July 4, 2025

Welcome Back,

Happy Friday—and Happy 4th of July, everyone! 🎆🇺🇸

Good morning! Whether you’re firing up the grill, planning a chill day off, or just excited about not opening your laptop (relatable), I hope your holiday is off to a great start.

Now, let’s talk about something they definitely didn’t teach us in school: leverage.

No, not the kind where someone tries to win an argument—this is the kind that helps you earn more without working more. It’s how the wealthy multiply their time, money, skills, and relationships to unlock way bigger results than they could ever achieve solo. 💼⚙️📈

Today, we’re diving into how leverage works—and how you can start using it to build more freedom, faster.

Let’s celebrate smart moves, big impact, and a future that scales with you.

— Ryan Rincon, Founder at The Wealth Wagon Inc.

Quote of The Day

“Freedom is the open window through which pours the sunlight of the human spirit and human dignity.”

— Herbert Hoover

Market Update

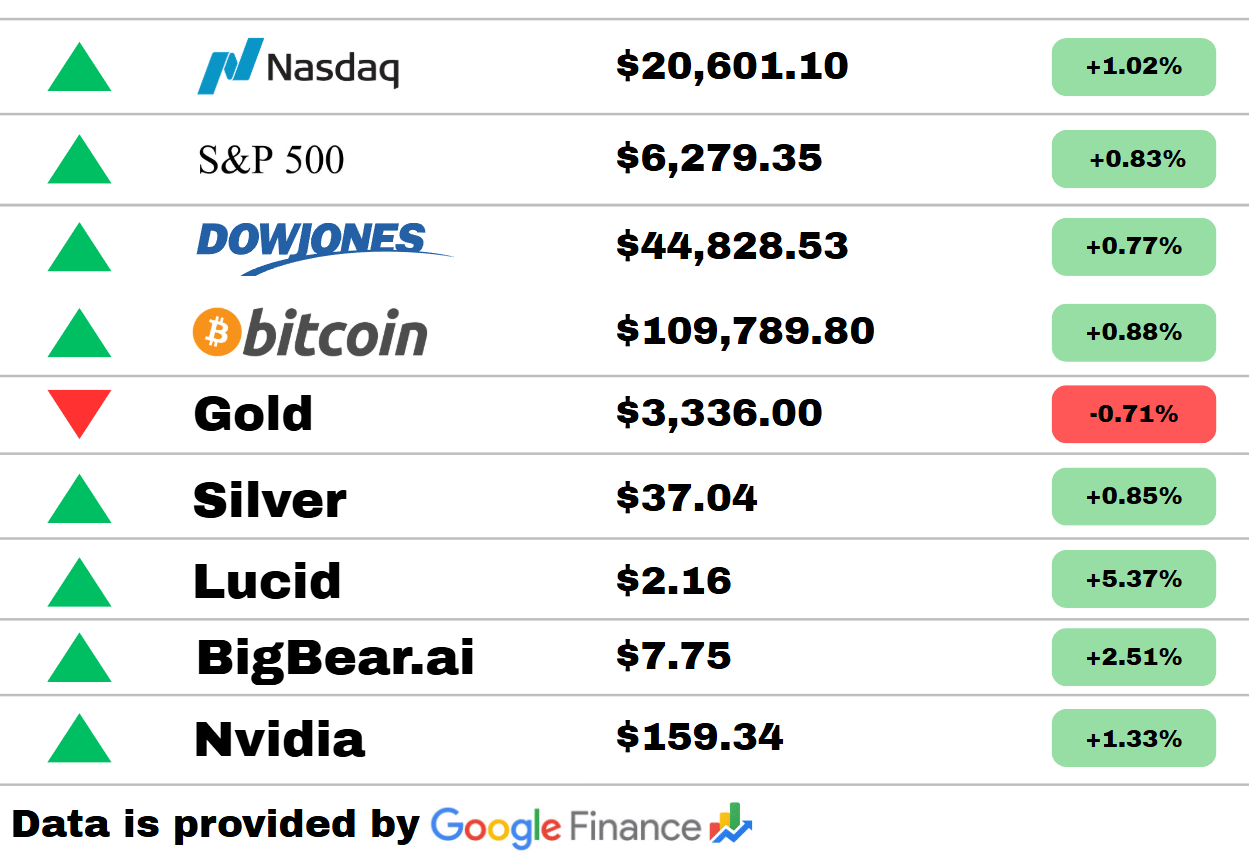

*Market data represents the most recent market close at 5:00pm ET

Market Update: Markets were riding high today, with green arrows lighting up like it was earnings Christmas 🎄📈

The Nasdaq popped 1.02%, the S&P 500 added 0.83%, and the Dow Jones rolled forward 0.77%, all keeping the momentum going strong. Even Bitcoin joined in, rising 0.88%—crypto’s not sleeping on this rally!

