December 17, 2025

Welcome Back,

Happy Wednesday, everyone! 🌤️

Good morning — truly hope you're feeling clear, calm, and just a little excited for the day ahead.

Let me ask you something:

Have you ever realized how much we hold onto — habits, expenses, commitments — simply because they’ve always been there?

It’s wild how often we keep paying for things (in money and energy) that no longer bring real value. But here’s the fun part: once you step back and actually look at your life through a value lens, you start discovering hidden pockets of capital — time, money, bandwidth — that you didn’t even know were available.

And that’s exactly what today’s post is about: running a “Cost-to-Value Review.”

Not to cut back, not to restrict… but to free up resources so you can redirect them into the things that matter and multiply.

A lighter life makes room for bigger opportunities.

— Ryan Rincon, Founder at The Wealth Wagon Inc.

Quote of The Day

“If you’re not embarrassed by the first version of your product, you’ve launched too late.”

— Reid Hoffman

Market Update

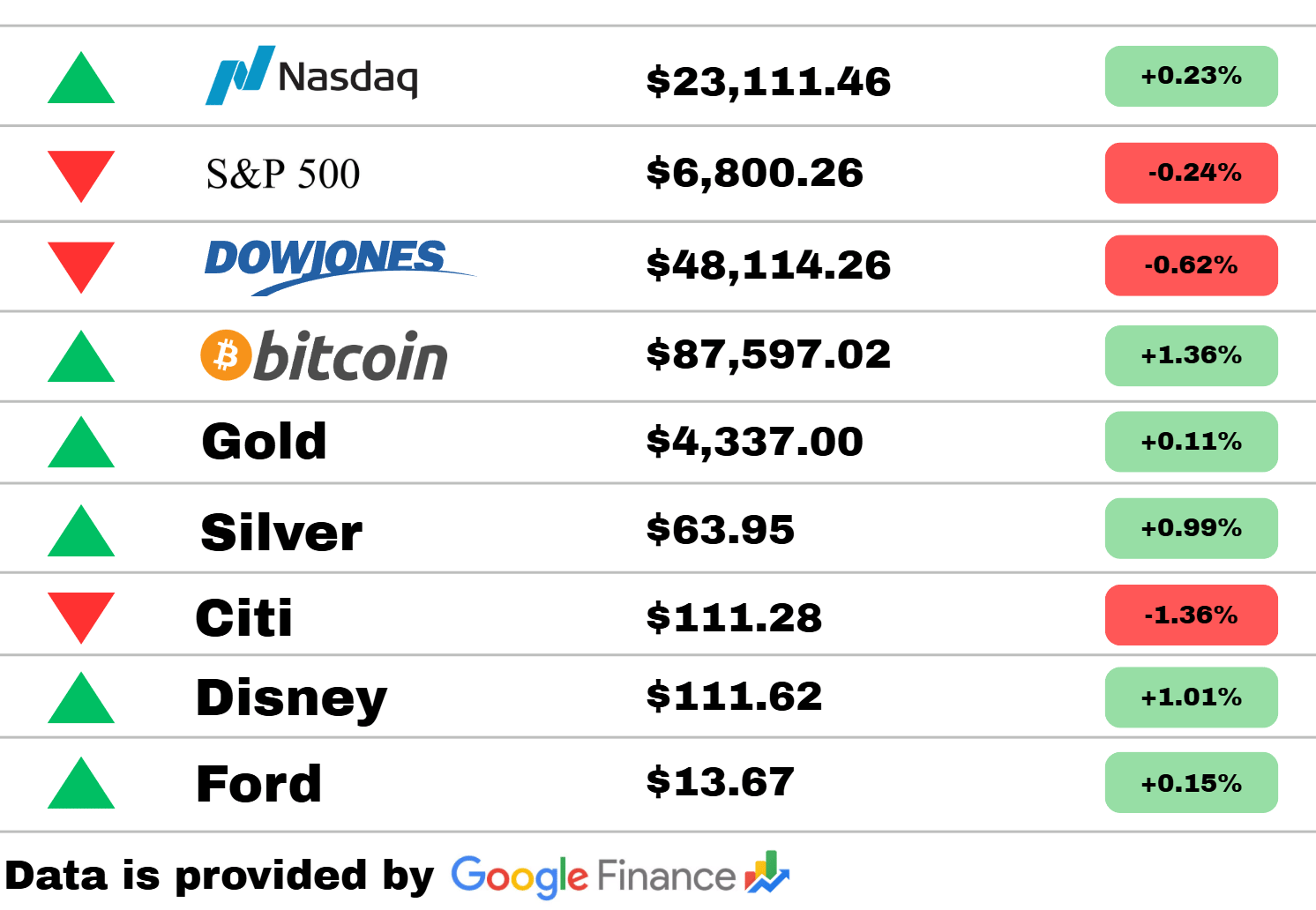

*Market data represents the most recent market close at 5:00pm ET

Market Update: Markets were mixed today as investors navigated a choppy trading session. The Nasdaq managed a modest 0.23% gain, while both the S&P 500 and Dow Jones slipped 0.24% and 0.62% respectively, reflecting cautious sentiment. Bitcoin continued its rebound with a strong 1.36% push higher, helping lift risk appetite even as equities wavered.

Commodities stayed mostly steady—Gold inched up 0.11% and Silver rose 0.99%, showing quiet but consistent demand. In the stock spotlight, Citi fell 1.36%, while Disney climbed 1.01% on renewed optimism around its content and park divisions. Ford also saw a slight lift, adding 0.15% as investors showed tempered confidence in the automaker.

World

Bondi Beach mass shooting suspects traveled to Philippines weeks before attack

Authorities revealed that the suspects connected to the Bondi Beach mass shooting had traveled to the Philippines shortly before the incident. Investigators are now tracing movements across both countries to understand possible coordination. Officials say the international angle is deepening the case and broadening the search for accomplices.

Under Ukraine security guarantees, Western troops could repel Russian forces post-ceasefire, says report

New analysis suggests a potential post-ceasefire security framework in Ukraine could involve Western forces positioned to deter renewed Russian aggression. The concept is being debated as diplomatic channels explore long-term stability measures. Officials say enforcement credibility will be key to preventing future escalations.

Scoop: White House scolded Netanyahu for violating Gaza ceasefire with strike

