July 19, 2025

Welcome Back,

Happy Saturday, everyone! 🎒

Good morning! I hope you’re easing into the weekend with your favorite drink, a cozy vibe, and zero pressure to be productive (unless you want to be).

Let’s talk side hustles—but not the kind that leave you glued to your screen at midnight, googling “passive income ideas that don’t feel like a second job.”

Today, we’re exploring the one side hustle nobody talks about—but absolutely everyone should consider. 👀

Spoiler: it’s not about flipping furniture or becoming a content machine. It’s about building something small, sustainable, and aligned with your strengths—something that not only makes money, but makes you feel more you.

Let’s dig into what that could look like—and why starting small might just be the smartest move of all.

— Ryan Rincon, Founder at The Wealth Wagon Inc.

Quote of The Day

“The man who moves a mountain begins by carrying away small stones.”

— Confucius

Market Update

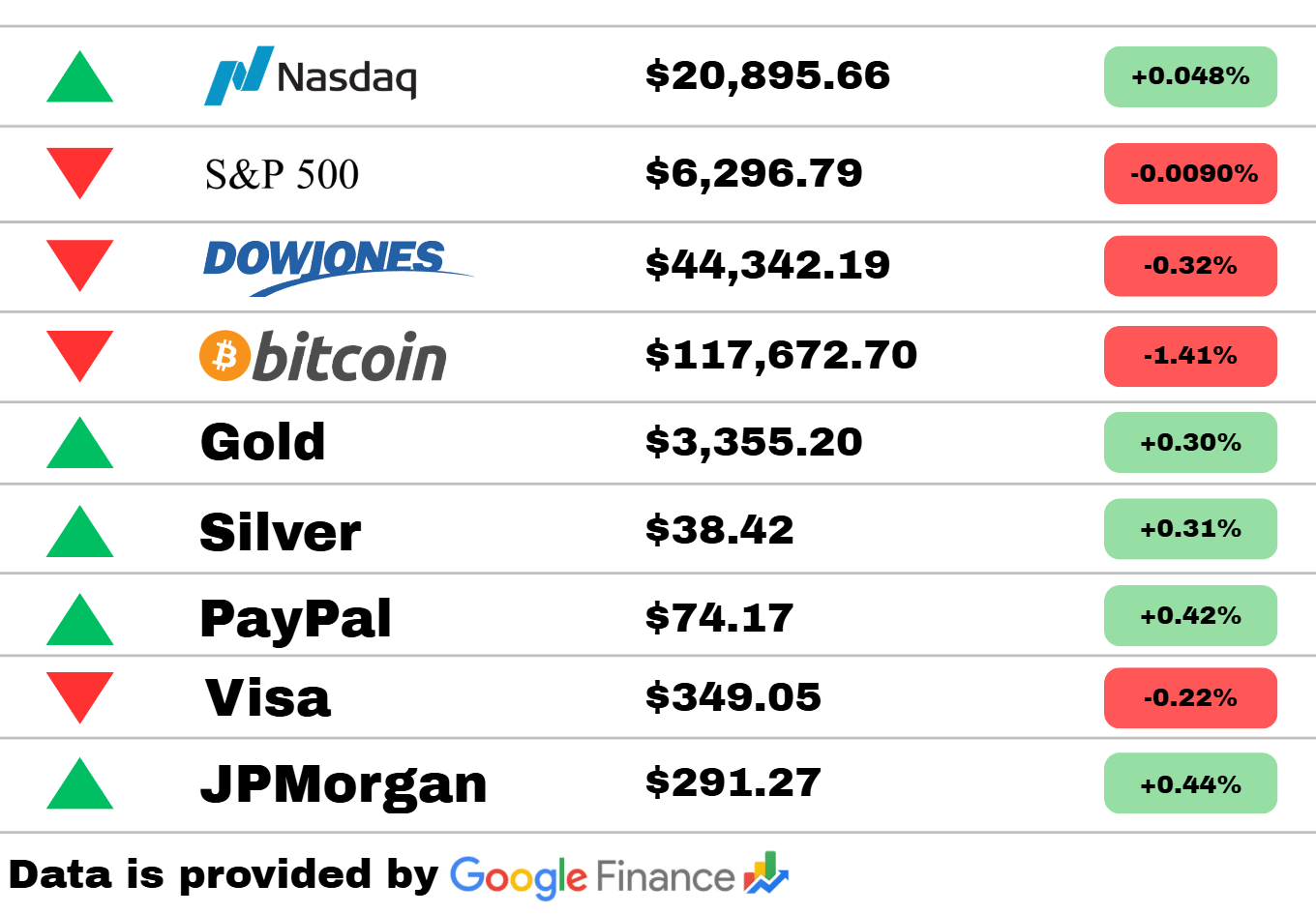

*Market data represents the most recent market close at 5:00pm ET

Market Update: Today’s market felt like a slow shuffle rather than a sprint—small moves, mixed directions, and a bit of head-scratching. 🧐

The Nasdaq barely budged but still edged up +0.048%, while the S&P 500 dipped by a hair (-0.0090%)—blink and you might miss it.

Dow Jones fell a bit more noticeably, sliding 0.32%, as blue chips took a breather.

Bitcoin stumbled, down 1.41%, snapping its recent winning streak.

Meanwhile, gold and silver quietly added to their shine, up 0.30% and 0.31%, respectively—modest, but steady. 🪙✨

In fintech, PayPal ticked up 0.42%, and JPMorgan added 0.44%, showing some quiet resilience.

Visa, however, declined 0.22%, perhaps feeling the weight of consumer credit caution.

Not a dramatic day, but definitely one for the “close watchers.” A little red, a little green, and a whole lot of waiting to see what tomorrow brings. 📉📈

What if a single test could unlock everything you need to know about your health? With TruAge, it can. From identifying your biological age to tracking key markers like inflammation, vitamins, and metabolic health, their reports are fully customized to you. You’ll receive actionable steps based on your results, giving you the clarity and confidence to make impactful changes. One finger prick of blood, one life-changing report. The Wealth Wagon readers can save 20% today with code WELLNESS20.

Global

🇮🇱 Israel’s Strike on Gaza Catholic Church Under Fire

