December 4, 2025

Welcome Back,

Happy Thursday, everyone! 🌞

Good morning — hope you woke up feeling hopeful, energized, or at the very least… caffeinated. ☕✨

Here’s a fun question for you today:

What if money, clients, and opportunities didn’t come from “luck”… but from a pipeline you built on purpose?

That’s exactly what we’re diving into:

how to create an Opportunity Pipeline — a system that keeps sending opportunities your way while you’re busy living your life.

Imagine waking up not wondering if something good is coming… but which good thing will show up next.

— Ryan Rincon, Founder at The Wealth Wagon Inc.

Quote of The Day

“Doubt kills more dreams than failure ever will.”

— Suzy Kassem

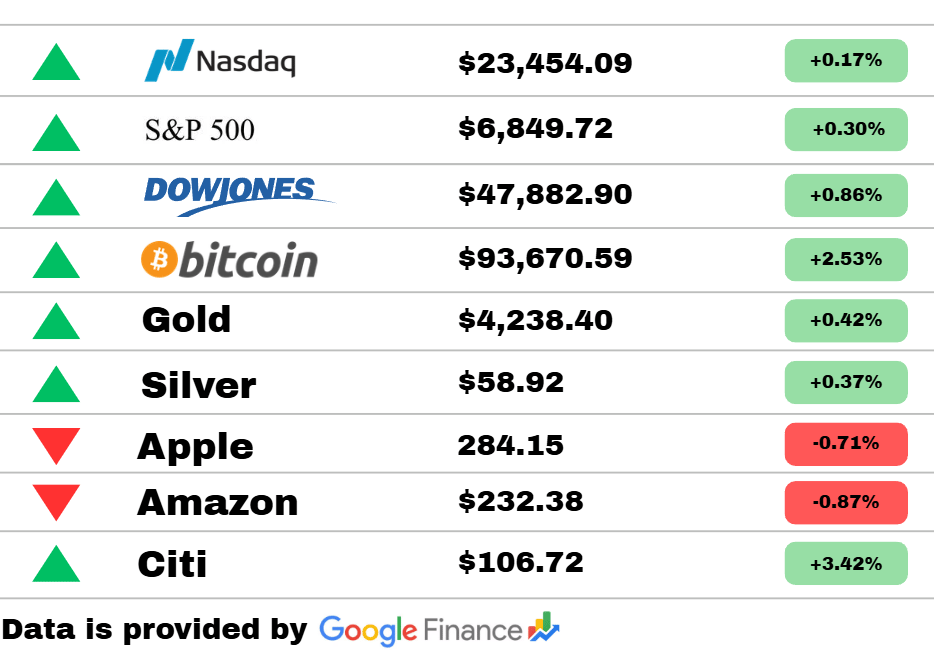

Market Update

*Market data represents the most recent market close at 5:00pm ET

Market Update: Markets pushed modestly higher today as all three major indices stayed in the green. The Nasdaq ticked up +0.17%, the S&P 500 followed with +0.30%, and the Dow led the pack at +0.86%, signaling a steady, low-drama climb across equities. Meanwhile, Bitcoin jumped +2.53%, extending its comeback streak and injecting some energy into the risk-on crowd.

Commodities saw their own quiet lift: Gold rose +0.42%, and Silver added +0.37%, continuing their slow and steady uptrend. In stock moves, Citi stole the spotlight with a strong +3.42%, riding financial-sector momentum. On the flip side, Apple slipped –0.71% and Amazon fell –0.87%, suggesting some cooling off in mega-cap tech after recent strength.

Overall, investors leaned optimistic today, with broad gains and only a few tech laggards holding back an otherwise upbeat session.

World

EU proposes using frozen Russian assets to fund Ukraine.

European officials are weighing whether to tap frozen Russian assets or borrow against them to provide long-term support for Ukraine. The move reflects growing concern that current funding channels may fall short as the war grinds on. If approved, the plan could become one of the largest financial measures taken by the bloc since the conflict began.

Israel receives remains of possible hostage and plans to reopen Gaza crossing.

