January 22, 2026

Welcome Back,

Happy Thursday, everyone ☀️

Good morning — hope today starts with a steady pace and a positive mindset.

Here’s a gentle question to think about: when you say “keep it conservative,” what do you actually mean?

Safety feels comforting… but over time, it can quietly drift into missed opportunities.

Today’s post explores why telling your advisor to “just keep me conservative” can backfire — and how clearer direction can lead to better long-term outcomes without unnecessary risk.

Because good strategy isn’t about avoiding movement — it’s about moving with intention.

— Ryan Rincon, Founder at The Wealth Wagon Inc.

Quote of The Day

“The man who moves a mountain begins by carrying away small stones, one deliberate effort at a time.”

— Confucius

Market Update

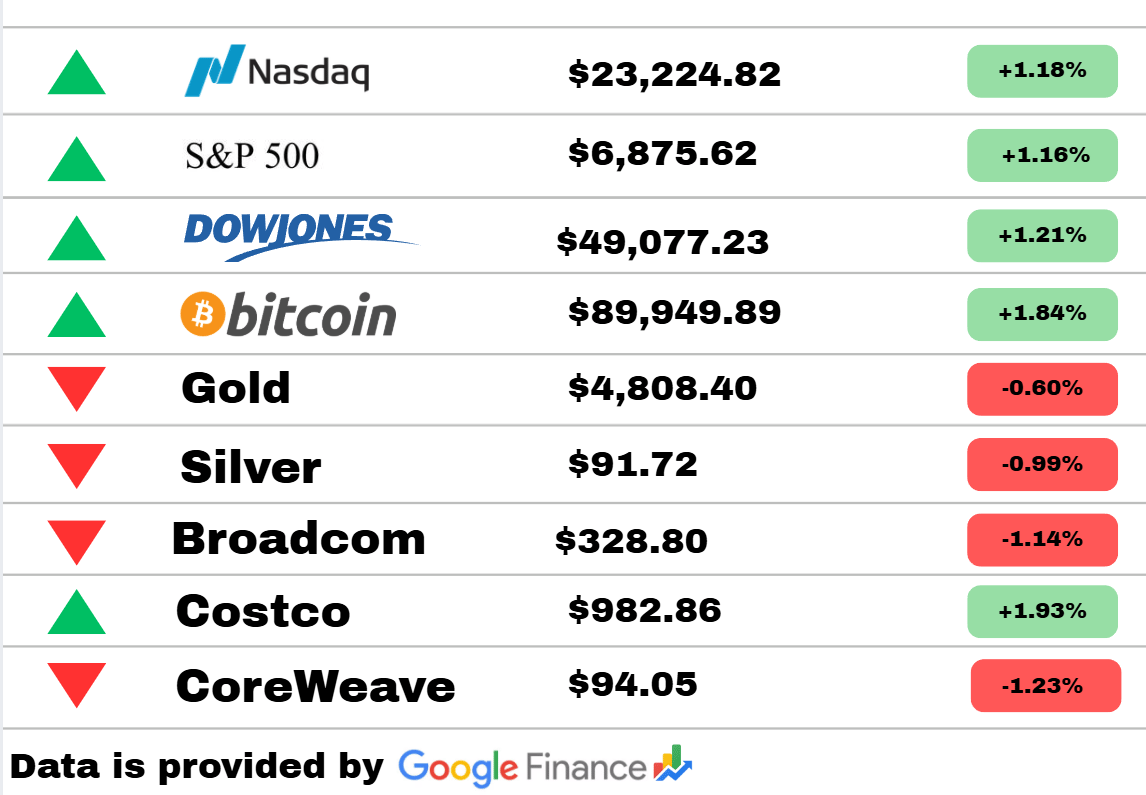

*Market data represents the most recent market close at 5:00pm ET

Market Update: Markets rebounded strongly today, with broad-based gains signaling renewed risk appetite. The Nasdaq climbed 1.18%, while the S&P 500 rose 1.16%, and the Dow Jones led with a 1.21% advance—pointing to solid participation across sectors.

Crypto also joined the rally, with Bitcoin gaining 1.84%, reinforcing momentum in risk-on assets. In contrast, traditional safe havens pulled back as capital rotated out of defensive positioning. Gold fell 0.60% and silver declined 0.99%, reflecting reduced demand for protection amid improving market sentiment.

On the equity front, consumer strength stood out as Costco surged 1.93%, highlighting continued confidence in resilient retail names. Meanwhile, tech-related pressure lingered with Broadcom down 1.14% and CoreWeave slipping 1.23%. Overall, today’s action reflects a decisive shift back toward growth and risk assets, even as select tech names digest recent gains.

PRESENTED BY

How much could AI save your support team?

Peak season is here. Most retail and ecommerce teams face the same problem: volume spikes, but headcount doesn't.

Instead of hiring temporary staff or burning out your team, there’s a smarter move. Let AI handle the predictable stuff, like answering FAQs, routing tickets, and processing returns, so your people focus on what they do best: building loyalty.

Gladly’s ROI calculator shows exactly what this looks like for your business: how many tickets AI could resolve, how much that costs, and what that means for your bottom line. Real numbers. Your data.

World

With Threats to Greenland, Trump Sets America on the Road to Conquest

The administration’s rhetoric toward Greenland has escalated from symbolic pressure to language that alarms allies abroad. Officials and analysts say the posture signals a more aggressive foreign policy mindset. The remarks are fueling concerns about U.S. credibility and long-term strategic stability in the Arctic. Allies are quietly reassessing how seriously to take the threat.

