November 21, 2025

Welcome Back,

Happy Friday, everyone! 🎉🌤️

Good morning! I hope you’re rolling into the end of the week with good energy — or at least the determination that coffee will handle the rest.

Let me ask you something fun to kick things off:

If you had a second income stream magically appear today, what’s the first thing you’d do with it?

Pay off something?

Invest it?

Treat yourself to something overdue?

Or maybe just smile because your money is finally working as hard as you do?

Here’s the good news:

You don’t need magic.

You don’t need to quit your job.

You don’t need a million-dollar idea.

You just need one intentionally built second income stream — the kind that fits your life, doesn’t eat your time, and quietly adds financial breathing room.

— Ryan Rincon, Founder at The Wealth Wagon Inc.

Quote of The Day

“Dream big. Start small. Act now.”

— Robin Sharma

Market Update

*Market data represents the most recent market close at 5:00pm ET

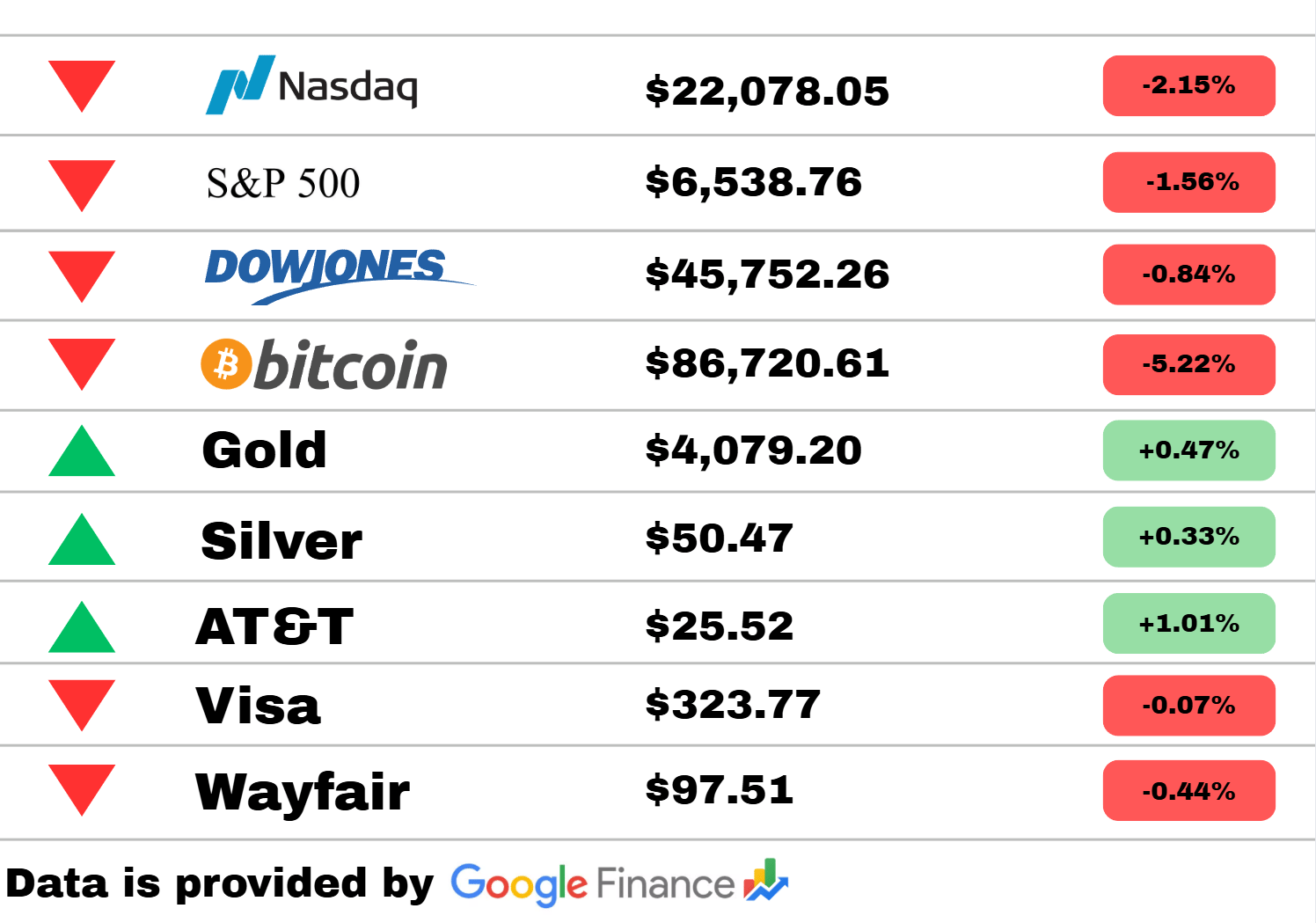

Market Update: Markets slid across the board today as investors pulled back ahead of key economic signals. The Nasdaq led the decline with a sharp 2.15% drop, followed by the S&P 500, which slipped 1.56%, and the Dow Jones, down 0.84%. Bitcoin took a heavy hit, falling 5.22%, adding pressure to the risk-asset space.

Commodities were mixed: Gold inched up 0.47%, and Silver gained 0.33%, showing traditional safe-havens attracting modest interest. In equities, AT&T posted a solid 1.01% increase, while Visa hovered nearly flat at -0.07%. Wayfair, however, dipped 0.44%, reflecting continued consumer-sector volatility.

Overall, today’s movement paints a classic risk-off mood: tech and crypto retreat, safe-havens stabilize, and select defensive names show resilience.

PRESENTED BY UPWORK

You don’t have to do everything yourself. Upwork Business Plus connects you with top freelancers and AI recruiting that delivers results in hours. Focus on growth while trusted experts handle the rest.

Spend $1,000, get $500 back in Upwork credit before December 31, 2025.

Buy back your time and build a better business with Upwork.

Travel