Silver sparkled with a 0.85% gain, while gold took a step back, down 0.71%—clearly letting silver have the spotlight today. ✨

In the stock spotlight:

Lucid zoomed ahead with a 5.37% gain—EV bulls, rejoice! ⚡️

BigBear.ai roared 2.51% higher—AI's still got claws. 🐻❄️

And Nvidia? Classic overachiever move with a 1.33% lift. 💻🚀

Today was a textbook “risk-on” kind of vibe—strong growth across tech, crypto, and AI while gold caught a breather. Let’s see if the bulls stay buckled in for tomorrow.

Crypto

JPMorgan Scales Back Stablecoin Forecast to $500B by 2028

JPMorgan downgraded its growth estimate for stablecoins from $4 trillion to $500 billion by 2028, citing limited real-world usage beyond trading and DeFi. For institutional crypto teams, that signals measured optimism (aka caution with champagne).

Texas Establishes Strategic Bitcoin Reserve via SB 21

Texas officially passed SB 21, allowing the state to create a Bitcoin reserve—its third after Arizona and New Hampshire. Crypto-curious investors: state treasuries are finally getting BTC-friendly.

Coinbase Stock Climbs After Stablecoin Payment Launch & Regulatory News

Coinbase shares surged after announcing a USDC payments solution (built into Shopify) and the Senate-approved GENIUS Act. Crypto meets commerce—and investors are cheering the bridge.

Sports

PayPal Powers Payments for Big Ten & Big 12 Athlete Deals

PayPal (via Venmo) struck deals to process revenue-sharing payments for Big Ten and Big 12 student-athletes—about $100 million over five years. College sports + fintech = a new revenue playbook.

DAZN Secures Exclusive U.S. Broadcast Rights for FIFA Club World Cup

DAZN landed U.S. rights for the FIFA Club World Cup through 2027 via a sublicensing deal with TelevisaUnivision. Sports streaming isn’t just catchy—it’s big-ticket investment.

NHL Commissioner Confirms No Plans for More Teams Beyond 32

NHL Commissioner Gary Bettman said the league isn’t pursuing further expansion, calling its current 32-team alignment “healthier than ever”. Stability over splash—at least for now.

AI

Google Unveils AI Agentic Checkout for Seamless Consumer Buying

Google’s Search now includes “agentic checkout”—AI that tracks price, selects sizes, and buys for you via Google Pay. Pollution-free cart (‘cause you don’t see the button, you just feel the checkout).

IBM Rolls Out AutoML Platform for Non-Tech Teams

IBM introduced a low-code ML platform that empowers non-engineers to build and deploy AI models without code know-how . Everyone’s a data scientist now—almost.

Adobe Beta Launches Context-Aware Remove Tool in Photoshop

Adobe’s Photoshop beta now includes an AI that magically removes objects and fills in backgrounds seamlessly. Design teams, rejoice: pixel perfection just got easier.

Career

Salesforce Introduces Carbon Footprint Dashboards for Teams

Salesforce deployed team-level carbon dashboards to track real-time emissions & foster eco-awareness in office culture—complete with low-carbon bragging rights. Green meets gamified.

Bain Releases Net-Zero Playbook for Corporate Sustainability

Bain & Company rolled out a detailed roadmap for big businesses aiming for net-zero by 2050—complete with benchmarks and case studies. Execs: your climate game just got strategic.

Microsoft Ties 20% of Executive Bonuses to ESG Goals

Microsoft announced that ESG achievements will now influence 20% of exec bonuses—a hefty stake in sustainability and social impact. Corporate morality meets shareholder ROI.

Real Estate

Multifamily Property Investments Jump 33% YoY to $28.8B

Q1 spending on multifamily commercial real estate surged 33% YoY, totaling $28.8 billion—proof that housing fundamentals remain strong . Rental demand + investor interest = a home run.

San Francisco Rents Projected to Rise 4–6% This Year

With prices still down 30–50% from peak, SF rents are expected to climb 4–6%, signaling a potential urban comeback . Value plays meet urban revival.

Office Deal Volume Jumps 80% in January, Reaching $6.2B

January saw $6.2 billion in office transactions—a sharp 80% increase YoY—hinting that investors still see value in workspace assets . Work-from-office? It’s not dead yet.

Today’s Snapshot

Leverage: The Money Multiplier Nobody Taught You About in School

Hey friend — let’s talk about one of the most underrated concepts in wealth building.

It’s not budgeting.

It’s not investing.

It’s not cutting out lattes (you already know how I feel about that nonsense 🙄).

It’s leverage.

And no, not the Wall Street kind where you're risking your house on margin trading.

I’m talking about the kind of leverage that helps you make way more without necessarily working way harder.

Sound like magic? It’s not. It’s just misunderstood.

Let’s break it down.

🧠 So, What Is Leverage?

Here’s the simplest way to put it:

Leverage is when you use tools, people, or systems to multiply your output without multiplying your effort.

You do one thing, and that one thing keeps working — sometimes forever.

Think about it like this:

You build a system once → it runs 100 times

You record a video once → it’s watched 1,000 times

You write one offer → it lands 10 clients

You invest $100 → it compounds quietly for years

Leverage = scaling results without scaling time.

🛠️ Types of Leverage You Can Use Right Now

There are 4 main types — and no, you don’t need a massive team or a million followers to start using them.

1. Code / Tools (a.k.a. Automation)

Use tech to do the boring stuff for you.

