October 31, 2025

Welcome Back,

Happy Friday — and Happy Halloween, everyone! 🎃👻

Good morning! I hope you’re feeling light, energized, and maybe even a little mischievous today — it is the one day of the year we can all get away with a little extra fun. Whether you’re dressing up, handing out candy, or just enjoying the spooky season vibes, I hope your day has a dash of magic in it. ✨

Now, speaking of treats — let’s talk about sweet income streams. 🍫

Today’s post is all about how to build multiple income streams that actually work — not the ones that drain your time or fizzle out after a few months. We’re talking about smart, sustainable ways to stack your income so it grows quietly in the background while you focus on what matters most.

So grab your coffee (or your candy bag — no judgment here), settle in, and let’s talk about how to make your money as creative and resilient as your Halloween costume. 🕸️💰

— Ryan Rincon, Founder at The Wealth Wagon Inc.

If you subscribed by accident or wish to no longer receive The Wealth Wagon content click here to un-subscribe →

Quote of The Day

“The cave you fear to enter holds the treasure you seek.”

— Joseph Campbell

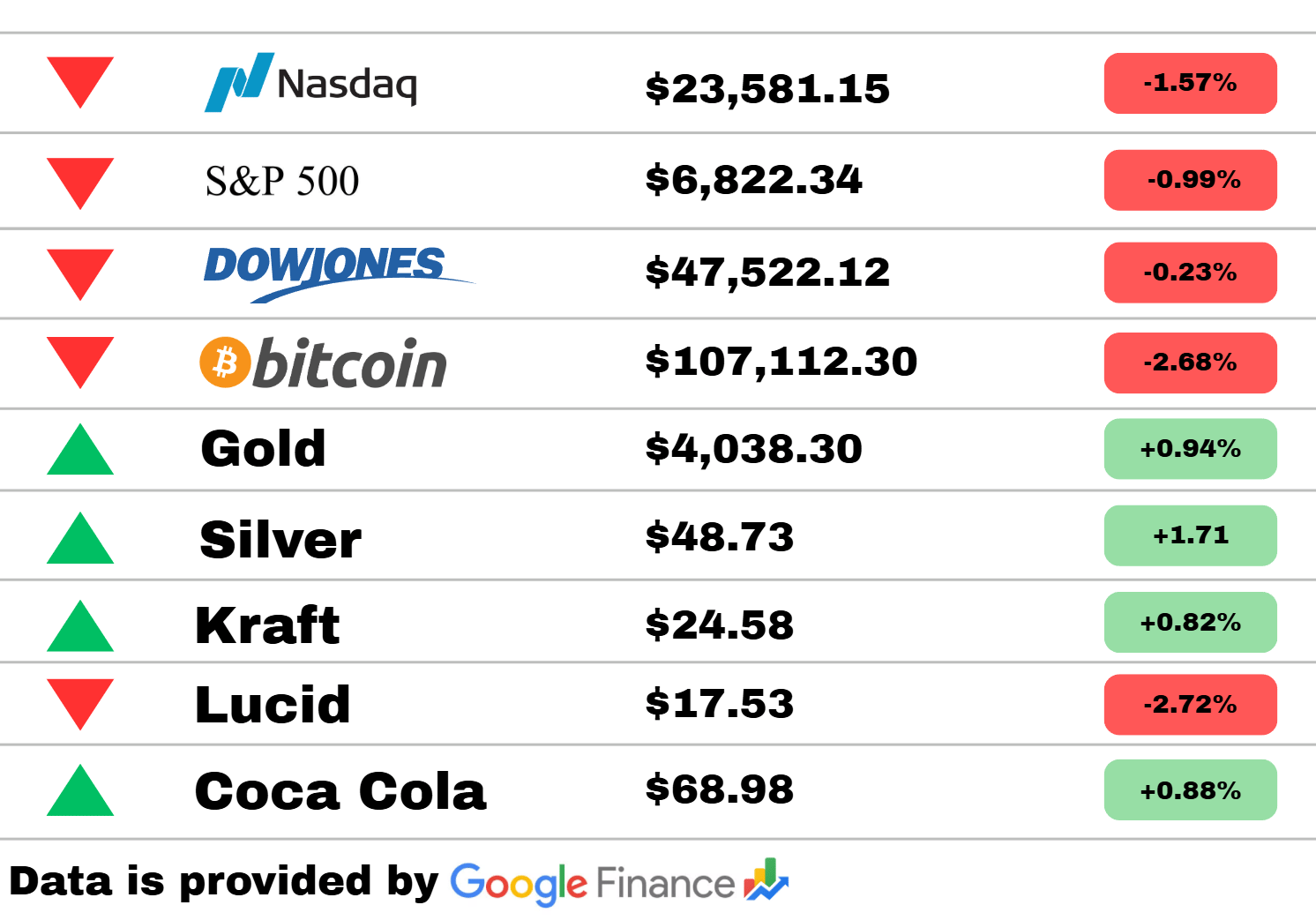

Market Update

*Market data represents the most recent market close at 5:00pm ET

Market Update: It was a red day across major indexes as investors hit the brakes. The Nasdaq tumbled -1.57% to $23,581.15, while the S&P 500 dropped -0.99% to $6,822.34. The Dow Jones managed to hold up better but still slipped -0.23% to $47,522.12.

