November 4, 2025

Welcome Back,

Happy Tuesday, everyone! 🌞

Good morning! I hope your coffee’s strong, your mindset’s clear, and your week is rolling in the right direction. Tuesdays often fly under the radar — not as sleepy as Monday, not as exciting as Friday — but they’re actually perfect for leveling up how we think.

And that’s exactly what today’s post is about: how to think like an investor in everyday life. 💡

Because “investor thinking” isn’t just about stocks or real estate — it’s about how you make decisions, spot value, and use your time, money, and energy with purpose.

Whether it’s buying something, learning a skill, or choosing how to spend your weekend — every move has a return. The people who win long term aren’t just lucky… they’re intentional.

So today, let’s sharpen that investor mindset — not just for your portfolio, but for your life. Small decisions, made with clarity, can quietly compound into something extraordinary. 💼✨

— Ryan Rincon, Founder at The Wealth Wagon Inc.

If you subscribed by accident or wish to no longer receive The Wealth Wagon content click here to un-subscribe →

Quote of The Day

“Courage is grace under pressure.”

— Ernest Hemingway

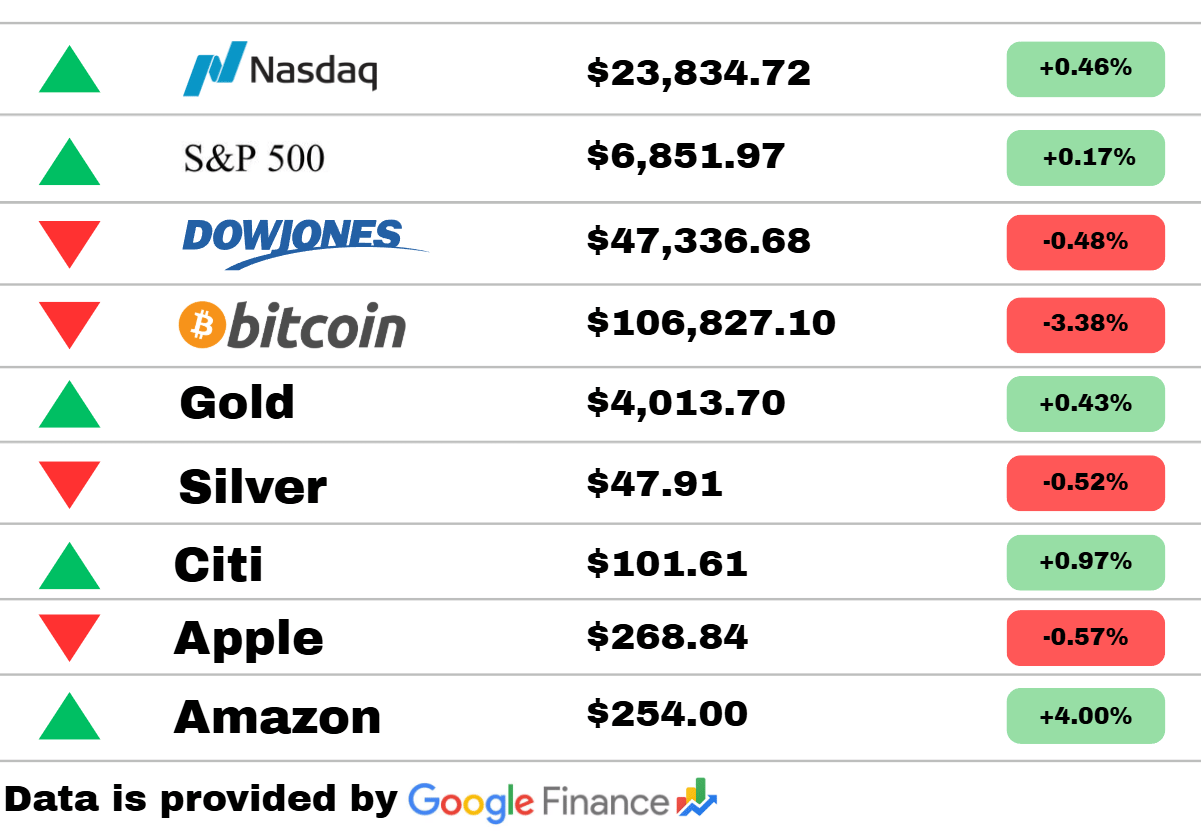

Market Update

*Market data represents the most recent market close at 5:00pm ET

Market Update: The Nasdaq rose +0.46% to $23,834.72, extending gains on the back of strong tech earnings optimism. The S&P 500 edged up +0.17% to $6,851.97, while the Dow Jones slipped -0.48% to $47,336.68, as industrials and energy names weighed on the blue-chip index.

