December 23, 2025

Welcome Back,

Happy Tuesday, everyone!

Good morning — hope you’re easing into the day feeling calm, clear, and maybe a little curious.

Quick question for you: Have you ever stared at a big purchase and wondered, “Should I just pay cash… or am I missing a smarter move?”

Most of us go with our gut — but a tiny bit of math can quietly save (or make) you a lot of money.

That’s exactly what today’s post is about: cutting through the noise and learning how to decide between paying cash, financing, or investing instead — without overthinking it.

Let’s make money decisions feel confident instead of confusing.

— Ryan Rincon, Founder at The Wealth Wagon Inc.

Quote of The Day

“Luck is what happens when preparation meets opportunity.”

— Seneca

Market Update

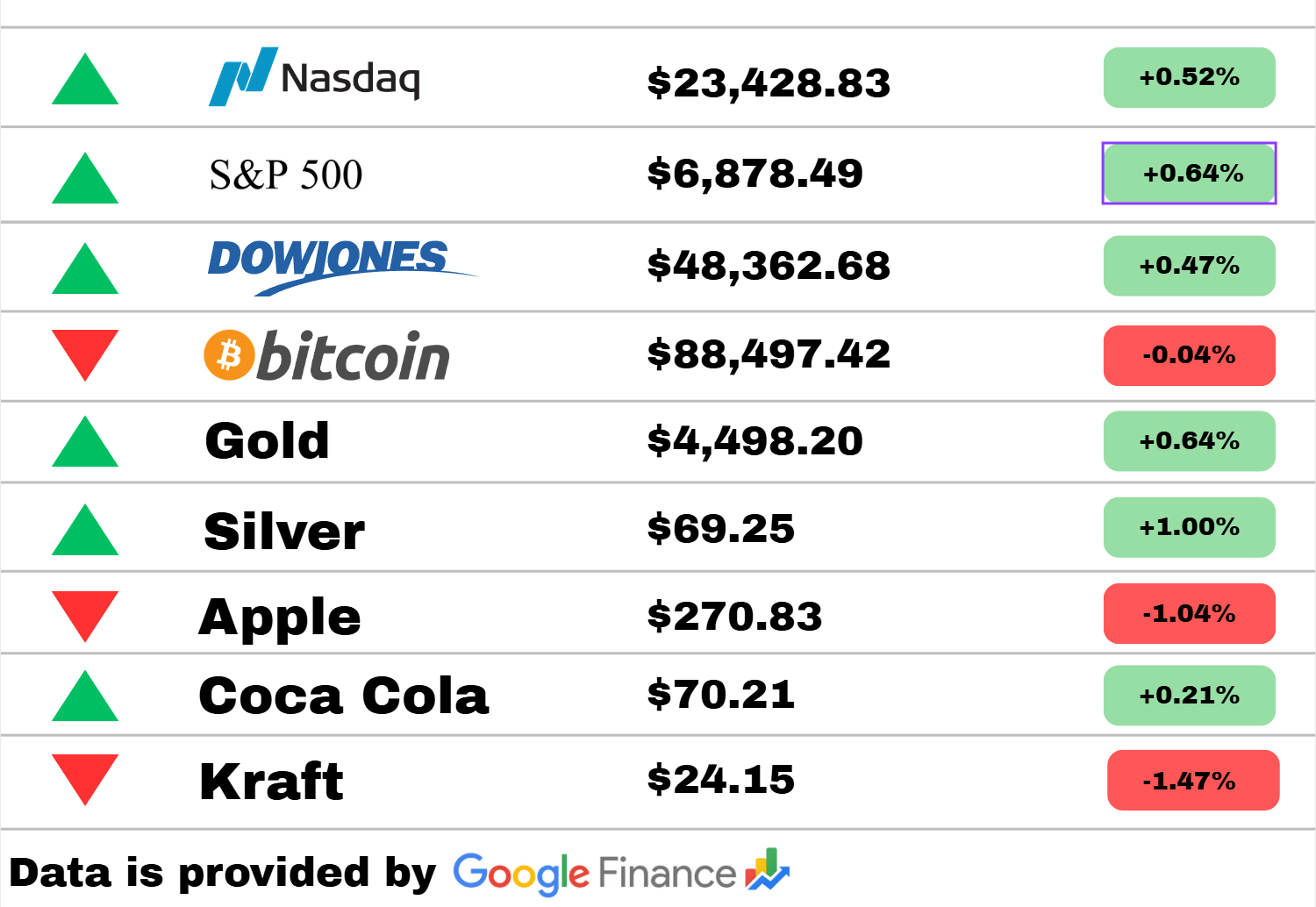

*Market data represents the most recent market close at 5:00pm ET

Market Update: Stocks pushed higher today as all three major indices closed in the green. The Nasdaq climbed 0.52%, the S&P 500 advanced 0.64%, and the Dow Jones added 0.47%, marking a steady, confidence-driven session across the board.