Crypto traders weren’t spared — Bitcoin plunged -2.68% to $107,112.30, marking another volatile session for digital assets as risk sentiment faded.

But there’s a silver (and gold) lining: Gold climbed +0.94% to $4,038.30 and Silver shined brighter, jumping +1.71% to $48.73, as investors sought safety in precious metals.

In the corporate space, Kraft gained +0.82% to $24.58, proving that comfort food might just be recession-proof, while Coca-Cola bubbled up +0.88% to $68.98, thanks to steady global demand. On the flip side, Lucid took a hard hit, sliding -2.72% to $17.53, as EV enthusiasm cooled off.

📉 The takeaway: It was a tough day for tech and crypto, but the classic safe havens — gold, silver, and even soda — offered some stability. The markets may be cooling, but there’s still plenty brewing beneath the surface.

PRESENTED BY AUTHOR INC

Smart leaders don’t write books alone.

You built your business with a team. Your book should be no different.

Author.Inc helps founders and executives turn their ideas into world-class books that build revenue, reputation, and reach.

Their team – the same people behind projects with Tim Ferriss and Codie Sanchez – knows how to turn your expertise into something that moves markets.

Schedule a complimentary 15-minute call with Author.Inc’s co-founder to map out your Book Blueprint to identify your audience, angles, and ROI.

Do this before you commit a cent, or sentence. If it’s a go, they’ll show you how to write and publish it at a world-class level.

If it’s a wait, you just avoided wasting time and money.

World

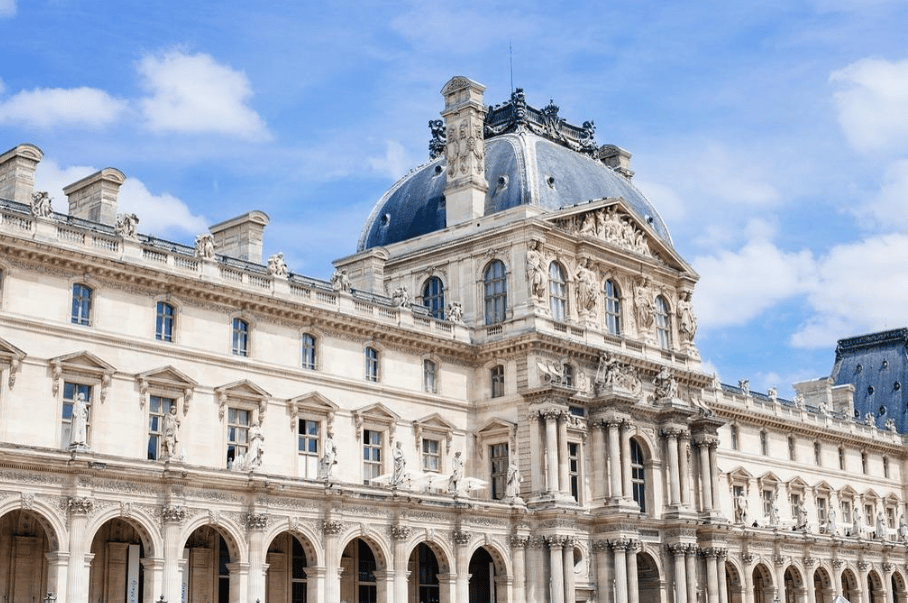

More arrests in Louvre jewel heist

Police in France arrested five additional suspects linked to the high-profile Louvre jewel heist. Authorities believe the operation was an international effort targeting rare gems worth millions.

Dutch voters rebuke far-right in close election

Dutch voters delivered a narrow defeat to the far-right in an election seen as a referendum on European populism. Centrist and liberal parties celebrated the result as a victory for “democratic stability.”

Hamas transfers remains of hostages to Israel

Israel confirmed receiving the remains of two hostages through an intermediary. The development marks a rare humanitarian gesture amid escalating regional tensions.

Politics

Trump continues travel, golf despite shutdown

Despite a federal shutdown, former President Trump’s travel and leisure schedule appears unchanged, sparking criticism from opponents who say the optics are damaging as government workers go unpaid.

