December 25, 2025

Welcome Back,

Happy Thursday, everyone — and Merry Christmas! 🎄✨

Good morning — hope today starts slow, peaceful, and surrounded by good energy (and maybe good food).

Here’s a gentle thought for today: real wealth is clarity. Knowing where you stand, what you own, and what’s working quietly in your favor brings a kind of confidence money alone can’t buy.

That’s what today’s post is about — using a simple personal balance sheet to see your financial life clearly, without stress or complexity.

Enjoy the day, enjoy the moment, and when you’re ready… let’s make your money work just as intentionally as you do.

— Ryan Rincon, Founder at The Wealth Wagon Inc.

Quote of The Day

“The habit of persistently trying to understand why things happen the way they do is the foundation of all wisdom.”

— Charlie Munger

Market Update

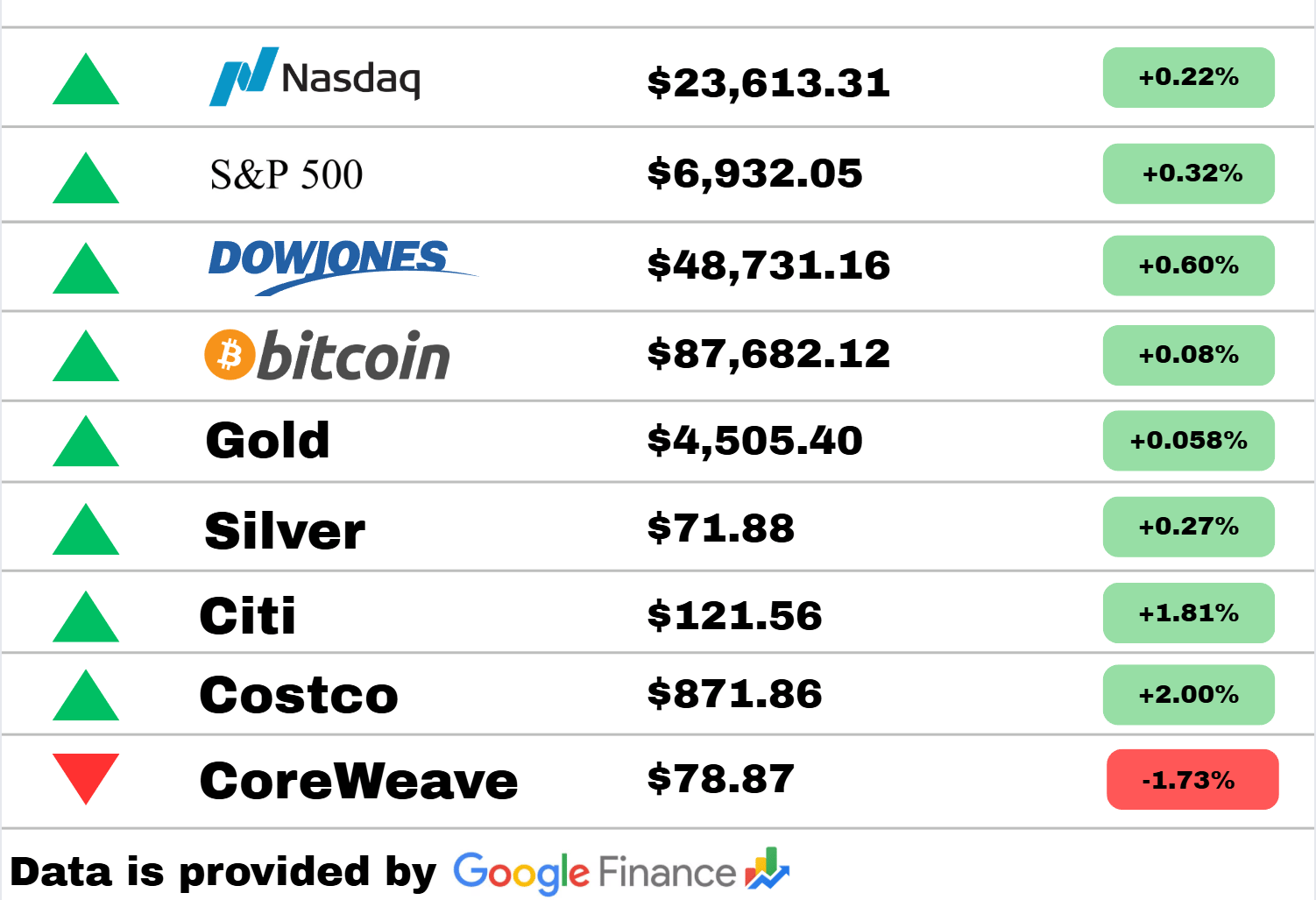

*Market data represents the most recent market close at 5:00pm ET

Market Update: Markets wrapped up the day in the green across nearly every major index, showcasing a steady and confidence-filled session. The Nasdaq ticked up 0.22%, the S&P 500 climbed 0.32%, and the Dow Jones added 0.60%, signaling continued resilience despite recent choppiness.