Israeli authorities say they have recovered the remains of a person believed to be a hostage, renewing public pressure for clearer answers about those still missing. Alongside this development, Israel announced plans to reopen a major Gaza crossing into Egypt to increase humanitarian access. The decision comes amid international calls for more aid and greater transparency.

Hong Kong faces scrutiny after deadly fire exposes systemic failures.

A fatal building fire in Hong Kong has reignited criticism of the city’s infrastructure safety and emergency preparedness. Officials acknowledge gaps in oversight, with investigators examining whether outdated systems contributed to the severity of the incident. The tragedy has sparked broader debate over governance and how the region manages rapid urban growth.

Personal Finance

Holiday tipping guidance resurfaces as budgets tighten.

As holiday spending accelerates, financial planners are outlining practical expectations for tipping seasonal workers and service providers. Many Americans are feeling squeezed by inflation, making thoughtful but manageable giving more important than ever. Experts advise using personal budgets—not social pressure—as the anchor for end-of-year tipping decisions.

Vanguard unveils its first new target-date fund series in over 20 years.

A major investment firm has launched its first new target-date lineup since 2003, aiming to modernize long-term retirement planning. The updated series introduces more flexible asset-allocation strategies designed to adapt to changing market conditions. Investors see the rollout as a signal of rising demand for hands-off, automated retirement solutions.

A millionaire with chronic illness describes financial isolation.

A woman with significant wealth shared how chronic illness has left her feeling financially and socially isolated despite her savings. Her experience highlights how money alone cannot insulate individuals from the emotional toll of health challenges. The story is prompting a broader conversation about the hidden struggles many high-net-worth individuals face.

Technology

Top Apple designer departs for a leadership role at Meta.

A longtime Apple design executive has joined Meta in a high-level design position, signaling growing competition between the companies for creative talent. The move surprised many observers, as the designer helped shape several major Apple product lines. Meta’s hiring strategy suggests it is doubling down on hardware and immersive technology ambitions.

Google faces backlash after replacing news headlines with AI-generated summaries.

Google is rolling out AI-generated headlines in its Discover feed, but early reactions show widespread confusion and criticism. Users say many summaries feel inaccurate or awkward, raising concerns about the reliability of AI-filtered news. The rollout underscores the challenge tech companies face in balancing automation with editorial trust.

Leak hints that Apple Health may soon connect directly to ChatGPT.

A new leak suggests that future Apple Health updates could integrate with ChatGPT, allowing users to ask questions about their health data in plain language. Such a feature could transform the way people interpret fitness metrics, symptoms, or wellness trends. If released, it would mark one of the deepest AI integrations Apple has allowed into a core app.

Today’s Snapshot

How to Build an “Opportunity Pipeline” That Consistently Brings You Money, Deals, Clients, and Career Breakthroughs

Most people think success comes from sudden luck — meeting the right person, landing the right deal, stumbling into the right idea.

But here’s the real truth:

Opportunities don’t appear randomly.

They appear for people who intentionally build a system that attracts them.

And this is something almost nobody does.

This isn’t networking.

This isn’t branding.

This isn’t “manifesting.”

This is an actual pipeline you construct that feeds you:

new clients

business partnerships

job offers

investors

mentors

collaborations

speaking gigs

interview requests

buying/selling opportunities

talent recruitment

consulting work

Let’s break down how to build this pipeline in a practical, actionable way.

1. Create a Simple “Surface Area” Strategy

Opportunity comes from surface area — the amount of chances you give the world to discover you.

Most people have a surface area of one:

one job

one business

one social presence

one skill

That’s not enough.

You want multiple points of visibility, even if they’re small.

Examples:

Posting once weekly on LinkedIn

Joining one industry Slack/Discord

Commenting thoughtfully on 5 creators’ posts

Being active in one alumni network

Showing up at one monthly industry meetup

Sending 3 messages/week to people you respect

Small actions create massive compounding exposure over time.

2. Build a “Send-Out Pipeline” (SOP)

Every week, send things out into the world:

insights

small projects

questions

summaries

helpful comments

recommendations

audit-style breakdowns

templates

resources

introductions

Each “send-out” is like a hook you cast into the ocean.

