June 20, 2025

Welcome Back,

Happy Friday, everyone! 🎉

Good morning! You’ve officially made it to the finish line of the week whether you sprinted, strolled, or tripped over Wednesday, you’re here now and that’s what counts.

Here’s something worth thinking about: Everyone talks about hitting their first million, but you know what really moves the needle? That first $10k.

Today, we’re digging into why your first $10k is a bigger deal than you might think—and how it sets the stage for everything that comes next.

Let’s talk about getting there—and staying motivated while we build.

“Challenging the status quo is where the real innovation happens.”

— Sara Blakely, Founder of Spanx

What if you stopped chasing more…

and started optimizing for better?

Growth without clarity is just scale without soul.

— Ryan Rincon, Founder at The Wealth Wagon Inc.

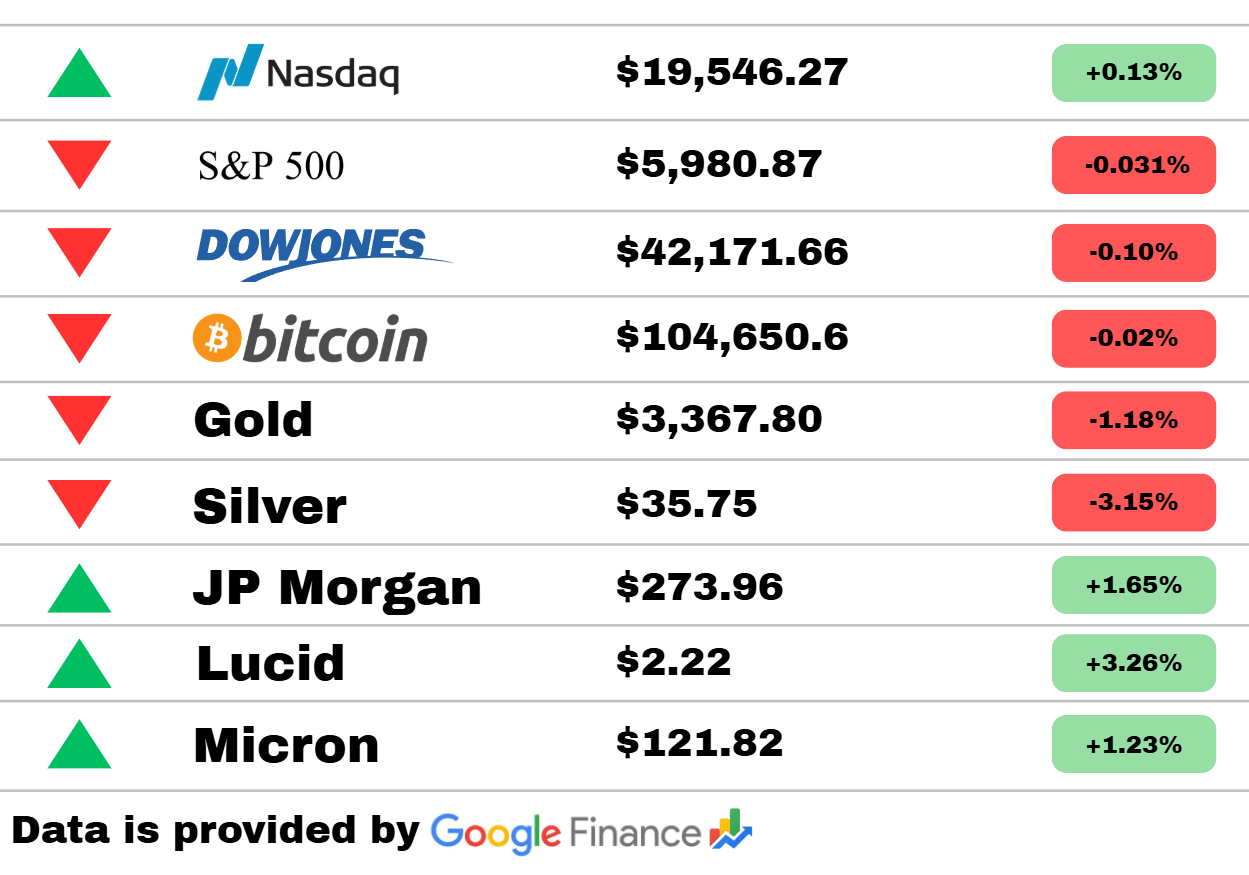

Market Update

*Market data represents the most recent market close at 5:00pm ET

Market Update: While the Nasdaq, S&P 500, and Dow stayed exactly where they were pre-holiday, gold dipped 1.18% and silver tumbled 3.15%, clearly not feeling festive. Bitcoin also slid just a smidge—down 0.02%, basically doing the financial equivalent of a shrug.

Meanwhile, stocks like Lucid (+3.26%), Micron (+1.23%), and JP Morgan (+1.65%) are showing gains from pre-holiday trading.

So, although Wall Street took the day off, the metals and crypto markets reminded us that there’s always someone still moving the needle. 💸📉📈

Banking

Swiss & Norwegian Central Banks Cut Rates as European Inflation Softens

Both Switzerland and Norway have eased monetary policy in response to moderating inflation, with the Swiss National Bank cutting rates to zero and hinting at potential negative rates again. These moves contrast with the ECB’s more cautious stance and reflect divergence within Europe. Market watchers see it as a signal that rate tightening cycles may be ending for smaller economies.

Bank of England Holds Rates at 4.25% Amid Oil-Driven Inflation Uncertainty

The BoE voted 6–3 to maintain its key rate at 4.25%, balancing weak UK growth with inflation risk tied to rising energy costs. Policymakers remain split on whether to resume tightening. Analysts expect data dependency to dominate future rate decisions.

Japan to Reduce Super‑Long Bond Sales by 10% to Stabilize Markets