Travelers without a Real ID will soon face new restrictions at TSA checkpoints, as U.S. airports prepare to enforce long-delayed federal identification rules. Officials say the change aims to strengthen security nationwide, but warn that millions may still be unprepared. Airport leaders recommend verifying ID compliance early to avoid holiday travel disruptions.

A fifth death has been reported at Walt Disney World within a single month, raising renewed concerns about safety and emergency response inside the parks. Officials say each case involved unrelated medical episodes, but the cluster is drawing national attention. Park operators insist that safety protocols were followed and that investigations are ongoing.

In an unusual attempt to improve commuter experience, a subway system has replaced foul odors with a curated pleasant fragrance in the world’s first-ever “aroma ad.” Transit officials partnered with a fragrance brand to install scent diffusers on high-traffic platforms. Commuters are giving mixed responses, with some calling it refreshing — and others calling it a strange marketing experiment.

Digital Currencies

Ripple plunged below $2 on the first day of trading for the new Bitwise XRP ETF, surprising investors who expected a confidence boost from the listing. Analysts say the volatility reflects broader uncertainty across the crypto market. Traders warn that until liquidity stabilizes, major altcoins may continue to face sharp price swings.

A new analyst report warns Bitcoin could fall to as low as $10,000 after its latest crash to $86,000. The analysis cites worsening macroeconomic sentiment, declining institutional inflows, and persistent sell-pressure across major exchanges. Experts say the outlook hinges heavily on inflation data and central-bank decisions in the coming weeks.

Bitcoin, Ethereum, and XRP all suffered steep declines as hopes for near-term rate cuts evaporated, triggering liquidations approaching $1 billion. Market watchers say investors quickly shifted out of risk assets amid rising bond yields and hawkish economic signals. The synchronized downturn underscores how vulnerable crypto remains to macroeconomic shocks.

