November 20, 2025

Welcome Back,

Happy Thursday, everyone! 🌤️✨

Good morning! I hope you woke up feeling refreshed — or at least refreshed enough to enjoy whatever caffeinated magic you’re sipping on right now.

Let me ask you something fun:

If you were the CFO of “You, Inc.”… would you give yourself a raise?

Would you invest more into your systems? Or would you pull yourself into a meeting and say, “Hey… what exactly are we doing here?” 😅

Most people think finances are this mysterious, complicated thing — but the truth is, the moment you start treating your money like a business (instead of a chaotic pile of decisions you’ll ‘fix later’), everything gets easier.

That’s what today’s post is all about: auditing your personal finances like a real CFO.

Not scary. Not overwhelming. Just clear, calm, grown-up financial confidence.

— Ryan Rincon, Founder at The Wealth Wagon Inc.

Quote of The Day

“To succeed, your desire for success should be greater than your fear of failure.”

— Bill Cosby

Market Update

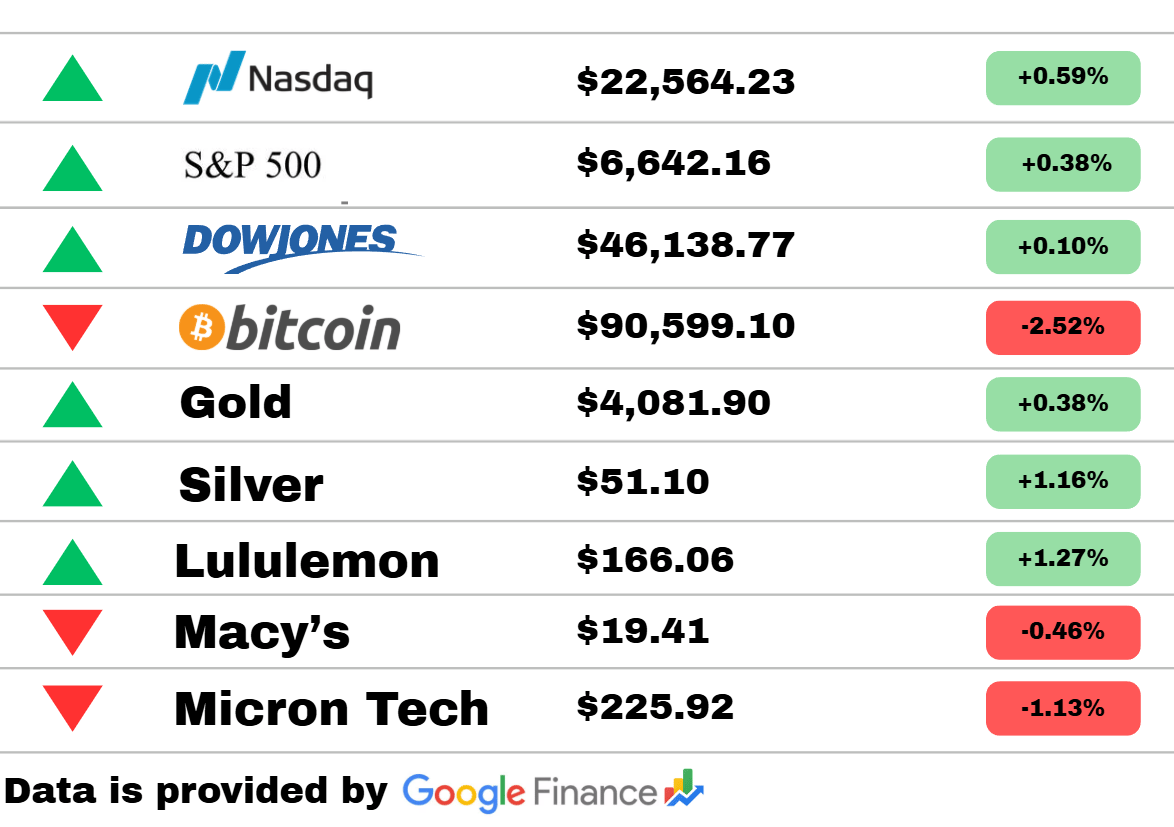

*Market data represents the most recent market close at 5:00pm ET

Market Update: Today’s markets delivered a mixed but mostly cautious session, with major indices showing modest gains while several assets remained under pressure. The Nasdaq edged up +0.59% to $22,564.23, supported by a rebound in large-cap tech, while the S&P 500 climbed +0.38% and the Dow Jones added +0.10%, signaling a slow but steady risk-on sentiment returning to equities.

Crypto, however, moved in the opposite direction. Bitcoin slid -2.52% to $90,599.10, extending its pullback as traders rotated away from digital assets despite broader market stability. Precious metals offered better balance—Gold ticked up +0.38% and Silver gained +1.16%, showing renewed interest in hedging assets even as stocks pushed higher.

