June 24, 2025

Welcome Back,

Happy Tuesday, everyone! 🔄

Good morning! I hope your day is off to a smooth start—bonus points if your socks match and your coffee didn’t betray you.

Now here’s something we don’t talk about enough: changing your mind. It happens. A lot. Careers shift, passions evolve, and that “dream plan” from five years ago might now feel... meh.

Today, we’re diving into Pivot-Proof Wealth—how to build income streams and financial freedom that stay strong, even if you take a new path later. 🚀💡

It’s about designing your money moves with flexibility in mind—so you don’t have to stick with Plan A if Plan B starts sounding better.

Let’s explore how to build wealth that rolls with you, not against you.

“Time is the friend of the wonderful company, the enemy of the mediocre.”

— Warren Buffett

Busyness is often a form of mental laziness.

It takes discipline to pause, think, and do only what matters — in business, leadership, and life.

— Ryan Rincon, Founder at The Wealth Wagon Inc.

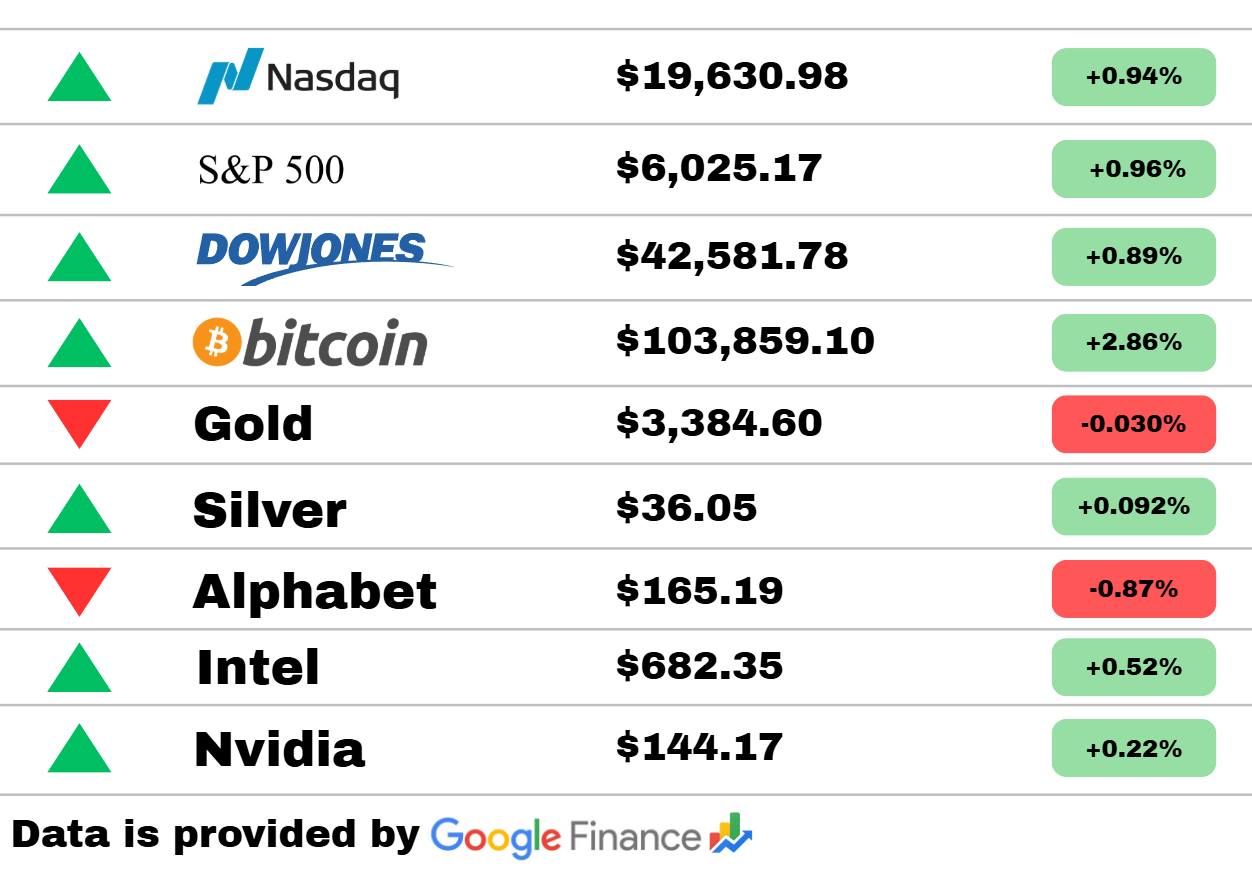

Market Update

*Market data represents the most recent market close at 5:00pm ET

Market Update: The markets bounced back with some pep today, and honestly? It felt like Wall Street had its morning coffee ☕️.

The Nasdaq climbed 0.94%, S&P 500 gained 0.96%, and even the Dow Jones joined the fun with a 0.89% lift. Meanwhile, Bitcoin came in hot, soaring 2.86% like it just remembered it's supposed to be exciting.

Silver sparkled a bit with a tiny +0.09% rise, and Intel and Nvidia followed along with decent gains. The only ones not invited to the party? Alphabet, which slid 0.87%, and gold, down a nearly invisible 0.03%, like it tripped over its own shoelaces.

Today was a green kind of day, with just enough red to keep things interesting. 📈🟢💰

Corporate

CEOs Report 82% ROI on Well-being Programs, But Only When Measured Monthly

A new Wellhub survey reveals that 82% of CEOs see returns on wellness investments—but only if HR tracks impact every month, not just yearly. Regular reporting pushes leaders to expand funding—and turns yoga classes into boardroom wins. CEO buy-in skyrockets when HR proves the value.

Israel Tech Firms Offer Extra Support Amid Rising Tensions

