December 27, 2025

Welcome Back,

Happy Saturday, everyone! ☀️

Good morning — hope today feels calm, unhurried, and exactly as slow (or productive) as you want it to be.

Quick question to start the day: Have you ever heard a “smart tax move” that sounded great… but also kind of risky?

Tax-loss harvesting is one of those tools — powerful when done right, frustrating when done wrong.

Today’s post breaks it down simply, showing how to use it correctly and avoid the mistakes that quietly cancel out the benefit.

No stress. No guesswork. Just smarter moves.

— Ryan Rincon, Founder at The Wealth Wagon Inc.

Quote of The Day

“First say to yourself what you would be; and then do what you have to do.”

— Epictetus

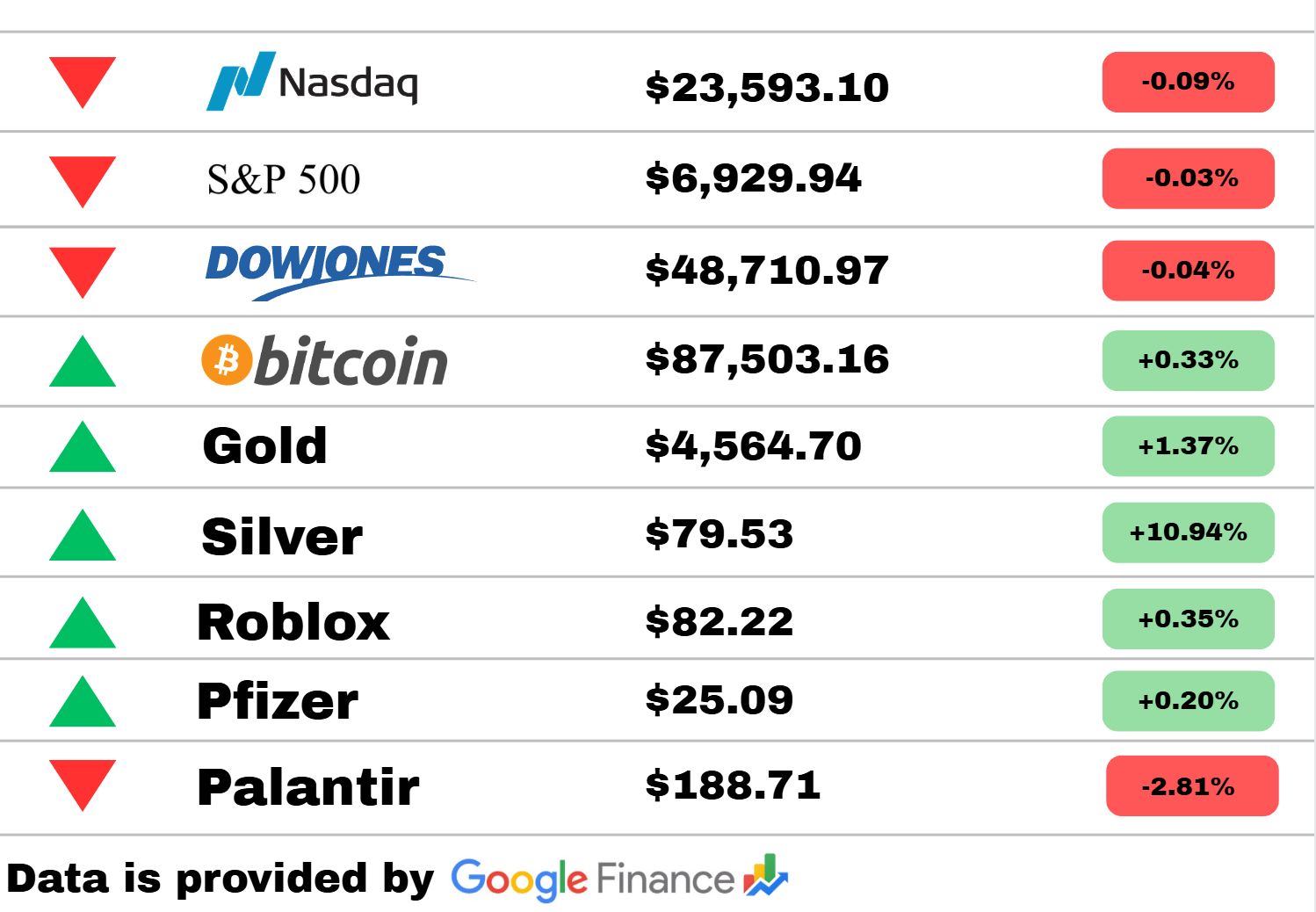

Market Update

*Market data represents the most recent market close at 5:00pm ET

Market Update: Today’s market action came in soft on the indices but surprisingly strong across several key assets. The Nasdaq, S&P 500, and Dow Jones all slipped slightly—down 0.09%, 0.03%, and 0.04% respectively—reflecting a quiet, cautious trading day rather than any major shift in sentiment.

