December 9, 2025

Welcome Back,

Happy Tuesday, everyone! 🌤️

Good morning — I hope you're all doing really, really well today!

Quick question for you: Have you ever wished you had a little control panel for your life that helped you make clearer, faster decisions? Something that saves you from overthinking and from making choices you regret later?

Well… that’s exactly what we’re diving into today.

Because when you build a Decision Dashboard — a simple system for evaluating money, work, and opportunities — everything suddenly feels lighter, clearer, and a whole lot easier to manage.

Think of it as giving your future self a smarter co-pilot.

— Ryan Rincon, Founder at The Wealth Wagon Inc.

Quote of The Day

“You don’t get paid for the hour. You get paid for the value you bring to the hour.”

— Jim Rohn

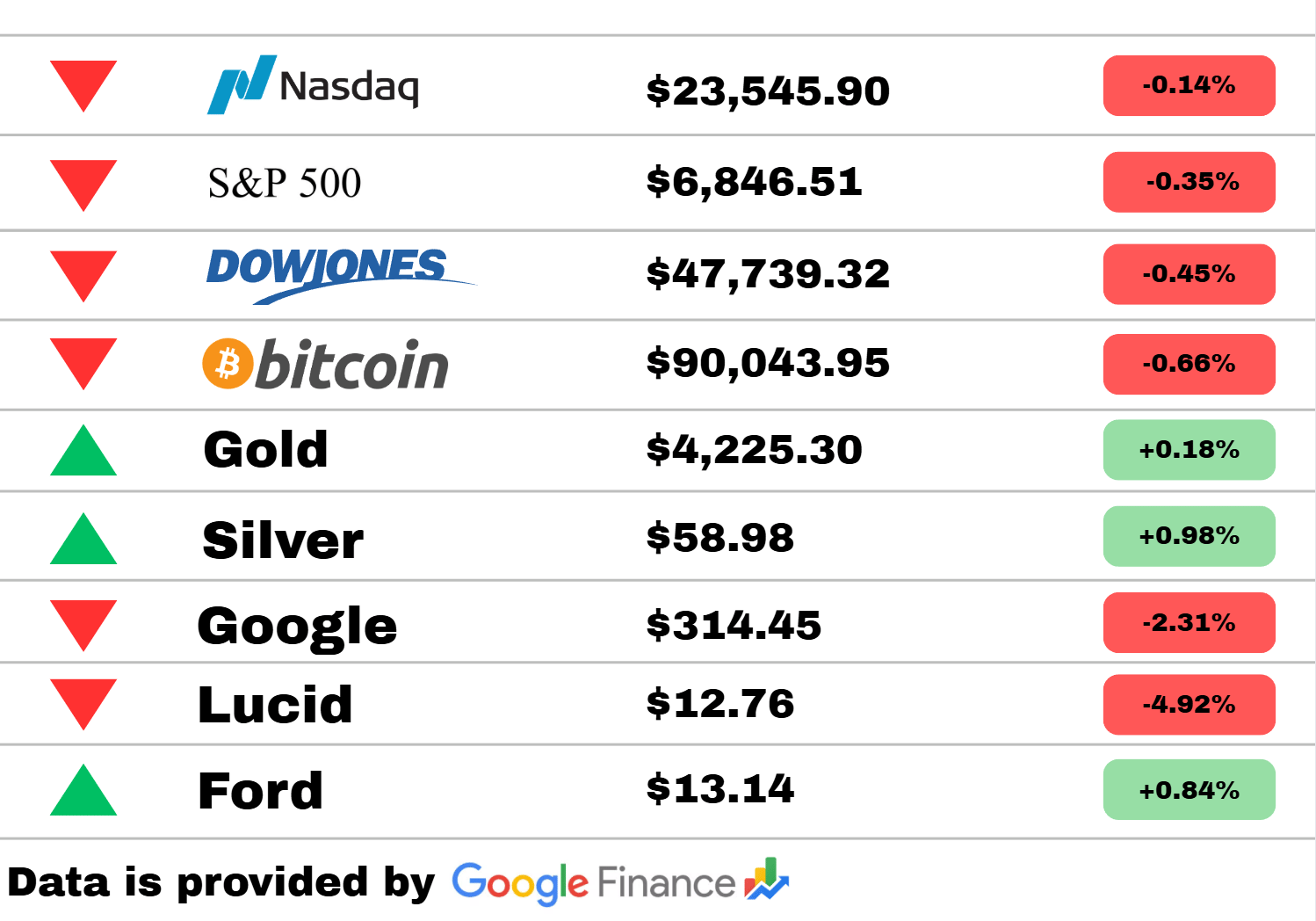

Market Update

*Market data represents the most recent market close at 5:00pm ET

Market Update:

The markets took a cautious step back today, with the Nasdaq slipping 0.14% and the S&P 500 down 0.35%, while the Dow Jones eased 0.45%. Bitcoin also cooled off, dropping 0.66% as traders pulled back from recent highs.