Bitcoin inched higher by 0.08%, while both Gold and Silver also saw modest gains, rising 0.058% and 0.27% respectively—suggesting a balanced appetite for both risk and safety assets.

On the equity side, Citi posted a solid 1.81% gain on renewed financial-sector optimism, and Costco advanced 2.00% as consumer strength continues to support retail giants. The only notable pullback came from CoreWeave, which slipped 1.73% after its recent hot streak.

Overall, it was a broadly positive day, with most asset classes nudging upward and investors showing refreshed confidence heading into the week.

Economy

Economy grows, chip tariff delay, new S&P 500 record and more in Morning Squawk

Fresh data shows the U.S. economy continuing to expand, even as uncertainty around chip tariffs eases some pressure on manufacturers. Markets reacted positively, helping push the S&P 500 to a new high. Investors are watching closely to see whether the momentum can carry into the new year. Early indicators suggest consumer demand is holding steadier than expected.

Affordability is a buzzword right now — these charts show why

Housing, groceries, and transportation costs continue to outpace wage gains, creating a widening affordability gap for many households. New data visualizations highlight how essential expenses have surged relative to income growth. Analysts say this trend is reshaping consumer behavior heading into 2026. Some policymakers are warning that affordability risks could deepen if inflation moderates too slowly.

U.S. economy is headed toward stagflation, followed by reacceleration, economist says

A leading economist warns that slowing growth paired with persistent price pressures could push the U.S. into a short-lived stagflation phase. Despite the grim outlook, the forecast suggests a rebound could follow as rate cuts eventually filter through the economy. Markets remain divided on whether this scenario is likely or overstated. Investors are preparing for volatility as major data releases approach.

Crypto

Bitcoin Misses Out on Wall Street Cheer to Stall Near $87,000

Bitcoin struggled to regain momentum even as broader markets rallied, keeping prices pinned below the $87,000 mark. Traders say fading liquidity and cautious sentiment are limiting upside potential. Some are watching for catalysts tied to institutional flows. For now, crypto markets remain noticeably disconnected from equity market optimism.

Samson Mow ‘fires’ Wall Street analyst over Bitcoin prediction

A dramatic online exchange unfolded after bold Bitcoin forecasts drew backlash from crypto advocates. The confrontation underscored the deep divide between traditional analysts and digital-asset believers. Market observers note that sentiment remains volatile as traders debate the next big move. The episode reflects growing tension around long-term valuation expectations.

Saylor’s USD Reserve Hits $2 Billion as Strategy Fortifies Against Bitcoin Winter

A major crypto treasury has significantly expanded its cash reserves, aiming to weather potential downturns and prepare for strategic buying opportunities. The move signals confidence in long-term Bitcoin accumulation despite short-term uncertainty. Analysts say such positioning could influence market stability during future drawdowns. It also highlights how institutional players are adapting to a maturing asset class.

Technology

Steam and Valve’s online games are down

Gamers worldwide reported outages affecting major online titles, sparking widespread frustration during peak usage hours. Early indications point to server issues rather than security threats. Valve acknowledged the disruption and is working to restore full functionality. The downtime comes during a busy holiday gaming period, amplifying user impact.

Santa Clarita resident and ‘Call of Duty’ creator Vince Zampella dies in crash

A prominent figure in the gaming industry has died following a vehicle collision, leaving fans and colleagues shocked. Zampella was known for shaping blockbuster franchises and influencing modern game design. Tributes poured in from across the gaming world as news spread. His legacy is expected to remain a defining force in the industry.

The Best PC Games Of 2025 According To Metacritic

A new ranking highlights the top-performing PC titles of the year, showcasing a mix of indie standouts and major studio releases. Critics praised innovations in storytelling, graphics, and gameplay depth. The list reflects shifting trends as players gravitate toward immersive single-player experiences. Developers are already taking cues from these successes as next year’s releases take shape.

Today’s Snapshot

How to Build and Use a Personal Balance Sheet (The Tool Most High Earners Never Actually Use)

Most people know what a balance sheet is for a business.

Very few people ever build one for themselves — even people making strong money, running companies, or investing regularly.

