December 12, 2025

Welcome Back,

Happy Friday, everyone! ☀️

Good morning — hope you’re stepping into today with a clear mind and maybe even a little extra energy knowing the weekend is almost here.

Let me ask you something: Have you ever walked into a business — a café, a store, a gym — and instantly thought, “This place is winning” or “This place won’t last long”?

Funny how our instincts pick up on things long before we consciously do.

Today, we’re tapping into that exact superpower.

Because once you know what to look for, you can size up almost any business in minutes — not with spreadsheets, but with simple, practical lenses anyone can use.

By the end of today’s post, you’ll be able to look at companies the same way great investors do: calmly, confidently, and without overthinking.

— Ryan Rincon, Founder at The Wealth Wagon Inc.

Quote of The Day

“If you want to lift yourself up, lift up someone else.”

— Booker T. Washington

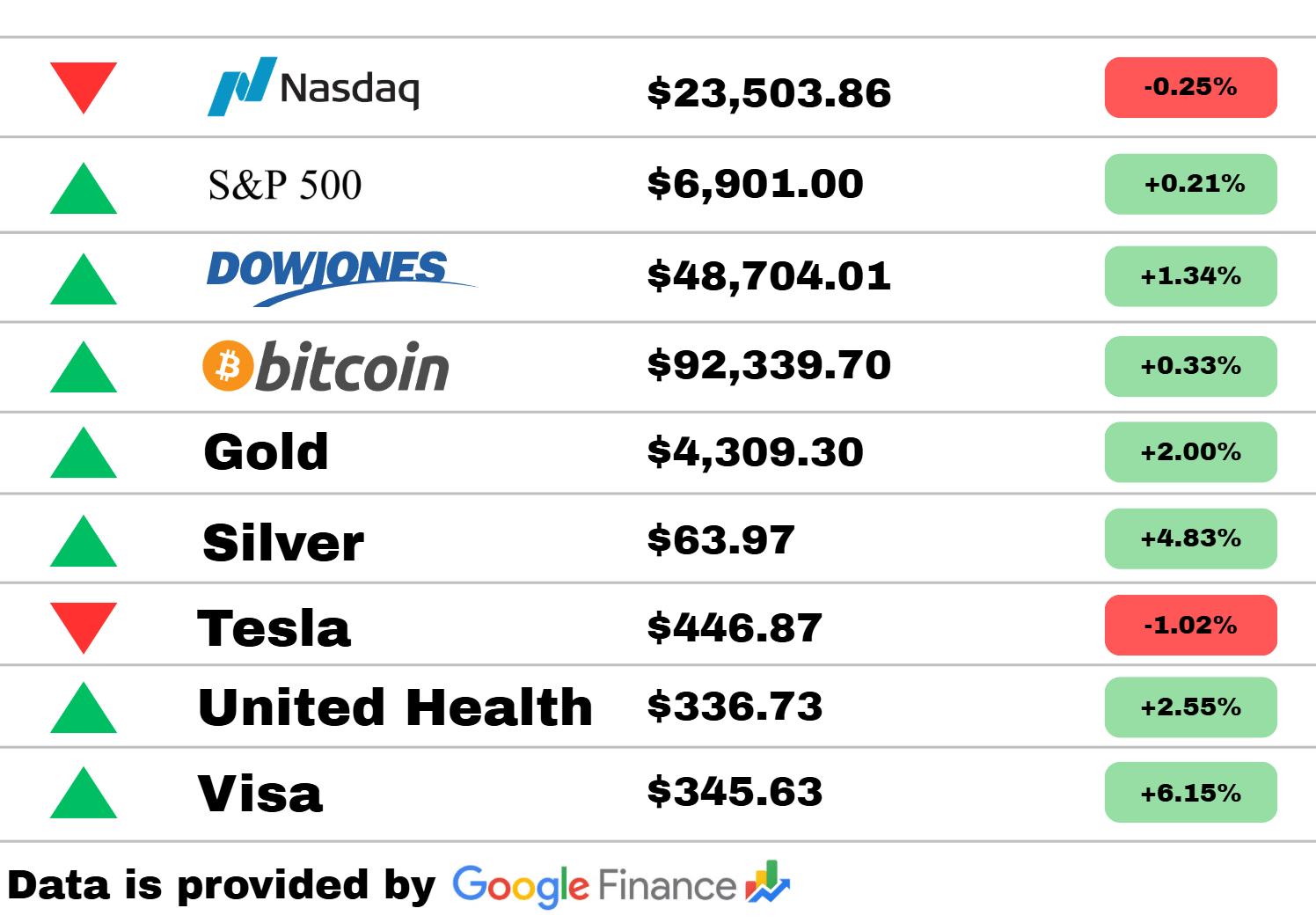

Market Update

*Market data represents the most recent market close at 5:00pm ET

Market Update: Markets leaned positive today despite a slight dip in the Nasdaq (-0.25%). The S&P 500 inched up 0.21%, while the Dow Jones posted a stronger 1.34% gain, signaling upbeat sentiment across large-cap names. Bitcoin also climbed 0.33%, continuing its steady upward momentum.