Senate weighs deal to end shutdown

Republican and Democratic senators are exploring an “off-ramp” to end the government shutdown as key agencies face funding shortfalls. Negotiations hinge on short-term spending and aid for border operations.

Opinion roundup: pundits weigh in on shutdown chaos

Commentators across the political spectrum analyze the current shutdown’s fallout, with several warning it could worsen inflation and public disillusionment with Washington.

Finance

Obamacare premiums surge nationwide

A New York Times report shows Affordable Care Act insurance premiums are increasing sharply across the U.S., particularly in southern states. The jump is being attributed to inflation, reduced subsidies, and insurer withdrawals from key markets.

Yen falls after Bank of Japan decision

The Japanese yen weakened as the Bank of Japan kept rates unchanged, signaling ongoing policy divergence from Western central banks. Markets are now watching whether Tokyo will intervene to stabilize the currency.

Higher ACA sign-ups expected despite rising costs

Enrollment for Affordable Care Act plans begins this weekend, with analysts expecting strong turnout despite rising premiums. Officials are focusing outreach on younger and lower-income Americans.

Travel

Elderly cruise passenger found dead after being left behind on island

An 80-year-old cruise passenger was discovered dead on a remote Great Barrier Reef island after reportedly being abandoned during an excursion. Authorities are investigating how the passenger was left behind and whether negligence played a role.

Air traffic controllers work without pay amid shutdown

Controllers at Seattle-Tacoma International Airport (SEA) are reportedly working unpaid as the government shutdown drags on. Union representatives warn the situation is undermining morale and aviation safety.

MTA chief criticizes free-bus proposal as costly and poorly planned

New York’s transit chief, Janno Lieber, slammed a proposed plan to make city buses free, calling it “half-baked” and potentially expensive. Advocates argue the plan would improve access for low-income residents.

Business/Market

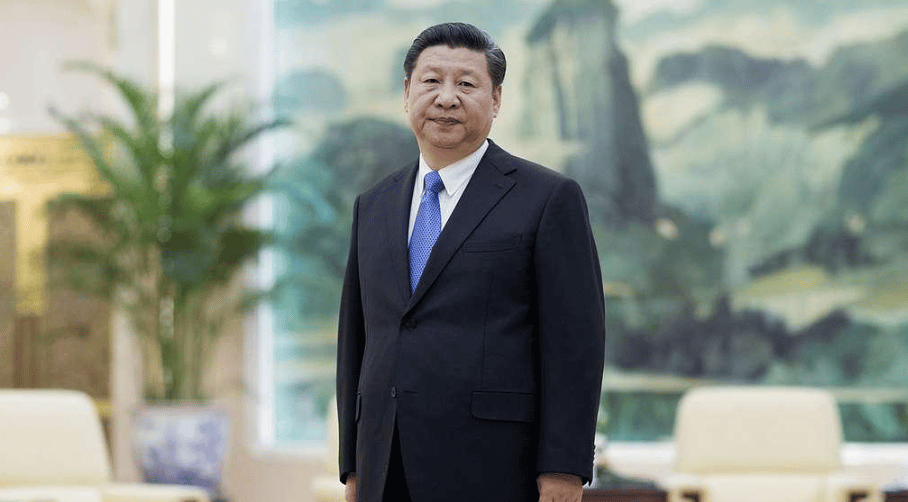

Trump–Xi trade truce unsettles markets

Following a temporary truce in U.S.–China trade talks, markets remain uncertain about long-term outcomes. Analysts warn rare earth stocks could face volatility as negotiations progress.

Amazon stock surges on strong AWS earnings

Amazon shares jumped after quarterly results beat forecasts, with Amazon Web Services driving the bulk of profits. The company reported significant gains in cloud infrastructure and AI-related services.

Apple posts Q4 earnings

Apple released its fourth-quarter results, with modest revenue growth led by strong iPhone sales and expanding services. Investors are watching for updates on its AI and hardware pipeline.

Today’s Snapshot

How to Build Multiple Income Streams That Actually Work

Let’s face it — in today’s world, one paycheck isn’t enough.

It’s not doom-and-gloom talk, it’s just math.

Costs rise. Layoffs happen. Inflation eats away your savings. And relying on one employer or one business can be risky — no matter how good things look right now.

That’s why the wealthy — and the soon-to-be wealthy — all have one thing in common:

They don’t rely on a single income stream.

Let’s break down exactly how to build multiple streams of income — the right way — without burning out, guessing, or spreading yourself too thin.

Step 1: Understand the 3 Types of Income

Not all income is created equal. Knowing the difference helps you decide where to focus your time and money.

