January 1, 2026

Welcome Back,

Happy New Year, everyone! 🎉✨

Good morning — hope today feels calm, hopeful, and full of that fresh-page energy only January 1st brings.

Quick question to kick off the year: Have you ever wondered who actually decides where the money goes inside a company — and why some ideas get funded while others don’t?

That behind-the-scenes decision-making shapes careers, businesses, and investments more than most people realize.

That’s exactly what today’s post explores — how money decisions really get made, and how understanding this can give you a quiet edge all year long.

New year. New clarity.

Let’s start strong.

— Ryan Rincon, Founder at The Wealth Wagon Inc.

Quote of The Day

“The future belongs to those who prepare for it today.”

— Malcolm X

Market Update

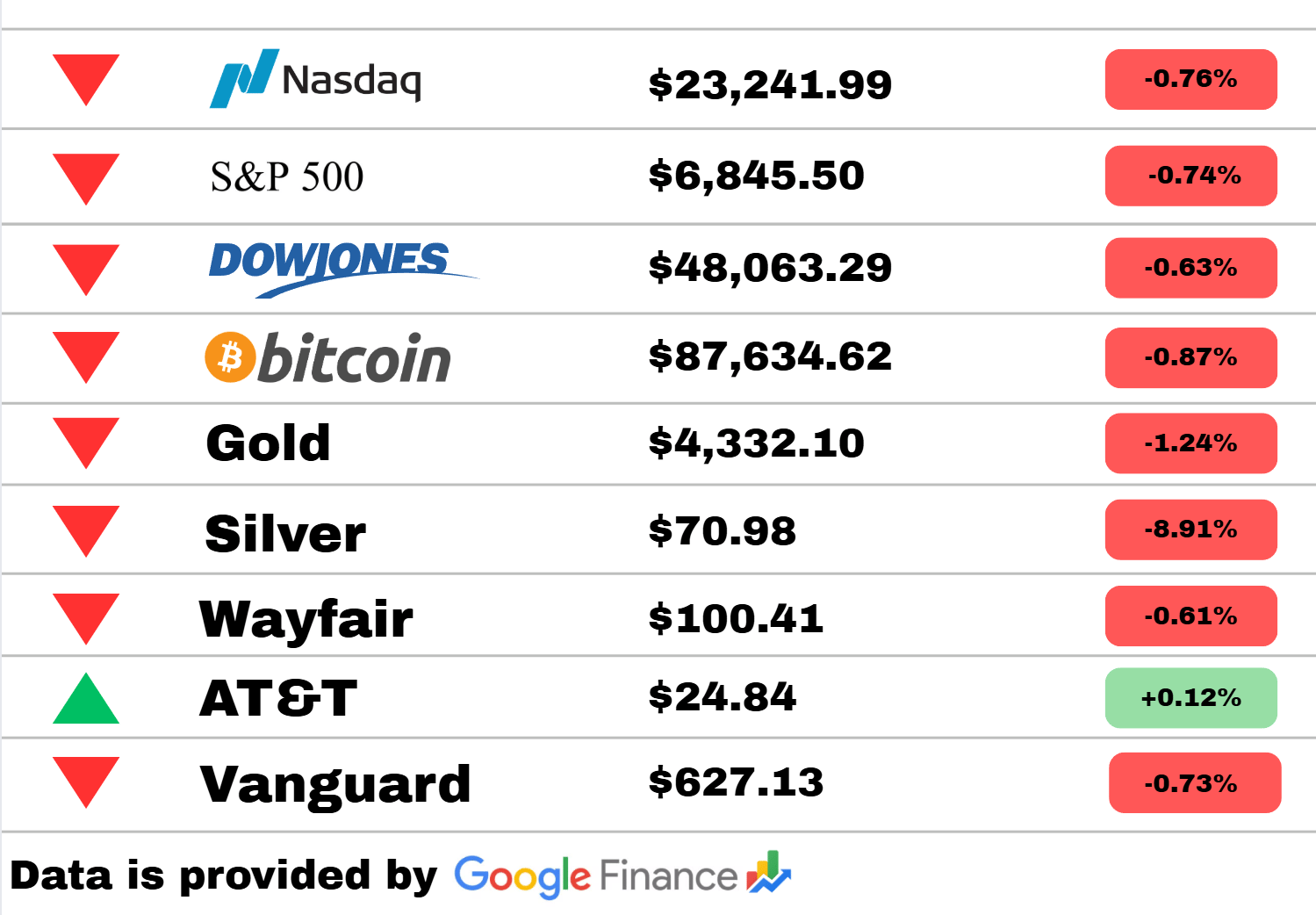

*Market data represents the most recent market close at 5:00pm ET

Market Update: Today’s market felt like it collectively rolled out of bed on the wrong side. All three major indices slid lower, with the Nasdaq down 0.76%, the S&P 500 dropping 0.74%, and the Dow Jones falling 0.63%. No panic—just steady red across the board as investors leaned cautious.