Safe-haven metals shined brightly—Gold jumped 2.00% and Silver surged 4.83%, marking one of the day’s standout performances. Among equities, Tesla slipped 1.02%, but healthcare and fintech saw strength: UnitedHealth rose 2.55% and Visa popped 6.15%, one of the strongest moves on the board.

A college student dreamed of Google in 2005. By 2009, Mukund was there, absorbing one lesson: foundations beat shortcuts.

Years later, cut to 2025, he built Emergent, an AI platform building production-ready apps while competitors ship prototypes.

Native backends. Real infrastructure. Built for scale.

2.5M+ builders and $25M ARR in just 5 months.

And now Google's AI Futures Fund invested.

The company that taught him how to build now backs what he built.

Perfect validation.

Economy

How Trump’s tariffs forced China to pivot — and export more

New data shows China has sharply increased exports to non-U.S. markets as it adjusts to several years of tariff pressure. Analysts say the shift has accelerated supply-chain diversification in Asia and boosted China’s trade ties with emerging economies. Despite tensions, Chinese manufacturers appear to have adapted faster than expected, reshaping global trade patterns.

Trump’s ‘A+++++’ review of economy clashes with Americans’ perceptions

While Trump continues to claim historic economic success, new polling shows many Americans feel inflation and housing stress are still major burdens. Voters report mixed views on job opportunities, with some sectors cooling even as wages rise. The contrast highlights a widening gap between political messaging and lived economic reality.

Trump: Prices are coming down after inheriting ‘worst inflation in history’

Trump argued this week that inflation is rapidly easing due to his economic policies, but economists say the decline has been gradual and driven by broader global trends. Food and goods prices have stabilized, yet services inflation remains sticky. Consumers remain cautious as mortgage costs and rent pressures continue to weigh on budgets.

Entertainment

Disney invests $1B in OpenAI to bring characters like Mickey Mouse to Sora AI video tool

Disney announced a major push into AI-generated entertainment, aiming to create lifelike, customizable character interactions. The investment signals a broader shift toward next-gen storytelling formats that blend animation with user-created content. Early demos suggest characters could respond dynamically to viewers, opening entirely new creative possibilities.

‘Hollywood is shocked’: Warner Bros sale looms large over movie industry

The potential sale of Warner Bros has sent ripples through the entertainment world as studios brace for consolidation. Industry insiders fear major restructurings could reshape how films are financed, produced, and distributed. The uncertainty comes amid a still-recovering box office and shifting audience habits.

Blue Ivy Carter, 13, looks identical to Beyoncé while rewearing shoes from 14 years ago

A new public appearance by Blue Ivy drew attention as fans noted her striking resemblance to her mother, Beyoncé. Photos showed her sporting a pair of heels her mom wore more than a decade ago, sparking nostalgia across social media. The moment highlighted how the Carter family continues to capture cultural fascination.

Personal Finance

Social Security COLA changes after Fed cuts rates again

The latest rate cuts are expected to influence next year’s Social Security cost-of-living adjustment, potentially reducing increases compared to prior inflation-driven boosts. Retirees may see slower benefit growth as price pressures ease across key spending categories. Analysts recommend planning for more modest adjustments going forward.

Weeks left to supersize your Roth conversion without raising your tax bill

Financial planners are urging savers to review conversion strategies before year-end, as current market dips may reduce the tax impact. Lower valuations can make shifting funds into a Roth account more favorable for long-term gains. Advisors warn not to wait too long, since administrative delays can push transactions into next year.

Natixis and Generali end talks over asset management tie-up

Two major European financial firms have halted negotiations over a potential merger of their asset management units. The decision comes after months of discussions aimed at creating a larger global investment platform. Markets reacted calmly, with analysts noting both companies still have strong independent strategies.

Today’s Snapshot

How to Analyze Any Business in 10 Minutes (Using a Simple 4-Part Framework)

Whether you’re an investor evaluating a company…

a business owner studying competitors…

or a professional trying to understand the companies you work for…

You need a fast way to understand a business.

Not a 40-page report.

Not an MBA textbook.

A simple, repeatable system you can use in 10 minutes that still gives you real insight.

This is that system.

The 4-Part Business Analysis Framework:

Value Creation

Value Delivery

Value Capture

Value Moat

Let’s break each one down and show you how to apply it instantly.

