January 21, 2026

Welcome Back,

Happy Wednesday, everyone ☀️

Good morning — hope today feels balanced, focused, and off to a calm start.

Here’s a simple question to kick things off: when everything is labeled “emergency,” is anything actually clear?

One bucket can feel tidy… until the moment you really need to know what’s meant for what.

Today’s post looks at why keeping a single emergency account for everything can create confusion — and how a little separation can bring clarity, confidence, and better decision-making.

Because peace of mind often comes from knowing exactly where things stand.

— Ryan Rincon, Founder at The Wealth Wagon Inc.

Quote of The Day

“What you leave behind is not what is engraved in stone monuments, but what is woven into the lives of others through your actions.”

— Pericles

Market Update

*Market data represents the most recent market close at 5:00pm ET

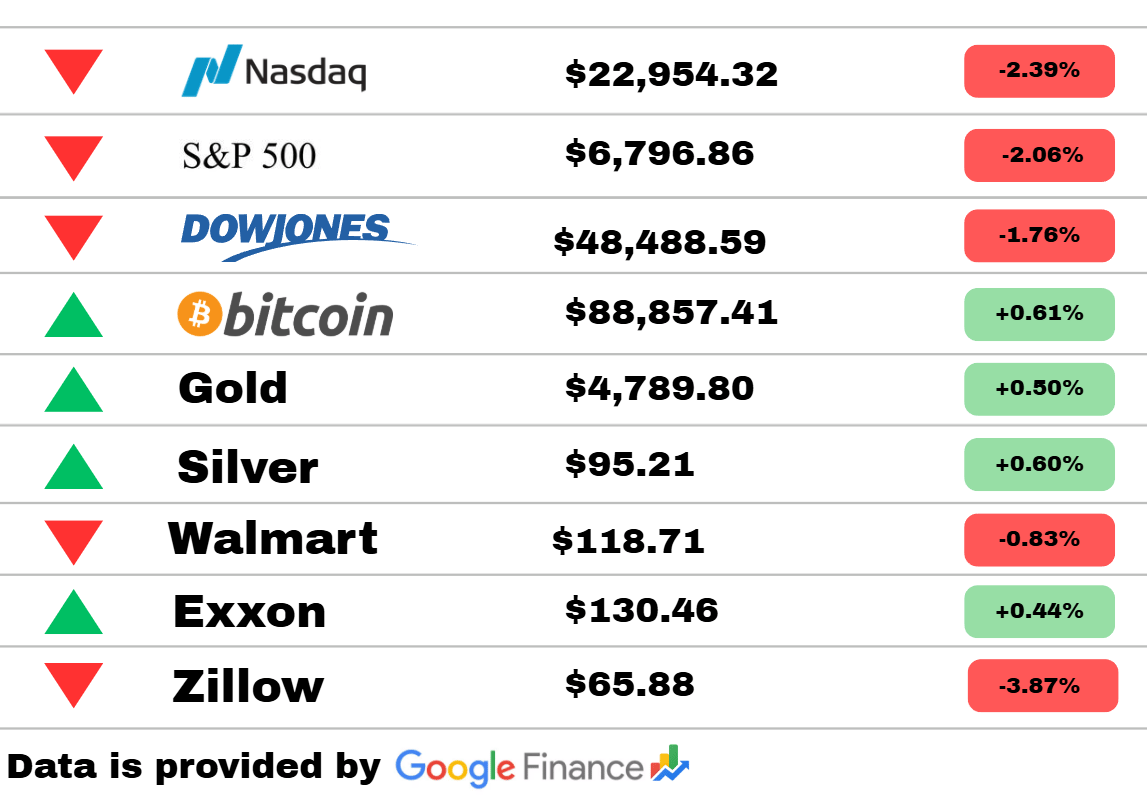

Market Update: Markets saw a sharp selloff today, with all major indexes under heavy pressure. The Nasdaq plunged 2.39%, leading the downside, while the S&P 500 dropped 2.06% and the Dow Jones slid 1.76%, signaling a broad risk-off move as investors pulled back aggressively.

Despite equity weakness, alternative and defensive assets held firm. Bitcoin edged higher by 0.61%, showing relative resilience amid the equity drawdown. Gold climbed 0.50% and silver rose 0.60%, reinforcing their role as safe-haven assets during periods of market stress.

On the stock side, Walmart fell 0.83%, reflecting pressure on defensive retail, while Zillow sank 3.87%, one of the session’s notable laggards. Exxon gained 0.44%, supported by strength in energy prices. Overall, today’s action reflects a decisive shift toward caution, with investors rotating away from growth and into hard assets and select defensive plays.

PRESENTED BY

Introducing the first AI-native CRM

Connect your email, and you’ll instantly get a CRM with enriched customer insights and a platform that grows with your business.

With AI at the core, Attio lets you:

Prospect and route leads with research agents

Get real-time insights during customer calls

Build powerful automations for your complex workflows

Join industry leaders like Granola, Taskrabbit, Flatfile and more.

Finance

Trump targets familiar villain for soaring health costs

The White House is renewing its focus on insurers and middlemen as health care expenses continue to rise nationwide. Officials argue consolidation and opaque pricing structures are driving higher premiums and out-of-pocket costs. Industry groups push back, saying policy uncertainty and regulation are adding pressure instead. The debate is setting up another high-profile clash over health care reform.

