October 29, 2025

Welcome Back,

Happy Wednesday! 🌤️

Good morning! I hope your coffee’s strong, your mindset’s sharp, and your Wi-Fi’s behaving — because today’s a perfect day to get things in order.

Here’s something to think about: everyone wants to build wealth, but not enough people talk about building stability first. You know — the boring, unsexy stuff that actually keeps your financial house standing when the winds start blowing. 💸

Today’s post dives into exactly that: how to build financial stability before you build wealth. Because real success isn’t about having more — it’s about feeling secure enough to use what you have with confidence.

So today, let’s slow down just enough to make sure your foundation is solid… because once it is, everything you build on top grows faster, smoother, and stronger. 🚀

— Ryan Rincon, Founder at The Wealth Wagon Inc.

If you subscribed by accident or wish to no longer receive The Wealth Wagon content click here to un-subscribe →

Quote of The Day

“Effort without thought wastes time; Thought without effort wastes potential. Real success is found when the two are united”

— Ryan Rincon

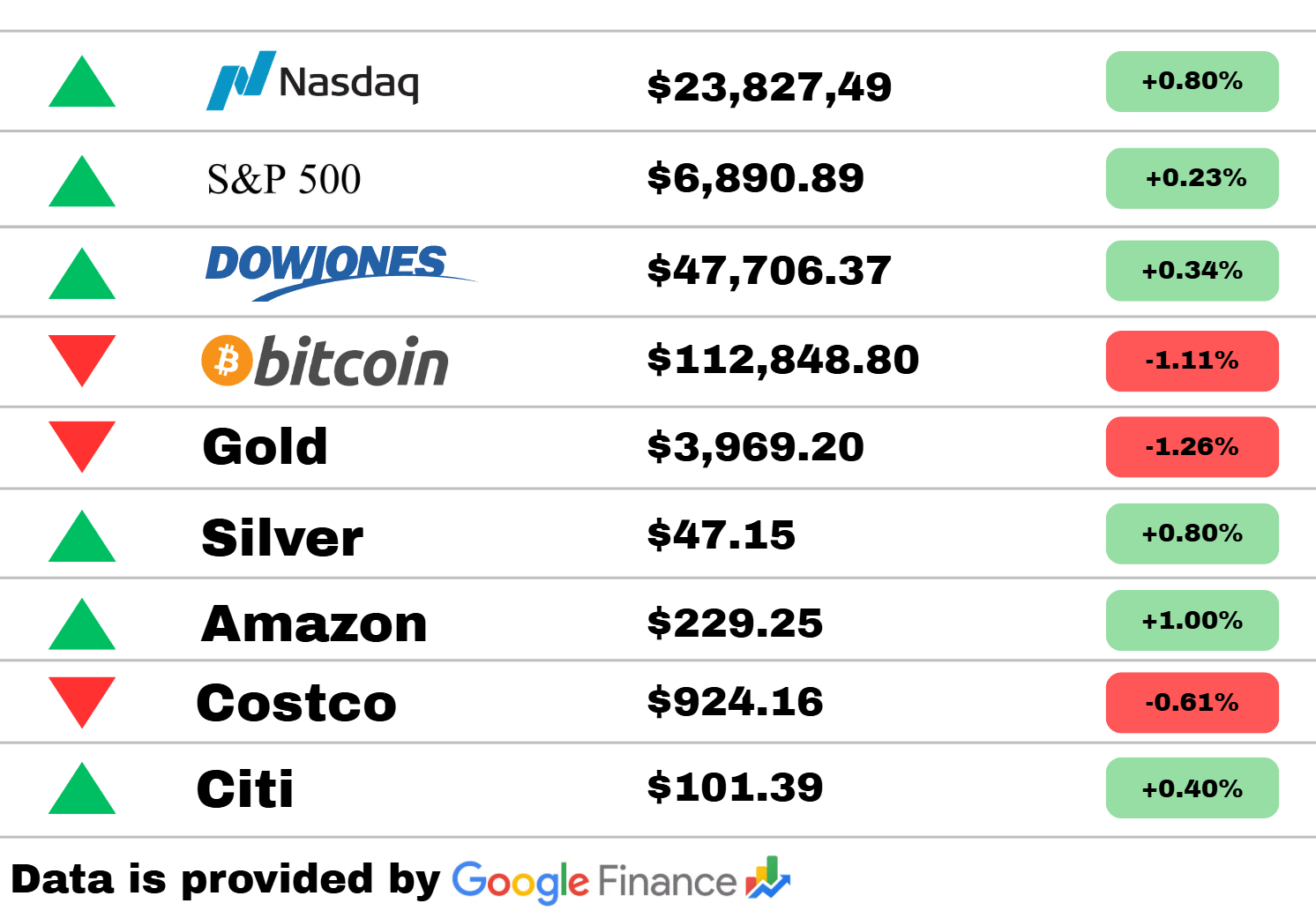

Market Update

*Market data represents the most recent market close at 5:00pm ET

Market Update: The Nasdaq led the charge, climbing +0.80% to $23,827.49, as tech stocks continued to power higher. The S&P 500 added +0.23% to $6,890.89, while the Dow Jones inched up +0.34% to $47,706.37, rounding out another upbeat session for U.S. markets.

Crypto, on the other hand, took a breather — Bitcoin slipped -1.11% to $112,848.80, cooling off after recent highs. In the commodities corner, Gold fell -1.26% to $3,969.20, while Silver edged higher +0.80% to $47.15, showing mixed signals in the metals market.