Bitcoin also cooled off, slipping 0.87% as crypto momentum paused. But the real volatility hit the metals market: Gold dipped 1.24%, and *Silver absolutely tumbled—down a sharp 8.91%, marking the biggest mover of the day and signaling a rapid retreat after recent strength.

On the stock side, Wayfair fell 0.61%, and Vanguard slid 0.73%, reflecting the broader risk-off mood. The lone green shoot? AT&T, up a modest 0.12%—not a fireworks moment, but today even a small gain feels heroic.

Overall, today’s session was a classic “everything red except telecom” kind of day, with caution dominating trading screens.

Travel

Take a look at the abandoned New York City subway station where Zohran Mamdani will be sworn in…

An iconic but long-shuttered NYC subway station is getting a rare moment back in the spotlight as it becomes the ceremonial venue for Zohran Mamdani’s upcoming swearing-in. The location’s ornate architecture and hidden-in-plain-sight history are drawing new attention. City preservationists say moments like this highlight the forgotten beauty built into New York’s transit system. For many residents, it’s a reminder of how much public infrastructure has evolved—and what’s been lost.

Washington Monument light show planned for NYE in honor of America’s 250th birthday

A major light show is being prepared at the Washington Monument to kick off New Year’s Eve celebrations and begin the countdown to America’s 250th birthday. Organizers say the display will blend historic imagery with modern laser technology for a dramatic nighttime spectacle. The event is expected to draw thousands from across the country. Officials call it a symbolic start to a yearlong celebration of national milestones.

Eurostar back on track after Channel Tunnel power fault

Eurostar services have resumed after a power fault in the Channel Tunnel caused significant delays and cancellations. Passengers faced long waits as engineers worked through the night to restore operations. The disruption raised fresh concerns about infrastructure strain during peak holiday travel. With trains moving again, carriers are prioritizing stranded travelers to ease the backlog.

Technology

Samsung unveils its new $200 Galaxy A17 5G smartphone, arriving in January

Samsung’s latest budget-friendly 5G smartphone is set to launch in January, offering upgraded cameras, a larger battery, and a surprisingly low price point. The Galaxy A17 5G targets users who want modern capabilities without the premium cost. Analysts say Samsung is tightening its grip on the mid-range market as competition intensifies. Early previews highlight a sleek redesign and strong value proposition.

Apple drops cryptic teaser for Apple Fitness+: ‘Something big is coming’ in 2026

Apple sent Fitness+ users into speculation mode after dropping a vague 2026 teaser hinting at a major update. The messaging suggests new training formats or a deeper integration with Apple’s expanding health ecosystem. Industry watchers believe Apple may be preparing a significant hardware tie-in. The teaser alone has sparked growing anticipation across the fitness tech community.

LG is taking on Samsung’s ‘The Frame’ with its new ‘Gallery TV’

LG is preparing a direct rival to Samsung’s popular “The Frame,” introducing a new “Gallery TV” designed to blend seamlessly into home decor. The set emphasizes ultra-thin design and customizable art displays. Early reviewers say LG is aiming squarely at consumers who value aesthetics as much as picture quality. The competition marks another escalation in the battle for premium living-room real estate.

Finance

ACA subsidies that lower monthly insurance premiums for millions of Americans set to expire

A wave of ACA subsidies that have helped keep insurance premiums lower for millions is approaching expiration, raising concerns about a sudden spike in costs. Health policy experts warn that many households could see sharp monthly increases if Congress doesn’t act. Insurers are already signaling potential adjustments for next year’s plans. The uncertainty is adding new pressure ahead of the next enrollment cycle.

Record Gold Price Ends 2025 Up 65%, Silver Jumps 144%

Precious metals closed the year with staggering gains, as gold surged 65% and silver vaulted an eye-popping 144%. Safe-haven demand intensified amid global policy shifts and market volatility. Investors rotated heavily into metals as expectations of rate cuts strengthened. The rally is now shaping debates about whether these highs mark a peak or the start of a new multi-year trend.

Affordable Care Act subsidies set to expire, impacting some Covered California premiums

Covered California enrollees may face premium increases as key ACA subsidies reach their sunset date. State officials say thousands could see material changes in out-of-pocket costs unless federal extensions are approved. Consumer advocates are urging immediate policy action to avoid destabilizing the marketplace. For many families, the timing coincides with already elevated living expenses.

Today’s Snapshot

How Companies Actually Decide Where Money Gets Spent (And Why This Matters for Your Career, Business, and Investments)

Most people think companies allocate money logically.

