January 8, 2026

Welcome Back,

Happy Thursday, everyone! ☀️

Good morning — hope your day is starting off smooth and unhurried.

Here’s a thought to sip on with your coffee: Why do some people earn a lot… yet still feel stuck?

It’s rarely about income — it’s about what happens in the middle, between earning and investing.

That’s what today’s post dives into — the small, often-overlooked money decisions that quietly make a huge difference over time.

Because wealth isn’t just about how much you make — it’s about what you do with it in between.

— Ryan Rincon, Founder at The Wealth Wagon Inc.

Quote of The Day

“You don’t build wealth by saving what’s left after spending; you build it by investing what’s left after thinking.”

— Naval Ravikant

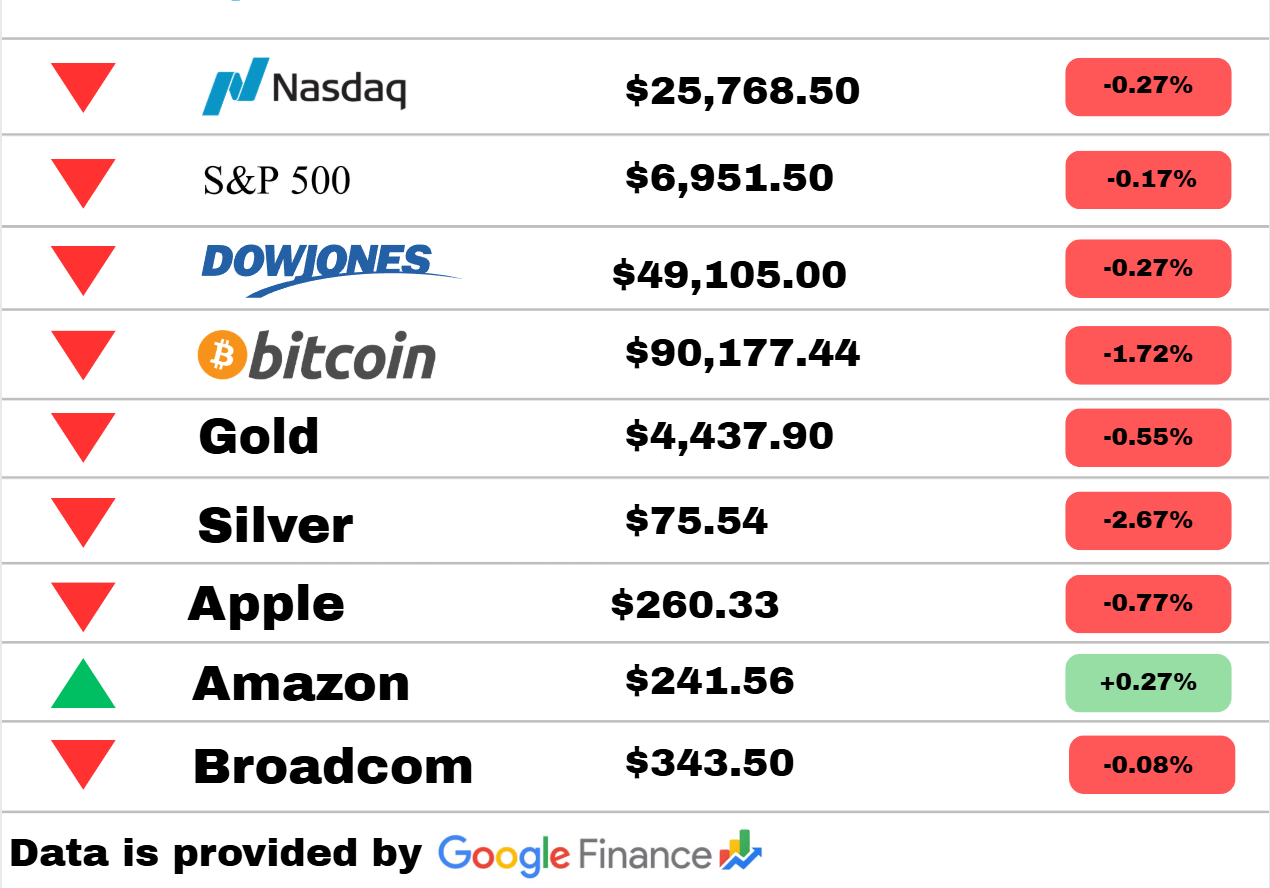

Market Update

*Market data represents the most recent market close at 5:00pm ET

Market Update: Markets pulled back modestly today as a wave of profit-taking moved through risk assets. The Nasdaq, S&P 500, and Dow Jones all slipped about a quarter of a percent, signaling a cautious pause after recent strength rather than a broad risk-off move.