Vanguard Total Stock Market ETF Daily Snapshot

The broad U.S. stock market remains relatively stable as investors balance optimism around earnings with caution over interest rates. Large-cap stocks continue to anchor performance while smaller names show more volatility. Trading volumes suggest investors are staying invested but hesitant to take aggressive new positions. Market sentiment remains sensitive to upcoming economic data.

GBP/USD Forex Signal Turns Strongly Bullish

The British pound is gaining momentum as the dollar softens and traders adjust interest-rate expectations. Technical indicators are pointing toward further upside in the near term. Currency markets are reacting to signs of easing inflation pressures and shifting central bank guidance. Short-term volatility remains likely around upcoming economic releases.

Crypto

Bermuda aims to build a fully onchain economy

Bermuda is positioning itself as a major digital asset hub by partnering with large crypto firms to expand blockchain infrastructure. The initiative focuses on payments, tokenization, and regulatory clarity to attract global capital. Officials say the goal is to integrate blockchain into everyday economic activity. The move highlights growing competition among jurisdictions to lead in digital finance.

Strategy adds over 22,000 Bitcoin to holdings

The company has significantly expanded its Bitcoin reserves, reinforcing its long-term bet on digital assets. Executives view the move as a hedge against currency debasement and financial instability. The purchase further cements the firm as one of the largest corporate Bitcoin holders. Markets are closely watching how this strategy impacts the company’s balance sheet.

Crypto scrutiny turns toward Congress

A new investigation raises concerns about lawmakers’ involvement in shaping crypto policy while holding related assets. The report highlights potential conflicts of interest as regulation accelerates. Advocates are calling for clearer disclosure rules and stronger ethics oversight. The issue adds political tension to an already heated regulatory debate.

Business

Netflix stock falls after missing outlook

Shares dropped after the company issued a softer-than-expected forecast despite solid subscriber trends. Investors reacted to slower revenue growth and rising content costs. Management emphasized long-term strategy and global expansion to reassure markets. The stock’s movement reflects broader sensitivity around growth expectations in tech.

Netflix pushes all-cash bid for Warner Bros

The streaming giant has updated its takeover proposal in an effort to strengthen its position. An all-cash offer is seen as a signal of confidence and urgency. Analysts are weighing regulatory hurdles and shareholder resistance. The potential deal could reshape the entertainment industry landscape.

AI, Big Tech, and Trump dominate Davos spotlight

Artificial intelligence and geopolitics are taking center stage at this year’s global gathering. Business leaders are debating regulation, competition, and economic resilience. Political developments in the U.S. are influencing discussions across industries. The tone reflects both optimism about innovation and anxiety about global stability.

Today’s Snapshot

Why Keeping One “Emergency Account” for Everything Is a Mistake

This is not about being under-funded.

This is not about discipline.

This is not about savings rates.

This is about category confusion — and how lumping all “just in case” money together creates avoidable problems.

Most people assume:

“Emergency money is emergency money.”

It isn’t.

The Core Issue: Not All Emergencies Are the Same

Money behaves differently based on why it exists.

An emergency fund might actually be covering:

income gaps

business volatility

tax obligations

medical risk

opportunity capital

Treating all of these as one pile blurs intent.

Blurred intent leads to bad decisions.

Where the Cost Quietly Appears

1. You Raid the Fund for the Wrong Reasons

When everything lives together:

opportunities feel like emergencies

true emergencies compete with wants

discipline erodes under pressure

The fund exists — but not for its original purpose.

2. Tax Surprises Become “Emergencies”

Tax payments aren’t emergencies.

But when tax money isn’t separated:

cash gets spent elsewhere

panic selling occurs

penalties and interest appear

Predictable obligations treated as surprises cost money.

3. Liquidity Mismatch Creates Stress

Different risks need different liquidity:

medical emergencies need instant access

business volatility needs flexibility

opportunity capital needs patience

One account can’t serve all three well.

4. Decision-Making Gets Sloppier Under Pressure

When money has no defined job:

choices become emotional

tradeoffs get muddled

hindsight regret increases

Structure reduces stress.

Why This Feels “Responsible” (But Isn’t)

A single emergency fund feels:

simple

conservative

organized

But simplicity without intention creates fragility.

Thought Of The Day

Long-term fulfillment comes when values guide decisions, patience steadies ambition, and you build a life intentionally instead of reacting to whatever demands attention.

That’s All For Today

I hope you enjoyed today’s issue of The Wealth Wagon. If you have any questions regarding today’s issue or future issues feel free to reply to this email and we will get back to you as soon as possible. Come back tomorrow for another market update, and snapshot. I hope to see you. 🤙

— Ryan Rincon, CEO and Founder at The Wealth Wagon Inc.

Disclaimer: This newsletter is for informational and educational purposes only and reflects the opinions of its editors and contributors. The content provided, including but not limited to real estate tips, stock market insights, business marketing strategies, and startup advice, is shared for general guidance and does not constitute financial, investment, real estate, legal, or business advice. We do not guarantee the accuracy, completeness, or reliability of any information provided. Past performance is not indicative of future results. All investment, real estate, and business decisions involve inherent risks, and readers are encouraged to perform their own due diligence and consult with qualified professionals before taking any action. This newsletter does not establish a fiduciary, advisory, or professional relationship between the publishers and readers.