January 23, 2026

Welcome Back,

Happy Friday, everyone ☀️

Good morning — hope today starts with good energy and a little excitement heading into the weekend.

Here’s a quick question to get things rolling: have you ever paid extra just to feel “safe”?

When it comes to taxes, overpaying can feel responsible… but it isn’t always harmless.

Today’s post breaks down why overpaying estimated taxes can cost you more than you think — and how better timing and planning can keep your money working for you instead of sitting on the sidelines.

Because being careful with money doesn’t always mean paying more — it means paying smarter.

— Ryan Rincon, Founder at The Wealth Wagon Inc.

Quote of The Day

“The biggest investment risk is not volatility. It is whether you will sustain the patience and discipline required for long-term success.”

— Charlie Munger

Market Update

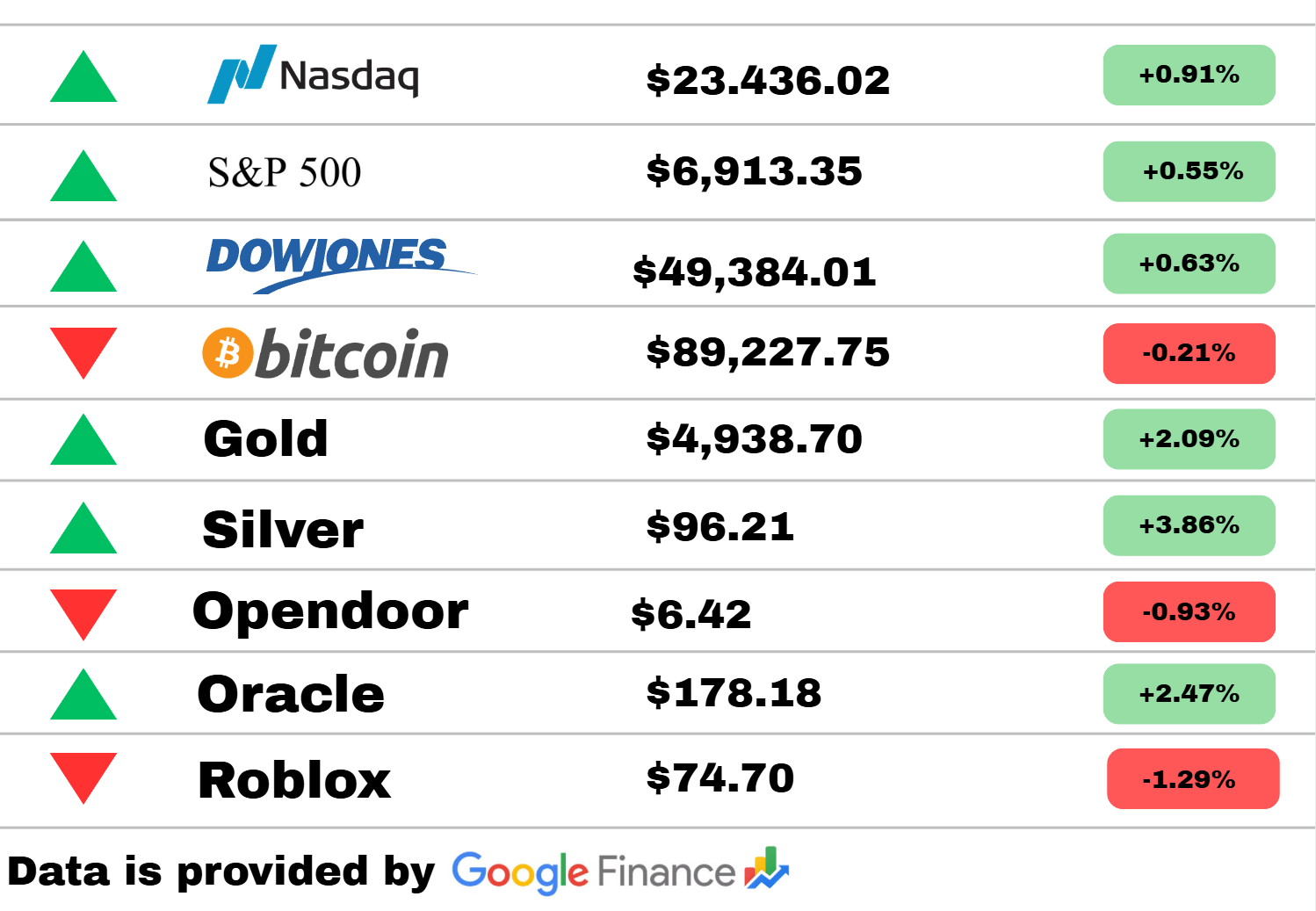

*Market data represents the most recent market close at 5:00pm ET

Market Update: Markets pushed higher again, with equities showing steady strength across the board. The Nasdaq led the charge, rising 0.91%, while the S&P 500 added 0.55% and the Dow Jones climbed 0.63%—a sign of broad, balanced participation rather than a narrow rally.

Risk assets were more mixed beneath the surface. Bitcoin slipped 0.21%, pausing after recent strength, while capital flowed aggressively into hard assets. Gold surged 2.09% and silver jumped 3.86%, signaling renewed interest in inflation hedges and real assets even as stocks grind higher.

In individual names, software and enterprise tech stood out. Oracle rallied 2.47%, reinforcing continued demand for cloud and infrastructure plays. On the flip side, higher-beta growth lagged, with Opendoor down 0.93% and Roblox falling 1.29%. Overall, today’s action suggests a measured risk-on environment, where investors are selectively rotating into quality, real assets, and profitable tech rather than chasing speculation.

PRESENTED BY

Introducing the first AI-native CRM

Connect your email, and you’ll instantly get a CRM with enriched customer insights and a platform that grows with your business.

With AI at the core, Attio lets you:

Prospect and route leads with research agents

Get real-time insights during customer calls

Build powerful automations for your complex workflows

Join industry leaders like Granola, Taskrabbit, Flatfile and more.

Science

Sonic booms could be a new way to track falling space junk

Researchers are exploring whether sonic booms created as debris reenters Earth’s atmosphere could help track falling space junk. The idea is to use sound waves picked up by sensors to pinpoint location and speed. If successful, it could improve warning systems and reduce risks to people and infrastructure. The approach may complement radar systems already in use.

