January 7, 2026

Welcome Back,

Happy Wednesday, everyone! ☀️

Good morning — hope today already feels productive in a calm, focused way.

Quick question to start the day: Have you ever earned more… but somehow felt like nothing really changed?

It happens more often than people admit. More income doesn’t always mean better finances — unless it’s handled intentionally.

That’s exactly what today’s post is about: making sure raises, promotions, and income bumps actually move the needle where it counts.

Because earning more is great — keeping and improving more is even better.

— Ryan Rincon, Founder at The Wealth Wagon Inc.

Quote of The Day

“Wealth is not about having a lot of money; it’s about having a lot of options.”

— Chris Rock

Market Update

*Market data represents the most recent market close at 5:00pm ET

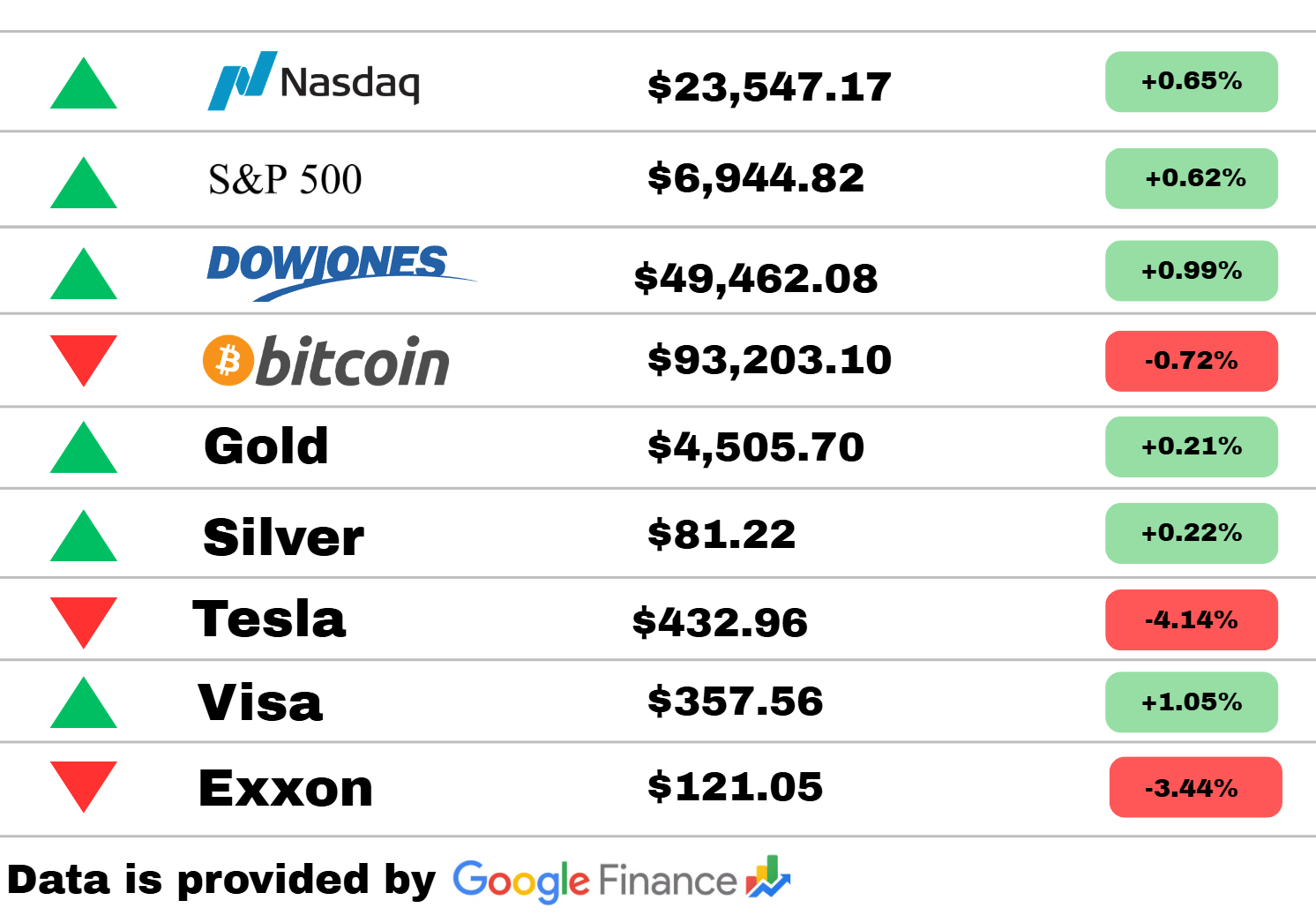

Market Update: Markets pushed higher again today, with all three major indexes closing in the green. The Nasdaq rose 0.65%, the S&P 500 added 0.62%, and the Dow Jones climbed 0.99%, showing steady optimism across equities as tech and blue-chips both found buyers.