1. Value Creation: What problem does the business actually solve?

Most people analyze a business by looking at revenue, products, logos, branding…

Wrong.

Start with the problem.

A business exists only to solve a specific problem for a specific customer.

Your job is to answer:

What problem does this company solve?

How painful is that problem?

For whom?

How urgently do they need it solved?

Example:

Uber doesn’t sell rides.

Uber solves “I need to get from A to B now, without waiting or worrying about payment.”

The clearer the problem → the stronger the business.

QUICK CHECK:

If you cannot describe the problem in one sentence, the business is weaker than it looks.

2. Value Delivery: How does the business solve the problem better than alternatives?

Now that you’ve identified the problem, analyze the solution pathway.

Ask:

How does the business deliver its solution?

Is it faster? Cheaper? Easier? Higher quality?

What makes the delivery mechanism unique?

Example:

Airbnb isn’t just lodging — it delivers:

More unique stays

Often cheaper options

Locations hotels can’t reach

A better experience for certain travelers

Delivery is where businesses differentiate.

Two companies can solve the same problem…

but the one with better delivery wins.

QUICK CHECK:

If the solution looks identical to competitors, the business will rely on price to survive — not ideal.

3. Value Capture: How does the business make money?

This part sounds obvious, but you’d be shocked how many people skip it.

Great companies:

Create value

Deliver value

And capture value efficiently

You want to understand:

What is the revenue model?

Is it subscription, transaction, licensing, usage-based, retainer?

Are revenues recurring or one-time?

What are margins like?

How predictable is future cash flow?

Example:

Adobe moved from selling one-time software ($600–$1000 upfront)

to a subscription model ($30–$60/mo).

Same customers.

Same product family.

Massively different value capture.

Recurring revenue increases lifetime value and stabilizes cash flow — a huge advantage.

QUICK CHECK:

If revenue is unpredictable or dependent on constant new customers, risk is higher.

4. Value Moat: Why can’t someone else copy this tomorrow?

This is where good companies become great companies.

A business moat = the reason competitors can’t easily take the market away.

Common moats include:

Brand (Apple, Nike)

Network effects (Facebook, Airbnb)

Switching costs (Salesforce)

Proprietary tech (Tesla batteries early on)

Regulation (utilities, insurance)

Capital requirements (airlines, infrastructure)

Distribution advantage (Amazon Prime ecosystem)

Your task is to identify:

What prevents customers from leaving?

What prevents competitors from replicating?

Without a moat, the business is vulnerable long term.

QUICK CHECK:

If the business can be copied quickly and cheaply, it's not defensible enough for long-term confidence.

How to Use This Framework in 10 Minutes

Here’s the rapid-fire process:

Minute 1–2 → Define the Problem (Value Creation)

Write one sentence describing the customer and the problem being solved.

Minute 3–4 → Evaluate the Solution (Value Delivery)

Identify what makes this business’ solution better or different.

Minute 5–6 → Understand the Money Flow (Value Capture)

Outline the revenue model and how predictable it is.

Minute 7–8 → Identify the Moat

Decide whether the business has defensibility or is easily replicated.

Minute 9–10 → Assess Strength + Risk

Ask:

Is the problem important?

Is the solution compelling?

Is the revenue strong?

Is the moat real?

If you can answer all of these clearly, you understand the business at a deeper level than 90% of people.

Why This Matters (No Matter Who You Are)

If you invest:

You avoid hype and identify companies with real substance.

If you run a business:

You see your own weaknesses and opportunities more clearly.

If you work at a company:

You understand the bigger picture — and become more valuable.

If you want to build wealth:

You stop guessing which opportunities make sense and which don’t.

Thought Of The Day

When you learn to see challenges as invitations to redesign your approach, you unlock a mindset where momentum grows, even when the path isn’t clear.

That’s All For Today

I hope you enjoyed today’s issue of The Wealth Wagon. If you have any questions regarding today’s issue or future issues feel free to reply to this email and we will get back to you as soon as possible. Come back tomorrow for another market update, and snapshot. I hope to see you. 🤙

— Ryan Rincon, CEO and Founder at The Wealth Wagon Inc.

Disclaimer: This newsletter is for informational and educational purposes only and reflects the opinions of its editors and contributors. The content provided, including but not limited to real estate tips, stock market insights, business marketing strategies, and startup advice, is shared for general guidance and does not constitute financial, investment, real estate, legal, or business advice. We do not guarantee the accuracy, completeness, or reliability of any information provided. Past performance is not indicative of future results. All investment, real estate, and business decisions involve inherent risks, and readers are encouraged to perform their own due diligence and consult with qualified professionals before taking any action. This newsletter does not establish a fiduciary, advisory, or professional relationship between the publishers and readers.