December 13, 2025

Welcome Back,

Happy Saturday, everyone! ☀️

Good morning — I hope you’re easing into the day with something warm to drink and zero rush in your step.

Here’s a question to wake up the brain a bit:

Have you ever looked at a business and wondered, “Could this thing actually grow… or is it already as big as it’s ever going to get?”

Some businesses scale like rockets. Others scale like… well, a stubborn shopping cart with a broken wheel.

Today’s post is all about spotting the difference.

By the time you’re done reading, you’ll be able to look at any business — yours, someone else’s, a potential investment — and instantly sense whether it can expand smoothly or whether it’ll break the moment you pour more customers into it.

— Ryan Rincon, Founder at The Wealth Wagon Inc.

Quote of The Day

“A person who never made a mistake never tried anything new.”

— Albert Einstein

Market Update

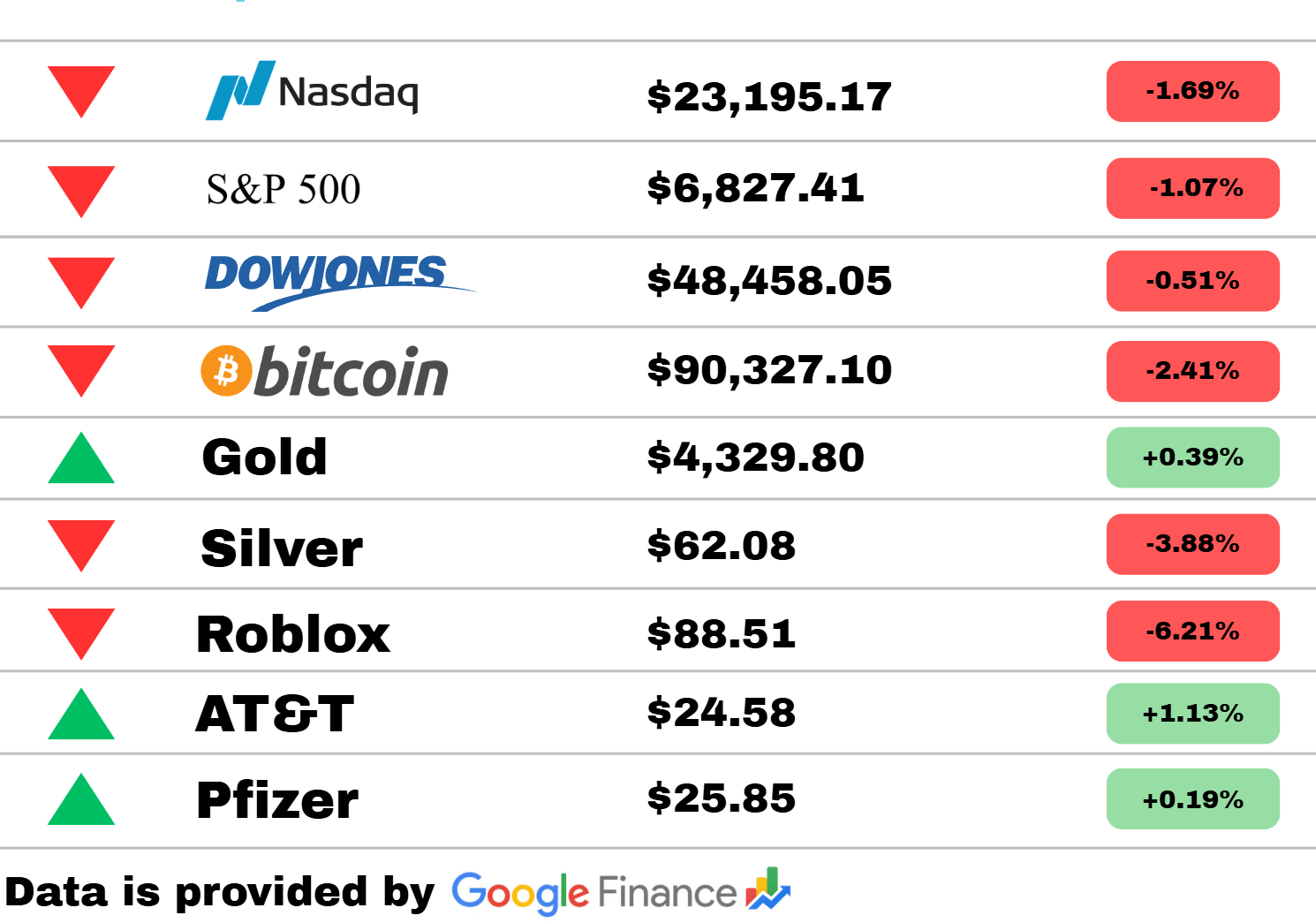

*Market data represents the most recent market close at 5:00pm ET

Market Update: Markets slid broadly today as all three major indexes retreated. The Nasdaq dropped 1.69%, the S&P 500 slipped 1.07%, and the Dow Jones eased 0.51%, reflecting a cautious tone across equities. Bitcoin also pulled back sharply, falling 2.41% as risk appetite weakened.