Meanwhile, Bitcoin managed a 0.33% climb, continuing to hover confidently near the upper end of its current range. Safe-haven metals shined as well: Gold added 1.37%, while Silver absolutely stole the show with a +10.94% surge, marking one of the day’s standout moves.

In equities, Roblox nudged higher by 0.35%, Pfizer ticked up 0.20%, and Palantir was the lone notable laggard, sliding 2.81% after a previously strong run.

Overall, despite softening in the major indices, strength in metals and select names made for a mixed but interesting day across the markets.

World

8 Killed in Syria Mosque Blast, Government Says

A deadly explosion at a Syrian mosque left eight people dead, prompting immediate government accusations toward extremist groups. Security forces have increased patrols in surrounding districts as fears of additional attacks rise. Local officials say the blast underscores ongoing instability in the region despite recent ceasefire efforts.

Former Malaysian Leader Najib Razak Sentenced in 1MDB Corruption Trial

Najib Razak received a 15-year sentence and a significant financial penalty in the long-running 1MDB scandal. The ruling marks one of the toughest legal outcomes yet for the former prime minister. Analysts say it sends a strong signal about Malaysia’s intent to address high-level corruption.

Southern Yemeni Separatists Reject Saudi Call to Withdraw

Southern separatist leaders dismissed Saudi Arabia’s request for their forces to pull back from key eastern provinces. The standoff highlights internal fractures within the coalition seeking to stabilize Yemen. Political observers warn the dispute could slow diplomatic progress and worsen regional tensions.

U.S.

What to Know About the Militants Targeted by U.S. Airstrikes in Nigeria

New U.S. strikes targeted militant groups in northwest Nigeria believed to be responsible for escalating violence in rural areas. Officials say the action is part of a broader effort to disrupt extremist networks before they expand further. Local leaders remain divided on how the operations will affect regional stability.

Trump Invited White South Africans to America — One Ended Up in Detention

A South African family brought to the U.S. under a Trump-era humanitarian invitation faced unexpected immigration scrutiny, leading to one member’s detention. The case has raised questions about policy inconsistencies and communication failures across agencies. Advocacy groups are urging for a review of similar cases involving vulnerable migrants.

Experts Say Denmark Isn't a Model for U.S. Vaccine Policy

Public-health specialists argue that Denmark’s approach to vaccination can’t be directly replicated in the U.S. due to demographic, political, and healthcare system differences. They caution that oversimplifying international comparisons leads to unrealistic expectations. The discussion comes amid ongoing debates about national immunization strategies.

Economy

Economic Divide Widens Between Portland and Rural Maine, Report Finds

A new report shows economic growth in Portland accelerating while many rural areas fall further behind. Analysts blame unequal investment, demographic shifts, and declining local industries. Policymakers are now facing pressure to address the widening gap before long-term damage sets in.

A 'Jobless Boom' Could Define the 2026 Economy

Experts warn that high productivity and automation could produce strong economic output without matching job growth. This potential “jobless boom” is already visible in several major industries. Lawmakers are increasingly focused on how to support workers displaced by rapid technological change.

So Long, American Exceptionalism

A new analysis suggests the U.S. may be losing several of the advantages that once distinguished its economy on the global stage. Slowing productivity, shifting trade dynamics, and rising international competition are shaping a new landscape. While the country remains influential, economists say the era of unquestioned dominance is fading.

Today’s Snapshot

How to Use Tax-Loss Harvesting Correctly (And Avoid the Mistakes That Cancel the Benefit)

Tax-loss harvesting is one of the few investing strategies that can increase your after-tax returns without increasing risk.

Yet most people either:

don’t use it at all, or

use it incorrectly and lose the benefit

This applies to employees investing in taxable brokerage accounts, business owners, and experienced investors alike.

Here’s how it actually works in real life.

What Tax-Loss Harvesting Actually Does

When an investment in a taxable account is below your purchase price, you can sell it at a loss and use that loss to:

offset capital gains

reduce taxable income (up to certain limits)

carry losses forward indefinitely

This does not mean you lose exposure to the market permanently.