In crypto, Bitcoin slipped 0.04%, holding relatively flat as traders paused after recent volatility. Meanwhile, commodities saw mixed but notable moves—Gold rose 0.64%, and Silver gained 1.00%, continuing to shine as investors looked for stability.

Among individual stocks, Apple dipped 1.04%, giving back some recent momentum, while Coca-Cola nudged up 0.21% in a slow but steady climb. Kraft struggled, falling 1.47% and landing at the bottom of today’s movers.

Overall, a green-leaning day with strong index performance and selective sector strength.

Travel

Record-breaking holiday travel expected in DC region amid major traffic changes

Holiday travel in the DC metro is surging to levels not seen in years, putting heavy strain on key commuter corridors. Officials warn drivers to expect long delays as updated traffic patterns and construction zones reshape routes. Real-time alerts are being pushed to help travelers navigate bottlenecks more smoothly.

New Yorkers mull creative ways to navigate redesigned subway fare gates

The MTA’s newly installed fare-gate system is forcing riders to rethink how they move through stations. Some commuters say the gates feel “parkour-like,” requiring awkward maneuvering during peak hours. Transit officials maintain the redesign will reduce fare evasion, though riders say the learning curve is steep.

Cinderella Castle repainting project to begin at Magic Kingdom in January

Disney announced a large-scale repainting of Cinderella Castle starting early next year, aiming to refresh its colors before major 2025 celebrations. Portions of the central hub may be rerouted as crews work around guest flow. The park says the makeover will preserve photo ops while minimizing disruption.

Crypto

Strategy pauses bitcoin buys, boosts cash reserves to $2.2B

A major institutional crypto holder is halting Bitcoin purchases to strengthen cash reserves, citing shifting market conditions. The pause comes as volatility intensifies and liquidity thins across digital assets. Analysts say the move signals a more defensive stance from large market participants.

JPMorgan considers expanding crypto trading as Wall Street doubles down

JPMorgan is weighing whether to open broader access to crypto trading for clients amid renewed interest from institutional investors. The firm has been testing infrastructure upgrades as demand grows for digital-asset exposure. The deliberation highlights how traditional finance is leaning further into blockchain-based markets.

Tom Lee’s Bitmine Immersion adds 99,000 ETH in major accumulation move

A prominent crypto investment group added nearly 100,000 ETH to its reserves, lifting total holdings above 4 million. The purchase reflects strong long-term conviction despite recent price swings. Market watchers say whale-sized acquisitions like this can influence sentiment during uncertain periods.

Economy

Fed seen risking recession unless more interest-rate cuts arrive, economist warns

New analysis suggests the economy could stall if borrowing costs remain elevated for too long. Softening consumer activity and slower business spending are raising concerns about a fragile growth outlook. The Fed faces mounting pressure to accelerate easing to stabilize momentum.

Trump economy likened to “one doll, multiple dolls” as critics highlight layering issues

A new critique frames the current economy as a stack of hidden complications masked by headline growth figures. Analysts argue wage pressure, supply bottlenecks, and regional inequalities create instability beneath the surface. Supporters counter that recent reforms will yield clearer gains over time.

Global map ranks world’s largest economies by GDP in new visualization

Fresh data highlights the massive concentration of global economic power, with the top 50 countries accounting for the majority of worldwide output. Recent shifts show emerging markets climbing the ranks as advanced economies battle slower growth. The visualization underscores how geopolitical influence increasingly follows economic scale.

Today’s Snapshot

How to Decide Whether to Pay Cash, Finance, or Invest Instead (and How to Actually Do the Math)

This is something almost everyone gets wrong, even people who are “good with money.”

You buy a car. You consider a house. You upgrade equipment for a business. You’re offered a 0% loan. Or a low-interest option. Or you’re tempted to just pay cash and be done with it.

Most people decide emotionally:

“I hate debt.”

“Cash feels safer.”

“Monthly payments scare me.”