Israel expressed “deep regrets” following a deadly airstrike that hit a Catholic church in Gaza. The NBC News report suggests this incident could have major diplomatic fallout. Religious and humanitarian groups are watching closely, especially as the Israeli military faces scrutiny.

🇸🇾 Bloodbath in Suweida Sparks Outrage

Druze residents in Suweida, Syria, described a “bloodbath” following intense violence in the city. The conflict appears to involve severe civilian impact, raising concerns about broader instability. The report from BBC emphasizes the humanitarian consequences and the pressure mounting on the Syrian regime.

🇪🇺 EU Strikes Russia with Harshest Sanctions Yet

The EU unveiled its toughest sanctions package against Russia in years, according to The Wall Street Journal. This move underscores the bloc's continued efforts to counter Russia’s actions, likely tied to the war in Ukraine. The sanctions are expected to impact key sectors of the Russian economy.

Markets

📊 Retail Resilience Defies Recession Worries

MarketWatch writes that despite mounting pressures, the U.S. retail sector remains surprisingly strong. Analysts say this resilience is helping stave off a full-blown recession. Consumer confidence and spending levels are crucial signs watched by investors and policymakers alike.

📉Trump Targets Fed Chair, Calling Him a ‘Numbskull’

Donald Trump criticized the Federal Reserve Chair, claiming he made housing less affordable. According to The Guardian, Trump’s words raise eyebrows in financial circles, especially with interest rate tensions already high. This could signal more volatility in Fed relations if Trump returns to office.

💰 Crypto Week Sees Major Legislative Action

Investor’s Business Daily reports that major crypto wins were scored after the House passed three key bills. These legislative developments mark a turning point for crypto regulation in the U.S. It suggests growing institutional and bipartisan acceptance of digital assets.

Science

🦖 Dinosaur Likely Tweeted Before It Roared

The New York Times shares a fascinating report suggesting that some dinosaurs may have “tweeted” (in birdlike chirps) before evolving the ability to roar. This finding reshapes our understanding of ancient vocal evolution. It also strengthens the evolutionary link between birds and dinosaurs.

🧊 1.5M-Year-Old Ice to Be Melted for Study

BBC highlights a unique scientific mission involving 1.5 million-year-old Antarctic ice. Scientists plan to melt and analyze it to study ancient climate patterns. The results could help refine models predicting future environmental shifts.