Japan’s Ministry of Finance will cut planned issuance of super-long bonds by 10% in the second half of the year. This unusual move aims to ease market volatility and prevent a yield spike in its ultra-long-dated debt market. The reduction underscores Japan’s delicate fiscal balance and market sensitivity.

Finance

Investors Warn of Stock Market Drop If U.S. Joins Israel–Iran Conflict

Strategists caution that direct U.S. involvement in Middle East conflict could trigger a broad market sell-off, driven by oil shocks and risk-off sentiment. Energy prices are already climbing on geopolitical tension. Equity volatility could spike if conflict escalates beyond the region.

Ireland Sells Final AIB Shares—Winding Up a 15-Year Bailout Story

Ireland has completed the sale of its remaining stake in Allied Irish Banks, wrapping up one of the EU’s most prolonged post-crisis state ownerships. The government exit marks a return to full private control and restores confidence in Ireland’s financial system. AIB’s stock responded positively.

U.S. 10‑Year Treasury Yields Retreat on Risk Aversion

Flight-to-safety flows sent the 10-year U.S. Treasury yield lower as global investors fled equities and commodities. This drop in yields may temporarily ease government borrowing costs. It also reflects broader concern about conflict, inflation, and potential Fed policy shifts.

Aerospace

Boeing Delivery Skyrockets Eyeing Canvas After Spirit Integration

With the integration of Spirit AeroSystems, Boeing is set to accelerate its delivery pace and resolve lingering backlogs. Analysts expect a wave of aircraft movement in H2 2025. This could realign OEM-supplier dynamics and pressure Airbus to keep pace.

Constellium Says "Aerospace Supply Fog Is Clearing," Thanks to Airbus Fixes

Aluminum supplier Constellium sees improved clarity in aerospace demand as Airbus addresses production kinks. The statement boosts confidence for downstream suppliers, including engine and interior manufacturers. Boeing may also benefit from easing supply snarls.

Airbus Holds 2025 Delivery Target Steady, Raising Supplier Hopes

At the Paris Airshow, Airbus reiterated its full-year delivery goals despite earlier delays, providing a lift to suppliers in avionics, materials, and engines. This stability reinforces confidence across the aerospace supply chain. Markets interpreted it as a vote of confidence in global aviation recovery.