💼 1. Active Income

This is what you work for.

You trade time for money — like your job, your freelance work, or your business.

Pros: Reliable, immediate.

Cons: If you stop working, the income stops too.

💰 2. Semi-Passive Income

This is income that needs effort to start but runs with less maintenance later.

Examples:

Digital products or courses

Rental property

Affiliate marketing

YouTube, newsletters, or subscription models

Pros: Scales well once built.

Cons: Takes time, patience, and initial effort to get going.

🏦 3. Passive Income

This is the dream — your money working without you.

Examples:

Dividend stocks

REITs (real estate investment trusts)

Index funds

Bonds

Peer-to-peer lending

Pros: Truly passive.

Cons: You need capital upfront — and discipline to reinvest.

Step 2: Protect and Optimize Your Primary Income

Before building new streams, strengthen your main one.

It’s your base — your “engine” for funding everything else.

Here’s what that looks like:

Get really good at what you do — expertise raises your income ceiling.

Ask for raises based on measurable results, not time served.

Build strong professional relationships — opportunities often come through people.

The more stable and higher your main income, the easier it becomes to fund other streams intelligently.

Step 3: Start With One Scalable Side Income

Now it’s time to expand — but don’t try to do everything at once.

You only need one small win to build momentum.

Ask yourself:

“What skill, knowledge, or asset do I already have that others value?”

Then match it to a scalable income idea.

Examples:

If you’re a marketer → offer consulting or build a course.

If you love writing → start a newsletter or ghostwrite.

If you’re analytical → explore trading, data consulting, or content analytics.

If you own property → short-term rentals or real estate syndication.

The trick is to start something that fits into your life — not something that takes it over.

Step 4: Reinvest, Don’t Just Earn

This is where most people mess up.

They start a side hustle, earn some money — then spend it like regular income.

But the real growth comes when you reinvest profits to create more streams.

For example:

Freelance profits → fund a dividend portfolio

Business revenue → buy real estate or T-bills

Side income → build an online course or newsletter

You’re not trying to get rich from one source — you’re stacking layers of income security.

Step 5: Automate What You Can

If managing multiple income streams sounds overwhelming, automation is your best friend.

Here’s how:

Use tools like QuickBooks or Notion to track income sources.

Automate investments (recurring transfers to ETFs or savings).

Outsource repetitive business tasks once revenue allows (VA, automation tools).

The goal is to multiply income, not workload.

You want your systems to work while you think.

Step 6: Play the Long Game

Let’s be clear — building multiple streams of income takes time.

Not months. Years.

But once it clicks, you start to notice something powerful:

You stop worrying about layoffs.

You can take calculated risks without fear.

You can build wealth even while you sleep.

You move from financial survival to financial flexibility — and that’s where true freedom starts.

Real-Life Example

Let’s say you make $100K a year from your job.

You start a small consulting gig on the side that earns $1,000/month ($12,000/year).

You invest half of that into dividend ETFs returning 6%.

After 1 year: $720 in passive dividends.

After 5 years: ~$6,000+.

After 10 years: ~$15,000+.

Now, imagine you repeat that with two or three other income streams.

That’s how wealth quietly builds — not overnight, but inevitably.

The Takeaway

You don’t need seven income streams today.

You just need to start building one and let it multiply naturally.

Here’s your simple roadmap:

Strengthen your main income.

Add one scalable side stream.

Reinvest profits into passive assets.

Automate, optimize, and repeat.

Because wealth isn’t about luck or timing — it’s about structure and consistency.

And multiple income streams are the structure that lets you stop worrying about money…

and start using it to build the life you actually want.

Thought of The Day

Every risk feels terrifying before it feels transformative. The key is doing it afraid — because fear fades, but regret compounds like bad interest. 💭

That’s All For Today

I hope you enjoyed today’s issue of The Wealth Wagon. If you have any questions regarding today’s issue or future issues feel free to reply to this email and we will get back to you as soon as possible. Come back tomorrow for another market update, and snapshot. I hope to see you. 🤙

— Ryan Rincon, CEO and Founder at The Wealth Wagon Inc.

Disclaimer: This newsletter is for informational and educational purposes only and reflects the opinions of its editors and contributors. The content provided, including but not limited to real estate tips, stock market insights, business marketing strategies, and startup advice, is shared for general guidance and does not constitute financial, investment, real estate, legal, or business advice. We do not guarantee the accuracy, completeness, or reliability of any information provided. Past performance is not indicative of future results. All investment, real estate, and business decisions involve inherent risks, and readers are encouraged to perform their own due diligence and consult with qualified professionals before taking any action. This newsletter does not establish a fiduciary, advisory, or professional relationship between the publishers and readers.