“I don’t want to overthink it.”

But the correct decision is almost always mathematical — and the math is simpler than people think.

The mistake isn’t choosing cash or debt.

The mistake is not comparing the opportunity cost of each option.

Let’s walk through how to actually think about this in real life.

The Three Options You Always Have (Whether You Realize It or Not)

Any time you’re making a large purchase, you are choosing between three paths:

Pay cash

Finance the purchase

Finance the purchase and invest the cash instead

Most people only consider the first two. The third is where the real leverage is — and where mistakes happen.

Step 1: Identify the True Cost of Financing (Not the Sticker Rate)

The interest rate alone doesn’t tell the full story.

You need to know:

The APR

The term length

Whether interest is simple or compounding

Any fees or penalties

Whether the rate is fixed or variable

Once you have that, calculate the total interest paid over the life of the loan, not the monthly payment.

Example:

$30,000 loan

6% interest

5-year term

Total interest paid ≈ $4,800

This number matters more than the monthly payment.

Step 2: Calculate Your Realistic Investment Return (Not Fantasy Returns)

Here’s where people lie to themselves.

Don’t assume:

Perfect stock market returns

Crypto moonshots

Business growth with no risk

Instead, ask:

“If I invested this cash conservatively, what would I reasonably earn?”

For most people:

Broad index funds: 6–8% long-term

High-yield savings / money markets: 4–5%

Low-risk business reinvestment: 8–12%

Risky investments: unpredictable (do not use for core decisions)

Be honest. Conservative math beats optimistic regret.

Step 3: Compare Interest Cost vs. Investment Return

This is the core decision rule:

If your expected investment return is higher than the loan’s interest rate (after tax), financing can make sense.

But only if:

Your income is stable

You won’t panic during market drops

You won’t touch the invested money emotionally

Example:

Loan interest: 6%

Expected investment return: 8%

On paper, investing wins.

But now comes the part people skip.

Step 4: Factor in Cash Flow Risk (This Is Where People Get Burned)

Even if the math works, cash flow matters more than theory.

Ask yourself:

Could I comfortably make this payment if income dropped 20–30%?

Would this payment restrict my ability to invest monthly?

Would it increase financial stress?

A mathematically “optimal” decision that increases stress often leads to worse behavior later — selling investments at bad times, missing opportunities, or overextending.

This is why high earners still go broke.

Step 5: The Rule Most Wealthy People Actually Use

Here’s the rule many financially disciplined people follow, even if they don’t say it out loud:

Cash for depreciating items unless financing is very cheap

Financing for assets or tools that increase income

Invest the difference only if cash flow remains strong

Examples:

Paying cash for a car? Often smart.

Financing equipment that increases revenue? Often smart.

Financing lifestyle upgrades while “planning to invest later”? Dangerous.

Step 6: When Paying Cash Is the Best Decision (Even If Math Says Otherwise)

Paying cash makes sense when:

The purchase provides no return

You value simplicity and low stress

The interest rate is high

You already invest consistently

You want to reduce fixed obligations

Peace of mind has real financial value — just don’t confuse it with fear.

Step 7: When Financing + Investing Makes Sense

This approach works best when:

The interest rate is low

The investment is automated

You won’t stop investing halfway

You have strong emergency reserves

Your income is stable

The biggest mistake people make here is financing something and then not investing the cash at all. That’s how debt quietly becomes expensive.

Thought Of The Day

Most people chase opportunity, but the real edge comes from building skills, reputation, and resilience long before opportunity decides to knock.

That’s All For Today

I hope you enjoyed today’s issue of The Wealth Wagon. If you have any questions regarding today’s issue or future issues feel free to reply to this email and we will get back to you as soon as possible. Come back tomorrow for another market update, and snapshot. I hope to see you. 🤙

— Ryan Rincon, CEO and Founder at The Wealth Wagon Inc.

Disclaimer: This newsletter is for informational and educational purposes only and reflects the opinions of its editors and contributors. The content provided, including but not limited to real estate tips, stock market insights, business marketing strategies, and startup advice, is shared for general guidance and does not constitute financial, investment, real estate, legal, or business advice. We do not guarantee the accuracy, completeness, or reliability of any information provided. Past performance is not indicative of future results. All investment, real estate, and business decisions involve inherent risks, and readers are encouraged to perform their own due diligence and consult with qualified professionals before taking any action. This newsletter does not establish a fiduciary, advisory, or professional relationship between the publishers and readers.