October 16, 2025

Welcome Back,

Happy Thursday, everyone! 🌤️

Good morning! I hope you’re feeling recharged, grateful, and ready to move a little closer to your goals today. Thursdays have that special energy — the week’s not over, but the finish line’s in sight… it’s like the “pre-Friday” motivation boost we all secretly love.

Here’s a thought to kick things off: what if you could make your money work while you sleep? 😴💸

That’s the dream, right? But it’s not magic — it’s strategy. The key isn’t just earning income… it’s learning how to convert that income into something that grows quietly in the background.

That’s exactly what we’re diving into in today’s post — how to turn active income into passive wealth. You’ll learn how to transform your effort today into freedom tomorrow, and how small shifts can make your money start pulling its own weight.

So take that morning sip, smile a little wider, and remember — every smart move you make today can buy you a little more peace tomorrow.

— Ryan Rincon, Founder at The Wealth Wagon Inc.

If you subscribed by accident or wish to no longer receive The Wealth Wagon content click here to un-subscribe →

Quote of The Day

“Create the highest, grandest vision possible for your life, because you become what you believe.”

— Oprah Winfrey

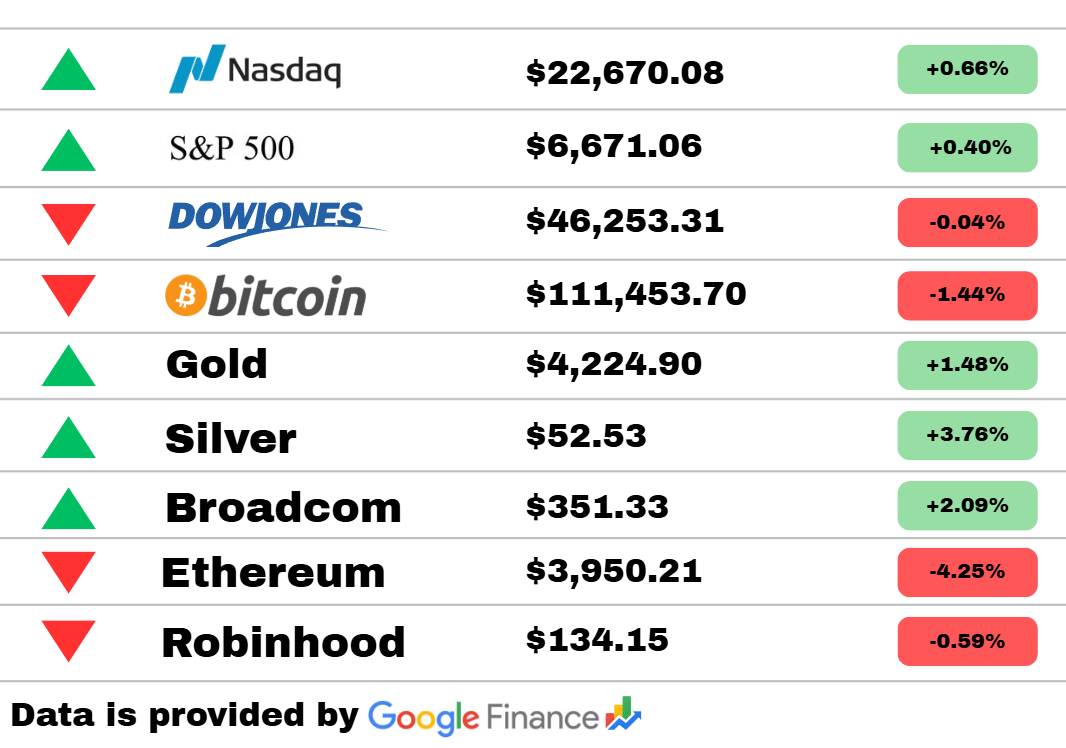

Market Update

*Market data represents the most recent market close at 5:00pm ET

Market Update: The Nasdaq climbed +0.66% to $22,670.08, while the S&P 500 followed suit with a +0.40% rise. The Dow Jones, however, couldn’t quite keep pace, slipping just -0.04%, showing a mild divergence across Wall Street’s big three.

Crypto stayed choppy — Bitcoin dropped -1.44% to $111,453.70, while Ethereum tumbled -4.25% to $3,950.21, signaling some profit-taking after recent volatility.

On the brighter side, commodities sparkled — Gold surged +1.48% to $4,224.90, and Silver soared +3.76% to $52.53, proving that safe-haven plays are still shining strong.

In the corporate spotlight, Broadcom jumped +2.09%, continuing its tech-leadership streak, while Robinhood slipped -0.59%, cooling off after a hot run.

📈 The bottom line: Markets felt cautiously optimistic today — tech found some footing, precious metals glowed, and while crypto cooled off, the bulls still seem to have the upper hand heading into the next session.

