June 26, 2025

Welcome Back,

Happy Thursday, everyone! 🛠️

Good morning! I hope you woke up to a moment of peace, a great cup of coffee, or at least no weird group texts from last night.

Let’s kick today off with a little reminder: Big wins don’t always come from big moves.

Sometimes, it’s the tiny levers—the small habits, micro-decisions, or simple systems—that quietly change everything over time. 💫💵

Today we’re diving into how those little tweaks can lead to big financial results. Because let’s be real: moving mountains is cool, but moving a pebble that tips a whole boulder? That’s genius.

Let’s explore the power of small things done well—and how a few smart shifts can create serious momentum.

“A man who does not think and plan long ahead will find trouble at his door.”

— Confucius

The goal isn’t to be busy.

The goal is to be effective.

Busyness is motion. Effectiveness is momentum.

— Ryan Rincon, Founder at The Wealth Wagon Inc.

Market Update

*Market data represents the most recent market close at 5:00pm ET

Market Update: Today’s market was all about selective energy—some names sprinted, while others took a nap.

The Nasdaq moved up a calm 0.31%, but the S&P 500 and Dow Jones stumbled just slightly, both slipping into the red. Nothing major—just tripped over their shoelaces. 👟📉

Meanwhile, Bitcoin strutted up 1.11%, and metals like gold and silver made modest climbs. 📈

Now for the real fireworks:

💥 QuantumScape absolutely launched, exploding 30.95% like it forgot it was a weekday.

💻 Nvidia wasn’t far behind, jumping 4.33% with a confident “I run this chip game.”

🏦 JP Morgan showed some bank-powered strength, adding a clean 1%.

All in all, it was a green day for tech and energy—with just enough red to remind us we’re still human. 🟢📊

AI & TECH

76% of CIOs Are Fast-Tracking Generative AI in Enterprises

Gartner reports that 76% of mid-sized enterprise leaders are adopting AI for content, chatbots, and new product development—though only ~40% of consumers actually trust the tech. Translation: Smart firms are sprinting ahead—but better mind the transparency gap.

NayaOne Teams Up with Google Cloud for Enterprise AI Boost

UK-based NayaOne is partnering with Google Cloud to help enterprises smoothly integrate AI into existing workflows—complete with security and scalability in mind. It’s AI rollout made easy for businesses that want results, faster.

HPE and NVIDIA Release “AI Factory” Platforms at HPE Discover

At HPE Discover, Hewlett Packard Enterprise introduced modular AI factory solutions with NVIDIA Blackwell GPUs—ideal for companies building massive AI pipelines. Think plug‑and‑play AI that doesn't require rocket scientists.

Economy

US Economic Slowdown Ahead—Growth to Dip to ~1.7% in 2025

BNP Paribas forecasts U.S. growth will slow to about 1.7% this year, after Q1’s slight contraction. It’s a sobering mid‑year check: still positive, but with fewer fireworks than 2024.

US Current Account Deficit Widens 44% to $450B in Q1

BEA data revealed the U.S. Q1 current-account deficit jumped to $450 billion (6% of GDP)—a 44.3% surge from Q4. Imports are outpacing exports hard right now—watch for currency and trade-policy ripple effects.

Conference Board’s LEI Drops 0.1% in May; Six-Month Decline Hits 2.7%

US Leading Economic Index fell again to 99.0, marking a 2.7% decline over six months—signaling slower growth. No red alert yet, but definitely yellow. Time to recalibrate expectations for H2.

Real Estate

“Super-Apps” Like Zillow & Redfin Consolidate Amid Slumping Home Sales

With housing sales at 30-year lows, companies like Zillow and Redfin are integrating listing, financing, and transaction tools into super-apps. Convenience meets necessity—investors take note.

June Housing Market Shift: Sellers Outnumber Buyers Again

According to analysts, sellers now outnumber buyers, leading to homes selling below asking price—a rare break for buyers. This could hint at a cooling market or an even bigger opportunity for strategic investors.