ISS astronaut spots Artemis 2 moon rocket on the launch pad

An astronaut aboard the International Space Station photographed NASA’s Artemis 2 rocket sitting on its launch pad. The image offers a rare orbital view of preparations for the next crewed mission around the Moon. Artemis 2 is a key step toward returning humans to the lunar surface. The sighting highlights how close the mission is to moving forward.

Kangaroos’ giant ancestor probably able to hop despite size

Scientists say a newly studied giant ancestor of modern kangaroos likely could hop despite weighing around 250 kilograms. Fossil evidence suggests its bones were adapted for movement rather than slow walking. This challenges earlier theories that massive kangaroos moved more like large mammals today. The findings reshape ideas about how marsupials evolved.

Personal Finance

2027 Social Security COLA forecast points to smaller raise

Early projections suggest the 2027 Social Security cost-of-living adjustment could be smaller than recent increases. Cooling inflation is the main factor behind the expected slowdown. While any increase helps retirees, a lower adjustment may strain those facing rising healthcare and housing costs. Final numbers will depend on inflation data over the next year.

Which Hampton Roads city ranks among worst in U.S. for money management

A new ranking places one Hampton Roads city among the lowest in the nation for money management. Factors include debt levels, savings rates, and credit health. The results highlight ongoing financial stress for many households in the region. Experts say better access to financial education could help improve outcomes.

When the ultra-rich hire family offices, costs can get complicated

Family offices offer personalized services for wealthy families, but their costs can quickly add up. Expenses often include staffing, legal structures, and investment management fees. For some, the flexibility is worth the price, while others find it hard to justify. The trend shows how wealth management grows more complex at the highest levels.

Politics

EU lawmakers stall U.S. trade deal over Greenland dispute

European lawmakers have slowed progress on a U.S. trade deal amid protests tied to Greenland-related tensions. Some officials argue the dispute has broader implications for sovereignty and alliances. The delay adds uncertainty for businesses hoping for smoother transatlantic trade. Negotiations are expected to remain tense in the near term.