Bitcoin took a sharp hit, dropping -3.38% to $106,827.10, reflecting continued risk-off sentiment in the crypto market as investors shifted toward more stable assets. Meanwhile, Gold gained +0.43% to $4,013.70, showing modest safe-haven demand, but Silver eased -0.52% to $47.91 amid profit-taking.

On the corporate front, Amazon dominated headlines with a +4.00% surge to $254.00, following upbeat revenue forecasts that signaled renewed consumer strength. Citi also advanced +0.97% to $101.61, supported by solid financial performance and investor confidence in the banking sector. However, Apple dipped -0.57% to $268.84, as supply-chain concerns resurfaced in tech manufacturing discussions.

📈 The takeaway: A split market session — with tech giants like Amazon lifting sentiment while crypto and precious metals stumbled. Investors appear cautiously optimistic, balancing between growth potential and near-term uncertainty.

Markets do not wait. Wispr Flow turns your voice into clean, final-draft writing across email, Slack, and docs so you capture ideas at the speed you read them. It matches your tone, handles punctuation and lists, and works across Mac, Windows, and iPhone. No start-stop edits, no formatting fixes, just thought-to-text that keeps pace with your research and deal flow.

World

Tanzania’s opposition is calling for international intervention after alleging massive fraud and violence in recent elections. Reports claim hundreds of protestors have been detained or injured during clashes with security forces. Human rights organizations are urging the government to ensure transparency and protect civil liberties.

Authorities in the U.K. have charged a man with attempted murder following a stabbing on a commuter train that shocked the nation. Police say the suspect was apprehended quickly, preventing further harm. The attack has reignited discussions about public safety and mental health in transit systems.

Rescue workers in Italy are racing to free a trapped laborer after part of a medieval tower collapsed during restoration work. Emergency crews are using specialized equipment to stabilize the structure as they dig through rubble. Local officials have opened an investigation into whether the collapse was linked to recent structural concerns.