Done correctly, you remain invested while improving your tax position.

Where Tax-Loss Harvesting Applies (And Where It Doesn’t)

This strategy only works in taxable brokerage accounts.

It does not apply to:

401(k)s

IRAs

Roth accounts

HSAs

If all your money is in retirement accounts, this doesn’t help yet.

If you have any taxable investments, it likely does.

When It Actually Makes Sense to Harvest Losses

You should consider harvesting losses when:

you have realized or expected capital gains

your investment is down meaningfully (not just a few dollars)

you plan to stay invested long-term

you are in a moderate to high tax bracket

You should not harvest losses just to “do something.”

The goal is tax efficiency, not activity.

The Single Rule Most People Break (Wash Sale Rule)

This is where people mess up.

The wash sale rule says:

If you sell an investment at a loss and buy the same or substantially identical investment within 30 days before or after the sale, the loss is disallowed.

This includes:

buying in another brokerage account

automatic reinvestment

buying in a spouse’s account

buying in a retirement account

If you violate this rule, the loss disappears.

How to Stay Invested Without Triggering a Wash Sale

You don’t sell and sit in cash.

Instead, you swap into a similar but not identical investment.

Example:

Sell one S&P 500 ETF

Buy a different broad-market ETF or total market fund

You maintain market exposure while preserving the loss.

This is the core technique that makes tax-loss harvesting effective.

How Much a Loss Is Actually Worth

A loss doesn’t reduce taxes dollar-for-dollar.

Its value depends on your tax rate.

Example:

$10,000 harvested loss

24% federal tax bracket

Value ≈ $2,400 in tax savings

That’s real money — without increasing risk.

And unused losses roll forward, so they can help future years.

Why Timing Matters More Than Market Direction

Tax-loss harvesting is not about predicting the market.

It’s about reacting to volatility.

Down markets create opportunity:

more losses

more tax assets

more flexibility

Ironically, bad market years are often when smart investors quietly improve long-term results.

How Often You Should Do This

You don’t need to monitor daily.

Most people benefit from checking:

quarterly

or during significant market pullbacks

or near year-end

Over-harvesting can create tracking complexity without much benefit.

This is a precision tool, not a hobby.

Common Mistakes That Kill the Benefit

These are expensive and common:

triggering wash sales unknowingly

harvesting tiny losses that don’t matter

selling without reinvesting properly

forgetting about automatic dividend reinvestment

creating massive tax complexity with no payoff

The strategy should simplify, not complicate, your investing life.

Who Benefits the Most From This Strategy

Tax-loss harvesting is most valuable for:

high-income W-2 earners

business owners with variable income

investors who rebalance regularly

people selling appreciated assets

anyone planning future large capital gains

If your taxable portfolio is large, this becomes increasingly powerful.

What This Actually Does Over Time

Tax-loss harvesting:

increases after-tax returns

reduces friction in rebalancing

smooths tax liability over years

gives you more control over when taxes are paid

It doesn’t make headlines.

It doesn’t feel exciting.

But over decades, it materially improves outcomes.

Bottom Line

Most investors focus on what to buy.

Smart investors also focus on:

when to sell

how taxes interact with returns

how to keep more of what they earn

Tax-loss harvesting is one of the few strategies that rewards discipline, patience, and understanding — not speculation.

Used correctly, it’s one of the cleanest ways to improve results without changing your risk profile.

Thought Of The Day

Lasting success begins when you define who you are becoming, align daily habits with that vision, and let small disciplined actions quietly compound into freedom.

That’s All For Today

I hope you enjoyed today’s issue of The Wealth Wagon. If you have any questions regarding today’s issue or future issues feel free to reply to this email and we will get back to you as soon as possible. Come back tomorrow for another market update, and snapshot. I hope to see you. 🤙

— Ryan Rincon, CEO and Founder at The Wealth Wagon Inc.

Disclaimer: This newsletter is for informational and educational purposes only and reflects the opinions of its editors and contributors. The content provided, including but not limited to real estate tips, stock market insights, business marketing strategies, and startup advice, is shared for general guidance and does not constitute financial, investment, real estate, legal, or business advice. We do not guarantee the accuracy, completeness, or reliability of any information provided. Past performance is not indicative of future results. All investment, real estate, and business decisions involve inherent risks, and readers are encouraged to perform their own due diligence and consult with qualified professionals before taking any action. This newsletter does not establish a fiduciary, advisory, or professional relationship between the publishers and readers.