November 22, 2025

Welcome Back,

Happy Saturday, everyone! ☀️😄

Good morning! I hope you woke up feeling just a little lighter today — or at least glad that alarms don’t hit quite as hard on weekends.

Here’s a question to warm up your brain as you sip whatever makes you feel alive in the morning:

What would your life look like if you earned just 20–30% more than you do right now — without changing careers, jobs, or industries?

More room to breathe?

More money stacking instead of stressing?

More confidence knowing you control your financial trajectory?

Most people think the only way to earn more is to uproot everything — new career, new degree, new chaos.

But the reality?

Your earning power is already sitting inside you. It just needs to be leveled up, polished, and aimed in the right direction.

— Ryan Rincon, Founder at The Wealth Wagon Inc.

Quote of The Day

“Success is walking from failure to failure with no loss of enthusiasm.”

— Winston Churchill

Market Update

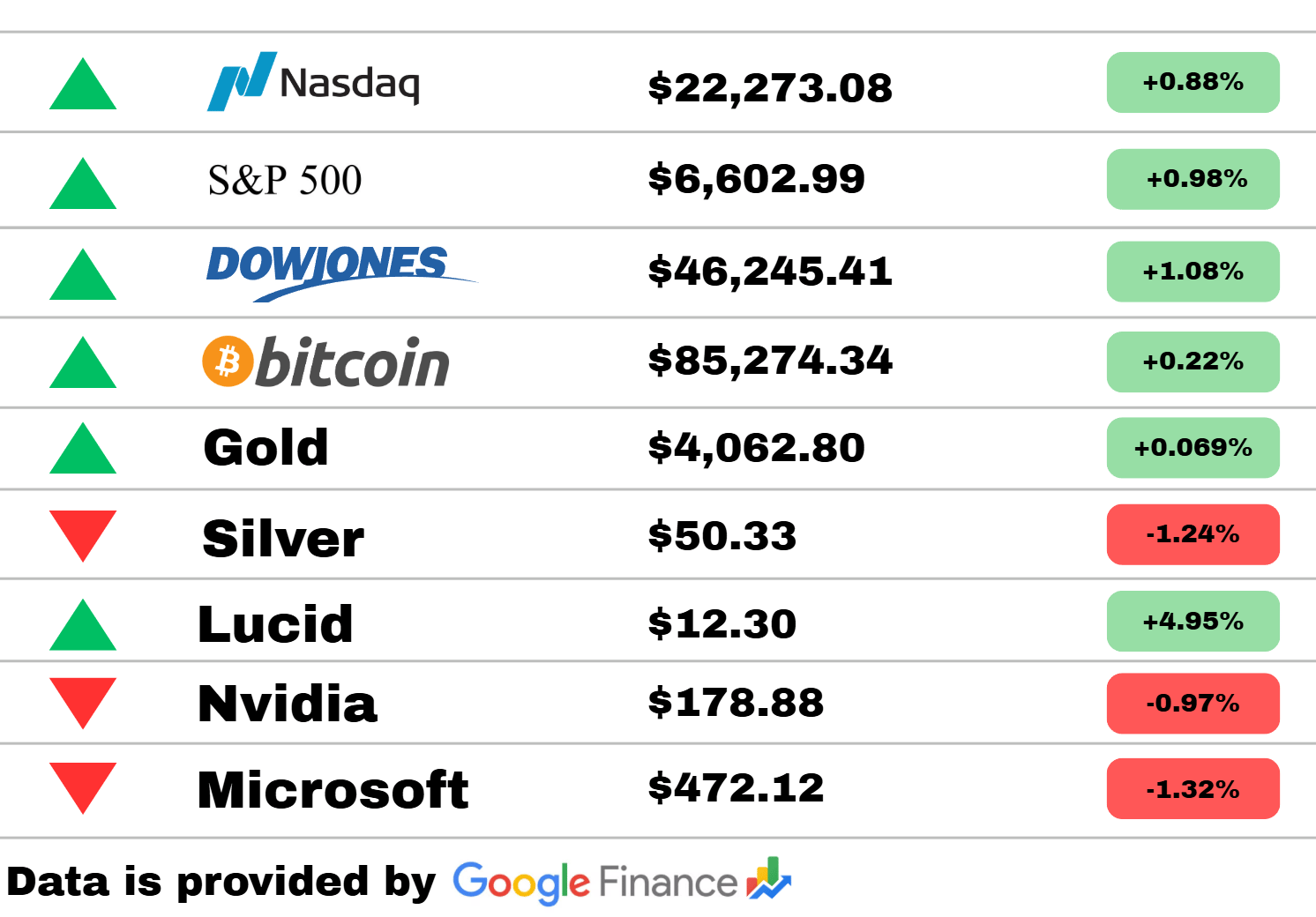

*Market data represents the most recent market close at 5:00pm ET

Market Update: The markets kicked off with strong momentum today as all three major indexes—Nasdaq, S&P 500, and the Dow—posted solid gains, rising +0.88%, +0.98%, and +1.08% respectively. Bitcoin inched up +0.22%, holding steady above the $85K mark, while gold was essentially flat with a slight +0.069% uptick. Silver, however, slipped -1.24%, giving back some of its recent strength. In equities, Lucid stole the spotlight with a sharp +4.95% surge, while Nvidia and Microsoft pulled back -0.97% and -1.32%, respectively, signaling a bit of cooling in the tech sector. Overall, it was a broadly positive day with growth-heavy sectors leading the charge and a few big names taking a breather.