Examples:

Set up email sequences to follow up with leads or customers

Use Calendly to stop playing “meeting ping pong”

Automate your savings or investments so you stop forgetting

Time saved = money earned (or energy redirected to higher ROI tasks).

2. Content (the silent salesperson)

Write or record once, let it sell/educate forever.

This is huge whether you:

Sell a product

Offer a service

Have a job and want to build a reputation

Examples:

A well-written tweet that brings in leads

A YouTube video that explains what you do

A blog post that lands you speaking gigs or interviews

This newsletter you’re reading 😎

3. People (delegation = freedom)

This one takes a mindset shift: you don’t have to do it all.

Examples:

Hire a virtual assistant for admin stuff

Bring on a contractor to handle what you’re not great at

Partner with someone who complements your skills

At first, it might feel like “losing money” to pay someone.

But if they free you up to focus on high-leverage tasks (like strategy, sales, creation)? It’s an investment.

4. Capital (money making money)

This is the classic one — but most people only think of it in the “buy index funds and wait 40 years” sense.

Let’s widen the lens.

You can use capital to:

Buy time (pay for services that speed you up)

Buy knowledge (courses, coaching, mentorship)

Buy income (investing in dividend-paying stocks or real estate)

Buy reach (running ads or sponsoring something smart)

Don’t hoard cash. Put it to work.

✨ Real-Life, Real-People Leverage Moves

This stuff isn’t just for the Gary Vees of the world.

Here are some everyday examples:

Tasha, a mid-level marketing manager, started a simple newsletter where she shares one idea a week. Now she gets inbound consulting offers — without pitching.

Ramon, a 22-year-old learning web design, posted tutorials on TikTok while building his portfolio. His videos work as 24/7 business cards.

David, a small business owner, finally hired a bookkeeper and stopped wasting 10 hours a month on spreadsheets. That freed him up to chase a new revenue stream.

None of these people have “insider status.”

They just started stacking small leverage moves.

💬 “Okay… but how do I use this in my world?”

Great question. Here’s a cheat sheet for wherever you’re at:

If You’re in a 9–5:

Start sharing ideas publicly (LinkedIn, email, whatever feels right)

Systematize your best work so others can use it (you’ll get promoted faster)

Look for one thing each week you can automate or delegate

If You Run a Business:

Write an SOP (standard operating procedure) for something you do often

Build a client onboarding flow that saves you hours

Turn common advice into a downloadable resource or course

If You’re Just Starting Out:

Document your learning publicly

Build a small digital product around something simple you know

Use tools to look 10x more professional (landing pages, schedulers, etc.)

🎯 Final Thought: Leverage Is a Multiplier, Not a Magic Wand

Here’s the truth:

You can hustle your face off and still hit a ceiling — unless you start multiplying your effort

Leverage helps you break that ceiling.

It’s how a single person can:

Run a business

Grow wealth

Create impact

And still have a life

Start small. Stack slowly.

But start now.

Because the sooner you stop doing everything... the faster you start earning like someone who doesn’t have to.

Fun Stuff

🧩 Riddle

I can be passive or active, big or small.

Governments track me, investors chase me.

I shape nations and portfolios alike.

What am I?

🏢 Guess the Company

Clue:

Started by a college dropout in the '70s, this company’s first product was a personal computer hand-built in a garage.

Its founders helped spark the tech revolution — and one of them got fired… then returned to save it.

🕰️ Financial History: What Happened Today?

July 4, 1776:

While not a financial event in the Wall Street sense, this day marked the birth of the U.S. economy.

Independence laid the foundation for what would become one of the most dynamic markets on Earth. 🇺🇸📜💰

🌀 Wild & Wacky

Budweiser once rebranded its cans to say “America.”

From May through November 2016, every can proudly said “America” instead of “Budweiser” — as part of a patriotic marketing campaign.

It didn’t boost sales much… but it did boost buzz.

*Answers at the bottom

Thought of The Day

Entrepreneurship is the most modern form of revolution.

You don’t need muskets — just ideas, action, and a refusal to wait for permission.

Answers

Riddle - Answer: Capital

Guess the Company - Answer: Apple Inc.

That’s All For Today

I hope you enjoyed today’s issue of The Wealth Wagon. If you have any questions regarding today’s issue or future issues feel free to reply to this email and we will get back to you as soon as possible. Come back tomorrow for another market update, and snapshot. I hope to see you. 🤙

— Ryan Rincon, CEO and Founder at The Wealth Wagon Inc.

Disclaimer: This newsletter is for informational and educational purposes only and reflects the opinions of its editors and contributors. The content provided, including but not limited to real estate tips, stock market insights, business marketing strategies, and startup advice, is shared for general guidance and does not constitute financial, investment, real estate, legal, or business advice. We do not guarantee the accuracy, completeness, or reliability of any information provided. Past performance is not indicative of future results. All investment, real estate, and business decisions involve inherent risks, and readers are encouraged to perform their own due diligence and consult with qualified professionals before taking any action. This newsletter does not establish a fiduciary, advisory, or professional relationship between the publishers and readers.