Bitcoin saw a sharper pullback, dropping 1.72% as crypto cooled alongside equities. Precious metals followed suit, with Gold down 0.55% and Silver sliding 2.67%, suggesting short-term traders locking in gains after a strong run.

In stocks, Apple declined 0.77% and Broadcom edged lower, reflecting softness in large-cap tech. Amazon was a standout on the upside, gaining 0.27% as buyers selectively rotated into growth leaders despite the broader market dip.

Overall, this looks like a healthy reset — consolidation rather than panic — as markets digest recent gains and wait for the next catalyst.

Economy

US service sector activity strengthens as hiring improves

U.S. service-sector activity picked up in December, signaling resilience despite higher interest rates and lingering inflation pressures. Stronger demand helped support hiring, easing some concerns about a near-term slowdown. Economists say services remain a key pillar of growth even as manufacturing stays uneven.

Alabama cities face uneven unemployment pressures

New data show notable gaps in unemployment rates across Alabama, with some cities struggling more than others. Analysts point to differences in local industries, workforce skills, and post-pandemic recovery speeds. The disparities are fueling renewed debate over targeted job training and economic development efforts.

India’s economy seen growing solidly in 2026 despite trade risks

India is projected to grow around 7.4% in 2026, supported by domestic consumption and infrastructure spending. Trade tensions and global slowdown risks remain, but policymakers appear confident in internal demand. The outlook reinforces India’s role as one of the world’s fastest-growing major economies.

Crypto

US lawmakers schedule major crypto hearings for mid-January

Two Senate committees have set hearings to debate sweeping cryptocurrency legislation early in the new year. Lawmakers are expected to focus on market structure, consumer protection, and regulatory authority. The outcome could shape the U.S. crypto landscape for years.

AI-linked stock jumps as Bitcoin treasury value surges

A popular AI-focused stock surged after its Bitcoin treasury holdings pushed its market value higher. Investors are increasingly rewarding companies that combine artificial intelligence narratives with crypto exposure. Critics warn the strategy adds volatility tied to Bitcoin price swings.

Bitcoin rally explained as price breaks above $94,000

Bitcoin’s move above $94,000 was driven by strong ETF inflows, tightening supply, and renewed institutional interest. Analysts point to improving macro sentiment and declining selling pressure. Volatility remains high, but momentum traders see room for further gains.

Business

Trump proposes ban on large investors buying homes

Donald Trump said he would bar large investors from purchasing residential homes, aiming to ease housing affordability. Details on enforcement and scope remain limited, raising questions from economists and real estate groups. Supporters argue it could help first-time buyers, while critics warn of unintended market distortions.

Warner Bros again rejects Paramount takeover bid

Warner Bros has once more turned away a takeover offer from Paramount, signaling confidence in its independent strategy. Company leaders emphasized long-term value creation and ongoing restructuring efforts. The decision keeps consolidation talks in Hollywood on hold.

China reviews Meta’s $2 billion AI acquisition

Chinese regulators are examining Meta’s $2 billion purchase of AI startup Manus, adding scrutiny to cross-border tech deals. Officials are assessing competition and data security implications. The review underscores rising geopolitical sensitivity around artificial intelligence investments.

Today’s Snapshot

How Most High Earners Accidentally Stay Broke by Mishandling Their “Middle Money”

There’s a phase of money almost nobody talks about.

It’s not poverty money.

It’s not generational wealth money.

It’s middle money.

This is the phase where you’re making good income, saving something, investing a little, but still feeling like your financial life isn’t moving the way it should.

This applies to:

corporate professionals making $80k–$300k

business owners with inconsistent income

investors with multiple accounts but no clarity

people who “should” be doing well but feel stuck

The problem usually isn’t income.

It’s how middle money is handled.

Let’s break down what actually goes wrong — and what to do instead.

Middle Money Has a Visibility Problem

When you’re broke, every dollar matters.