PRESENTED BY PEAK BANK

Bank Boldly. Climb Higher.

Peak Bank offers an all-digital banking experience, providing all the tools and tips you need to make your way to the top. Take advantage of competitive rates on our high-yield savings account and get access to a suite of smart money management tools. Apply online and start your journey today.

Member FDIC

U.S.

Covert CIA operation authorized in Venezuela amid rising tensions

The administration approved a secret CIA initiative focused on Venezuela, aiming to counter foreign influence and internal instability. Officials suggest the move reflects growing concern over the country's ties with rival powers. Details of the operation remain classified, sparking debate about intervention policy.

U.S. passport power ranking slips out of global top ten

The latest global passport index shows the United States no longer among the ten most powerful travel documents. The change reflects stricter visa requirements from other nations and a slowdown in new diplomatic agreements. Analysts say it marks a subtle shift in global mobility trends.

Refugee system overhaul could prioritize Western Hemisphere applicants

Officials are considering a restructuring of the refugee admissions process to give preference to applicants from the Americas. The proposal aims to address migration pressures closer to home. Critics argue it could limit opportunities for people fleeing conflict in other regions.

Politics

Unions prepare legal challenge to block mass layoffs during shutdown

Labor groups plan to file court motions to halt thousands of impending layoffs tied to the ongoing government shutdown. They argue the administration’s cuts violate federal labor protections. The move signals growing friction between public sector workers and the White House.

Congress’s longest-serving members: a look at seniority and influence

A new analysis highlights which lawmakers have held their seats the longest in the House and Senate. The findings reveal how longevity shapes committee power and legislative priorities. Critics say entrenched incumbency fuels gridlock and dampens generational turnover in leadership.

Both parties brace for drawn-out battle as shutdown drags on

Democrats and Republicans remain far apart on budget negotiations, with each side blaming the other for stalled talks. The shutdown’s economic fallout is starting to ripple through local economies. Insiders warn a quick resolution appears unlikely.

Economy

Tariffs have modest effect on U.S. growth but rising risks remain

Economists report that current tariffs have had only limited short-term economic impact but could weigh more heavily over time. Businesses warn supply chain costs are creeping higher. Policymakers face pressure to strike new trade deals before conditions worsen.

Bank CEOs express confidence despite ongoing market uncertainty

Leaders from major U.S. banks projected steady growth, citing strong consumer spending and corporate lending. Despite headwinds from inflation and trade disputes, they expect continued resilience. Investors welcomed the reassurance but remain cautious about future rate moves.

New furniture tariffs drive up prices for shoppers and retailers alike

Recent import tariffs are pushing up costs for both furniture makers and buyers. Many companies are splitting expenses with consumers to stay competitive. Analysts say prices could keep climbing through the holiday season.

Science

SpaceX targets tower catch in next phase of Starship tests

Following a successful flight, engineers are preparing for a new Starship launch that will attempt a “catch” landing using a launch tower. The maneuver could mark a breakthrough for rapid rocket reusability. Development continues to move at record pace ahead of future Mars missions.

Ancient hand fossils reveal new clues about extinct human relatives

Archaeologists have uncovered well-preserved hand fossils from an extinct hominin species that show surprising adaptations for tool use. The discovery reshapes understanding of early human evolution. Researchers say it suggests multiple hominin lines developed advanced dexterity.

Lead exposure may have aided early human evolution

New research proposes that exposure to trace amounts of lead might have inadvertently triggered neural adaptations in ancient humans. The finding challenges long-held assumptions about prehistoric environments. Scientists caution that modern exposure levels remain far more harmful.

Business and Market

United Airlines reports strong summer profits despite revenue dip

United exceeded profit forecasts thanks to high travel demand and cost control measures, even as revenue slightly missed expectations. Executives remain optimistic heading into the holiday travel season. Analysts call the results a sign of continued airline industry recovery.

Canadian jobs lost as automaker shifts new investment to U.S.

Thousands of Canadian workers face uncertainty after a major auto manufacturer announced plans to expand production in the U.S. instead. Officials say trade policy incentives played a role in the decision. Labor leaders warn of deep regional economic effects.

Markets edge higher as gold hits fresh record

Major stock indices ticked upward, led by tech and energy gains, while gold prices reached new highs amid geopolitical uncertainty. Investors are balancing optimism about earnings with caution over inflation data. Analysts expect continued volatility through the quarter.

Today’s Snapshot

How to Turn Active Income into Passive Wealth

If you make good money but still feel like you’re running on a treadmill, you’re not alone.

Most people, even high earners, never make the shift from earning money to building wealth — because they stay stuck in “active income” mode.

Here’s the truth: income makes you comfortable, but assets make you free.

Let’s break down how to actually convert your hard-earned money into wealth that works for you.

1. Understand the Two Types of Money You Earn

There are only two ways you make money:

Active income: You trade time for money. (Job, freelancing, consulting, even running your own business if it needs you daily.)