PRESENTED BY MASTERWORKS

Here’s an un-boring way to invest that billionaires have quietly leveraged for decades

If you have enough money that you think about buckets for your capital…

Ever invest in something you know will have low returns—just for the sake of diversifying?

CDs… Bonds… REITs… :(

Sure, these “boring” investments have some merits. But you probably overlooked one historically exclusive asset class:

It’s been famously leveraged by billionaires like Bezos and Gates, but just never been widely accessible until now.

It outpaced the S&P 500 (!) overall WITH low correlation to stocks, 1995 to 2025.*

It’s not private equity or real estate. Surprisingly, it’s postwar and contemporary art.

And since 2019, over 70,000 people have started investing in SHARES of artworks featuring legends like Banksy, Basquiat, and Picasso through a platform called Masterworks.

23 exits to date

$1,245,000,000+ invested

Annualized net returns like 17.6%, 17.8%, and 21.5%

My subscribers can SKIP their waitlist and invest in blue-chip art.

Investing involves risk. Past performance not indicative of future returns. Reg A disclosures at masterworks.com/cd

World

A fierce debate over fossil fuels erupted at the UN climate summit, with multiple countries clashing over timelines for phasing out oil, gas, and coal. Delegates described “a lot of fighting” behind closed doors as negotiations grew increasingly tense. Climate advocates warn that without a breakthrough, the summit could end without meaningful commitments.

A grizzly bear attacked a group of students and teachers during an outdoor school activity in western Canada, leaving several injured. Officials say the attack was sudden and unprovoked, prompting an immediate search-and-rescue response. Wildlife authorities are investigating the incident and assessing whether the bear poses ongoing danger to the area.

Japan publicly rejected demands from China to retract recent comments related to Taiwan, escalating diplomatic friction between the two nations. Japanese officials emphasized that their stance remains unchanged despite Beijing’s warnings. Analysts expect this dispute to fuel further tension in an already strained regional environment.

Tech

Apple has released its second limited-edition iPhone accessory this month, sparking excitement among collectors and fans. The rapid back-to-back launches suggest Apple is testing new marketing strategies for premium add-ons. Early demand appears strong, with units selling out quickly in several markets.

A new full-screen experience for Windows 11 PCs is now available to Xbox Insider testers, aiming to make PC–Xbox integration more seamless. The feature enhances navigation, game launching, and media access with a more console-like interface. Microsoft says it’s part of a broader push to unify gaming experiences across platforms.

SpaceX’s first “Version 3” Super Heavy Starship booster encountered buckling during early pressure testing, raising questions about design tolerances. Engineers say the test was intentionally aggressive to identify structural limits before full-scale flights. SpaceX maintains confidence in rapid revisions as part of its iterative development strategy.

Science

A well-known professor openly criticized NASA for what he called a “deceptive” press briefing about a newly detected interstellar object. He claims key information was withheld or minimized, fueling speculation and frustration within parts of the scientific community. NASA maintains that all publicly released data is accurate and appropriately vetted.

Blue Origin’s newly returned New Glenn booster drew attention for its remarkably clean condition after landing. Engineers explained that improvements in heat shielding, engine configuration, and descent software contributed to the pristine result. The booster’s performance is being hailed as a promising sign for future reuse reliability.

Scientists have announced that moss samples survived a nine-month journey on the exterior of the International Space Station. The experiment suggests certain plant species may be far more resilient to harsh cosmic conditions than previously believed. Researchers say the findings could have implications for future long-term space habitats and biological survival beyond Earth.

Today’s Snapshot

How to Raise Your Earning Power in the Next 12 Months (Without Switching Careers)

Most people think increasing their income means changing jobs, begging for a raise, or starting an entire new business.

But here’s the truth:

Your earning power is mostly determined by the skills you stack, the results you produce, and the problems you can solve — not your job title.

Whether you're a manager, a business owner, a specialist, or someone early in their career, you can radically increase your value in the marketplace in a single year with a focused plan.

Let’s walk through what that looks like in real life.

1. Identify the “Money Skills” in Your Industry

Every industry has skills that quietly determine who earns the most.