Amid regional unrest, Israeli tech companies—including local Microsoft teams—are providing staff with emergency leave and mental health assistance. It’s a solidarity move and a strategic retention play. When your office is on alert, empathy becomes essential infrastructure.

IMD Study: Co-Created Stress-Busting Solutions Outperform Top-Down Plans

IMD’s new research shows that when employees co-design stress solutions—like flexible hours or peer coaching—they’re twice as effective as executive-mandated programs. Bottom-up equals buy-in; turn your people into your wellness architects. Empowerment + strategy = better outcomes.

AI

Lenovo ‘Hybrid AI’ Services Boost Productivity by 31% in Pilot

Lenovo announced that its hybrid-AI tools improved productivity by 31% during enterprise tests. The goal: combine automation with human smarts to remove bottlenecks. Think of it as AI-as-an-assistant, not an overlord.

97% of Companies Prioritize AI—Only 38% Have Tackled Post-Deployment Issues

Exploding Topics reports that 97% of global firms rank AI as a top priority—yet only 38% are solving post-launch challenges like integration and ROI. Lesson: adoption is easy, but execution is where the rubber meets the cloud. Strategy wins over buzz every time.

Qatar Amplifies Tech Ecosystem with AI-Driven Economic Push

Consultancy reports reveal Qatar is leaning hard into AI and tech transformation—fueling economic diversification beyond oil . Look for government-funded accelerators and AI partnerships flooding its startup scene. Cash meets code on the Gulf.

Economy

Conference Board: U.S. Leading Economic Index Edges Down on Housing & Unemployment

In May, the Leading Economic Index dipped 0.1%—pulled by weak housing permits and rising unemployment insurance filings. No red-flag recession yet, but a clear slowdown is on the radar. Heads-up for strategic planning and cautious capital moves.

Poland's Economic Rebound Postponed After Flat May Data

Poland saw tepid economic performance in May, missing forecasts for recovery despite hopes earlier this year. Key sectors are lagging, and inflation remains sticky—throwing cold water on European forecasts. Emerging market caution may translate to investor volatility.