In individual names, Lululemon posted a solid +1.27% gain, riding continued consumer strength and premium retail momentum. Macy’s dipped -0.46%, giving back recent progress as department stores faced uneven foot traffic. Micron Tech fell -1.13%, retracing after recent semiconductor volatility and lingering concerns around memory pricing trends.

Overall, the market leaned mildly bullish, with equities showing resilience and select sectors stepping higher, even as Bitcoin and a few individual names experienced notable declines. The tone remains cautiously optimistic heading into the next session.

PRESENTED BY EVERQUOTE

Own a Home? Unlock Lower Auto Insurance Rates

Owning a home gets you equity, a place that’s all yours, and now, better auto insurance rates. Drivers who own their home, own multiple cars, and have a clean driving record can save big by comparing insurance rates. And now, with EverQuote, that process is easier than ever.

EverQuote is a smart insurance marketplace built for people like you. We simplify the entire process:

Quick & Easy: Stop filling out the same forms repeatedly.

Maximum Savings: We connect you with trusted national and local carriers.

Confidence in Coverage: Our platform helps you compare and confidently select the perfect policy.

You deserve great coverage without the headache.

Politics

A major bill is expected to be signed by the administration, shifting the national conversation toward new policy priorities. Officials say the legislation will have significant implications for federal programs and regulatory enforcement. Political analysts note that the move comes at a crucial moment, as the administration responds to growing public and congressional pressure.

The death sentence of Sheikh Hasina in Bangladesh has intensified political tensions as the country approaches a high-stakes national election. Observers warn the ruling has fueled widespread anger and could lead to unrest among supporters and opposition groups alike. The situation has made the upcoming vote one of the most volatile in the nation’s recent history.

Diplomats say a potential peace deal could arrive as early as this week, following a rapid acceleration in negotiations. Officials close to the talks report that both sides have made notable concessions in recent days. While nothing is finalized, expectations are rising that a breakthrough may finally be within reach.

Economy

UK inflation has fallen to 3.6%, marking the first meaningful decline since March and offering a rare moment of relief for households and businesses. Economists say cooling energy prices and easing supply pressures are helping stabilize the outlook. Still, many caution that rates remain well above pre-pandemic levels and could fluctuate in the months ahead.

A new study reports that the United States has become the largest recipient of Chinese loans, a shift that challenges long-held assumptions about global financial influence. Researchers say the borrowing spans public, private, and institutional sectors. The findings highlight the increasingly complex financial ties between the world’s two largest economies.

The administration is promoting a series of initiatives aimed at making everyday life more affordable, from groceries to childcare costs. Officials argue these measures will ease financial pressure on working families. However, many households say they have yet to feel meaningful improvements, signaling an uphill battle for long-term affordability.

Business

Nvidia shares are rallying ahead of the company’s upcoming quarterly earnings report, driven by investor optimism about continued AI-chip demand. Analysts expect strong revenue tied to data-center expansion and accelerated computing. The stock’s surge underscores Nvidia’s role as one of the most influential forces in tech markets today.

Newly released Federal Reserve minutes reveal deep internal disagreement over the timing of future rate cuts. Some officials pushed for easing in October, while others argued economic conditions remained too uncertain. The split has cast fresh doubt on whether the Fed will move ahead with a December cut.

AWS has expanded its partnership with a Saudi AI firm to deploy advanced chips designed for high-performance training and inference workloads. The deal includes both Nvidia and Trainium processors, signaling a push to strengthen cloud-based artificial intelligence capabilities across the Middle East. Industry analysts say the move is part of a broader global race to dominate AI infrastructure.

Today’s Snapshot

How to Audit Your Personal Finances Like a CFO (A Skill That Changes Everything)

Here’s something most people never realize:

Wealthy individuals don’t manage their finances like “consumers.”

They manage them like CFOs.

And once you learn this skill — whether you're a 20-year-old trying to escape a low-paying job or a business owner already making six or seven figures — your whole financial life snaps into focus.

This is one of the highest-ROI habits anyone can adopt… and almost nobody does it correctly.

Let’s break it down in a clear, friendly, “you can actually use this today” way.

1. Start With a “Financial MRI”

Before a CFO makes any move, they diagnose the situation.

You do the same by asking:

Where is every dollar coming from?

(You’ll be shocked how many people can’t answer this clearly.)

Where is every dollar going?

(Most leaks hide in “small recurring things” that add up.)

What % of income is going toward assets vs. liabilities?

Here’s a simple breakdown you can use:

Green (Healthy): 20–40% going into assets

Yellow (Caution): 10–20%

Red (Danger): <10%

A CFO never makes emotional decisions.