On the commodities side, Gold inched up 0.18%, and Silver added a stronger 0.98%, giving metals a quiet but positive day.

In equities, Google stumbled with a bigger 2.31% drop, and Lucid slid 4.92% as EV sentiment weakened. Meanwhile, Ford delivered a mild surprise, climbing 0.84% and bucking the broader market trend.

Economy

Despite tariffs, China’s trade surplus surpasses $1T for the first time

China’s trade surplus has crossed the $1 trillion threshold, reflecting strong export performance despite tariff pressures. The surge highlights how manufacturers have adapted supply chains and pricing to stay competitive. Economists say the milestone may intensify global trade tensions heading into next year.

Japan revises economic data, revealing deeper summer contraction

Japan has reissued its July–September numbers to show a larger economic decline than initially reported. The downward revision points to weaker consumer demand and slower manufacturing activity. Policymakers warn that continued soft spending could complicate planned recovery measures.

Mortgage rates begin the week hovering near three-month highs

U.S. mortgage rates ticked upward again, approaching levels last seen in early fall. Borrowers are grappling with higher monthly payments as lenders adjust to evolving expectations around inflation and Fed policy. Housing analysts say buyer demand may cool if rates remain elevated through December.

Crypto

Major buyer pours nearly $1B into Bitcoin, largest purchase in months

A single strategic buyer has snapped up close to $1 billion worth of Bitcoin, marking the biggest accumulation move in months. The purchase sparked renewed volatility as traders debated whether it signals long-term conviction or short-term positioning. Market watchers say the timing could reshape sentiment heading into year-end.

Investors race into Ripple amid surge toward $40B valuation

Ripple has drawn heavy attention as a quiet shift in strategy pushed its implied valuation near $40 billion. Traders are speculating whether new partnerships and institutional interest will fuel broader momentum. Analysts caution that the move may already be pricing in optimistic expectations.

Bitcoin weekly metrics hint at shifting market momentum

Fresh on-chain data shows tightening liquidity and rising long-term holder activity in Bitcoin markets. Volatility remains elevated as traders weigh macro headwinds against accumulation trends. Market analysts say these signals could determine whether Bitcoin stabilizes or enters another corrective phase.

Technology

Google plans first AI glasses powered by Gemini, targeting 2026 launch

Google is preparing to release its first AI-enabled smart glasses built around the Gemini platform. Early details suggest real-time translation, visual assistance, and contextual computing features. The project signals Google’s renewed push into wearable tech after years of quiet development.

New AI coding tools integrated directly into Slack’s workflow

Slack users will soon gain access to advanced code-generation features designed to automate routine development tasks. The integration promises faster debugging, smarter suggestions, and instant documentation support. Engineers say the upgrade could significantly streamline team workflows.

Next-gen Exynos chip rumored to enable early AI-focused smartphone leap

A new Exynos 2600 chip is reportedly on track to debut much sooner than anticipated, potentially redefining mobile performance benchmarks. Leaks suggest the processor is optimized for on-device AI and advanced graphics. Smartphone makers are watching closely to see which flagship device adopts it first.

Today’s Snapshot

How to Build a “Decision Dashboard” to Make Faster, Smarter Financial and Business Choices

One of the biggest hidden leaks in people’s careers, businesses, and financial lives isn’t money.

It’s decision drag — the time, energy, and mental bandwidth wasted trying to choose between options.

Most people don’t realize how much it costs them to:

hesitate

overthink

delay

constantly reconsider

second-guess

revisit decisions they already made

The most effective operators — CEOs, investors, founders, top earners — all have one thing in common:

They reduce decision drag by standardizing how they make important choices.

That’s where a Decision Dashboard comes in.

It’s simple, fast, and ridiculously effective.

Let’s break it down.

1. What Is a Decision Dashboard?

A decision dashboard is a repeatable system that helps you evaluate any major decision in your:

career

business

finances

investing

personal development

time allocation

Instead of making emotional decisions or relying on “gut feelings,” you run the decision through a structured filter.