Politics

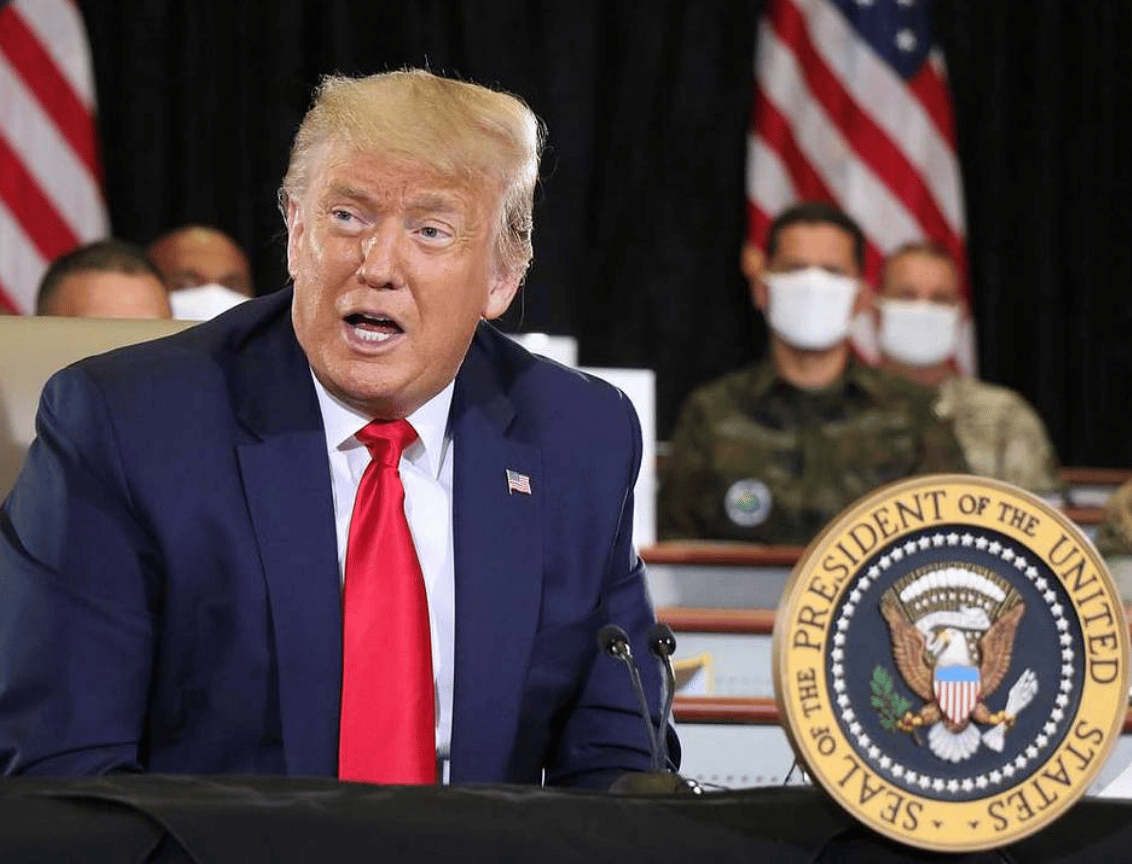

President Trump signaled that the ongoing government shutdown is unlikely to end soon, despite mounting pressure from lawmakers. Negotiations remain stalled as both parties refuse to compromise on budget terms. Economists warn that an extended shutdown could slow consumer spending and harm confidence heading into winter.

Nigeria has responded sharply to President Trump’s recent “guns-a-blazing” remark, calling it “provocative and disrespectful.” The statement has stirred diplomatic tensions, with Nigerian officials demanding clarification from Washington. Analysts say the episode underscores the fragile relationship between the two countries amid ongoing security cooperation.

Defense officials have been prohibited from discussing recent drug-interdiction operations after controversy over leaked mission details. The directive aims to limit exposure of classified information and prevent political fallout. Critics argue the move could reduce transparency and public accountability for overseas military activity.

Economy

Federal Reserve officials are emphasizing that labor market stability remains a higher priority than inflation control at this stage. Policymakers believe the risk of job losses outweighs the dangers of modestly higher prices. Analysts say the statement signals the Fed’s cautious approach to balancing growth with fiscal restraint.

Industrial firms are showing signs of recovery as tariffs ease and raw material prices stabilize. Heavy-equipment producers and construction suppliers report improving orders after months of uncertainty. Economists see this as a tentative rebound but caution that demand from China and Europe remains uneven.

The broader U.S. economy is flashing mixed signals, with strong consumer spending offset by weaker manufacturing and investment. Some sectors are benefiting from reduced inflation pressures, while others still face headwinds from global slowdowns. Experts say clarity will depend on the next round of federal budget negotiations.

Business

Kimberly-Clark has agreed to acquire Kenvue, the maker of Tylenol, in a massive $40 billion deal. The merger is expected to reshape the consumer-health landscape, combining household and personal-care brands under one global giant. Executives say the move will streamline distribution and accelerate innovation across multiple product lines.

OpenAI has signed a groundbreaking $38 billion cloud computing agreement with Amazon, solidifying a deep partnership between two tech powerhouses. The deal will expand AI model training capabilities and speed up large-scale deployments. Industry analysts believe this collaboration could redefine infrastructure standards for advanced AI systems.

Former President Trump addressed questions about his controversial pardon of Binance’s former CEO, claiming he “didn’t know” the crypto billionaire personally. The remarks come amid renewed scrutiny of the decision as cryptocurrency regulation intensifies. Legal experts suggest the case could set precedents for executive clemency involving financial crimes.

PRESENTED BY AUTHOR INC

Smart leaders don’t write books alone.

You built your business with a team. Your book should be no different.

Author.Inc helps founders and executives turn their ideas into world-class books that build revenue, reputation, and reach.

Their team – the same people behind projects with Tim Ferriss and Codie Sanchez – knows how to turn your expertise into something that moves markets.

Schedule a complimentary 15-minute call with Author.Inc’s co-founder to map out your Book Blueprint to identify your audience, angles, and ROI.

Do this before you commit a cent, or sentence. If it’s a go, they’ll show you how to write and publish it at a world-class level.

If it’s a wait, you just avoided wasting time and money.

Today’s Snapshot

How to Think Like an Investor in Everyday Life

You don’t need to be Warren Buffett to think like an investor.

You just need to start looking at the world a little differently.

Because here’s the truth:

Investing isn’t just what you do with your money — it’s how you make decisions in every part of your life.

Once you start thinking like an investor, you begin seeing opportunities, not obstacles. You spend differently, work differently, and even live differently.