They look at data first.

This is your data.

2. Categorize Your Money Into Only 3 Buckets

Forget the complex budgeting systems that collapse after a week.

A CFO uses simple, powerful categories:

1. Money that grows (investments, business spending that produces return)

2. Money that protects (emergency fund, insurance, buffers)

3. Money that disappears (consumption)

Here’s the trick:

Most people exaggerate how much is in category #1 and underestimate #3.

When you categorize honestly, you start seeing where financial drag lives — and how to get rid of it.

3. Calculate Your “Financial Efficiency Score”

This is a concept used inside companies but almost never applied to personal finances.

Here’s how to calculate it:

(Total Asset Growth + Passive Income) ÷ Total Income

Scores below 0.15

→ you're working too hard for your money.

Scores between 0.15 – 0.30

→ you're transitioning toward wealth.

Scores over 0.30

→ your money is working harder than you.

For most people, the first time they calculate this is a punch in the stomach…

But in a good way.

It gives direction.

4. Review Your Top 5 Costs (They Control More Than You Think)

Every person has five categories that dominate their spending:

Housing

Transportation

Food

Lifestyle / recurring subscriptions

Debt payments

A CFO never cuts randomly — they target the highest-impact areas first.

Ask yourself:

Can I eliminate or restructure one of these?

Can I negotiate or switch providers?

Can I replace one recurring cost with a one-time solution?

Can I convert any expense into an asset or income-producing tool?

Example:

A $400/month car payment saved and redirected into investing becomes $240,000+ over 20 years.

But people rarely zoom out far enough to see it.

5. Identify Your “Silent Multipliers”

Businesses have assets that multiply returns “behind the scenes.”

You should too.

Look for:

skills you already have but aren't monetizing

connections you haven't leveraged

tools you’re underusing

knowledge gaps that, if filled, raise income

opportunities inside your job or industry

processes in your business that can be automated

Most people have $20,000–$50,000 in potential annual value sitting dormant simply because they’ve never audited what they already have.

A CFO would never let that happen.

6. Fix the Bottleneck (The One Thing Slowing Everything Down)

Instead of trying to “do everything,” a CFO finds the one constraint that, once fixed, unlocks everything else.

For individuals, it’s usually one of these:

low income

inconsistent savings

no investment habit

poor tracking

overspending in 1–2 categories

fear of risk

no plan

lack of time

poorly structured taxes

Pick one, solve it over 30–90 days, and your financial trajectory changes.

Final Thought

Personal finance becomes easy when you stop acting like a consumer…

and start acting like the Chief Financial Officer of your life.

This approach works whether you’re:

earning $40k or $400k

running a business or trying to start one

investing $50 or $50,000 a month

just beginning or already financially stable

Because CFO-level clarity leads to CFO-level outcomes:

✔ better decisions

✔ fewer mistakes

✔ more growth

✔ more stability

✔ more options

✔ more wealth

Thought Of The Day

Success compounds when you choose intentional action over convenience. Each day you make tiny, disciplined decisions, you add weight to a future that feels truly free.

The Wealth Wagon’s Other Newsletters:

The Wealth Wagon – Where it all began, from building wealth to making money – Subscribe

The AI Wagon – AI trends, tools, and insights – Subscribe

The Economic Wagon – Global markets and policy shifts – Subscribe

The Financial Wagon – Personal finance made simple – Subscribe

The Investment Wagon – Smart investing strategies – Subscribe

The Marketing Wagon – Growth and brand tactics – Subscribe

The Sales Wagon – Selling made strategic – Subscribe

The Startup Wagon – Build, scale, and grow – Subscribe

The Tech Wagon – Latest in tech and innovation – Subscribe

Side Hustle Weekly - Actionable side-hustle ideas and income tips - Subscribe

That’s All For Today

I hope you enjoyed today’s issue of The Wealth Wagon. If you have any questions regarding today’s issue or future issues feel free to reply to this email and we will get back to you as soon as possible. Come back tomorrow for another market update, and snapshot. I hope to see you. 🤙

— Ryan Rincon, CEO and Founder at The Wealth Wagon Inc.

Disclaimer: This newsletter is for informational and educational purposes only and reflects the opinions of its editors and contributors. The content provided, including but not limited to real estate tips, stock market insights, business marketing strategies, and startup advice, is shared for general guidance and does not constitute financial, investment, real estate, legal, or business advice. We do not guarantee the accuracy, completeness, or reliability of any information provided. Past performance is not indicative of future results. All investment, real estate, and business decisions involve inherent risks, and readers are encouraged to perform their own due diligence and consult with qualified professionals before taking any action. This newsletter does not establish a fiduciary, advisory, or professional relationship between the publishers and readers.