December 31, 2025

Welcome Back,

Happy Wednesday, everyone — and Happy New Year’s Eve! 🎉

Good morning — hope today feels calm, thoughtful, and full of that “fresh start” energy.

Here’s a question to end the year with: Have you ever felt that something was off… before you could actually prove it?

Great investors and business owners don’t just watch numbers — they notice the signals underneath them.

That’s exactly what today’s post explores: how to spot when a company or business is quietly getting weaker before the headlines or financials catch up.

As we head into a new year, sharper awareness is one of the most valuable skills you can have.

Let’s carry that clarity forward into what’s next. ✨

— Ryan Rincon, Founder at The Wealth Wagon Inc.

Quote of The Day

“You don’t learn to walk by following rules. You learn by doing, and by falling over.”

— Richard Branson

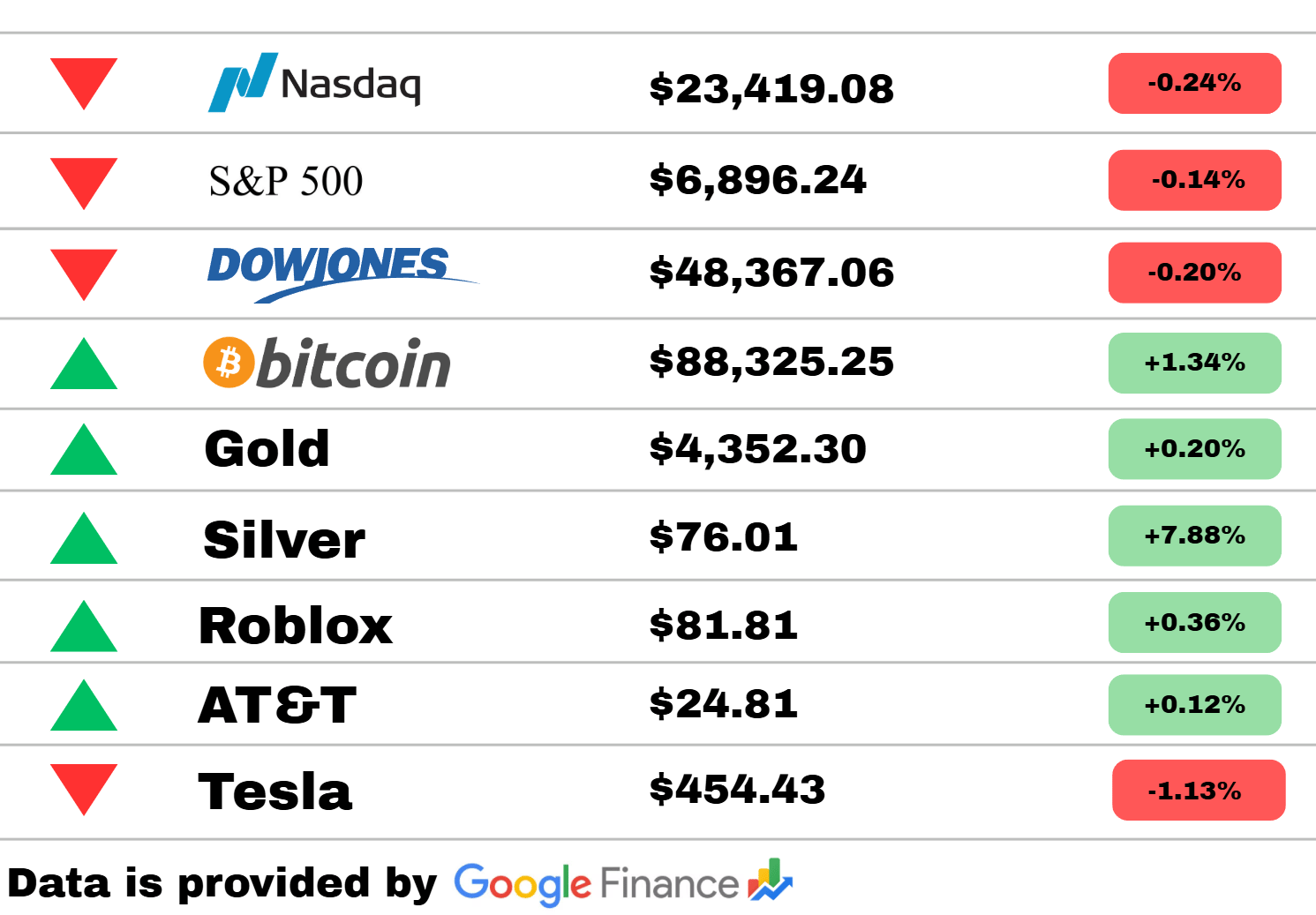

Market Update

*Market data represents the most recent market close at 5:00pm ET

Market Update: Markets drifted slightly lower today as all three major indices dipped into the red. The Nasdaq slipped 0.24%, the S&P 500 edged down 0.14%, and the Dow Jones eased 0.20%. Not a dramatic sell-off—more like the market collectively hitting the snooze button.