U.S. officials privately reprimanded Israel’s leadership after a strike was launched during an agreed ceasefire window. The exchange underscores growing tension between Washington and Jerusalem over military conduct. The White House is reportedly pushing harder for adherence to negotiated pauses.

Politics

Germany news: Merz welcomes EU turn on gas-engine ban

German opposition leader Friedrich Merz praised the EU’s openness to revisiting its planned phaseout of gas-powered engines. He argues the shift recognizes economic realities facing manufacturers and workers. Critics say it risks slowing Europe’s clean-energy transition.

UK to probe foreign meddling after Russia bribery scandal

Britain is launching a formal inquiry into foreign political interference following allegations linked to a recent bribery scheme. Lawmakers warn the case highlights vulnerabilities in campaign financing oversight. The government says the review aims to restore public confidence amid rising geopolitical tensions.

Senators brace for another possible shutdown in January

With no long-term budget deal in place, lawmakers are once again preparing for a potential government shutdown early next month. Negotiators remain divided on spending priorities and policy riders. Several senators warn that repeated brinkmanship is undermining economic stability.

Business

Ford CEO says the $70,000 Lightning EV pickup wasn’t selling, but this new version will

Ford’s chief executive acknowledged lagging sales of the high-priced Lightning EV pickup, noting the market wasn’t responding to the premium model. The company plans to introduce a redesigned, more affordable version aimed squarely at mainstream buyers. Executives hope the pivot will revitalize Ford’s electric truck strategy.

Democratic senators investigate data centers’ effects on electricity prices

A group of lawmakers has launched a probe into whether the rapid expansion of AI and cloud data centers is driving up local energy costs. They argue the facilities’ enormous power demand may burden residential consumers. Energy regulators are being asked to provide detailed assessments of usage patterns and pricing impacts.

The Kraft Heinz Company names Steve Cahillane Chief Executive Officer

Kraft Heinz announced that longtime industry leader Steve Cahillane will take over as CEO as the company enters a new strategic phase. Executives say his experience modernizing major consumer brands will guide the next stage of growth. Cahillane is expected to emphasize innovation and supply-chain efficiency in his early agenda.

Today’s Snapshot

How to Run a “Cost-to-Value Review” on Your Life to Free Up Hidden Capital You Didn’t Know You Had

(You have not received anything like this — this is not mindset, not opportunity selection, not wealth frameworks, not optimization philosophy. This is a practical, financial audit technique borrowed from private equity, adapted for individuals.)

Most people think they need more income to grow financially.

In reality?

