July 3, 2025

Welcome Back,

Happy Thursday, everyone! 🎨

Good morning! Hope your coffee is strong, your inbox is tame, and your confidence is wearing its best shoes today.

Here’s a little truth to kick off your morning: You already have a personal brand. Yep—whether you’re intentionally building it or not, people are noticing how you show up.

And here’s the kicker… your personal brand is either making you money or quietly costing you. 💸🕶️

Today, we’re diving into how to take the reins—how to shape your story, show your value, and make sure your digital (and real-life) presence is doing the heavy lifting for you, not against you.

Let’s talk about turning reputation into revenue—without becoming someone you’re not.

— Ryan Rincon, Founder at The Wealth Wagon Inc.

Quote of The Day

“The greatest wealth is to live content with little.”

— Plato

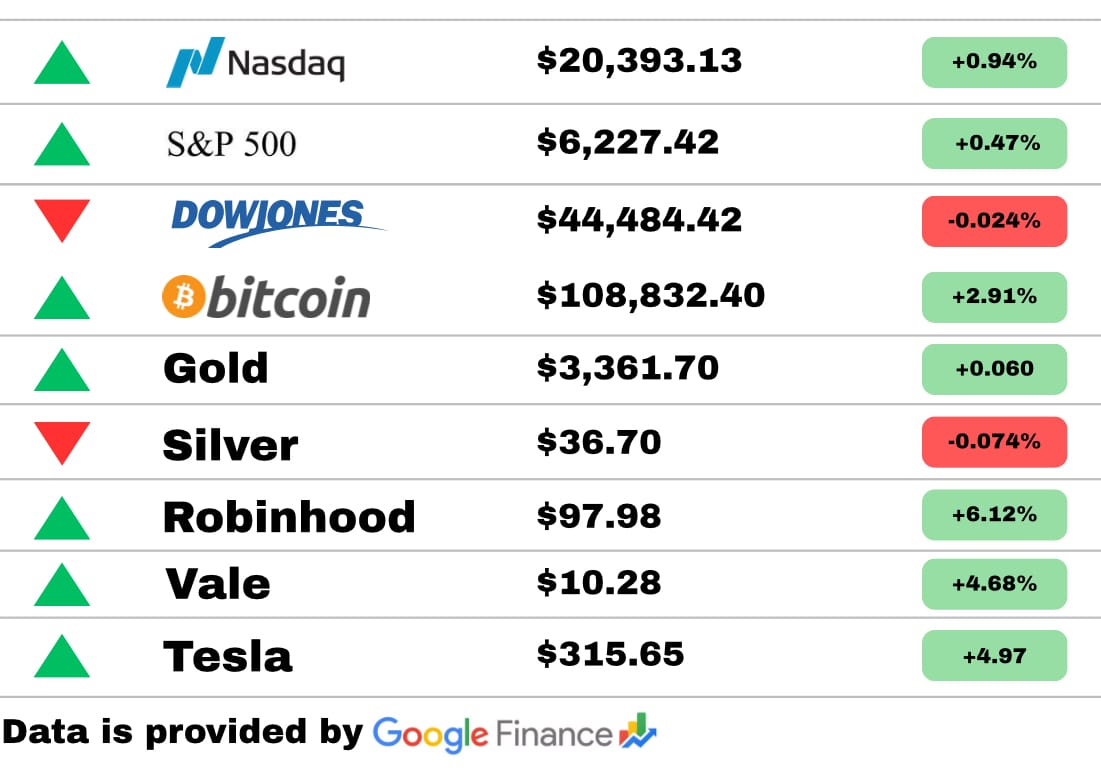

Market Update

*Market data represents the most recent market close at 5:00pm ET

Market Update: Markets were glowing green today—well, almost all of them!

The Nasdaq climbed 0.94% and the S&P 500 followed with a 0.47% rise. The Dow Jones tried to keep up but tripped at the finish line, sliding just 0.024%—basically flat with a frown. 😐📉

Bitcoin was the star of the show, jumping 2.91%, while gold kept its cool with a gentle 0.06% gain. Silver lost a little shine, down 0.074%, but not enough to cause panic.

And in stock news:

Robinhood flew high with a 6.12% surge—clearly robbing gains from the bears today. 🏹💰

Vale added 4.68%, showing strong momentum.

And Tesla hit the accelerator with a 4.97% jump—turns out, it’s not just the cars that go fast! ⚡🚗

Overall? A bright day for markets with just enough red to keep things interesting

PRESENTED BY THE RUNDOWN AI

Stay up-to-date with AI

The Rundown is the most trusted AI newsletter in the world, with 1,000,000+ readers and exclusive interviews with AI leaders like Mark Zuckerberg, Demis Hassibis, Mustafa Suleyman, and more.

Their expert research team spends all day learning what’s new in AI and talking with industry experts, then distills the most important developments into one free email every morning.

Plus, complete the quiz after signing up and they’ll recommend the best AI tools, guides, and courses – tailored to your needs.