Trump Vows ‘No Going Back’ on Greenland Push

Leaked texts and AI-generated mockups have intensified scrutiny of the administration’s intentions toward Greenland. Trump has doubled down publicly, framing the issue as a matter of national resolve. The episode has raised questions about decision-making processes inside the White House. European leaders are watching closely for concrete next steps.

Trump’s Letter to Norway Should Be the Last Straw

A sharply worded message to Norway has strained an already tense relationship with European partners. Critics argue the communication reflects a broader pattern of diplomatic escalation. Supporters say it reinforces America’s bargaining position abroad. The fallout could complicate cooperation on security and trade.

Economy

Trump Tariff Threats Risk Triggering Global Escalation

Warnings from international officials suggest new tariff threats could spark retaliatory moves across major economies. Markets remain sensitive to any sign of renewed trade conflict. Economists caution that supply chains are less resilient than in past cycles. Even the threat alone is already influencing business decisions.

U.S. Growth May Top 5% as Europe Faces Retaliation Risks

Optimistic projections for U.S. growth contrast with rising concerns across Europe. Officials warn that retaliatory measures could undermine fragile recoveries overseas. Investors are weighing whether strong U.S. data can offset global trade uncertainty. Currency and bond markets have begun to react.

Uncertainty Returns as Trump Trade Threats Resurface

Global financial leaders say familiar patterns of volatility are re-emerging. Past episodes of trade brinkmanship offer a cautionary roadmap. Businesses are once again delaying investment decisions. The renewed uncertainty is testing market confidence early in the year.

Travel

National Harbor Sphere Revenues Could Dwarf Regional Attractions

New projections suggest the National Harbor Sphere could outperform major regional entertainment venues. Supporters argue it would transform tourism and local tax revenue. Critics question infrastructure readiness and long-term demand. The debate highlights growing competition among destination cities.

Equipment Issues Snarl Traffic at O’Hare Airport

Travelers faced widespread delays after technical problems disrupted airport operations. Airlines worked to reroute flights, but congestion lingered through peak hours. Officials said safety was not compromised, though frustrations mounted. Repairs are underway to prevent repeat incidents.

Metro Considers Heavy Rail for Sepulveda Transit Corridor

Transit planners are weighing heavy rail as a long-term solution for a congested corridor. Proponents say it offers greater capacity and reliability than alternatives. Cost and construction timelines remain major hurdles. Public input will shape the final decision.

Today’s Snapshot

Why Telling Your Advisor “Just Keep Me Conservative” Backfires Over Time

This is not about bad advisors.

This is not about risk tolerance questionnaires.

This is not about market timing.

This is about vague mandates — and how ambiguity gets translated into permanent inefficiency.

Most people assume:

“Conservative means safe.”

In practice, conservative often means unexamined drift.

The Core Issue: “Conservative” Is Not an Instruction — It’s an Avoidance

“Conservative” has no operational definition.

It doesn’t specify:

time horizon

income needs

tax sensitivity

liquidity requirements

drawdown tolerance

So advisors default to the safest interpretation for them.

Not necessarily for you.

Where the Quiet Cost Shows Up

1. Inflation Becomes the Invisible Tax

Over time:

purchasing power erodes

real returns shrink

future flexibility declines

Nothing feels risky.

Until years later — when it’s irreversible.

2. Tax Drag Gets Ignored

Conservative portfolios often:

throw off taxable income

generate unnecessary distributions

lack tax-aware placement

The result is steady, quiet tax leakage.

3. Opportunity Cost Compounds Silently

Missed compounding doesn’t send statements.

But it:

narrows future options

increases dependency on savings

limits lifestyle flexibility

Safety today trades away choice tomorrow.

4. Portfolios Drift Without Review

Because nothing looks broken:

reviews get shorter

adjustments get postponed

allocations fossilize

Inertia becomes policy.

Why This Happens So Often

Because ambiguity is comfortable.

it avoids hard conversations

it feels responsible

it minimizes short-term anxiety

But long-term outcomes are built on clarity, not comfort.

What Actually Works Instead

This doesn’t require sophistication.

It requires specific constraints.

Examples:

“Limit drawdowns to X% over Y years”

“Minimize taxable income while preserving growth”

“Prioritize flexibility in 10–15 years”

“Optimize for optionality, not stability”

Specificity forces better decisions.

Thought Of The Day

Progress feels lighter when momentum replaces motivation, systems beat willpower, and you design your environment to support the person you’re becoming.

That’s All For Today

I hope you enjoyed today’s issue of The Wealth Wagon. If you have any questions regarding today’s issue or future issues feel free to reply to this email and we will get back to you as soon as possible. Come back tomorrow for another market update, and snapshot. I hope to see you. 🤙

— Ryan Rincon, CEO and Founder at The Wealth Wagon Inc.

Disclaimer: This newsletter is for informational and educational purposes only and reflects the opinions of its editors and contributors. The content provided, including but not limited to real estate tips, stock market insights, business marketing strategies, and startup advice, is shared for general guidance and does not constitute financial, investment, real estate, legal, or business advice. We do not guarantee the accuracy, completeness, or reliability of any information provided. Past performance is not indicative of future results. All investment, real estate, and business decisions involve inherent risks, and readers are encouraged to perform their own due diligence and consult with qualified professionals before taking any action. This newsletter does not establish a fiduciary, advisory, or professional relationship between the publishers and readers.