🌌 First-Ever Observation of Solar System Birth

According to ABC News, astronomers have, for the first time, witnessed the birth of a new solar system. This discovery, observed through advanced telescopes, provides unprecedented insight into planetary formation. It could also inform theories on how Earth and its neighbors came to be.

Economy

🛃 Trump’s Trade Tariffs Made Wall Street Rich

Axios explains how Trump-era tariff battles unexpectedly enriched Wall Street. By triggering market fluctuations, these trade moves opened up profit-making opportunities for investors. The article points out that while average consumers may have paid more, financial elites capitalized on the volatility.

📦 U.S. Retail Sales Beat Expectations

According to Reuters, U.S. retail sales have exceeded forecasts, signaling that consumers continue to spend despite broader economic concerns. This resilience has helped ease fears of a near-term recession. It also supports a stable labor market outlook, providing optimism amid mixed signals from other economic indicators.

💼 The ‘Kitchen Sink’ Thrown at Economy Isn’t Causing a Recession

MarketWatch reports that despite aggressive economic policy actions and external pressures, the U.S. economy is not tipping into recession. The piece argues that robust job numbers and consumer activity are keeping the economy afloat. This perspective contrasts with doomsday forecasts that anticipated a downturn by mid-2025.

Personal Finance

💵 Social Security COLA for 2026 Estimated at 2.7%

USA Today reports that the projected cost-of-living adjustment (COLA) for Social Security in 2026 is 2.7%. However, much of that increase is expected to be offset by higher Medicare Part B premiums. Seniors may see only a modest net benefit, raising concerns about financial preparedness in retirement.

👨👩👧 Family Offices and Payroll Strategy

CNBC highlights how family offices are adapting their financial strategies by putting relatives on payroll to protect wealth. This method is gaining popularity among high-net-worth families seeking tax-efficient ways to distribute income. It reflects a broader shift in how generational wealth is being managed.

🔐 Trump Eyes Retirement Funds for Crypto

As reported by Cointelegraph, Donald Trump may authorize retirement accounts to invest in cryptocurrency via executive order. This controversial proposal could revolutionize personal investing for millions. While it offers diversification, it also brings regulatory and volatility concerns to retirement portfolios.

Today’s Snapshot

The One “Side Hustle” Nobody Talks About (But Everyone Should Start)

Hey hey 👋

Let’s talk about something real for a second.

We all love the big flashy stuff—startups, crypto, passive income, high-growth portfolios. But let’s be honest: most wealth doesn’t start with a bang… it starts with a quiet, simple move that compounds over time.

So here’s a thought...

What if I told you that one of the smartest side hustles you could start right now doesn't require a product, audience, or even a business plan?

It’s called: Building a Personal Operating System

Wait—don’t run. I’m not talking spreadsheets and stress.

I’m talking about designing the way you think, act, and grow — like you’re a high-performing company.

Because you are.

Let’s break it down. This will change how you work, earn, invest, and relax. Promise.

🚀 Why You (Yes, You) Need a Personal OS

Whether you’re:

Climbing the corporate ladder

Running your own business

Flipping sneakers on eBay

Or still figuring out what the heck you want to do…

The difference between people who float and people who fly is systems.

Systems beat motivation.

Systems beat talent.

Systems quietly build empires.

So, instead of hustling 24/7 or “manifesting millions,” why not install a few simple habits that make you money while you sleep (or at least stress less during the day)?

🧠 Step 1: Think Like a Business

Let’s be real—if you were a company, would you invest in you?

Would you hire yourself, give yourself funding, or fire you for poor performance?

Okay, tough love over. Here’s what you do:

Set quarterly goals like a CEO.

Forget vague stuff like “make more money.” Try:

→ “Increase income by $2K/month through consulting by Q4.”Do weekly reviews like a manager.

What worked? What didn’t? What’s next?

A 15-minute Sunday reset = unfair advantage.Track your time like a CFO.

Where does your attention go? You don’t need spreadsheets. Just awareness.

🛠 Step 2: Build Assets, Not Just To-Do Lists

Most people spend their days doing tasks. High-leverage people? They build assets.

Assets = anything that continues to pay you over time.

