthy do differently:

They separate money by function.

Set up a simple system:

Operating Account: All your bills and daily spending.

Profit Account: Where savings and investments go first — not last.

Tax/Buffer Account: For quarterly taxes, emergency funds, or large annual expenses.

This setup alone helps you:

✅ Track where your money goes

✅ Avoid accidental overspending

✅ Automate saving and investing

It’s clean. It’s organized. It’s how real businesses operate.

3. Think in Terms of ROI (Return on Investment)

Every business decision gets measured by ROI. Your life should, too.

Ask this about everything you spend or invest in:

“Will this give me a return — financially or in quality of life?”

Examples:

A $1,000 course that raises your earning potential → ✅ ROI positive.

A $60 dinner every weekend that you forget by Monday → ❌ ROI negative.

A $500/month gym membership you use 4x a week → ✅ ROI positive (health = productivity).

This mindset flips how you view spending. You’re no longer just buying — you’re allocating capital.

4. Build an Emergency Fund (Your “Business Reserves”)

Businesses keep reserves for slow months. You need the same.

The rule of thumb:

3–6 months of expenses if your income is stable

6–12 months if you’re self-employed or commission-based

This gives you room to breathe when life hits you with layoffs, downturns, or random chaos.

Think of it as your business’s “cash flow cushion.”

5. Create a Profit Plan

Businesses grow by reinvesting profits. You can do the same.

When you get paid:

Take a percentage for investing (10–20% minimum).

Reinvest in skills or tools that increase earning power.

Pay down high-interest debt (your business’s “bad expenses”).

If you do this consistently, your net worth grows automatically.

Here’s a simple split many use:

Category | % of Income | Purpose |

|---|---|---|

Fixed Expenses | 50% | Rent, utilities, insurance |

Investing/Saving | 20% | Stocks, 401(k), emergency fund |

Growth (skills, biz) | 10% | Courses, networking, software |

Fun | 10% | Travel, hobbies |

Flex Buffer | 10% | Miscellaneous or short-term goals |

Adjust these numbers to your situation — the point is intentionality.

6. Audit Your Finances Quarterly

You know how companies do quarterly reviews? You should, too.

Every 3 months, sit down with a cup of coffee (or a spreadsheet, if you’re that kind of person) and review:

Income growth or decline

Expenses that crept up

Investment performance

Debt progress

New opportunities for returns

You’ll start spotting patterns — like subscriptions you forgot about or side projects that need more attention.

This isn’t about obsessing over every dollar. It’s about operating your life with clarity.

7. Treat Income Growth Like Business Expansion

Businesses grow through new product lines or markets. You grow through new income streams or better monetization of your skills.

Think like a CEO:

What can I do to expand my earning capacity this year?

Is there an opportunity to raise prices, ask for a promotion, or start a side business?

What can I automate or delegate to free up time for higher-value work?

Growth doesn’t just mean “work harder.”

It means think like an owner — someone who creates value, not just earns a paycheck.

8. Pay Yourself Dividends

Here’s a fun one most people skip: reward yourself.

Just like a company distributes profits to shareholders, you should pay yourself “dividends” when you hit milestones — debt-free, hit an investment target, or a big savings goal.

The trick is to celebrate responsibly — something meaningful, not wasteful.

It keeps you motivated while staying disciplined.

The Takeaway

The wealthy don’t accidentally become wealthy — they operate their lives like profitable, well-run companies.

They:

Track their numbers.

Allocate capital efficiently.

Keep reserves.

Reinvest in growth.

Audit and adjust regularly.

If you start managing your personal finances with that same structure, your money will start behaving like a business too — productive, organized, and always growing.

Because at the end of the day, you are the CEO of your financial life.

So start running it like one.

Thought of The Day

Every excuse delays your evolution. You don’t need the perfect plan — just momentum. The first step is never glamorous, but it’s everything. 🚀

That’s All For Today

I hope you enjoyed today’s issue of The Wealth Wagon. If you have any questions regarding today’s issue or future issues feel free to reply to this email and we will get back to you as soon as possible. Come back tomorrow for another market update, and snapshot. I hope to see you. 🤙

— Ryan Rincon, CEO and Founder at The Wealth Wagon Inc.

Disclaimer: This newsletter is for informational and educational purposes only and reflects the opinions of its editors and contributors. The content provided, including but not limited to real estate tips, stock market insights, business marketing strategies, and startup advice, is shared for general guidance and does not constitute financial, investment, real estate, legal, or business advice. We do not guarantee the accuracy, completeness, or reliability of any information provided. Past performance is not indicative of future results. All investment, real estate, and business decisions involve inherent risks, and readers are encouraged to perform their own due diligence and consult with qualified professionals before taking any action. This newsletter does not establish a fiduciary, advisory, or professional relationship between the publishers and readers.