Most won’t catch anything — but a few will, and those few change your life.

A good target is:

10 send-outs per week.

Not spam.

Just genuine signal.

3. Build a “Follow-Up” Database

The biggest opportunities come from people you’ve already met — not strangers.

So create a simple spreadsheet:

Name

Where you met

Their goals

What they mentioned struggling with

Your last interaction

A reminder date

Then every week:

Follow up with 5 people.

It’s shocking how many business deals, job offers, or partnerships come from someone you talked to once six months ago.

Most people forget you exist after 72 hours.

Following up respectfully makes you unforgettable.

4. Build Strong “Opportunity Triggers”

Opportunity triggers are signals that make people think of you when something happens.

For example:

A friend hears someone needs a website — they think of the web designer who helped them last year.

A CEO hears an analyst talking about AI — they think of the guy who posted about AI implementation.

A founder needs marketing — they remember your once-per-week value post.

You want to define 2–4 things you want to be known for.

Then become loudly consistent about them.

You’re training the market:

“When X happens, think of me.”

5. Build an “Inbound System” (This is Where the Money Happens)

Inbound means opportunities come to you instead of you chasing them.

To create inbound, you need:

A place where people can reach you

LinkedIn DMs

Email newsletter

Portfolio

Calendly link

Simple landing page

Instagram profile

Twitter/X profile

If people can’t reach you, nothing happens.

A reason for them to reach out

Post value.

Share wins.

Share lessons.

Share frameworks.

Share industry commentary.

Share helpful tools.

Share quick case studies.

You’re not posting to go viral — you’re posting to attract the right 50–500 people.

6. Create a Monthly “Opportunity Review”

Take 15 minutes each month and review:

Who reached out

What opportunities appeared

Which channels produced them

What didn’t work

Who you need to follow up with

What content performed best

Which conversations led to introductions

Then double down on the channels producing actual results.

This creates exponential opportunity growth, not linear.

7. Build the Habit of Making “Light Asks”

You don’t need to ask for big things.

Small asks create big connections.

Examples:

“Can I get your opinion on X?”

“Do you know anyone who does Y?”

“Mind if I send you something I’m working on?”

“Could I interview you for 5 minutes about your industry?”

People LOVE low-pressure asks.

It makes them feel useful — without commitment.

These tiny asks lead to:

mentorship

job openings

partnerships

collaborations

warm intros

referrals

8. Track Your “Opportunity ROI”

Ask yourself:

What produced the best outcomes?

What cost the least time?

What produced the highest leverage?

What surprised you?

What could be automated or repeated?

Most people waste 90% of their opportunity potential because they never track what works.

After 90 days of tracking, you'll know EXACTLY where to focus your time for the highest return.

Final Thought

A strong opportunity pipeline doesn’t make you “lucky.”

It makes you predictably discoverable.

The world is full of people who:

want to hire you

want to work with you

want to invest in you

want to learn from you

want you on their team

want your expertise

want your help

want your product or idea

But none of that matters unless they can find you.

Build this system, and finding you becomes the easiest part.

Thought Of The Day

The gap between where you are and where you want to be is often filled with unseen discipline, quiet patience, and consistent, unglamorous effort that compounds over time.

That’s All For Today

I hope you enjoyed today’s issue of The Wealth Wagon. If you have any questions regarding today’s issue or future issues feel free to reply to this email and we will get back to you as soon as possible. Come back tomorrow for another market update, and snapshot. I hope to see you. 🤙

— Ryan Rincon, CEO and Founder at The Wealth Wagon Inc.

Disclaimer: This newsletter is for informational and educational purposes only and reflects the opinions of its editors and contributors. The content provided, including but not limited to real estate tips, stock market insights, business marketing strategies, and startup advice, is shared for general guidance and does not constitute financial, investment, real estate, legal, or business advice. We do not guarantee the accuracy, completeness, or reliability of any information provided. Past performance is not indicative of future results. All investment, real estate, and business decisions involve inherent risks, and readers are encouraged to perform their own due diligence and consult with qualified professionals before taking any action. This newsletter does not establish a fiduciary, advisory, or professional relationship between the publishers and readers.