Bitcoin was the lone major risk asset in the red, slipping 0.72% after its recent surge — more of a healthy cooldown than a reversal. Meanwhile, safe-haven metals continued their quiet climb: Gold ticked up 0.21% and Silver gained 0.22%.

On the stock side, Tesla took a notable hit, falling 4.14% as investors rotated away from high-volatility names. Exxon also slid 3.44%, pressured by softening energy prices.

In contrast, Visa stood out with a strong 1.05% gain, reinforcing the strength in financial and payment sectors as consumer activity remains resilient.

Overall, a constructive day for equities, even as crypto and energy stocks cooled off.

Politics

Mystery trader garners $400,000-plus windfall on Maduro’s capture

A little-known trader made a massive profit after betting on market moves tied to the dramatic capture of Venezuela’s leader. The sudden spike in related assets raised eyebrows across financial circles. Analysts note the timing was unusually precise, prompting curiosity about what the trader may have anticipated.

Trump officials told lawmakers that Maduro and his wife hid their heads as they attempted to flee US forces

US officials briefed lawmakers on new details surrounding the couple’s attempted escape during the high-stakes military operation. The account paints a chaotic scene as forces closed in faster than expected. The update adds another layer to tensions surrounding the ongoing US-Venezuela standoff.

NYT, WSJ pour cold water on report Venezuelan opposition leader was snubbed for accepting US help

Major outlets challenged claims that the opposition figure was sidelined due to ties with the US. Their reporting suggests the situation is far more nuanced, shaped by internal strategy and shifting alliances. The revision comes as competing narratives continue to swirl around Venezuela’s political landscape.

Travel

Hilton cuts ties with Minnesota hotel owner after DHS, ICE agents allegedly denied service

A major hotel chain terminated its agreement after reports surfaced that federal agents were refused lodging. The incident sparked immediate backlash and questions about the property’s management decisions. Officials say the review process is ongoing as the fallout continues to grow.

Three bidders shortlisted for next Commuter Rail contract, MBTA says

Transit leaders announced the finalists in the competition to run a key regional rail system. Each contender brings different operational strengths that could shape the network’s future. The decision marks a major step toward modernizing service in the coming years.

TriMet to eliminate Portland-area bus routes, shorten MAX Green Line amid budget crisis

Facing a widening financial gap, the regional transit agency unveiled significant service cuts. Officials say the changes are necessary to stabilize operations heading into 2026. Riders are preparing for longer waits and reduced access in several neighborhoods.

Finance

4 money moves to make in response to the events in Venezuela

Financial experts are advising Americans to reassess their portfolios as geopolitical risks escalate. They point to currency exposure, energy markets, and safe-haven assets as key areas to review. The guidance aims to help households stay grounded through fast-moving global developments.

Mechanicsburg-based financial advisory firm expands into Lancaster County

A local advisory group is broadening its footprint with a new office in a neighboring region. Leadership says rising demand for personalized financial planning drove the decision. The expansion underscores the firm’s confidence in long-term growth opportunities.

Hannah Dugan likely to keep state pension despite felony conviction, resignation

A former official is expected to retain retirement benefits even after stepping down amid legal troubles. The case has reignited debate over pension protections for public employees. Lawmakers are signaling interest in reviewing rules that govern such outcomes.

Today’s Snapshot

How to Make Sure a Pay Raise, Promotion, or Income Increase Actually Improves Your Finances

Most people assume that earning more money automatically improves their financial situation.

In practice, that’s often not what happens.

A raise, a bonus, a promotion, or a jump in income frequently leads to higher taxes, higher lifestyle costs, new expenses, and more financial complexity. Six to twelve months later, many people realize they’re working harder but feel no more financially secure than before.

This article is about how to capture the financial upside of earning more, instead of letting it quietly disappear.

Why Income Increases Often Don’t Translate to Wealth

When income rises, three things usually happen at the same time:

First, taxes increase immediately.

Second, spending slowly expands.

Third, financial decisions become more complex.