In commodities, Gold managed a modest 0.39% gain, while Silver sank 3.88%, marking one of the largest declines of the day. On the stock front, Roblox suffered a steep 6.21% drop, while defensive and telecom names provided some stability—AT&T climbed 1.13% and Pfizer edged up 0.19%, offering rare spots of green in an otherwise red-heavy session.

World

King Charles says cancer treatment will scale back as he credits early diagnosis

King Charles announced that his cancer treatment will now shift into a lighter phase, saying early detection played a critical role in his recovery. While he will still undergo medical monitoring, the palace says his schedule may gradually expand as his health improves. The update aims to reassure the public amid ongoing questions about his capacity. His medical team remains cautiously optimistic about his long-term outlook.

How Nobel laureate Maria Corina Machado escaped from Venezuela

Maria Corina Machado’s escape from Venezuela has become a dramatic symbol of the country’s ongoing political turmoil. Supporters say she fled after escalating threats and pressure from the government. Her departure highlights the risks faced by opposition figures as political tensions rise. Many view her story as a reflection of deepening instability in the region.

Nobel laureate Narges Mohammadi arrested in Iran, supporters say

Iranian activist and Nobel laureate Narges Mohammadi has reportedly been detained again, sparking renewed international concern. Her supporters say she was targeted for her outspoken human rights advocacy. The arrest comes amid broader crackdowns on dissent inside the country. Calls for her release are growing as global organizations condemn the move.

Travel

White House sued by historic preservation group over ballroom plans

A preservation group has filed a lawsuit claiming proposed White House ballroom renovations threaten the building’s historic integrity. The group argues that the changes would alter structurally significant spaces. Officials say the update is needed for modernization and functionality. The dispute highlights a long-running tension between historic protection and presidential infrastructure needs.

Disney World sets final day for Rock ’n’ Roller Coaster ahead of retheme

Disney World has announced the closing date for the long-running Rock ’n’ Roller Coaster as it prepares for a major redesign. Fans now have limited time to ride the attraction before refurbishment begins. The update is part of a broader refresh across the park. Many visitors are already flocking to experience the classic version one last time.

George Washington’s mansion reopens after $40M renovation

Mount Vernon has reopened to the public after an extensive two-year restoration effort. The renovation focused on structural preservation and enhancing historical accuracy. Visitors will now see improved exhibits and restored architectural details that reflect the estate’s original design. Officials say the project ensures the landmark remains stable for future generations.

Technology

Amazon pulls AI recap from Fallout show after accuracy complaints

Amazon has removed its AI-generated recap of the Fallout TV series after viewers pointed out numerous factual errors. Critics said the tool misrepresented plot points and confused characters, raising concerns about automated content. Amazon acknowledged the mistakes and paused the feature for review. The decision reflects growing public scrutiny over AI-generated media.

OnePlus 15R expected to get surprise version update

A new update is reportedly coming to the OnePlus 15R, surprising users who weren’t expecting another upgrade this cycle. Early hints suggest improvements to performance and system stability. The move indicates OnePlus may be extending software support beyond its typical patterns. Fans are watching closely for official details.

Google Translate adds real-time speech translation to any headphones

Google has introduced real-time speech translation that works with standard headphones, marking a major expansion of its language tools. The feature aims to make live multilingual communication more accessible without special devices. Early testers say the speed and accuracy have improved noticeably. This rollout could reshape how travelers and global teams communicate on the go.

Today’s Snapshot

How to Evaluate Whether a Business Is Actually Scalable (A Practical Guide You Can Use Immediately)

One of the biggest mistakes investors, founders, and ambitious professionals make is assuming that any business can scale.

It can’t.

Some businesses grow cleanly and predictably…

others get messier, more expensive, and harder to manage the bigger they get.

Knowing the difference is one of the most valuable skills in business and investing — and luckily, you can evaluate scalability using a simple set of tests.

This article walks you through a practical, real-world framework for analyzing whether a business can scale without blowing up.

1. Understand the Core Constraint

Every business has a “primary bottleneck” that limits how fast it can grow.

Your job is to identify it.

Ask:

Does the business rely heavily on labor hours?

Does it require physical inventory or manufacturing?

Is growth limited by capital?

Is growth limited by expertise or talent?

Is scaling dependent on a physical location?

Businesses with fewer natural constraints scale faster.

Examples:

A consulting business is limited by hours and experts.

A SaaS product is limited mostly by customer acquisition, not headcount.

A construction company is limited by labor, equipment, and permitting.

If the core constraint is difficult or expensive to remove → scaling will be slow.

2. Check if Margins Improve With Scale

A scalable business doesn’t just grow revenue — it gets more profitable as it grows.