Denmark’s Business Confidence Climbs as Manufacturing Recovers

Denmark’s manufacturing confidence rose to 98.4 in June, a rebound from the previous decline to 96.3. That’s the highest morale since December 2023—signaling possible EU-wide momentum. If northern Europe is optimistic, global supply chains may sigh with relief.

Travel

Global Business Travel Set to Hit $1.64 Trillion in 2025

New data shows corporate travel spending is projected to reach $1.64 trillion this year—up from $1.48 trillion in 2024. This surge hints at resumed in-person deal-making, conferences, and client meetups. Keep an eye on airline stocks—they’re flying higher.

29% of Companies Expect Business Trips to Drop 20% in 2025

A GBTA survey finds nearly one-third of companies plan to reduce business travel volume by an average of 21% this year. That’s a big shift toward virtual meetings—or tighter travel budgets. Corporate travel managers are revamping policies fast.

AI Concierge Apps Promise Smoother Corporate Trips

Next-gen travel platforms are integrating AI to automate itineraries, adjust flights, and handle disruptions—making travel managers’ jobs easier. Think trip planning done while you sleep. Business travelers might finally ditch the travel chaos.

Fintech

Revolut CEO Could Score Multi-Billion Bonus if Firm Hits $150B Valuation

Revolut’s founder Nik Storonsky stands to double-dip on a Musk-style awards package if valuation booms from £45B to $150B—earning up to an extra 10% stake in stages. That’s stormy weather for European fintech valuations—and a CEO payday to watch. Expect investor intrigue and public scrutiny to ramp up.

PhonePe Sets Sights on $1.5B IPO as Indian Digital Payments Boom Continues

Walmart-backed PhonePe is prepping a $1.5 billion IPO in India, targeting a valuation near $15 billion. With 600 million users and 310 million daily transactions, it's positioning itself as India’s top fintech play. Watch this one—it could be the watershed moment for Indian markets.

Tipalti Acquires AI-Powered Treasury Automation Startup Statement

Fintech provider Tipalti quietly snapped up Statement—a tool that uses AI to automate cash flows and treasury processes. This move reflects a growing trend: fintechs enhancing platforms through smart M&A. CFOs, rejoice—your cash management just got a tech boost.

Today’s Snapshot

“Pivot-Proof Wealth”: How to Make Money Even If You Change Your Mind Later

Let’s be real for a sec…

A lot of people out here are stressing over choosing the “right path.”

The right business idea

The right investment strategy

The right career move

The right niche

The perfect plan

But here’s the truth no one says out loud:

Most successful people have no idea what they’re doing at first.

They’re just willing to start somewhere — and smart enough to build things that still work when they pivot.

Today we’re gonna talk about how to build what I like to call “pivot-proof wealth.”

The kind that:

Grows with you

Doesn’t fall apart when you change direction

Gives you options, freedom, and a financial cushion

Let’s get into it.

💡 Step 1: Stack Skills That Print Options

Want to know the real flex?

Being able to make money even after quitting your job, switching industries, or ditching your last big idea.

To do that, you need skills that follow you anywhere. Stuff like:

Writing clearly (emails, sales pages, LinkedIn posts)

Selling (products, services, ideas — same rules apply)

Creating systems or processes

Managing money like a boss

Building an audience or community

Talking to people and actually getting them to trust you

These are the “I can always figure it out” skills.

Every wealthy person I know has at least two of them dialed in.

🧱 Step 2: Build Assets, Not Just Activities

Activities are things you do once to make money.

Assets are things you do once that keep making money.

Here’s the difference:

Activity | Asset |

|---|---|

Freelancing | A digital product you sell forever |

Coaching 1:1 | A course people buy while you sleep |

Posting content | An email list you own and monetize later |

Making money | Investing money that keeps growing |

You don’t need a million-dollar business.

You just need to start turning your efforts into assets that:

Help people

Solve a small problem

Make their life easier or faster

Even if you pivot next year, those assets still work.

📦 Step 3: Create a “Freedom Product” (Even If You Don’t Sell It Yet)

Let’s talk about what I call a freedom product.