The goal:

Get to clarity faster and with fewer mistakes.

2. The Four-Core Questions of a Decision Dashboard

These questions eliminate 90% of bad decisions instantly.

1. What’s the ROI if it succeeds?

Not hypothetically. Not “best case.”

Realistically — what is the upside?

2. What’s the downside if it fails?

If the worst-case scenario happens, what’s the true cost?

3. What remains true either way?

This is a powerful question.

Example:

If you start a side business and it fails…

you still keep the skills, connections, experience, and lessons.

If the “remains true” column is valuable, the decision is safer than it looks.

4. Will this matter in 3 years?

If the answer is no, it’s often not worth major time, stress, or money.

3. Add a Decision Score: 1–5 Based on Each Factor

For any major choice, score these categories:

ROI Potential

Risk Level

Skill-Building

Time Requirement

Long-Term Alignment

Higher total = better decision.

Low total = walk away.

This prevents you from emotionally chasing distractions and saying yes to low-value commitments.

4. Use the “Default Path Test”

Most people never ask themselves:

“What happens if I do nothing?”

You will be shocked how many decisions solve themselves if you simply maintain your current trajectory.

Example:

Your career might improve naturally within months.

Your business might grow without the new idea.

Your investments might perform without active tinkering.

Doing nothing is often the most profitable choice — but people rarely consider it.

5. The 30-Hour Rule for Large Decisions

Business owners, investors, and executives use this all the time:

If a decision could meaningfully impact your life for years, give it 30 hours of spaced-out thought, not 30 seconds or 30 days.

Enough time to think clearly

Not enough time for paralysis

If you're still unsure after 30 hours, it probably doesn’t meet your threshold of importance.

6. Pre-Commit to Your “Hard Nos”

Smart decision-makers eliminate categories of decisions before they appear.

Examples:

“I don’t invest in things I don’t understand.”

“I don’t join partnerships where I don’t own at least X%.”

“I don’t commit to projects requiring more than 5 hours a week.”

“I don’t work with people who drain my energy.”

“I don’t pursue opportunities with unclear revenue models.”

By pre-defining your nos, you save yourself from thousands of unnecessary decisions.

7. Build a 3-Tier Decision System

Not all decisions deserve equal attention.

Here’s how high performers categorize them:

Tier 1 — Big Decisions (High Impact, Low Frequency)

Examples:

changing careers

starting a business

acquiring a company

major financial moves

forming partnerships

Use the full dashboard.

Tier 2 — Medium Decisions (Moderate Impact, Medium Frequency)

Examples:

choosing between job offers

deciding on new investments

changing pricing

upgrading skills

Use an abbreviated dashboard (ROI, downside, time).

Tier 3 — Small Decisions (Low Impact, High Frequency)

Examples:

minor workflow decisions

small purchases

simple business choices

day-to-day planning

Make these decisions instantly.

Save decision bandwidth for Tier 1.

Why This Matters

The people who grow quickest and build wealth the fastest aren’t the smartest.

They’re the ones who:

make decisions quickly

make decisions confidently

make decisions consistently

avoid decision fatigue

avoid unnecessary mistakes

avoid wasting time on low-value options

A Decision Dashboard turns chaotic decision-making into a predictable, structured, repeatable advantage.

And advantage compounds.

Every high-quality decision sets up the next one.

Thought Of The Day

When you remove the need for instant validation, you free yourself to pursue deeper mastery. Real breakthroughs come from patient effort and quiet, consistent evolution over time.

That’s All For Today

I hope you enjoyed today’s issue of The Wealth Wagon. If you have any questions regarding today’s issue or future issues feel free to reply to this email and we will get back to you as soon as possible. Come back tomorrow for another market update, and snapshot. I hope to see you. 🤙

— Ryan Rincon, CEO and Founder at The Wealth Wagon Inc.

Disclaimer: This newsletter is for informational and educational purposes only and reflects the opinions of its editors and contributors. The content provided, including but not limited to real estate tips, stock market insights, business marketing strategies, and startup advice, is shared for general guidance and does not constitute financial, investment, real estate, legal, or business advice. We do not guarantee the accuracy, completeness, or reliability of any information provided. Past performance is not indicative of future results. All investment, real estate, and business decisions involve inherent risks, and readers are encouraged to perform their own due diligence and consult with qualified professionals before taking any action. This newsletter does not establish a fiduciary, advisory, or professional relationship between the publishers and readers.