Meanwhile, Bitcoin woke up with energy, jumping 1.34% and keeping its uptrend intact. Gold added a modest 0.20%, but the real star of the day was Silver, surging 7.88%—a breakout move that turned plenty of heads.

In equities, Roblox ticked up 0.36%, and AT&T posted a small but steady 0.12% gain. Tesla, however, couldn’t catch traction and slid 1.13%, continuing a choppy stretch for the EV giant.

Overall, the broader market cooled off, but precious metals and select growth names brought some spark to an otherwise muted trading day.

U.S.

The Trump Administration’s Most Paralyzing Blow to Science

A sweeping rollback of key scientific initiatives is raising alarms among researchers who say the changes could slow innovation for years. Critics argue the adjustments undermine long-standing standards for evidence-based policy. Supporters, however, frame the shift as a move toward bureaucratic efficiency. The long-term impact remains unclear as agencies begin restructuring.

How abortion rights in the US have changed since the 2024 election

In the year following the election, several states have enacted sharply different abortion laws, widening the national divide. Some regions expanded access, while others imposed near-total bans. Advocates on both sides say the issue has become more polarized than ever. The shifting landscape is prompting legal battles likely to reach federal courts.

Despair for would-be US citizens as American dream blocked by Trump

Tightened immigration policies have left thousands of applicants in limbo, facing longer waits and stricter criteria. Families say the new hurdles make the path to citizenship feel increasingly unattainable. Officials maintain the measures are necessary to strengthen national security. The changes have sparked renewed debate over America’s role as a destination for newcomers.

Science

Full Moon January 2026: Exactly When To See a ‘Wolf Supermoon’ Rise

Skywatchers are preparing for a striking supermoon that will appear larger and brighter than usual. The event is expected to draw widespread attention as it kicks off a busy year of celestial activity. Experts recommend finding clear horizons for the best view. It’s one of several notable lunar moments scheduled for early 2026.

Artemis 2 moon astronauts rehearse for launch day (photos)

The Artemis 2 crew ran through a full launch-day simulation, testing suits, procedures, and communications. The exercise marks another milestone toward NASA’s first crewed lunar mission in decades. Engineers say the rehearsal helps identify small adjustments before final training. Excitement continues to build as the mission timeline firms up.

The year’s first meteor shower and supermoon clash in January skies

Astronomers say early January will bring a rare overlap of a meteor shower and a supermoon, promising a dramatic but challenging view. The moon’s brightness may wash out some meteors, but peak activity should still offer a memorable show. Observers in dark areas will have the best chance at catching both. It's expected to kick off 2026’s astronomy calendar with a flourish.

Business

Disney to pay $10m over alleged children’s privacy law violations

Disney has agreed to a multimillion-dollar settlement after allegations it mishandled children’s data across several digital platforms. The agreement includes new compliance measures aimed at strengthening user protections. The company says it remains committed to improving safety standards. Regulators view the settlement as a warning to the wider industry.

Meta to buy Manus, an AI startup with Chinese roots

Meta is set to acquire Manus in a bid to accelerate development of next-generation AI tools. The startup’s technology is expected to boost Meta’s productivity and personalization features across its platforms. The move highlights fierce competition among tech giants for emerging AI talent. Analysts say it could signal a new wave of strategic acquisitions.

These restaurant chains closed locations in 2025

A turbulent year for dining has led several major chains to shutter underperforming stores. Higher operating costs and shifting consumer habits contributed to the closures. Industry analysts say brands are consolidating to focus on more profitable regions. Despite the pullback, new concepts and digital expansion remain bright spots for 2026.

Today’s Snapshot

How to Identify Whether a Company (or Business) Is Quietly Getting Weaker Before the Numbers Show It

Most people think financial trouble shows up in earnings reports.

In reality, by the time numbers look bad, the damage already happened months—or years—earlier.

Experienced operators, investors, and executives don’t wait for financial statements to tell them something is wrong. They watch behavioral and operational signals that appear long before revenue declines.

This article shows you what those signals are and how to spot them in real life—whether you’re:

an employee deciding whether to stay,

an investor evaluating risk,

a business owner watching competitors,

or someone considering buying or partnering with a company.

No theory. These are observable, practical indicators.

