December 29, 2025

Welcome Back,

Happy Monday, everyone! ☀️

Good morning — hope you’re starting the day feeling clear, capable, and ready to ease into the final stretch of the year.

Quick question to kick things off: Did you know credit can actually be a tool — not a trap — when it’s used the right way?

Most people only see the danger side, but the real advantage comes from understanding how to use credit strategically without carrying debt.

That’s exactly what today’s post is about: flipping the script and learning what most people get completely wrong.

Let’s end the year a little smarter than we started it.

— Ryan Rincon, Founder at The Wealth Wagon Inc.

Quote of The Day

“Do not seek praise. Seek criticism.”

— Elon Musk

U.S.

What America Might Look Like With Zero Immigration

A new analysis paints a stark picture of how the U.S. would change if immigration halted entirely. Population growth would slow sharply, shrinking the future workforce and straining programs like Social Security. Economists warn that labor shortages would deepen across key industries. The report underscores how immigration remains tied to America’s long-term economic vitality.

The Unexpected Winner of Rising American Tariffs Is Mexico

As U.S. tariffs reshape global trade, Mexico is capturing business once headed to Asia. Companies are shifting production closer to American consumers to avoid higher import costs. This shift has fueled a surge in Mexican manufacturing activity and cross-border investment. The trend signals how geopolitical tensions are redefining supply chains.

Nigeria Averts Unilateral US Action by Cooperating on Airstrike

Nigeria has agreed to work more closely with the United States following scrutiny over a deadly airstrike. Officials emphasized that cooperation helps prevent unilateral intervention and maintains diplomatic stability. The discussions highlight growing U.S. concern about regional security threats. Nigeria says it intends to strengthen oversight of future military operations.

Politics

Brazil’s Former President Bolsonaro Has Surgery to Treat Hiccups

Brazil’s former president underwent a procedure to address recurring, persistent hiccups that have troubled him since past medical complications. Physicians say the issue is linked to previous abdominal surgeries. The recovery is expected to be smooth, though doctors plan continued observation. His condition has drawn public attention amid ongoing political tensions.

Argentina’s Senate Hands Javier Milei a Win as It Approves Budget

Argentina’s legislature approved a key budget plan that gives the new administration fresh momentum. Supporters say it reflects a shift toward tighter fiscal controls after years of instability. The vote signals lawmakers’ willingness to back the president’s early economic agenda. Markets will be watching to see if the reforms translate into measurable progress.

Benazir Bhutto and the Moment She Chose

A new profile revisits the pivotal moment when Benazir Bhutto stepped into a leadership role that changed Pakistan’s political trajectory. The reflection explores the pressure, sacrifice, and vision behind her decision. It also delves into how her legacy continues to shape the country’s modern political landscape. The story highlights her enduring influence decades later.

Business

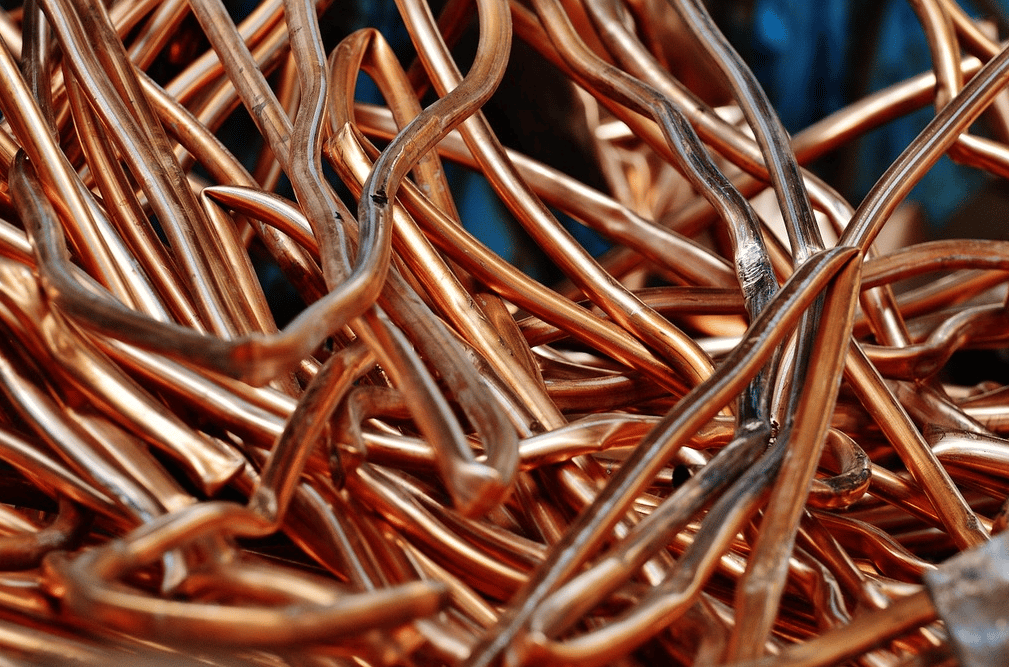

Silver Topped Gold in 2025. It’s Copper’s Turn.

As precious metals rally, silver has outpaced gold this year — but analysts say copper may be next in line. Global demand for electrification continues to soar, putting upward pressure on copper supplies. Traders expect structural shortages to support higher prices into 2026. The shift reflects changing priorities across energy and manufacturing sectors.

Dysart Man Claims $1 Million Lottery Ticket

A small-town resident is celebrating after discovering his ticket hit a $1 million jackpot. He says he originally bought it without much thought, only realizing later how life-changing it was. The unexpected win is prompting plans for debt payoff and long-delayed purchases. Local officials confirmed the prize and congratulated the new winner.