When you’re wealthy, money is intentionally structured.

But in the middle, money becomes invisible.

Raises go straight into lifestyle.

Bonuses disappear into spending.

Side income blends into checking accounts.

Extra cash just “kind of goes away.”

Most people in this phase don’t intentionally deploy money — they absorb it.

That’s where progress stalls.

Checking Accounts Are Where Money Goes to Die

One of the most common middle-money mistakes is letting excess cash sit in checking accounts.

Not because it’s “safe.”

Because it’s convenient.

Money that sits there gets spent emotionally, not strategically.

The fix isn’t complicated:

checking should only hold operating money

anything beyond monthly needs should be moved on purpose

If money doesn’t have a destination, it will default to consumption.

Raises Are the Most Dangerous Form of Income

Raises feel earned, so they feel spendable.

That’s why most people stay at the same net worth trajectory for years despite earning more.

A practical rule that works in real life:

treat 50% of every raise as nonexistent

redirect it immediately to investing, debt reduction, or reserves

never let it touch your lifestyle

This one behavior alone creates long-term separation between people with similar incomes.

Too Many Accounts Create False Progress

People love opening accounts:

brokerage here

crypto app there

savings account somewhere else

retirement accounts they never check

But scattered money creates the illusion of progress without coordination.

You don’t need fewer accounts.

You need roles for each one.

Every dollar should have a job:

short-term stability

medium-term opportunity

long-term compounding

If you can’t explain what an account is for, it’s probably doing nothing meaningful.

Middle Money Is Where Bad Debt Hides

High earners often carry:

car loans longer than needed

credit balances they don’t notice

subscriptions masked as “small”

financing on depreciating assets

None of these feel urgent because income covers them.

But they silently reduce flexibility.

The goal in this phase isn’t zero debt.

It’s debt that serves a purpose.

If debt doesn’t:

reduce risk

increase income

or buy back time

…it’s probably working against you.

Investing Without Intent Is Still Gambling

Middle money investors often:

buy random stocks

dabble in crypto

contribute to retirement accounts automatically

reinvest dividends without thinking

None of this is bad.

But without intent, it’s uncoordinated.

Ask yourself:

What is this investment supposed to do for me?

Is it growth, stability, income, or optionality?

How does it fit with everything else I own?

If you can’t answer that, you’re not investing — you’re participating.

The Real Goal of Middle Money Is Control

This is the phase where you build financial leverage, not flash.

Control looks like:

knowing exactly where excess money goes

being able to fund opportunities quickly

having margin for mistakes

not panicking when income fluctuates

not being forced into bad decisions

People don’t get rich by earning more alone.

They get rich by controlling money before it controls them.

A Simple Weekly Habit That Changes Everything

Once per week, do this:

open your accounts

look at balances

ask where money moved

decide where excess should go next

Not budgeting.

Not tracking every expense.

Just active awareness.

This single habit prevents drift — the real enemy of middle money.

Why This Matters

Most people don’t fail financially.

They plateau.

They earn more.

They work harder.

They invest “a little.”

But nothing compounds because money is never directed with intention.

Middle money is where financial futures are decided.

Handle it poorly, and you stay stuck for decades.

Handle it well, and wealth becomes inevitable.

Thought Of The Day

Success compounds quietly when you prioritize ownership, leverage, and long-term thinking, while others remain distracted by short-term comfort and noise.

That’s All For Today

I hope you enjoyed today’s issue of The Wealth Wagon. If you have any questions regarding today’s issue or future issues feel free to reply to this email and we will get back to you as soon as possible. Come back tomorrow for another market update, and snapshot. I hope to see you. 🤙

— Ryan Rincon, CEO and Founder at The Wealth Wagon Inc.

Disclaimer: This newsletter is for informational and educational purposes only and reflects the opinions of its editors and contributors. The content provided, including but not limited to real estate tips, stock market insights, business marketing strategies, and startup advice, is shared for general guidance and does not constitute financial, investment, real estate, legal, or business advice. We do not guarantee the accuracy, completeness, or reliability of any information provided. Past performance is not indicative of future results. All investment, real estate, and business decisions involve inherent risks, and readers are encouraged to perform their own due diligence and consult with qualified professionals before taking any action. This newsletter does not establish a fiduciary, advisory, or professional relationship between the publishers and readers.