1. Decision Speed Slows Down Noticeably

One of the earliest signs of internal trouble is when decisions that used to take days start taking weeks.

This happens when:

leadership loses confidence,

internal politics increase,

risk tolerance drops suddenly,

accountability becomes unclear.

You’ll notice more meetings, more approvals, more “let’s circle back,” and fewer decisive actions.

Healthy organizations move fast even when wrong.

Weakening organizations move slow because everyone is afraid of being blamed.

2. The Company Starts Cutting Small Costs Publicly

Major cost cuts are normal during downturns.

But obsession with small expenses is a warning sign.

Examples:

freezing software subscriptions that save time,

micromanaging travel or training budgets,

discouraging tools that improve productivity,

sudden policy enforcement that never mattered before.

Strong businesses cut strategically.

Weak businesses cut reactively—and usually in the wrong places.

This often signals cash pressure that leadership doesn’t want to openly admit yet.

3. Talent Quality Quietly Declines

This one is subtle but extremely reliable.

Watch for:

high performers leaving without replacement,

key roles staying open too long,

promotions happening out of necessity instead of merit,

reliance on contractors where full-time expertise used to exist.

Good companies attract talent even during tough times.

Weakening companies struggle to keep it—and eventually stop trying.

Once talent quality drops, recovery becomes exponentially harder.

4. Customer Feedback Becomes Defensive Instead of Curious

Healthy businesses want feedback, even when it’s uncomfortable.

Weakening businesses:

explain away complaints,

blame customers for misunderstanding,

justify friction instead of fixing it,

stop asking for feedback altogether.

If a company stops being curious about its customers, it’s usually because leadership already knows things aren’t improving—and doesn’t want confirmation.

This is especially visible in SaaS, service businesses, and consumer brands.

5. Short-Term Metrics Replace Long-Term Thinking

When organizations start obsessing over:

daily revenue instead of retention,

short-term growth at the expense of quality,

aggressive discounts to hit targets,

vanity metrics over meaningful performance,

it often means long-term confidence is gone.

Strong companies are willing to sacrifice short-term numbers for durable growth.

Weak companies chase numbers to reassure themselves.

6. Internal Communication Gets Vague

Pay attention to how leadership communicates.

Warning signs:

fewer concrete plans,

more buzzwords and vision talk,

less transparency around priorities,

inconsistent messaging between teams.

Clear communication is confidence.

Vagueness is usually fear or uncertainty.

This is one of the clearest signals that leadership is reacting rather than steering.

7. Core Customers Are No Longer the Focus

Watch where attention shifts.

When a company:

chases new customer segments while neglecting existing ones,

pivots messaging constantly,

launches unrelated initiatives,

spreads resources thin without clear rationale,

it often means the core business isn’t performing as expected.

Diversification should be intentional.

Desperation diversification is chaotic.

Why This Matters to You Personally

This isn’t about predicting collapse.

It’s about positioning yourself early.

If you’re an employee:

you get time to prepare,

you can leave on your terms,

you can negotiate from strength.

If you’re an investor:

you can reduce exposure early,

you avoid holding through avoidable declines.

If you’re a business owner:

you can spot struggling competitors,

you can learn what not to do,

you can identify acquisition opportunities.

If you’re considering a partnership or acquisition:

this saves you from expensive mistakes.

The Key Takeaway

Financial statements tell you what already happened.

Behavior tells you what’s about to happen.

People who learn to read behavior—inside companies, not just spreadsheets—make better decisions, earlier, and with far less risk.

That skill compounds quietly over time.

Thought Of The Day

As the year ends, reflect on how small daily decisions, repeated with discipline and courage, quietly compound into massive long-term success.

That’s All For Today

I hope you enjoyed today’s issue of The Wealth Wagon. If you have any questions regarding today’s issue or future issues feel free to reply to this email and we will get back to you as soon as possible. Come back tomorrow for another market update, and snapshot. I hope to see you. 🤙

— Ryan Rincon, CEO and Founder at The Wealth Wagon Inc.

Disclaimer: This newsletter is for informational and educational purposes only and reflects the opinions of its editors and contributors. The content provided, including but not limited to real estate tips, stock market insights, business marketing strategies, and startup advice, is shared for general guidance and does not constitute financial, investment, real estate, legal, or business advice. We do not guarantee the accuracy, completeness, or reliability of any information provided. Past performance is not indicative of future results. All investment, real estate, and business decisions involve inherent risks, and readers are encouraged to perform their own due diligence and consult with qualified professionals before taking any action. This newsletter does not establish a fiduciary, advisory, or professional relationship between the publishers and readers.