It’s Not Just a COLA: Four Big Social Security Changes Coming in 2026

Major adjustments are set to reshape Social Security benefits in 2026. Beyond routine cost-of-living increases, changes will affect earnings thresholds, tax rules, and benefit calculations. Retirees and workers are being urged to review their long-term financial plans now. The updates could meaningfully impact both monthly payments and retirement timelines.

Today’s Snapshot

How to Use Credit Strategically Without Going Into Debt (What Most People Get Completely Wrong)

Most people think credit is either:

dangerous and should be avoided, or

something you use only when you’re desperate

Both views are wrong.

High earners, business owners, and investors use credit intentionally, not emotionally. They don’t use it to buy things they can’t afford — they use it to improve cash timing, preserve liquidity, and unlock flexibility.

If you understand how credit actually works, it becomes a tool.

If you don’t, it quietly works against you.

This article explains how to use credit correctly — without accumulating real debt.

First: The Core Rule People Miss

Credit is not about spending power.

It’s about timing and optionality.

If you treat credit as “extra money,” you’ll lose.

If you treat credit as a temporary bridge, you gain leverage without risk.

Everything below flows from that idea.

1. Why Paying Everything in Cash Is Not Always Smart

Paying in cash feels safe.

But it can quietly make you financially fragile.

When you pay cash for everything:

your liquidity drops

your emergency buffer shrinks

your ability to react disappears

Liquidity matters more than net worth in real life.

Credit allows you to:

keep cash available

smooth uneven income

handle surprises without panic

avoid selling investments at bad times

The goal is not to owe money long-term — it’s to avoid being cash-constrained.

2. The Difference Between “Bad Debt” and “Temporary Credit”

Bad debt:

carries balances long-term

accumulates interest

funds consumption

reduces future options

Temporary credit:

is paid off monthly

does not accumulate interest

preserves cash flow

increases flexibility

Same credit card.

Completely different outcome.

If you never carry a balance, credit stops being dangerous.

3. How High-Income People Actually Use Credit Cards

They don’t:

max them out

chase rewards blindly

pay interest

They use cards to:

delay cash outflow by 30–45 days

separate spending categories

build transaction history

earn secondary benefits without dependency

Example:

You spend $8,000/month.

If you pay cash, money leaves immediately.

If you use a card and pay in full, you gain:

30–45 days of float

better tracking

preserved liquidity

zero interest

That float is quiet leverage.

4. Credit Utilization Is More Important Than Credit Score

People obsess over credit scores.

Lenders obsess over utilization.

Utilization = how much of your available credit you use.

Key rules:

Under 10% utilization = excellent

10–30% = acceptable

Over 30% = red flag

Someone with:

$50k available credit

$3k monthly spend

has more financial stability than someone with:$5k limit

$3k monthly spend

Same spending. Very different risk profile.

This matters for:

mortgages

business loans

lines of credit

insurance pricing

future flexibility

5. Why Lines of Credit Are More Valuable Than Loans

Loans are rigid.

Lines of credit are flexible.

A loan:

locks you into fixed payments

charges interest immediately

reduces adaptability

A line of credit:

sits unused until needed

charges interest only when drawn

functions as insurance

Smart people secure credit before they need it.

Once income drops or risk rises, lenders disappear.

6. How Business Owners Should Think About Credit Differently

Business credit is not personal spending power.

It’s operational oxygen.

Used correctly, it:

smooths payroll timing

bridges receivables

prevents equity dilution

avoids emergency financing

Used incorrectly, it:

hides bad margins

delays hard decisions

compounds losses

Rule of thumb:

If credit is funding growth that produces cash → acceptable.

If credit is funding losses → dangerous.

7. Credit as Downside Protection (Not Upside Fuel)

This is the mental shift.

Credit is not for:

lifestyle upgrades

speculative bets

emotional spending

Credit is for:

protecting liquidity

managing timing mismatches

absorbing shocks

keeping optionality alive

People who understand this sleep better and survive downturns longer.

8. The Simple Personal Credit Playbook

If you want to use credit properly:

Maintain high total available credit

Keep utilization under 10–15%

Pay balances in full, always

Use cards for expenses you already budgeted

Keep cash reserves untouched

Secure lines of credit while income is strong

Never rely on credit to “fix” structural problems

This turns credit into a shield instead of a trap.

Thought Of The Day

The fastest way to improve is to welcome feedback, confront weaknesses, and treat mistakes as data, not personal failures, while staying committed to long-term goals.

That’s All For Today

I hope you enjoyed today’s issue of The Wealth Wagon. If you have any questions regarding today’s issue or future issues feel free to reply to this email and we will get back to you as soon as possible. Come back tomorrow for another market update, and snapshot. I hope to see you. 🤙

— Ryan Rincon, CEO and Founder at The Wealth Wagon Inc.

Disclaimer: This newsletter is for informational and educational purposes only and reflects the opinions of its editors and contributors. The content provided, including but not limited to real estate tips, stock market insights, business marketing strategies, and startup advice, is shared for general guidance and does not constitute financial, investment, real estate, legal, or business advice. We do not guarantee the accuracy, completeness, or reliability of any information provided. Past performance is not indicative of future results. All investment, real estate, and business decisions involve inherent risks, and readers are encouraged to perform their own due diligence and consult with qualified professionals before taking any action. This newsletter does not establish a fiduciary, advisory, or professional relationship between the publishers and readers.