They’re usually sitting on trapped capital — money they already have but can’t see because it’s tied up in inefficient habits, subscriptions, service providers, processes, assets, or purchases they never reevaluated.

This is the same thing private equity firms do when they buy a company:

They identify bloat, reallocate capital, and instantly raise cash flow without increasing revenue.

You can do the exact same thing in your life or business.

Here’s how.

Step 1: Identify Every Recurring Expense (Personal + Business)

This isn’t a traditional budget.

You’re not looking for “stop buying lattes” nonsense.

You’re looking for anything that hits your card monthly or yearly, including:

SaaS tools

Insurance

Phone bills

Subscriptions

Services

Memberships

Apps

Automations

Cloud storage

Domains

Software licenses

Retainers

Coaching/consulting

Unused platforms

Most people underestimate how much money leaks out through “invisible subscriptions.”

A typical business owner can recover $300–$2,000/mo in under 20 minutes.

Step 2: Assign a Value Score from 1–5

Forget “Do I use it?”

That’s the wrong question.

Instead ask:

“How much financial or operational value does this provide relative to its cost?”

Score each item:

5 = High ROI (tool saves 10+ hours/mo, or earns money)

4 = Good ROI (efficient, still worth it)

3 = Neutral (useful, questionable ROI)

2 = Low value

1 = Zero value

Do not overthink: first instinct is usually right.

Step 3: Categorize Into Four Buckets

This is the key step most people miss.

A. Keep

High-value items that directly save time, earn money, or prevent headaches.

B. Replace

Medium-value items that you can swap for cheaper alternatives without losing performance.

Examples:

Switching CRM

Using shared tools

Consolidating subscriptions

Switching insurance providers

Moving from paid SaaS to open-source

C. Reduce

Services you still need but don’t need at the current quantity.

Examples:

Lower phone plan

Downgrade software tier

Decrease number of seats/users

Reduce cloud storage

Cut back advertising that isn’t converting

D. Remove

Anything with a value score of 1 or 2.

Kill it immediately.

This recovers instant capital.

Step 4: Unlock “Time Capital” (The Multiplier Everyone Misses)

Some expenses don’t waste money — they waste time, which is more expensive.

Ask:

“Does this cost me time every week?”

Examples:

tools that break often

services that require extra follow-up

manual tasks you haven’t automated

software with slow workflows

vendors who cause friction

People underestimate how many hours they lose to inefficient systems.

Replacing a tool that saves 2 hours/week gives you 104 hours returned per year — equivalent to 2.6 full workweeks.

Time capital compounds the same way money does.

Step 5: Reallocate Your Recovered Capital Into Growth Buckets

Most people “save money” and let it disappear into normal spending.

Top performers immediately reassign that capital to growth:

Investing

Debt paydown

Education/skills

Better tools

Marketing

Asset building

Income-producing projects

Emergency reserves

Wealth vehicles

The key is:

**Don’t let recovered capital fall back into default spending patterns.

Put it to work immediately.**

Expected Results (Based on Real Data)

When individuals or businesses do this process, they typically uncover:

$2,000–$15,000 per year in wasted expenses

5–20 hours per month in recovered time

2–10% instant profitability increase (for entrepreneurs)

Immediate ability to increase savings rate without earning more

And the best part?

This is the only “income boost” that doesn’t require new skills, new hours, or new risk.

It’s simply optimizing what you already have.

Thought Of The Day

Every opportunity you want tomorrow is quietly being built by the micro-habits you commit to today. Consistency compounds into clarity, and clarity fuels unstoppable execution.

That’s All For Today

I hope you enjoyed today’s issue of The Wealth Wagon. If you have any questions regarding today’s issue or future issues feel free to reply to this email and we will get back to you as soon as possible. Come back tomorrow for another market update, and snapshot. I hope to see you. 🤙

— Ryan Rincon, CEO and Founder at The Wealth Wagon Inc.

Disclaimer: This newsletter is for informational and educational purposes only and reflects the opinions of its editors and contributors. The content provided, including but not limited to real estate tips, stock market insights, business marketing strategies, and startup advice, is shared for general guidance and does not constitute financial, investment, real estate, legal, or business advice. We do not guarantee the accuracy, completeness, or reliability of any information provided. Past performance is not indicative of future results. All investment, real estate, and business decisions involve inherent risks, and readers are encouraged to perform their own due diligence and consult with qualified professionals before taking any action. This newsletter does not establish a fiduciary, advisory, or professional relationship between the publishers and readers.