Look for signs that:

Unit costs drop at higher volume

Fixed costs stay mostly fixed while revenue rises

Automation replaces human labor at scale

Customer acquisition becomes cheaper with network effects

High-scalability example:

A digital product (like software):

Costs ≈ fixed.

Each new customer increases profit dramatically.

Low-scalability example:

A high-end restaurant:

More customers = more staff, more space, more operating complexity

Margins stay flat or shrink.

If margins expand as revenue grows → the business can scale.

If margins shrink → proceed with caution.

3. Look for Process Repeatability

A business cannot scale chaos.

Ask:

Is the core operation repeatable?

Can someone with average skills follow the process?

Is training standardized or artisanal?

Is quality dependent on one or two “experts”?

Businesses that depend on genius-level operators fail to scale.

Businesses with systems, templates, automation, and playbooks scale beautifully.

Quick test:

If the founder stepped away tomorrow, would outputs stay the same?

If no → scalability is weak.

If yes → the business is operationally sound.

4. Assess Customer Acquisition Scalability

Acquiring the first customers is easy.

Acquiring the next 10,000 is where scalability breaks.

Ask:

Does the business have an unlimited pool of potential customers?

Do acquisition channels get cheaper or more expensive as scale increases?

Are referrals or network effects built-in?

Can marketing be automated or duplicated?

Example of poor scalability:

A local service business with a small geographic catchment — the customer pool is capped.

Example of high scalability:

A business with digital distribution and global reach — customer pool is virtually unlimited.

If acquisition becomes more expensive as the company grows → scalability hits a wall.

5. Evaluate Operational Complexity at Higher Volume

Some businesses get much harder to run as they grow.

The question is:

Does complexity grow linearly, or exponentially?

Signs of dangerous complexity:

Every new client requires custom work

Logistics get disproportionately harder

More staff = more management layers = slower decisions

Mistakes multiply with scale

Systems break under volume

Signs of scalable simplicity:

Workflows stay consistent no matter the quantity

Automation handles repetitive tasks

Quality control improves with size

Management layers don’t explode

Customer experience stays consistent

If complexity scales faster than revenue → the model is fragile.

6. Determine Capital Requirements for Growth

Capital-efficient businesses scale faster and safer.

Ask:

Does each new customer require more equipment, inventory, or humans?

Does growth require borrowing or large upfront investment?

Does the business throw off enough cash to self-fund expansion?

Scalable:

Software, digital products, platforms — low incremental cost.

Hard to scale:

Manufacturing, real estate, heavy equipment businesses — capital-intensive.

A business that needs massive injections of capital to grow is technically scalable, but riskier.

7. Identify Hidden Friction Points

These are the scalability killers nobody talks about:

Regulatory limits

Licensing or permitting bottlenecks

Seasonal or labor shortages

Supply chain instability

Customer churn rising as volume grows

Reputation damage risks (common in service businesses)

A business can look scalable on paper but collapse under these buried constraints.

Your job is to uncover them early.

8. The 10-Minute Scalability Scorecard

Rate each section from 1–5:

Core constraint

Margin expansion

Process repeatability

Acquisition scalability

Operational complexity

Capital requirements

Hidden friction points

Total score:

30–35: Highly scalable

22–29: Moderately scalable

15–21: Difficult to scale

<15: Not scalable in practice

This takes 3–10 minutes and gives you a clearer picture than most full reports.

Why This Matters to You

Whether you:

Invest in companies

Want to buy a business

Want to start one

Want to grow your existing one

Want to understand your employer’s trajectory

…knowing how to evaluate scalability is a superpower.

Scalable companies create:

Faster returns

More predictable growth

Higher valuations

Better exit potential

More career upside

Learning this skill puts you ahead of 99% of people making business decisions.

Thought Of The Day

Sometimes the biggest breakthroughs come from quiet, unnoticed shifts in how you think. Nurture those subtle adjustments — they often create the strongest long-term momentum.

That’s All For Today

I hope you enjoyed today’s issue of The Wealth Wagon. If you have any questions regarding today’s issue or future issues feel free to reply to this email and we will get back to you as soon as possible. Come back tomorrow for another market update, and snapshot. I hope to see you. 🤙

— Ryan Rincon, CEO and Founder at The Wealth Wagon Inc.

Disclaimer: This newsletter is for informational and educational purposes only and reflects the opinions of its editors and contributors. The content provided, including but not limited to real estate tips, stock market insights, business marketing strategies, and startup advice, is shared for general guidance and does not constitute financial, investment, real estate, legal, or business advice. We do not guarantee the accuracy, completeness, or reliability of any information provided. Past performance is not indicative of future results. All investment, real estate, and business decisions involve inherent risks, and readers are encouraged to perform their own due diligence and consult with qualified professionals before taking any action. This newsletter does not establish a fiduciary, advisory, or professional relationship between the publishers and readers.