Examples:

A blog post that ranks on Google and brings leads

A 1-page freebie that builds your email list

An SOP you can hand off to a freelancer

Even a great Tweet that gets reshared forever

🔁 Ask yourself: “What can I create today that keeps working after I stop?”

This is how you escape the trap of trading time for money.

🔋 Step 3: Energy > Everything

Let’s get a little woo-woo for a sec (but backed by data, I swear).

Energy is the currency of execution.

If you’re burnt out, your brain can't make smart money decisions.

If you're scattered, you say yes to too much (and dilute your growth).

If you feel stuck, you miss obvious opportunities.

Your job? Protect your energy like it’s your retirement fund.

Some quick wins:

Ditch doomscrolling before 10am. (Start with your brain, not the internet.)

Do 1 "money move" per morning.

Email a lead. Send a pitch. Study a new market.Unfollow noisy people. Seriously. Curate your input = elevate your output.

🧱 Step 4: Stack Tiny Wins

You don’t need a 10-year plan.

You need a 10-minute habit.

10 minutes of writing per day? That’s a book in a year.

10 minutes of outreach? That’s 300+ new connections.

10 minutes of research? That’s a new investment edge.

Small > Big. Consistent > Intense. Always.

🎯 TL;DR – Your Personal OS Starter Pack

Here’s your no-fluff checklist:

✅ Set 1 clear goal per quarter

✅ Do a weekly 15-min review

✅ Create 1 asset per week

✅ Protect your energy like it’s cash

✅ Stack small daily habits

💬 Real Talk to Wrap It Up

We live in a world screaming, “Go big or go home.”

But the truth? Most winners go small — again and again — and don’t stop.

You don’t need to quit your job, build an app, or chase a new “opportunity” every 2 weeks.

You just need a solid system.

Build it once. Improve it over time. And watch everything — your income, your freedom, your confidence — compound.

You got this.

Now go be the CEO of you.

Catch you tomorrow,

Get ready for new career opportunities with hands-on learning from Codecademy. With 600+ interactive courses, Codecademy Pro helps you learn job-ready skills like AI, cybersercurity, and data science. Learners can also practice for technical interviews, build portfolio-worthy projects, and prepare for top industry certification tests. Ready to give hands-on learning a try? The Wealth Wagon readers can save 15% on an annual Pro membership when they use code SKILLUP15 at checkout.

Fun Stuff

😂 Funny Joke

Why did the economist bring a ladder to work?

Because the market was climbing, and he didn’t want to miss out on the upside.

🧩 Riddle

I’m often inflated, sometimes burst.

Speculators chase me, then get hurt.

When I pop, fear rules the Earth.

What am I?

🏢 Guess the Company (Trivia)

Clue:

This company began as a bookseller but now powers cloud infrastructure, voice assistants, groceries, and blockbuster TV shows — and it started in Jeff Bezos’s garage.

🕰️ Financial History: What Happened Today?

July 19, 1999:

Napster launched — sparking a digital music revolution and setting the stage for Spotify, Apple Music, and the streaming economy.

It was sued into oblivion, but its disruption lives on in every playlist you stream today.

*Answers at the bottom

Thought of The Day

Growth doesn’t just come from adding more.

Sometimes the most powerful acceleration comes from removing the things slowing you down.

In business — and life — subtraction is often strategy.

Answers

Riddle - Answer: A bubble (financial)

Guess the Company - Answer: Amazon

That’s All For Today

I hope you enjoyed today’s issue of The Wealth Wagon. If you have any questions regarding today’s issue or future issues feel free to reply to this email and we will get back to you as soon as possible. Come back tomorrow for another market update, and snapshot. I hope to see you. 🤙

— Ryan Rincon, CEO and Founder at The Wealth Wagon Inc.

Disclaimer: This newsletter is for informational and educational purposes only and reflects the opinions of its editors and contributors. The content provided, including but not limited to real estate tips, stock market insights, business marketing strategies, and startup advice, is shared for general guidance and does not constitute financial, investment, real estate, legal, or business advice. We do not guarantee the accuracy, completeness, or reliability of any information provided. Past performance is not indicative of future results. All investment, real estate, and business decisions involve inherent risks, and readers are encouraged to perform their own due diligence and consult with qualified professionals before taking any action. This newsletter does not establish a fiduciary, advisory, or professional relationship between the publishers and readers.