Corporate movers were a tale of two moods: Amazon rallied +1.00% to $229.25, staying strong on e-commerce momentum, while Costco dipped -0.61% to $924.16, likely catching its breath after a big run. Meanwhile, Citi added +0.40% to $101.39, continuing its steady climb alongside broader financials.

📈 The takeaway: Wall Street’s feeling confident, tech is shining bright, and silver’s sparkle returned. Crypto and gold lost a bit of their luster — but overall, the bulls are still steering this week’s market wagon forward.

PRESENTED BY UPWORK

Winning in business isn’t about doing more, it’s about doing it better. Upwork gives you access to top freelance talent across AI, marketing, design, and development so you can execute fast without compromising quality.

Whether you’re scaling operations, launching new products, or optimizing performance, Upwork helps you build teams that move as quickly as your ideas.

Trusted by Fortune 500s and high-growth startups alike, Upwork’s platform offers flexible terms, transparent pricing, and payment protection for every project. Hire the talent your competition wishes they had.

Science

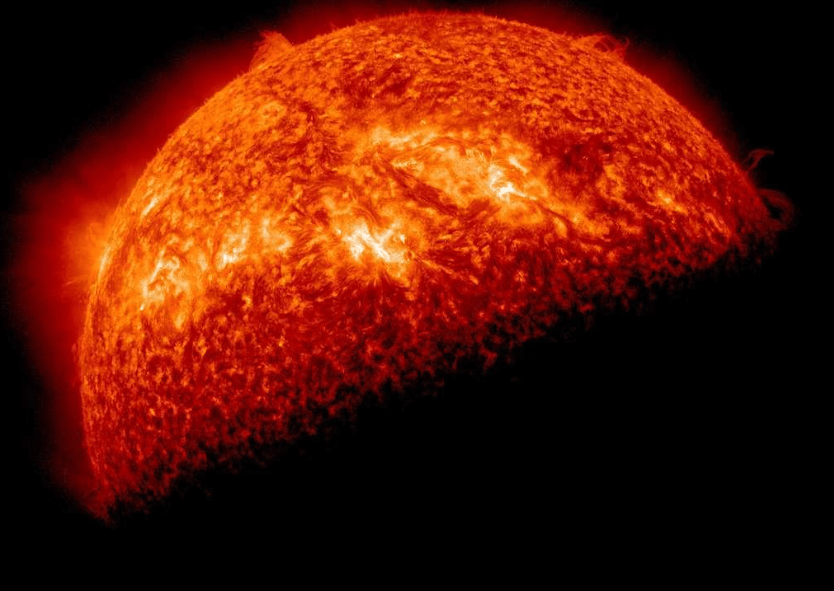

Interstellar object approaches close to the Sun

Astronomer Avi Loeb analyzed the interstellar object 3I/ATLAS as it nears perihelion — the closest point to the Sun in its orbit. The event offers scientists a rare chance to study material from outside our solar system and compare it to known comets and asteroids.

Mysterious sky lights linked to past nuclear tests

A new study suggests that unexplained luminous events recorded in the atmosphere may be connected to historic nuclear detonations. Researchers say the findings highlight how radiation and atmospheric chemistry from mid-20th-century tests can still produce detectable effects today.