They usually fall into three categories:

A) Revenue Skills

Anything that directly drives revenue:

sales

lead generation

marketing

partnerships

pricing strategy

customer lifetime value optimization

People who touch revenue almost always earn more.

B) Efficiency Skills

Skills that save companies time and money:

automation

process design

systems creation

operations

workflow optimization

These get you promoted because they make teams more effective with fewer people.

C) Strategic Skills

Skills that improve decision-making:

data analysis

forecasting

financial planning

competitive research

product insight

Great decision-makers rise fast.

Your first step: Identify which skills have the highest earning potential in your field.

Pick one.

Just one.

That’s your focus for the next year.

2. Become the Person Who Solves a High-Value Problem

Money flows to the person who solves the biggest bottlenecks.

Ask yourself (or your team / boss / clients):

“What slows us down the most?”

“Where do we lose money?”

“What takes way too long?”

“Who is overloaded?”

“What system is always breaking?”

“What do people constantly complain about?”

Every answer = a money-making opportunity.

Professionals who rise quickly don’t do more work.

They solve more important problems.

3. Build One “Signature Skill” That Makes You Stand Out

Look at the top earners in your industry.

They usually have one standout ability that makes them hard to replace.

Examples:

The marketer who understands analytics better than anyone

The salesperson who also knows copywriting

The operations person who can automate half the workflow

The engineer who’s amazing at communicating with non-technical teams

The business owner who can train people better than anyone else

You don’t need to be world-class.

You just need to be the person others rely on for one specific thing.

Pick a lane and own it.

4. Create a Documented Track Record of Results

Here’s a high-earning hack almost nobody uses:

Document everything you improve.

If you:

increase a metric

shorten a process

save time

save money

grow a number

build a system

streamline a workflow

turn chaos into order

Document it.

This becomes your ROI Portfolio — a personal results folder you can use for:

raises

new jobs

consulting

promotions

negotiating equity

pitching clients

building a personal brand

People listen when you can show:

“I saved 22 hours per month.”

“I increased revenue by 14%.”

“I reduced customer complaints by 37%.”

“I cut onboarding time from 10 days to 3.”

Results speak louder than résumés.

5. Learn How to Communicate Your Value (This Is the Earn-More Superpower)

Your earning power is not just based on what you do —

it’s based on how clearly people understand your impact.

If you want to earn more, master two communication skills:

A) The Value Update

Once a week, send a short message to your boss, team, or clients:

“Quick update: improved X by Y, next step is Z.”

It positions you as proactive and high-performing.

B) The Impact Summary

When asking for compensation or presenting results:

“Here are the improvements I’ve made:

Reduced ____

Increased ____

Saved ____

Improved ____

Here is the value of those results to the team/company.”

No emotion.

No begging.

Just numbers and outcomes.

Professionals who communicate clearly always earn more.

Final Thought

You don’t need a new career.

You don’t need another degree.

You don’t need 80-hour weeks.

In 12 months, you can substantially increase your earning power by doing three things:

Master one high-value skill

Solve one high-value problem

Communicate your value clearly and consistently

Your job title doesn’t determine your income.

Your value does.

Thought Of The Day

When you consistently choose discipline over distraction, life begins to shift in ways that appear almost magical. The truth is, it’s just focus compounding.

The Wealth Wagon’s Other Newsletters:

The Wealth Wagon – Where it all began, from building wealth to making money – Subscribe

The AI Wagon – AI trends, tools, and insights – Subscribe

The Economic Wagon – Global markets and policy shifts – Subscribe

The Financial Wagon – Personal finance made simple – Subscribe

The Investment Wagon – Smart investing strategies – Subscribe

The Marketing Wagon – Growth and brand tactics – Subscribe

The Sales Wagon – Selling made strategic – Subscribe

The Startup Wagon – Build, scale, and grow – Subscribe

The Tech Wagon – Latest in tech and innovation – Subscribe

Side Hustle Weekly - Actionable side-hustle ideas and income tips - Subscribe

That’s All For Today

I hope you enjoyed today’s issue of The Wealth Wagon. If you have any questions regarding today’s issue or future issues feel free to reply to this email and we will get back to you as soon as possible. Come back tomorrow for another market update, and snapshot. I hope to see you. 🤙

— Ryan Rincon, CEO and Founder at The Wealth Wagon Inc.

Disclaimer: This newsletter is for informational and educational purposes only and reflects the opinions of its editors and contributors. The content provided, including but not limited to real estate tips, stock market insights, business marketing strategies, and startup advice, is shared for general guidance and does not constitute financial, investment, real estate, legal, or business advice. We do not guarantee the accuracy, completeness, or reliability of any information provided. Past performance is not indicative of future results. All investment, real estate, and business decisions involve inherent risks, and readers are encouraged to perform their own due diligence and consult with qualified professionals before taking any action. This newsletter does not establish a fiduciary, advisory, or professional relationship between the publishers and readers.