That’s a mistake.

A personal balance sheet gives you something budgeting, investing tips, and income goals never will:

A clear picture of where you actually stand financially — right now — and what moves will matter most next.

Not in theory.

Not in the future.

Right now.

Let’s walk through how to build one, how to read it, and how to use it to make better financial decisions.

1. What a Personal Balance Sheet Actually Is (Plain English)

A personal balance sheet is just a snapshot of:

What you own

What you owe

What’s left over

That’s it.

Formula:

Assets – Liabilities = Net Worth

But the power isn’t the number — it’s how you break it down.

2. Step One: List Your Assets (Be Honest, Not Optimistic)

Assets are things you own that have monetary value.

Common categories:

Cash (checking, savings)

Investments (stocks, ETFs, crypto, retirement accounts)

Real estate (market value, not purchase price)

Business equity (what you could realistically sell it for)

Vehicles (current resale value, not what you paid)

Other assets (valuable equipment, collectibles, etc.)

Important rule:

Use conservative values.

If you had to sell it in 30 days, what would you actually get?

This keeps the balance sheet useful instead of ego-driven.

3. Step Two: List Your Liabilities (This Is Where Clarity Hits)

Liabilities are anything you owe.

Typical ones:

Mortgage balance

Student loans

Credit card balances

Auto loans

Personal loans

Business debt you personally guarantee

Taxes owed

Again — be precise.

Seeing liabilities clearly often changes behavior faster than any motivational advice ever could.

4. Step Three: Separate “Productive” vs “Non-Productive” Items

This is where most people never go — and where the real insight comes from.

Productive assets:

Assets that generate income

Assets that appreciate

Assets that reduce future expenses

Examples:

Rental property

Dividend-producing investments

Business ownership

Cash reserves (reduce risk)

Non-productive assets:

Personal residence (from a cash-flow perspective)

Cars

Luxury items

Lifestyle upgrades

This doesn’t mean non-productive assets are bad.

It just means they shouldn’t be confused with growth tools.

5. Do the Same for Liabilities

Split liabilities into two groups:

Strategic liabilities:

Mortgage on a reasonably priced home

Low-interest business debt

Loans tied to income-producing assets

Drag liabilities:

High-interest credit cards

Consumer loans

Debt that doesn’t increase earning power

This distinction instantly tells you where to focus your effort.

6. What Your Balance Sheet Is Telling You (If You Know How to Read It)

Once it’s built, ask these questions:

How much of my net worth is liquid?

How much is tied up and hard to access?

How much of my debt is actually helping me?

What percentage of my assets produce income?

How exposed am I if income stopped for 3–6 months?

Most people discover they’re:

asset-heavy but cash-poor, or

income-rich but balance-sheet weak, or

overexposed to one asset type

This clarity is invaluable.

7. How to Use This to Make Better Decisions

The balance sheet becomes a decision filter.

Before any big move, ask:

Does this improve my balance sheet?

Does it increase productive assets?

Does it reduce drag liabilities?

Does it improve liquidity or stability?

Examples:

Should I invest more or pay off debt?

Should I buy property or stay liquid?

Should I reinvest in the business or diversify?

Can I afford to take career risk right now?

The answer is usually obvious once the numbers are visible.

8. Update It Twice a Year (That’s Enough)

This is not a daily or monthly exercise.

Twice a year is ideal:

once mid-year

once end-of-year

Track:

net worth change

asset mix change

liability reduction

liquidity improvement

You’re looking for direction, not perfection.

Thought Of The Day

Real success often comes when you slow down, reflect deeply, and realign daily actions with long-term freedom, meaningful work, and intentional relationships.

That’s All For Today

I hope you enjoyed today’s issue of The Wealth Wagon. If you have any questions regarding today’s issue or future issues feel free to reply to this email and we will get back to you as soon as possible. Come back tomorrow for another market update, and snapshot. I hope to see you. 🤙

— Ryan Rincon, CEO and Founder at The Wealth Wagon Inc.

Disclaimer: This newsletter is for informational and educational purposes only and reflects the opinions of its editors and contributors. The content provided, including but not limited to real estate tips, stock market insights, business marketing strategies, and startup advice, is shared for general guidance and does not constitute financial, investment, real estate, legal, or business advice. We do not guarantee the accuracy, completeness, or reliability of any information provided. Past performance is not indicative of future results. All investment, real estate, and business decisions involve inherent risks, and readers are encouraged to perform their own due diligence and consult with qualified professionals before taking any action. This newsletter does not establish a fiduciary, advisory, or professional relationship between the publishers and readers.