SpaceX adds to satellite fleet with new launch

SpaceX successfully launched 28 more Starlink satellites from California and landed its booster on a drone ship in the Pacific. The mission marks another step in expanding its global broadband network and maintaining its record-setting launch pace.

Finance

Soybean prices rise on trade optimism

Soybeans and other major crops rallied on new trade hopes, with investors anticipating renewed global demand. Analysts note that grain prices are being buoyed by export optimism, while cattle futures fell as traders adjusted positions.

Health insurance premiums surge amid political standoff

Millions of Americans are facing steep increases in health insurance costs as lawmakers fail to extend Affordable Care Act subsidies. Experts warn that without renewed federal support, many low- and middle-income families could lose coverage.

UnitedHealth projects strong growth through 2026

UnitedHealth Group reported a better-than-expected outlook, forecasting continued growth into 2026 thanks to its expanding insurance and healthcare services divisions. The company’s optimism comes even as broader healthcare costs remain under pressure.

Crypto

Bitcoin steadies amid “double edged sword” trading risks

Bitcoin’s price remained relatively stable despite warnings from analysts about excessive leveraged positions. Some traders are concerned that market volatility could trigger cascading liquidations if prices fall suddenly.

XRP treasury firms draw investor attention

Several XRP-focused financial firms have entered the market, sparking speculation about their potential role in expanding Ripple’s ecosystem. Analysts say their emergence could signal renewed institutional interest in XRP-based products.

Ethereum holdings hit record highs

BitMine has increased its Ethereum reserves to over 3.3 million tokens after its latest acquisition. The accumulation reinforces growing confidence among mining firms and investors in the long-term value of the network’s transition to proof-of-stake.

Economy

Electricity costs mapped across U.S. states

A new analysis visualizes the average residential electricity prices by state, showing sharp regional disparities. Northeastern states lead with the highest costs, while several southern regions continue to benefit from lower energy prices.

Consumer confidence slips slightly in October

Americans’ confidence in the economy weakened modestly, reflecting concerns over inflation, housing affordability, and slower wage growth. Economists say the sentiment drop suggests that spending could cool entering the holiday season.

Russia’s wartime economy under strain

Experts are questioning how long Russia can sustain its defense-heavy spending amid mounting international sanctions. Although oil revenue remains strong, analysts warn that structural weaknesses could limit Moscow’s ability to finance the prolonged war effort.

Business

Nokia shares jump after Nvidia investment

Nvidia’s $1 billion stake in Nokia sent the telecom company’s stock soaring to a decade-high. The partnership is expected to accelerate Nokia’s integration of AI into its network infrastructure and hardware offerings.

Microsoft valuation surges past $4 trillion after OpenAI restructuring

Microsoft’s market capitalization topped $4 trillion following internal restructuring at OpenAI, which bolstered investor optimism about the company’s long-term dominance in artificial intelligence.

Stock market hits record highs ahead of Fed meeting

U.S. equities closed at all-time highs as traders bet on continued momentum in AI-related sectors and potential rate cuts by the Federal Reserve. Tech stocks led gains across major indexes.

Apple joins trillion-dollar elite

Apple became the third U.S. company to reach its latest valuation milestone, driven by robust demand for its devices and ongoing investment in AI technologies.

PRESENTED BY BELAY

Drowning in Details? Here’s Your Life Raft.

Stop doing it all. Start leading again. BELAY has helped thousands of leaders delegate the details and get back to what matters most.

Access the next phase of growth with BELAY’s resource Delegate to Elevate.

Today’s Snapshot

How to Build Financial Stability Before You Build Wealth

Let’s talk about something that doesn’t get enough credit in the world of “make money fast” — stability.

Because here’s the truth:

You can’t build wealth if you’re constantly trying not to lose it.

Everyone wants to talk about investing, passive income, and compounding — but few talk about the foundation that makes all of that possible: being financially stable enough to take smart risks.

What Financial Stability Actually Means

Financial stability isn’t about being rich — it’s about being resilient.

It means you can handle the unexpected without panic, and take opportunities without begging the universe for timing to be perfect.

Here’s what that looks like in real life:

You can pay your bills comfortably.

You have savings for emergencies.

You don’t rely on debt to survive the month.

You can take a calculated risk without blowing up your life.