PwC Highlights “Flight to Wellness” in Modern Office Picks

PwC’s 2025 investor guide notes that newer office buildings with wellness amenities are outperforming older stock. Investors are paying extra for light, air, and community-centric designs—healthy ROI meets healthy workplace.

Defense

NATO Members Agree to Spend 5% of GDP on Defense by 2035

NATO has set a target for all members to allocate 5% of GDP to defense by 2035—pushing up valuations for defense contractors like Babcock International. More spending = more contracts = happier shareholders.

CMU’s SEI Wins DoD Contract Extension for National Security Software R&D

The DoD has renewed a five-year agreement with Carnegie Mellon’s Software Engineering Institute to advance defense AI, software engineering, and cybersecurity. It's a big win for dual-use innovation and academic-industry collaboration.

Carnegie Mellon Bags $1.5B DoD Contract to Propel Advanced Tech Projects

CMU’s SEI also snagged a $1.5 billion indefinite-delivery contract for prototyping and developing national-security software. Think battlefield tech meets academic rigor, funded at scale.

Startups & VC

TerraPower Raises $650M to Power Nuclear Innovation

Bill Gates-backed TerraPower secured a huge $650 million funding round to build advanced nuclear reactors . Clean energy just got hotter—and nuclear just got cooler.

Blueprint Finance Snags $9.5M to Build DeFi Infrastructure

Start-up Blueprint Finance raised $9.5 million to develop secure, multi-chain DeFi solutions—putting serious rails under decentralized finance . DeFi, now with enterprise-grade plumbing.

Abridge Rockets to $5B Valuation with Health AI Backing from A16z

AI health startup Abridge closed a round at a $5 billion valuation, led by Andreessen Horowitz—bolstering conversational AI for clinical settings . Health care meets hedge-fund audacity.

This guide is your go-to resource for streamlining payments, improving cash flow, and keeping your business running smoothly. What’s inside: ✔️ An actionable 8-step framework to create a seamless payment process ✔️ Expert strategies to reduce late payments and enhance your professional image A well-structured payment system leads to smoother operations, happier clients, and long-term financial success.

Today’s Snapshot

The Tiny Lever Principle: How Small Shifts Create Big Financial Wins

Let’s be honest — sometimes this whole “build wealth” thing feels like a giant mountain of to-dos, strategies, spreadsheets, and buzzwords, right?

Start a business. Invest early. Max your Roth. Learn skills. Save money. Network. Personal brand. Sleep 8 hours. Drink water. Don’t die.

...bro. Can I just get a win this week?

Here’s the good news — you don’t need to overhaul your entire life to get ahead financially.

You just need to start pulling a few tiny levers.

Let me show you what I mean. 👇

🧠 What’s a “Tiny Lever”?

A tiny lever is a small shift in behavior, mindset, or strategy that:

Feels easy to do

Doesn’t require a huge time/money investment

Creates disproportionate upside over time

Basically: low effort → high impact.

This is how people quietly build momentum, confidence, and wealth — without needing to “go big” from day one.

Let’s go through some real-life examples, so you can start pulling your own.

🔑 Tiny Lever #1: Make It Automatic

This one’s so basic… and so powerful.

If you have to remember to save or invest? You probably won’t.

Instead:

Set up an automatic transfer from checking → savings every payday

Auto-invest into index funds (even $50/month is a flex)

Auto-pay your bills so your credit stays clean without brainpower

Automation removes friction. And when you remove friction, you remove excuses.

This lever turns “I’ll get to it” into “it’s already happening.”

💸 Tiny Lever #2: Raise Your Price 10%

If you freelance, consult, run a business, or offer anything for sale — try this:

Raise your rate by 10%. Just once. Today.

Most people won’t blink. And that tiny increase compounds FAST:

$50 → $55

$1,000 → $1,100

$5,000 → $5,500

That’s free money just sitting on the table.

(And if someone does blink? Cool. You're probably undercharging anyway.)