Corporate

GE Partners with MIT for Digital ‘Factory of the Future’ Plan

GE and MIT launched a “Factory of the Future” initiative to drive smart manufacturing using IoT and predictive AI systems. It’s a bold vision: production lines that practically run themselves. Prepare for a future where “lights-out manufacturing” goes mainstream.

Unilever’s CEO Commits to 20% Gender-Diverse Board by 2026

Unilever’s top brass just pledged to fill nearly 20% more seats on its board with diverse talent by 2026. It's an inclusive leadership move with global appeal—and boardroom vibrance to match.

Intel CEO Announces Flexible ‘Work-from-Everywhere’ Plan for 2026

Intel’s CEO unveiled a strategy that allows employees to work from any U.S. location for up to three months annually. Nomad-friendly work with corporate structure. Pack your laptop—and maybe your flip-flops.

Retail

Aldi Launches ‘Zero-Waste’ Checkout in Germany

Aldi Germany debuted a new checkout option that skips plastic bags—shoppers bringing their own carryalls get a discount. Thrifty meets eco-friendly in the quest to reduce packaging waste.

Walmart Tests Drone Delivery in Rural Texas This Summer

Walmart is piloting drone-based delivery for essentials in rural Texas towns—hot coffee, groceries, and all. Faster than you can say “Would you like fries with that?” Tech meets town life.

Sephora Introduces In-Store ‘Fragrance Pods’ for Personalized Samples

Sephora’s scent-lab pods let customers create customized fragrance blends digitally and spray sample vials in-store. It’s perfumery 2.0: as personalized as your playlist—and easier to smell before you buy.

Investing

Bitcoin’s Volatility Declines as Trading Volume Stabilizes

Bitcoin’s daily price swings have cooled, with sustained trading volumes hinting at growing institutional appetite. Crypto isn’t just a rollercoaster—it’s being tamed.

Vanguard Expands ESG Bond Access with New $500M Fund

Vanguard launched a $500 million ESG bond fund focused on climate resilience and clean infrastructure. It’s a green-first option for income investors—yields with values.

Small-Caps Outperform in Q2, Showing 4.3% Gains So Far

Small-cap stocks are beating large caps by 200 basis points through Q2. Investors betting on economic upside are seeing real returns—not just hope.

AI

Cisco Debuts AI-Enhanced Cybersecurity Dashboard for SMEs

Cisco launched an AI dashboard tailored for small and mid-sized enterprises to spot threats in real-time. Enterprise-level security for businesses scaling fast.

Microsoft Teams Rolls Out Live AI Meeting Highlights

Microsoft Teams now auto-generates meeting recaps and action items using AI—delivering a neat summary minutes after your video call. No more screenshotting, just efficiency.

Zoom Launches Virtual Office Experience for Hybrid Teams

Zoom’s new “virtual office” lets distributed teams hang out in a shared avatar space—watercooler talk meets remote work. Tech meets touchy-feely office vibes.

Sports

F1 Teams Show 3% Revenue Growth Ahead of Record 2026 Deal

F1 team revenues rose ~3% in Q2 as the sport gears up for a bigger broadcast rights deal in 2026. Racing’s fast—and profitable.

NBA Launches In-Season Tournament with $5M Prize Pool

The NBA just kicked off a new mid-season tournament with sizable prize money—spicing up regular-season intensity. Think March Madness... but in November.

MLB Announces $1B Regional Tech Investment Program for Stadiums

MLB will invest $1 billion in digital amenities and high-speed connectivity across regional ballparks. Baseball is going high-tech in the name of fan experience.

Today’s Snapshot

Your Personal Brand Is Already Making You Money (Or Losing You Some)

Let’s talk about something that might sound a little fluffy at first… but stick with me.

Because it’s secretly one of the most powerful (and free) wealth-building tools you have:

Your personal brand.

Now before your eyes roll back and you picture a guy in a hoodie yelling “build your audience!” on TikTok — relax.

We’re not talking about going viral.

We’re not talking about becoming an influencer.

We’re talking about intentionally shaping your reputation — so money, trust, and opportunity come to you.

Sound good? Let’s go.

🧠 First — What Is a Personal Brand, Really?

It’s not your logo.

It’s not your website.

It’s not your color palette or LinkedIn header.

Your personal brand is just this:

What people think of when they hear your name.

That’s it. That’s the whole thing.

And whether you’re a:

Corporate manager

Business owner

Freelancer

Investor

Careerless 20-something with ambition and a Canva account…

…you already have a personal brand.

The question is: are you using it to build wealth? Or is it working against you without you realizing it?

💰 Why Your Brand Is a Money Magnet (or Repellent)

Here’s the thing: people pay attention to people who make it easy to trust them.

And the easiest way to build trust at scale?

→ Be visible for something valuable.

→ Show up consistently.

→ Deliver wins, ideas, or clarity.

That’s a personal brand. And it can quietly:

Attract job offers

Close clients without sales calls

Increase your rates

Get you invited into deals or partnerships

Grow your audience

Build your business faster

Get you funded, featured, or followed

And it’s not reserved for “internet people.”

The highest-paid execs and operators also build personal brands — just more quietly.

🛠️ How to Build One (Without Being Cringe)

Let’s keep it chill and practical. You don’t need a content calendar or a ring light.