This is something small, digital, and helpful that:

You can create in a weekend

Solves a real problem

Could sell for $10–$100

Doesn’t need your face or 1:1 time

Examples:

A Notion or Google Sheets template

A guide, checklist, or tiny eBook

A mini-course

A collection of prompts or email templates

Even if it only makes $200/month, that’s $2,400/year of almost-passive money.

It’s yours. It doesn’t rely on trends. It just quietly pays you to exist.

(Plus, the confidence boost of “I made money from something I created” is unreal.)

🪜 Step 4: Make Your Job (or Business) Fund the Future

This part’s for everyone — whether you’re climbing the corporate ladder, running a company, or just starting out.

Here’s the mindset shift:

Stop spending your income on stuff that makes you feel successful.

Start using it to build actual success.

That could look like:

Saving aggressively to buy time later

Funding your first investment property or business

Paying for mentorship, tools, or teams

Setting up recurring investments that build even when you chill

Your 9–5 or current hustle doesn’t have to be your forever thing.

Just make sure it’s buying you options, not keeping you stuck.

🔄 Step 5: Be Cool With Changing Your Mind (But Don’t Stop Building)

You’re allowed to:

Outgrow your niche

Quit a business that drains you

Try five things before one sticks

Start over at 25… or 45… or 65

The trick is to keep building things that give you leverage.

Write content. Learn useful stuff. Build relationships. Create tiny products. Invest early and often.

None of it’s wasted.

Even the “failures” become foundation for the next version of you.

🎯 Final Thought: You Don’t Need the Perfect Path — You Need Forward Motion

Forget finding the “one right way.”

Just focus on building the kind of wealth that follows you, funds your pivots, and gives you breathing room.

Because the real goal?

Not to get rich doing one thing forever — but to have the freedom to change without falling apart.

Start with what you’ve got. Stack smart. Stay curious.

You’ll be amazed where it takes you.

This guide is your go-to resource for streamlining payments, improving cash flow, and keeping your business running smoothly.

What’s inside:

✔️ An actionable 8-step framework to create a seamless payment process

✔️ Expert strategies to reduce late payments and enhance your professional image

A well-structured payment system leads to smoother operations, happier clients, and long-term financial success.

Fun Stuff

😂 Funny Joke

What’s a consultant’s favorite workout?

Jumping to conclusions and stretching the truth.

🕰️ Financial History: What Happened Today?

June 24, 1997:

Apple officially welcomed Steve Jobs back after acquiring his company, NeXT.

The deal not only saved Apple from collapse — it eventually led to the iMac, iPhone, and one of the greatest corporate turnarounds in history.

🌀 Wild & Wacky

The creator of Spanx, Sara Blakely, never took outside investment.

She started with $5,000 in savings and ended up becoming the youngest self-made female billionaire — proving that ownership matters just as much as innovation.

🤔 Would You Rather

Would you rather…

Know how every customer feels about your product in real time,

ORKnow exactly what your top competitor is planning three months ahead?

(Empathy vs. intel — which edge would you choose?)

*Answers at the bottom

That’s All For Today

I hope you enjoyed today’s issue of The Wealth Wagon. If you have any questions regarding today’s issue or future issues feel free to reply to this email and we will get back to you as soon as possible. Come back tomorrow for another market update, and snapshot. I hope to see you. 🤙

— Ryan Rincon, CEO and Founder at The Wealth Wagon Inc.

Disclaimer: This newsletter is for informational and educational purposes only and reflects the opinions of its editors and contributors. The content provided, including but not limited to real estate tips, stock market insights, business marketing strategies, and startup advice, is shared for general guidance and does not constitute financial, investment, real estate, legal, or business advice. We do not guarantee the accuracy, completeness, or reliability of any information provided. Past performance is not indicative of future results. All investment, real estate, and business decisions involve inherent risks, and readers are encouraged to perform their own due diligence and consult with qualified professionals before taking any action. This newsletter does not establish a fiduciary, advisory, or professional relationship between the publishers and readers.