Healthcare

U.S. Telecom Execs Debate Healthcare Worker Minimum Wage Increase

California’s new wage floor for health workers is sparking concern over labor costs in hospitals, urgent care centers, and long-term care facilities. Executives warn that sudden expense spikes may strain budgets or lead to service cuts. Others argue it’s essential for workforce retention.

Employer Penalties Heat Up Under ACA Shared‑Responsibility Rules

The IRS is stepping up enforcement of Affordable Care Act penalties, fining employers that fail to offer affordable coverage to at least 95% of full-time staff. Noncompliance now comes with steeper financial consequences. HR departments should revisit benefits compliance immediately.

Medicare Telehealth Flexibility Extended Through Sept. 2025 by HHS

HHS has extended Medicare’s telehealth waivers through September 2025, ensuring continued access to virtual care. This supports providers, especially in rural areas, and stabilizes hybrid models. Expect more payer innovation in telehealth reimbursement.

Retail

PepsiCo Expects Nearly $1M in Annual Fuel Savings from EV Semis

PepsiCo’s growing fleet of EV trucks is projected to save nearly $1 million annually in fuel. New charging hubs are coming online in key states, and Pepsi is also targeting carbon offsets. The case for EV freight is increasingly economic, not just environmental.

DHL Units Pilot Heavy-Duty EV Freight Circuits on I‑10 Corridor

DHL, IKEA, and other logistics firms are piloting heavy-duty electric freight along the I-10 corridor. This marks a pivotal step toward electrified long-haul trucking in the U.S. Early results will inform larger fleet deployments and EV infrastructure investments.

SAP Launches Cloud ERP Bundles to Ease Supply Chain Migrations

SAP has launched modular cloud ERP packages aimed at helping manufacturers and distributors modernize their supply chains. The bundles simplify procurement, planning, and logistics integration. It’s a timely response to global digital transformation pressure.

Today’s Snapshot

The First 10k: Why Your First Stack of Cash Matters More Than the Next Million

Let’s have some real talk.

We all want financial freedom — or at least to not feel like we’re sprinting on a treadmill made of bills, deadlines, and overpriced lattes.

But the journey to “wealth” can feel like staring up at a massive mountain in flip-flops.

Where do you even begin?

I’ll tell you where: with the first $10,000.

Not flashy. Not viral. But it’s powerful.

The first $10K you stack on purpose is like flipping a switch in your brain.

So let’s break down why it matters so much — and how you can get there even if you’re starting with more enthusiasm than experience.

🧠 Why the First $10K Hits Different

There’s something psychological about getting your first five figures together that changes everything. Here’s what happens when you do:

You realize you can do it

You start thinking in terms of ownership, not just income

You get your first taste of breathing room

You can take your foot off the panic pedal and start playing offense

It’s not just about the number.

It’s about who you become on the way to hitting it.

💸 Where Does the First $10K Come From?

No magic. No secrets. Just momentum and a few good moves.

Here are five simple ways people I’ve worked with (and me too, back in the day) have stacked their first intentional $10K:

1. Sell Stuff You Forgot You Owned

You probably have hundreds (or thousands) of dollars lying around in the form of:

Old tech (phones, cameras, laptops)

Clothes, shoes, bags

Hobby equipment you swore you’d use

Furniture or decor you’ve outgrown

List it. Sell it. Stack it.

(And enjoy the side effect of a cleaner space.)

2. Offer a Skill You Already Have

You’d be shocked how many people will pay you for stuff you already know how to do:

Editing resumes

Making slides look pretty

Organizing files

Writing emails or captions

Teaching people things you’ve learned the hard way

Start with friends or small communities. Charge something. Improve as you go.

3. Freelance Your Way There

There’s nothing wrong with good old-fashioned time-for-money when you’re starting out.

Websites like Upwork, Fiverr, Contra, or even your own network can be gold mines.

Think:

Copywriting

Admin work

Virtual assistance

Video editing

Social media help

💡 Pro tip: Don't aim to get rich here. Just aim to get $1K/month consistently. Do that for 10 months and boom — you’re there.