🧠 Tiny Lever #3: Ask Better Questions

Here’s a mindset one that changes everything:

Instead of asking,

“How can I make more money?”

ask:

“What system or asset could I build that makes money without me being there every second?”

Boom. That one shift turns you from:

Hustler → Builder

Worker → Owner

Busy → Strategic

You’ll start seeing ideas everywhere — mini products, content, services, systems — that give you leverage.

💬 Tiny Lever #4: One Bold Message a Week

Networking can be exhausting. So instead of trying to “build a network,” just do this:

Send one bold message per week.

Could be:

A DM to someone you admire

A thank-you email to a former client

A “hey I’d love to help with XYZ” to a business owner

A “want to grab coffee or Zoom?” to someone cool

Over 12 weeks, you’ve made 12 high-quality connections.

That’s how careers shift. That’s how opportunities show up.

One message at a time.

📈 Tiny Lever #5: Turn One Thing Into Three

Next time you write something, create something, or teach something, ask:

“How can I repurpose this into 2 more formats?”

Example:

A blog post becomes a tweet thread + a checklist

A coaching call becomes a template + mini-guide

A tutorial becomes a YouTube short + a newsletter blurb

This builds what I call “asset stacking” — where your work gets reused, repackaged, and multiplied.

(Yes, this is how creators and entrepreneurs scale without losing their minds.)

💡 Tiny Lever #6: Define “Enough” for Right Now

Here’s a curveball: not every financial win needs to be about more.

Sometimes the lever is defining what “enough” looks like for your current season.

What’s enough income to feel safe?

What’s enough growth to not burn out?

What’s enough savings to take that leap?

Once you define it, you stop chasing shadows. You get focused. You get efficient.

And that clarity?

It’s freeing. (And ironically leads to more.)

🔄 Tiny Lever #7: Teach What You Just Learned

The best way to level up your skills, credibility, and even business?

Teach what you’re actively learning.

You don’t need to be a guru. You just need to say:

“Hey, I just figured this out. Here’s how I did it.”

Whether you share it in a tweet, a blog post, a Loom video, or a casual convo — you position yourself as someone who takes action.

That energy is magnetic. It attracts clients, partners, followers, and respect.

🎯 Final Thought: Stack Tiny Levers, Not Just Big Goals

Look — the big goals are great.

But they don’t happen by accident.

They happen when you consistently pull small levers that quietly stack on each other until suddenly you look around and go:

“Wait… when did things get this good?”

So this week, forget trying to 10x your life.

Instead:

Pick 1–2 tiny levers

Commit for 7 days

Watch what shifts

Momentum beats perfection. Always has.

You’re closer than you think.