Politics

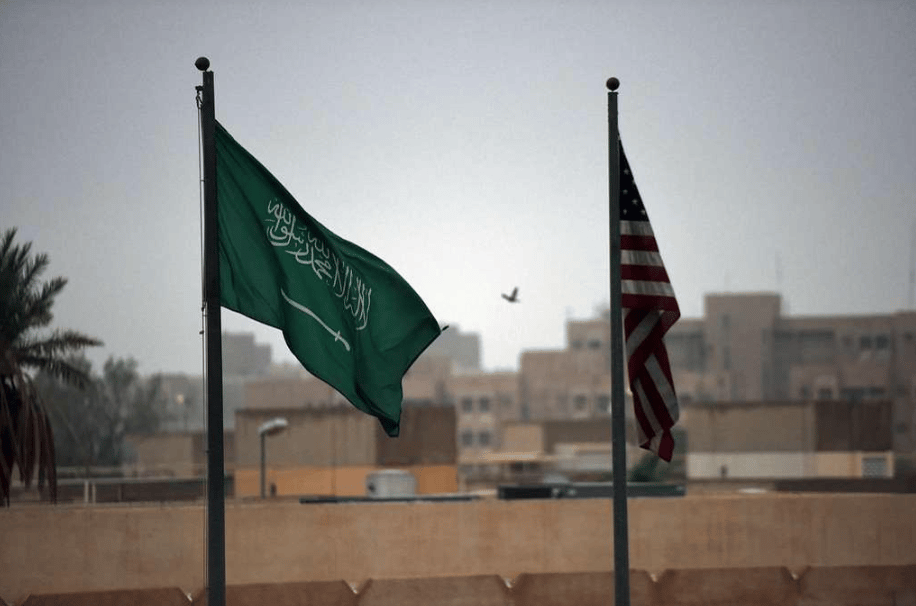

A U.S. citizen detained in Saudi Arabia for posting critical tweets has been released after international pressure mounted on the kingdom. Advocates say his case highlighted growing concerns about digital speech laws in the region. Family members expressed relief, though human-rights groups insist similar cases require closer U.S. oversight.

A major political briefing outlined five key issues dominating national attention heading into Nov. 20, including new Epstein court filings, Dick Cheney’s public statements, endangered species rulings, and developments in Ukraine. Analysts say the rapid shifts underscore how crowded and unpredictable the political news cycle has become. Voters are increasingly turning to summary briefings to keep up.

Regional political circles are buzzing after Vasireddy Padma resigned from her party, prompting speculation about her next move. Local leaders say she currently has no clear political home, and recruitment efforts appear cautious. Her departure has added uncertainty to an already fragmented political landscape.

PRESENTED BY EVERQUOTE

Own a Home? Unlock Lower Auto Insurance Rates

Owning a home gets you equity, a place that’s all yours, and now, better auto insurance rates. Drivers who own their home, own multiple cars, and have a clean driving record can save big by comparing insurance rates. And now, with EverQuote, that process is easier than ever.

EverQuote is a smart insurance marketplace built for people like you. We simplify the entire process:

Quick & Easy: Stop filling out the same forms repeatedly.

Maximum Savings: We connect you with trusted national and local carriers.

Confidence in Coverage: Our platform helps you compare and confidently select the perfect policy.

You deserve great coverage without the headache.

Today’s Snapshot

How to Build a Second Income Stream Without Quitting Your Job

Let’s talk about something almost everyone thinks about…

but very few people actually build properly:

A second income stream.

Not a side hustle that dies in 3 weeks.

Not a passion project that earns $40 a month.

Not a “maybe one day” business idea.

I mean a real, durable, reliable income stream that supports your financial goals — whether that’s investing more, leaving your job eventually, or just having breathing room.

This isn’t hype.

It’s not magical.

It’s a process.

Let’s walk through it step-by-step like a friend showing you how to do it the smart way — the way busy professionals, business owners, and ambitious beginners can all use.

1. Start With the Type of Income, Not the Idea

Most people start with,

“Hmm… what should I create? A course? A side business? A service?”

Wrong starting point.

Start with this instead:

What type of income fits my life right now?

Here are the four main categories:

Active + Skill-based (freelance, consulting, service work)

Active + Product-based (small e-com, selling templates, digital products)

Semi-passive (affiliate income, niche audience building, low-maintenance products)

Passive (investing, long-term assets, automated systems)

Ask yourself:

How much time do I have?

How fast do I want results?

How much do I want to earn?

Do I want to use my existing skills or build new ones?

Choosing the correct category saves months of wasted effort.

2. Identify Your Most Monetizable Skill (It’s Not What You Think)

Everyone has skills — even people early in their career who think they “don’t.”

But the monetizable ones tend to fall into three buckets:

1. Technical skills

writing, coding, design, data, editing, operations

2. Relational skills

sales, customer service, communication, negotiation

3. Outcome skills

things you’re good at that solve problems:

organization

accountability

planning

research

explaining complex topics simply

You don’t need to be elite.