4. Learn While You Earn

Want to get paid and level up?

Offer to help someone who’s 2–3 steps ahead of you — for cheap or free at first — and learn everything.

Example:

"Hey, I’ll help you organize your client onboarding process for free. I just want to learn how you run your business."

You might not earn a lot upfront, but the knowledge, network, and confidence? Worth way more than money.

5. Cut Like a Ninja

This one isn’t sexy, but it works.

Look at where your money’s going for the next 90 days and ask:

“Do I actually use this?”

“Is this helping me build or just helping me cope?”

“Can I replace this with a cheaper or free version?”

You don’t have to live like a monk. Just trim the fat for a few months and reallocate the difference to savings, skills, or small bets.

🛠 What To Do With the First $10K

This is where it gets fun.

Once you’ve got it, don’t let it rot in a checking account.

You’re gonna want to:

👉 Step 1: Split it into 3 mini buckets

$4,000 - Keep Safe (emergency buffer, peace of mind)

$3,000 - Put to Work (index funds, ETFs, high-interest savings)

$3,000 - Build Something (your first product, a small business, a service offer, a website)

Each one serves a purpose:

Stability

Compounding

Momentum

And you don’t have to be perfect. Just start messy and adjust as you go.

🧠 Final Thought: The First $10K Teaches You How to Think Like an Owner

Once you’ve built your first stack from scratch, something clicks.

You stop saying:

“I need a raise.”

And you start saying:

“I know how to make it myself.”

That shift? That’s wealth energy.

So forget trying to jump straight to millionaire status or crypto stardom. Just focus on your first $10K made on purpose — and let that momentum carry you.

You’ve got this. And I’ve got your back.

AARP ‘s mission is to empower people to choose how they live as they age. At $15 a year with auto-renew, AARP provides access to hundreds of benefits that help you live your best life. Whether you want to enjoy discounts on things like travel, restaurants, and eyeglasses, or get resources and information on social security, jobs, caregiving, or retirement planning, AARP provides members with a wealth of opportunities to save money, play, learn, and volunteer. Check out AARP and get instant access to hundreds of carefully chosen benefits.

Fun Stuff

😂 Funny Joke

Why don’t investors trust atoms?

Because they make up everything — including earnings reports.

🏢 Guess the Company

Clue:

This brand started out selling books online, but now owns a massive grocery chain, dominates cloud computing, and has its own space program.

🕰️ Financial History: What Happened Today?

June 20, 1975:

Jaws premiered in theaters — and not only did it change Hollywood, it launched the concept of the summer blockbuster.

It also transformed movie marketing, showing how hype, timing, and media buzz could drive billion-dollar box office economics.

🌀 Wild & Wacky

Yahoo once turned down buying Google for $1 million.

They later offered $3 billion to buy Facebook — and were rejected.

Moral of the story? Opportunity knocks quietly and leaves fast.

*Answers at the bottom

Answers

Guess the company - Answer: Amazon (but acceptable side guesses include Blue Origin or Whole Foods)

That’s All For Today

I hope you enjoyed today’s issue of The Wealth Wagon. If you have any questions regarding today’s issue or future issues feel free to reply to this email and we will get back to you as soon as possible. Come back tomorrow for another market update, and snapshot. I hope to see you. 🤙

— Ryan Rincon, CEO and Founder at The Wealth Wagon Inc.

Disclaimer: This newsletter is for informational and educational purposes only and reflects the opinions of its editors and contributors. The content provided, including but not limited to real estate tips, stock market insights, business marketing strategies, and startup advice, is shared for general guidance and does not constitute financial, investment, real estate, legal, or business advice. We do not guarantee the accuracy, completeness, or reliability of any information provided. Past performance is not indicative of future results. All investment, real estate, and business decisions involve inherent risks, and readers are encouraged to perform their own due diligence and consult with qualified professionals before taking any action. This newsletter does not establish a fiduciary, advisory, or professional relationship between the publishers and readers.