They assume budgets go to:

the best ideas

the highest ROI projects

the smartest teams

That’s not how it actually works.

Inside real companies—large and small—money flows based on internal power dynamics, timing, incentives, and narrative, not just spreadsheets.

If you understand how capital allocation really happens, you gain an edge as:

an employee trying to advance

a business owner pitching ideas or funding

an investor evaluating management quality

This is extremely practical knowledge that applies everywhere.

How Budget Decisions Really Start

Budgets don’t start with numbers.

They start with priorities.

Each year, leadership quietly decides:

what they want to grow

what they want to protect

what they are willing to sacrifice

Those decisions are driven by:

pressure from investors or owners

last year’s failures or wins

upcoming risk (regulatory, competitive, market)

leadership ego and visibility

who is closest to decision-makers

Only after those priorities are set do spreadsheets get built.

That’s why two projects with identical ROI can get wildly different funding.

The 3 Places Money Actually Flows First

In almost every organization, capital flows first to:

Revenue protection

Anything that prevents revenue loss

Customer retention

System stability

Compliance

Brand protection

Leadership visibility projects

Initiatives executives can point to

Projects tied to promotions or bonuses

High-profile launches

Strategic narratives (“AI”, “growth”, “international expansion”)

Existing momentum

Teams already succeeding

Projects that look “safe”

Initiatives with political support

This is why great ideas often die quietly while mediocre ones survive.

Why This Matters If You’re an Employee

If you want:

promotions

raises

job security

influence

You need to align your work with where money is already flowing.

High performers don’t ask:

“What should I work on?”

They ask:

“What is leadership already protecting or expanding?”

If your work:

protects revenue

reduces risk

supports a visible initiative

You become harder to cut and easier to promote.

People who get laid off are often good at their jobs—but misaligned with capital priorities.

Why This Matters If You Run a Business

Founders often make this mistake:

They invest in what they find interesting.

Strong operators invest in:

customer acquisition

retention

pricing power

operational bottlenecks

cash-flow stability

Capital should flow to constraints, not ideas.

Ask yourself regularly:

What would break my business if underfunded?

What would unlock growth if overfunded?

What looks important but doesn’t move revenue?

Smart businesses don’t spend evenly.

They spend unevenly and intentionally.

Why This Matters If You’re an Investor

When you invest in a company, you’re not just buying products or earnings.

You’re buying management’s capital allocation ability.

Poor capital allocators:

chase trends

over-hire

over-expand

under-invest in core strengths

destroy value slowly

Great capital allocators:

reinvest where returns are highest

cut aggressively where ROI drops

stay boring during hype cycles

protect downside first

This is why two similar companies can have wildly different outcomes.

Look at where money is actually going—not what management says.

How to Read Capital Allocation Signals in Real Life

You can spot priorities without access to internal meetings.

Watch for:

headcount growth by department

hiring freezes in specific functions

sudden budget cuts

increased reporting requirements

new internal initiatives getting attention

changes in compensation structures

Money leaves footprints.

If you follow the footprints, you understand the real strategy.

A Simple Question That Changes Everything

Whenever you’re evaluating a company, role, or investment, ask:

“What does this organization spend aggressively on—and what does it starve?”

The answer tells you:

what they truly value

what will survive downturns

where power lives

where risk hides

This single question gives you more clarity than most financial statements.

The Real Takeaway

Money inside organizations is not neutral.

It’s political, strategic, emotional, and reactive.

People who understand this:

advance faster

build stronger businesses

avoid bad investments

position themselves near growth

protect themselves during downturns

This is not theory.

This is how decisions actually get made.

And once you see it, you can’t unsee it.

Thought Of The Day

The start of a year is proof that time resets, but habits don’t—choose actions today that your future self will quietly thank you for.

That’s All For Today

I hope you enjoyed today’s issue of The Wealth Wagon. If you have any questions regarding today’s issue or future issues feel free to reply to this email and we will get back to you as soon as possible. Come back tomorrow for another market update, and snapshot. I hope to see you. 🤙

— Ryan Rincon, CEO and Founder at The Wealth Wagon Inc.

Disclaimer: This newsletter is for informational and educational purposes only and reflects the opinions of its editors and contributors. The content provided, including but not limited to real estate tips, stock market insights, business marketing strategies, and startup advice, is shared for general guidance and does not constitute financial, investment, real estate, legal, or business advice. We do not guarantee the accuracy, completeness, or reliability of any information provided. Past performance is not indicative of future results. All investment, real estate, and business decisions involve inherent risks, and readers are encouraged to perform their own due diligence and consult with qualified professionals before taking any action. This newsletter does not establish a fiduciary, advisory, or professional relationship between the publishers and readers.