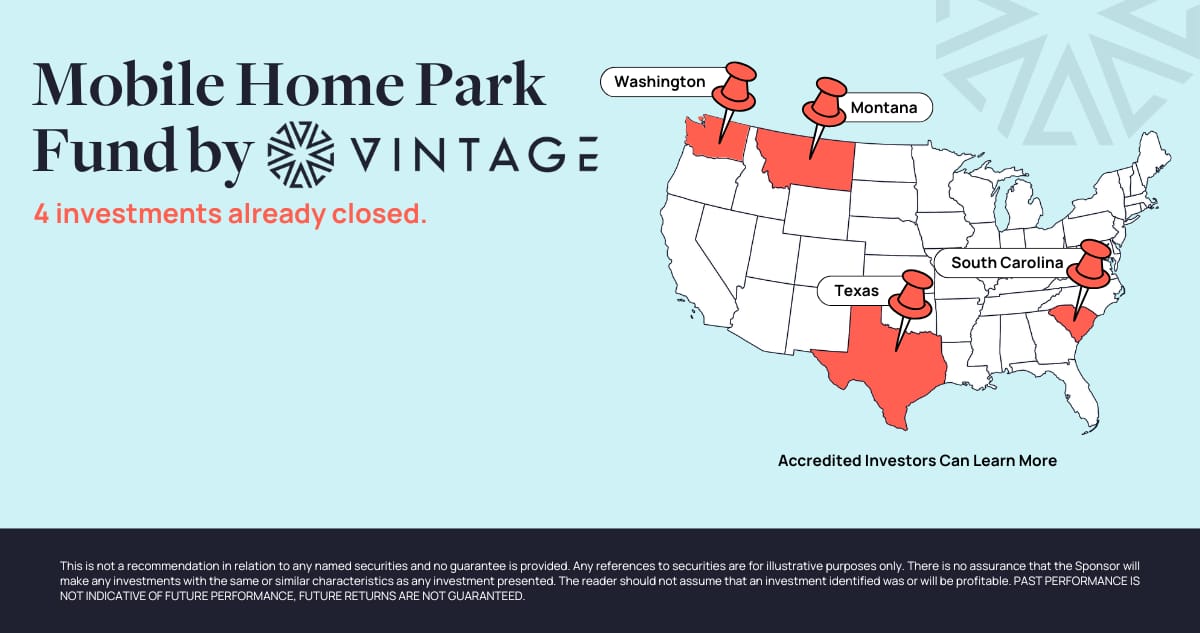

Invest in recession-resilient Mobile Home Parks with Vintage Capital. Invest direct or in a fund of 20+ underlying assets. 1031s are also available. Access stable, income-generating properties with consistent demand and low tenant turnover.

Now is the time to act: Current market conditions are creating opportunities to acquire properties at attractive valuations.

Our fund targets a 15%-17% IRR and makes monthly distributions, which provides a steady income stream alongside strong upside potential and tax-efficient benefits.

Recession-Resilient: Affordable housing demand drives stable returns in any economy

High Tenant Retention: The average MHP tenant stays 10-12 years (compared to 2-3 in Multifamily)

Proven Expertise: $100MM+ track record in mobile home park investments.

Tax-Smart Investing: Bonus depreciation offers tax advantages.

Fun Stuff

🏢 Guess the Company

Clue:

This company started as a DVD-by-mail service, made the leap to streaming, and now produces award-winning films and series.

Its signature “tudum” sound is now globally recognized.

🕰️ Financial History: What Happened Today?

June 26, 1974:

The first barcode was scanned at a supermarket in Ohio — on a pack of Wrigley’s gum.

That moment revolutionized retail inventory, data tracking, and eventually e-commerce logistics.

🌀 Wild & Wacky

Burt’s Bees was started in an abandoned one-room schoolhouse by a beekeeper and an artist.

They sold homemade lip balm at craft fairs — and eventually sold the company for $925 million.

📦💄🐝 → Proof that small, natural, and niche can scale big.

🤔 Would You Rather

Would you rather…

Be guaranteed viral success for your next product launch,

ORGet 5 loyal customers per week for life, who each spend $5,000 annually?

(Flash fame or forever revenue?)

*Answers at the bottom

Answers

Guess the company - Answer: Netflix

That’s All For Today

I hope you enjoyed today’s issue of The Wealth Wagon. If you have any questions regarding today’s issue or future issues feel free to reply to this email and we will get back to you as soon as possible. Come back tomorrow for another market update, and snapshot. I hope to see you. 🤙

— Ryan Rincon, CEO and Founder at The Wealth Wagon Inc.

Disclaimer: This newsletter is for informational and educational purposes only and reflects the opinions of its editors and contributors. The content provided, including but not limited to real estate tips, stock market insights, business marketing strategies, and startup advice, is shared for general guidance and does not constitute financial, investment, real estate, legal, or business advice. We do not guarantee the accuracy, completeness, or reliability of any information provided. Past performance is not indicative of future results. All investment, real estate, and business decisions involve inherent risks, and readers are encouraged to perform their own due diligence and consult with qualified professionals before taking any action. This newsletter does not establish a fiduciary, advisory, or professional relationship between the publishers and readers.