FCC warns talk shows to comply with equal-time rules

The FCC is reminding broadcasters that political talk shows must follow equal-time requirements. The warning comes as election-related programming ramps up across networks. Failure to comply could lead to fines or other penalties. The move signals closer scrutiny of political media content.

Greenland prime minister left in dark on Trump’s ‘ultimate’ deal

Greenland’s prime minister says they were not fully informed about a proposed deal involving the island. The lack of clarity has raised concerns about transparency and sovereignty. Local leaders are pushing for more direct involvement in any future negotiations. The situation has strained relations between Greenland and larger powers.

Today’s Snapshot

Why Overpaying Estimated Taxes Can Cost You More Than You Think

This is not about penalties.

This is not about underpayment risk.

This is not about ignoring the IRS.

This is about excess precision — and how sending too much money too early creates invisible costs.

Most people assume:

“Paying extra just to be safe can’t hurt.”

It can.

The Core Issue: The IRS Pays You Nothing for Being Early

When you overpay estimated taxes:

the money leaves your control

it earns you nothing

it can’t be redeployed

it becomes hard to recover

You gave the government an interest-free loan.

And you absorbed all the opportunity cost.

Where the Quiet Cost Shows Up

1. Liquidity Gets Removed at the Worst Time

Estimated payments usually happen during the year — when:

businesses are still operating

cash is most flexible

opportunities still exist

Overpaying early removes optionality before the year’s outcome is known.

2. Refunds Arrive Late and Inflexibly

Even when you overpay:

refunds come months later

timing can’t be controlled

offsets may get applied automatically

planning windows are missed

That money doesn’t return when it’s most useful.

3. Overpayment Masks Real Planning Opportunities

When taxes are “handled” early:

income timing isn’t questioned

deductions aren’t optimized

gains aren’t coordinated

strategy stops prematurely

Overpayment replaces planning with padding.

4. High Earners Feel This Disproportionately

The more income you have:

the larger the overpayment tends to be

the higher the opportunity cost

the more flexibility you lose

Small percentages on large dollars matter.

Why This Habit Persists

Because fear feels prudent.

penalties are scary

letters feel final

certainty feels responsible

But certainty has a price.

And it’s rarely discussed.

What Actually Works Instead

This is not about underpaying.

It’s about right-sizing.

Effective approaches include:

conservative but not padded estimates

mid-year recalibration

holding excess in accessible reserves

adjusting as the year clarifies

Control beats excess compliance.

Who This Hurts Most

This shows up most for:

business owners

commission earners

investors

people with variable income

anyone who “rounds up to be safe”

Safety without flexibility still costs money.

The Takeaway (Quiet but Real)

Overpaying taxes feels like discipline.

It’s not.

It’s deferred planning — with interest paid by you.

The goal isn’t to pay early.

It’s to pay accurately, intentionally, and late enough to matter.

Say another new one when you’re ready.

I’ll keep them this specific and non-overlapping.

Thought Of The Day

Growth becomes inevitable when patience replaces panic, long-term vision outweighs short-term emotion, and daily habits quietly align with the future you want.

That’s All For Today

I hope you enjoyed today’s issue of The Wealth Wagon. If you have any questions regarding today’s issue or future issues feel free to reply to this email and we will get back to you as soon as possible. Come back tomorrow for another market update, and snapshot. I hope to see you. 🤙

— Ryan Rincon, CEO and Founder at The Wealth Wagon Inc.

Disclaimer: This newsletter is for informational and educational purposes only and reflects the opinions of its editors and contributors. The content provided, including but not limited to real estate tips, stock market insights, business marketing strategies, and startup advice, is shared for general guidance and does not constitute financial, investment, real estate, legal, or business advice. We do not guarantee the accuracy, completeness, or reliability of any information provided. Past performance is not indicative of future results. All investment, real estate, and business decisions involve inherent risks, and readers are encouraged to perform their own due diligence and consult with qualified professionals before taking any action. This newsletter does not establish a fiduciary, advisory, or professional relationship between the publishers and readers.