Passive income: You trade money for time. (Investments, ownership, automation, systems.)

Active income is important — it fuels the machine.

But if all you do is earn and spend, you’ll always have to keep earning.

The goal is simple: use active income to buy assets that generate passive income.

That’s the real wealth game.

2. Follow the “Wealth Flow” Formula

Here’s a simple mental model for how rich people think about money:

Earn → Save → Invest → Reinvest → Repeat

Most people stop at “save.”

But wealth builders push money through this cycle over and over.

Let’s break it down:

Earn: Build your income — job, business, side hustle.

Save: Don’t just cut costs — redirect surplus cash for opportunity.

Invest: Put it into income-producing or appreciating assets.

Reinvest: Feed the gains back into more assets.

Repeat: Do it long enough, and the compounding gets wild.

That’s how capital quietly replaces labor.

3. Pick the Right Wealth Vehicles for Your Situation

Depending on where you are financially, different “vehicles” make sense.

Here’s a quick guide:

If you’re early stage:

Focus on increasing your earning power and saving rate. Build a base.

→ Side hustles, digital skills, cash-flowing small businesses.If you’re mid-stage:

Start building ownership.

→ Invest in index funds, REITs, rental property, or small equity stakes in businesses.If you’re advanced:

Focus on capital efficiency.

→ Private equity, syndications, venture investing, or lending opportunities.

Each stage feeds the next — but only if you keep moving up the ladder instead of just upgrading your lifestyle.

4. Automate the Conversion

Most people “intend” to invest but never do — because they rely on willpower.

You need automation.

Here’s how:

Set up an auto-transfer that moves money to your investment account the day you get paid.

Create a “freedom fund” — a separate account for wealth-building (not emergencies, not spending).

Treat investing like a bill that must be paid — not an optional afterthought.

Once this system is running, wealth-building stops depending on your mood or discipline.

It just happens.

5. Focus on Assets That Pay You in 3 Ways

When evaluating an investment or business idea, ask:

“Does it make me money in at least one — ideally more — of these ways?”

Cash Flow — regular income (rent, dividends, interest).

Appreciation — the value goes up over time.

Leverage — your asset can be borrowed against or multiplied.

Example:

Real estate: ✅ Cash flow, ✅ Appreciation, ✅ Leverage.

Stocks: ✅ Appreciation, ✅ Dividends.

A business: ✅ All three (if run right).

You don’t need to own everything — just enough good assets that compound together.

6. Reinvest Until You Replace Yourself

This is the turning point.

Once your investments start throwing off consistent income, resist the urge to spend it right away.

Reinvest until the returns from your assets can replace your active income.

That’s financial freedom — not retiring, but having choice.

Because when your assets pay your bills, your time becomes 100% yours.

And that’s when the real opportunities show up — not because you’re chasing money, but because you have the freedom to pursue what matters.

7. Keep Your Lifestyle Lagging Behind Your Growth

This is where most people blow it.

Every raise, bonus, or profit surge leads to… lifestyle inflation.

New car, bigger house, nicer vacations — and before you know it, the “extra” is gone.

Wealthy people don’t do that.

They let lifestyle lag behind income, sometimes for years.

That’s how they keep compounding when others plateau.

The formula is simple:

Grow your income. Keep your lifestyle steady. Invest the gap

Do that for even five years and you’ll never look at money the same way again.

Final Thought

You don’t have to be born rich, take huge risks, or start a company to build wealth.

You just need to redirect your effort — from making money to multiplying it.

Your job, business, or side hustle is your engine.

Your investments are the vehicle that takes you somewhere.

Most people keep revving the engine without ever moving the car.

Don’t be most people.

Start converting your active income into passive wealth today — and let your money start working harder than you do.

Thought of The Day

Your beliefs become your reality. To shift results, begin by rebelling against limiting beliefs — then build new ones that empower your journey.

That’s All For Today

I hope you enjoyed today’s issue of The Wealth Wagon. If you have any questions regarding today’s issue or future issues feel free to reply to this email and we will get back to you as soon as possible. Come back tomorrow for another market update, and snapshot. I hope to see you. 🤙

— Ryan Rincon, CEO and Founder at The Wealth Wagon Inc.

Disclaimer: This newsletter is for informational and educational purposes only and reflects the opinions of its editors and contributors. The content provided, including but not limited to real estate tips, stock market insights, business marketing strategies, and startup advice, is shared for general guidance and does not constitute financial, investment, real estate, legal, or business advice. We do not guarantee the accuracy, completeness, or reliability of any information provided. Past performance is not indicative of future results. All investment, real estate, and business decisions involve inherent risks, and readers are encouraged to perform their own due diligence and consult with qualified professionals before taking any action. This newsletter does not establish a fiduciary, advisory, or professional relationship between the publishers and readers.