It’s not glamorous, but it’s the foundation every investor and entrepreneur quietly relies on.

The 4 Pillars of Financial Stability

Let’s break this down practically — the stuff that gives you financial breathing room and sets you up to grow.

🧱 1. Cash Flow You Can Count On

You can’t stabilize what you don’t understand.

Start by getting clear on:

Your fixed costs (the bills that don’t change)

Your variable costs (stuff that fluctuates — subscriptions, food, entertainment)

Your income sources (salary, side hustles, investments, etc.)

Then ask yourself:

“If one income stream disappeared tomorrow, could I still function?”

If not, the solution isn’t to panic — it’s to build redundant cash flow.

Even small side incomes matter. A $300/month income stream may not seem like much, but multiply that by three or four, and you’ve got a cushion.

💰 2. Liquidity That Buys You Time

Emergencies don’t care about your portfolio returns.

You need accessible money — cash, not crypto, not locked-up stocks, not assets that take months to sell.

The sweet spot for most people:

3–6 months of expenses in cash or near-cash accounts

A separate “opportunity fund” if you want to jump on deals, market dips, or business moves

Liquidity doesn’t make you rich. It keeps you from going broke.

And that’s a huge difference.

🧾 3. Manageable (and Smart) Debt

Not all debt is bad. But unmanaged debt is a wealth killer.

Here’s a simple framework to assess yours:

Bad debt: high-interest consumer debt (credit cards, personal loans for lifestyle stuff)

Neutral debt: car loans or low-interest personal credit

Good debt: anything that funds income-producing assets (business, real estate, education with ROI)

If you’re using debt, make sure it’s either:

Producing cash flow, or

Buying you time or leverage

Otherwise, it’s just draining future you.

📈 4. An Investment Base You Don’t Touch

Once you’ve got cash flow and liquidity, start building a base of investments that compounds quietly in the background.

Focus on:

Broad-based index funds

Real estate or REITs

Dividend stocks or ETFs

Business reinvestment

The key isn’t to invest in what’s trending — it’s to stay invested through good and bad cycles.

You’ll sleep better knowing your future is compounding while your present stays stable.

The Big Advantage of Stability

Financial stability gives you choice.

It’s what lets you say “no” to bad clients.

It’s what keeps you calm when markets crash.

It’s what gives you time to think instead of react.

Most people’s financial lives are one small surprise away from chaos.

But when you’re stable, surprises become inconveniences, not disasters.

And that’s the power most people overlook — because stability doesn’t look exciting until instability shows up.

How to Build It (Even If You’re Starting Small)

Start simple. Try this:

Set up two accounts — one for living, one for saving.

Route income into savings first, then pay yourself.

Track one key metric — your “runway” (how long you can survive without new income).

Make that number go up every month.

Automate everything possible.

Transfers, savings, debt payments.

You want fewer emotional decisions and more consistent action.

Then, once your stability grows, you can safely start scaling risk: investing, starting a business, or acquiring assets.

That’s how real wealth gets built — stability first, risk second.

Final Thought

Everyone wants to talk about making money.

But the truth is: the people who keep money play a different game.

They don’t chase constant growth. They build a foundation that allows them to grow — without fear.

Because in the end, stability isn’t the opposite of ambition.

It’s what lets ambition compound safely.

Thought of The Day

You can’t control the outcome, but you can master your input. Focus on what’s within reach, and results will chase discipline, not desire.

That’s All For Today

I hope you enjoyed today’s issue of The Wealth Wagon. If you have any questions regarding today’s issue or future issues feel free to reply to this email and we will get back to you as soon as possible. Come back tomorrow for another market update, and snapshot. I hope to see you. 🤙

— Ryan Rincon, CEO and Founder at The Wealth Wagon Inc.

Disclaimer: This newsletter is for informational and educational purposes only and reflects the opinions of its editors and contributors. The content provided, including but not limited to real estate tips, stock market insights, business marketing strategies, and startup advice, is shared for general guidance and does not constitute financial, investment, real estate, legal, or business advice. We do not guarantee the accuracy, completeness, or reliability of any information provided. Past performance is not indicative of future results. All investment, real estate, and business decisions involve inherent risks, and readers are encouraged to perform their own due diligence and consult with qualified professionals before taking any action. This newsletter does not establish a fiduciary, advisory, or professional relationship between the publishers and readers.