Let’s break that mindset down — and talk about how to apply it daily, even outside the stock market.

1. Think in Terms of ROI (Return on Investment)

Every investor asks one simple question before putting money anywhere:

“What’s the return?”

That same question should guide your decisions in everyday life — not just with dollars, but with time, energy, and attention.

Here’s what that looks like in practice:

Spending $200 on a course that teaches you a skill → ✅ ROI positive.

Spending $200 on clothes you’ll wear twice → ❌ ROI zero.

Spending 30 minutes a day walking and thinking clearly → ✅ ROI exponential (health = longevity = earning potential).

When you start viewing choices as investments, your decisions sharpen. You stop asking “Can I afford this?” and start asking “Does this pay me back?”

2. Understand Compounding in Every Form

Everyone knows compound interest is powerful in finance — but it’s even more powerful in life.

Because compounding doesn’t just apply to money — it applies to habits, relationships, and reputation.

Reading 10 pages a day → hundreds of books over a decade.

Building trust with your clients → massive long-term referrals.

Improving your craft 1% a day → mastery in a few years.

Compounding is what separates short-term hustlers from long-term builders.

So when you make daily choices, ask:

“If I did this for 10 years, what would it turn into?”

That’s how real investors think.

3. Diversify, But With Intention

In money terms, diversification protects you from risk.

In life terms, it gives you optionality.

Financially, sure — diversify your portfolio with:

Stocks

Real estate

Index funds

Cash or bonds

But mentally, diversify your skills and relationships, too.

Learn something outside your career field. Network in different industries. Build friendships beyond your age group or income level.

Diversification keeps you relevant, flexible, and open to opportunities.

Because the more baskets you have — financially and personally — the less likely one bad day wipes you out.

4. Avoid “Shiny Object” Investing

Whether it’s crypto, startups, or the latest get-rich-quick scheme, investors lose money chasing excitement.

The same happens in life — people burn time and energy chasing trends instead of building value.

Here’s the investor’s rule:

“If it feels too exciting, it’s probably not sustainable.”

Boring things — like index funds, consistent habits, and steady progress — build quiet wealth.

So when you find something that feels too good to be true, pause. Ask yourself:

“Am I chasing excitement or results?”

“Would I still do this if no one knew about it?”

True investors — and successful people in general — care more about results than applause.

5. Focus on Cash Flow, Not Just Appearances

Investors know that cash flow beats clout.

A rented Lamborghini doesn’t pay your bills.

A boring rental property does.

In your personal life, this translates to one simple mindset shift:

Build assets that produce, not liabilities that impress.

That can mean:

A business that runs without you

A YouTube channel that earns ad revenue

A skill that consistently brings in clients

Even if you make great money at your job, start thinking:

“How can I turn this paycheck into something that keeps paying me later?”

That’s investor thinking.

The Bottom Line

Thinking like an investor isn’t about watching CNBC or memorizing ticker symbols.

It’s about seeing the world through the lens of value creation, compounding, and rational decisions.

To recap:

Think in ROI, not price tags.

Let compounding work for you — in money and habits.

Diversify intelligently.

Ignore shiny distractions.

Prioritize cash flow over clout.

Control emotions under pressure.

Keep reinvesting in yourself.

If you do these consistently, your wealth, stability, and peace of mind will grow faster than any stock portfolio — because you’ll be thinking and acting like an investor in everything you do.

Thought of The Day

Your environment shapes your energy — surround yourself with builders, thinkers, and doers. You can’t plant dreams in toxic soil and expect them to bloom.

That’s All For Today

I hope you enjoyed today’s issue of The Wealth Wagon. If you have any questions regarding today’s issue or future issues feel free to reply to this email and we will get back to you as soon as possible. Come back tomorrow for another market update, and snapshot. I hope to see you. 🤙

— Ryan Rincon, CEO and Founder at The Wealth Wagon Inc.

Disclaimer: This newsletter is for informational and educational purposes only and reflects the opinions of its editors and contributors. The content provided, including but not limited to real estate tips, stock market insights, business marketing strategies, and startup advice, is shared for general guidance and does not constitute financial, investment, real estate, legal, or business advice. We do not guarantee the accuracy, completeness, or reliability of any information provided. Past performance is not indicative of future results. All investment, real estate, and business decisions involve inherent risks, and readers are encouraged to perform their own due diligence and consult with qualified professionals before taking any action. This newsletter does not establish a fiduciary, advisory, or professional relationship between the publishers and readers.