You need to be useful.

If someone will pay for the outcome — you have a monetizable skill.

3. Match Your Skill to a Pain Point (This Is Where Money Happens)

A mistake many people make:

They try to monetize skills nobody urgently needs.

A CFO solving tax strategy? Valuable.

A designer improving brand identity? Valuable.

A TikTok editor saving entrepreneurs 20 hours a week? Valuable.

A researcher finding leads for a business owner? Extremely valuable.

Here’s the formula:

Skill × Urgent Pain Point = Income Stream

Ask yourself:

Who is losing time?

Who is losing money?

Who is overwhelmed?

Who is behind on something?

Who is trying to grow faster but can’t?

That is your target.

4. Build the “Minimum Sellable Offer”

Don’t spend 3 months making a website.

Instead, create:

a one-sentence offer

a clear price

a clear deliverable

a simple “getting started” process

Example:

“I’ll find and qualify 50 high-intent leads for your business each week — $350/month.”

Or:

“I’ll manage your bookkeeping so you never stress about taxes again — $200/month.”

Or:

“I’ll edit 8 videos per month for your social media — $400/month.”

Straightforward.

Valuable.

Easy to say yes to.

5. Set Up the Simplest Sales System Possible

You only need two things to start:

1. A place where people can see what you offer

LinkedIn

Instagram

X

Your email signature

Your existing network

2. A simple script to start conversations

Something like:

“Hey — I’ve started offering [service].

If you or anyone you know needs help with [specific pain point], I can take it off your plate.”

That’s it.

Second income streams don’t begin with funnels and ads.

They begin with conversations.

6. Systemize the Work So It Doesn’t Overwhelm Your Life

This is where second income streams fail for most people — things become chaotic.

Here’s the fix:

Use 1–2 tools you like (Notion, Trello, ClickUp).

Block dedicated work windows weekly.

Automate repetitive tasks where possible.

Overcommunicate with clients.

Track every deliverable.

You’re not building a side hobby.

You’re building a tiny business next to your main life.

Treat it like a business and it behaves like one.

Final Thought

A second income stream is not just about extra money.

It gives you:

options

confidence

financial stability

a path to quitting your job (if you want)

fuel for investing

a way to build actual wealth

You don’t need the perfect idea.

You need:

one monetizable skill

one pain point

one simple offer

a few consistent conversations

one day per week to deliver quality

That’s it.

Thought Of The Day

Your future changes the moment you choose clarity over chaos. When you slow down, define what matters, and commit to it, your next steps become powerful and intentional.

The Wealth Wagon’s Other Newsletters:

The Wealth Wagon – Where it all began, from building wealth to making money – Subscribe

The AI Wagon – AI trends, tools, and insights – Subscribe

The Economic Wagon – Global markets and policy shifts – Subscribe

The Financial Wagon – Personal finance made simple – Subscribe

The Investment Wagon – Smart investing strategies – Subscribe

The Marketing Wagon – Growth and brand tactics – Subscribe

The Sales Wagon – Selling made strategic – Subscribe

The Startup Wagon – Build, scale, and grow – Subscribe

The Tech Wagon – Latest in tech and innovation – Subscribe

Side Hustle Weekly - Actionable side-hustle ideas and income tips - Subscribe

That’s All For Today

I hope you enjoyed today’s issue of The Wealth Wagon. If you have any questions regarding today’s issue or future issues feel free to reply to this email and we will get back to you as soon as possible. Come back tomorrow for another market update, and snapshot. I hope to see you. 🤙

— Ryan Rincon, CEO and Founder at The Wealth Wagon Inc.

Disclaimer: This newsletter is for informational and educational purposes only and reflects the opinions of its editors and contributors. The content provided, including but not limited to real estate tips, stock market insights, business marketing strategies, and startup advice, is shared for general guidance and does not constitute financial, investment, real estate, legal, or business advice. We do not guarantee the accuracy, completeness, or reliability of any information provided. Past performance is not indicative of future results. All investment, real estate, and business decisions involve inherent risks, and readers are encouraged to perform their own due diligence and consult with qualified professionals before taking any action. This newsletter does not establish a fiduciary, advisory, or professional relationship between the publishers and readers.