The problem isn’t irresponsibility. It’s timing.

Most people wait until after the raise or income increase hits to think about what to do with it. By then, the money has already been absorbed into daily life.

The solution is to make decisions before the money arrives.

Step One: Lock in the “Non-Negotiables” Ahead of Time

Before your income increases, decide what portion of the new money will never be spent.

This is not about budgeting every dollar. It’s about creating automatic outcomes.

Examples:

“50% of my raise goes directly to long-term investments.”

“My bonus pays down debt first, no exceptions.”

“Any income above X gets routed into a separate account.”

When these decisions are made in advance, there’s no willpower involved. The money never feels available to spend, so lifestyle creep doesn’t get a chance to start.

People who build wealth don’t rely on discipline — they rely on pre-commitment.

Step Two: Adjust Tax Strategy Before the Paycheck Changes

This is where many high earners lose thousands without realizing it.

An income increase often pushes you into:

a higher marginal tax bracket

reduced deductions

different payroll withholding behavior

higher estimated tax requirements (for business owners or investors)

The mistake is letting payroll or default tax settings handle this automatically.

Instead, you should:

update withholding intentionally

project your new annual tax liability

adjust estimated payments if applicable

look for deductions or credits that phase out at higher income levels

This one step alone can prevent surprise tax bills and keep more of your raise in your pocket.

Step Three: Separate “Lifestyle Improvements” From “Lifestyle Expansion”

Not all spending increases are bad.

The problem is uncontrolled expansion, not intentional upgrades.

A smart approach is to decide in advance which lifestyle improvements are worth it and which aren’t.

Examples of high-value upgrades:

buying back time (cleaning, admin help, better tools)

improving health or energy

reducing daily friction

increasing flexibility or stability

Examples of low-value expansion:

automatic upgrades in housing, cars, or subscriptions

spending increases that don’t improve quality of life

expenses that rise simply because income rose

When you choose upgrades deliberately, your life improves without eroding your financial progress.

Step Four: Treat the Raise as a Financial Event, Not a Paycheck Change

High performers treat income changes the same way companies treat major financial events.

That means:

reviewing cash flow

adjusting savings and investment targets

revisiting risk exposure

updating emergency reserves

reassessing debt strategy

This doesn’t need to be complicated. It just needs to happen once.

Most people never pause to recalibrate, so the new income blends into old habits.

Those who pause once gain a permanent advantage.

Step Five: Protect the Increase From Future Drift

Even if you do everything right initially, drift happens over time.

To prevent that:

review your finances 90 days after the income increase

compare actual outcomes to your original plan

correct early before habits set in

Small adjustments early prevent big regrets later.

This is especially important for people with variable income, bonuses, commissions, or business profits.

Why This Matters More as Income Grows

At lower income levels, mistakes are survivable.

At higher income levels, mistakes compound.

An extra $10,000 per year mismanaged for a decade is not just $100,000 lost — it’s lost compounding, lost optionality, and lost leverage.

The difference between people who “earn well” and people who “build wealth” is not intelligence or ambition.

It’s whether income increases are captured intentionally or absorbed passively.

Final Thought

Earning more money is an opportunity — not a guarantee.

If you don’t decide what the extra money is for, it will decide for you.

But when you handle income increases deliberately, each one permanently improves your financial position instead of resetting your baseline.

That’s how progress becomes permanent.

Thought Of The Day

Freedom grows quietly when you align discipline, long-term vision, and consistent action, even while others chase shortcuts and instant gratification.

That’s All For Today

I hope you enjoyed today’s issue of The Wealth Wagon. If you have any questions regarding today’s issue or future issues feel free to reply to this email and we will get back to you as soon as possible. Come back tomorrow for another market update, and snapshot. I hope to see you. 🤙

— Ryan Rincon, CEO and Founder at The Wealth Wagon Inc.

Disclaimer: This newsletter is for informational and educational purposes only and reflects the opinions of its editors and contributors. The content provided, including but not limited to real estate tips, stock market insights, business marketing strategies, and startup advice, is shared for general guidance and does not constitute financial, investment, real estate, legal, or business advice. We do not guarantee the accuracy, completeness, or reliability of any information provided. Past performance is not indicative of future results. All investment, real estate, and business decisions involve inherent risks, and readers are encouraged to perform their own due diligence and consult with qualified professionals before taking any action. This newsletter does not establish a fiduciary, advisory, or professional relationship between the publishers and readers.