Here’s a basic Personal Brand Starter Pack:

1. Pick Your “Money Topics”

What do you want to be known for?

What topics do you love that also connect to income, investing, or opportunity?

Pick 1–3.

Examples:

Marketing that sells

Simplified investing

Leadership & operations

Creator economy

Startup culture

Career pivots

Financial freedom mindset

This gives your brand clarity.

2. Show Your Work

Don’t just say what you know — show what you’re doing.

Post things like:

“Just helped a client reduce churn by 30% — here’s what worked”

“Finally hit $1K/month from my side hustle. What I’d do differently:”

“Trying this 7-day investing habit experiment — let’s see what happens”

This builds credibility fast.

People love real-time learners and doers. Not just “experts.”

3. Pick a Channel and Stick With It

Don’t try to be everywhere. Pick the one you like:

LinkedIn for career + corporate credibility

X (formerly Twitter) for thought leadership + startups/investing

Instagram for story-driven branding

YouTube if you love explaining and teaching

A newsletter (👋) if you enjoy deeper content

Post 2–3 times a week.

Engage. Share ideas. Share results. Ask questions.

That’s literally it. Over time, people associate your name with value. And that opens doors.

4. Make It Easy for People to Work With You

Have a clear next step in your bio or content.

Examples:

“Need help optimizing your offer? Book a call.”

“Join my free investor insights newsletter.”

“I consult with B2B brands on growth — DM me ‘scale’ to chat.”

“Currently open to remote roles in fintech ops — let’s talk.”

Don’t assume people know what you offer or want. Tell them.

🔥 Real Talk: You Don’t Need to Be Loud — Just Clear

You don’t need to go viral.

You don’t need to become a thought leader™.

You just need to show up as someone with clarity, confidence, and a little consistency.

Even something as simple as:

“Hey, I help new solopreneurs make their first $1K without burning out. Here’s how 👇”

...is enough to turn followers into clients or connections into collaborators.

🎯 Final Thought: Reputation Pays Dividends

Your personal brand is a compounding asset.

The more you invest in it — little by little, post by post, convo by convo — the more unfair advantages you create for yourself.

Remember:

Opportunities don’t just come from resumes.

Wealth doesn’t just come from work.

And influence doesn’t mean being famous — it means being trusted.

Build that. Quietly. Consistently. Casually.

And your future self will thank you loudly.

Invest in recession-resilient Mobile Home Parks with Vintage Capital. Invest direct or in a fund of 20+ underlying assets. 1031s are also available. Access stable, income-generating properties with consistent demand and low tenant turnover.

Now is the time to act: Current market conditions are creating opportunities to acquire properties at attractive valuations.

Our fund targets a 15%-17% IRR and makes monthly distributions, which provides a steady income stream alongside strong upside potential and tax-efficient benefits.

Why Mobile Home Parks?

Recession-Resilient: Affordable housing demand drives stable returns in any economy

High Tenant Retention: The average MHP tenant stays 10-12 years (compared to 2-3 in Multifamily)

Proven Expertise: $100MM+ track record in mobile home park investments.

Tax-Smart Investing: Bonus depreciation offers tax advantages.

Fun Stuff

😂 Funny Joke

Why did the investor bring a life jacket to the market?

Because they heard about a liquidity crisis.

🧩 Riddle

I’m invisible but essential.

I cost nothing — until I fail.

I power teams, leaders, and brands alike.

What am I?

🤔 Would You Rather

Would you rather…

Have a million social media followers with average engagement,

ORHave 100 superfans who buy anything you create?

(Vanity metrics vs. value metrics — where’s the real gold?)

🧠 Brain Teaser

You buy a product for $200 and sell it for $250.

Then you buy it back from the customer for $230 and resell it for $270.

What’s your total profit?

*Answers at the bottom

Thought of The Day

In startups and strategy, the first mover isn't always the winner.

But the one who moves with clarity, timing, and consistency usually is.

Answers

Riddle - Answer: Trust

Brain teaser - Answer:

First sale: $250 - $200 = $50 profit

Buyback: $230

Resale: $270 - $230 = $40 profit

✅ Total profit = $50 + $40 = $90

That’s All For Today

I hope you enjoyed today’s issue of The Wealth Wagon. If you have any questions regarding today’s issue or future issues feel free to reply to this email and we will get back to you as soon as possible. Come back tomorrow for another market update, and snapshot. I hope to see you. 🤙

— Ryan Rincon, CEO and Founder at The Wealth Wagon Inc.

Disclaimer: This newsletter is for informational and educational purposes only and reflects the opinions of its editors and contributors. The content provided, including but not limited to real estate tips, stock market insights, business marketing strategies, and startup advice, is shared for general guidance and does not constitute financial, investment, real estate, legal, or business advice. We do not guarantee the accuracy, completeness, or reliability of any information provided. Past performance is not indicative of future results. All investment, real estate, and business decisions involve inherent risks, and readers are encouraged to perform their own due diligence and consult with qualified professionals before taking any action. This newsletter does not establish a fiduciary, advisory, or professional relationship between the publishers and readers.