January 14, 2026

Welcome Back,

Happy Wednesday, everyone ☀️

Good morning — halfway through the week and hopefully feeling a little momentum building.

Here’s something to think about as the day gets going: what feels stable isn’t always what’s most flexible.

A consistent paycheck can feel comforting… but sometimes comfort comes with trade-offs we don’t notice right away.

Today’s post dives into why paying yourself the same amount every month can actually increase taxes and limit flexibility — and how a more thoughtful approach can give you breathing room without sacrificing peace of mind.

Because smart money habits should support your life — not quietly box you in.

— Ryan Rincon, Founder at The Wealth Wagon Inc.

Quote of The Day

“We suffer more often in imagination than in reality. Most limits disappear the moment disciplined action replaces fear.”

— Marcus Aurelius

Market Update

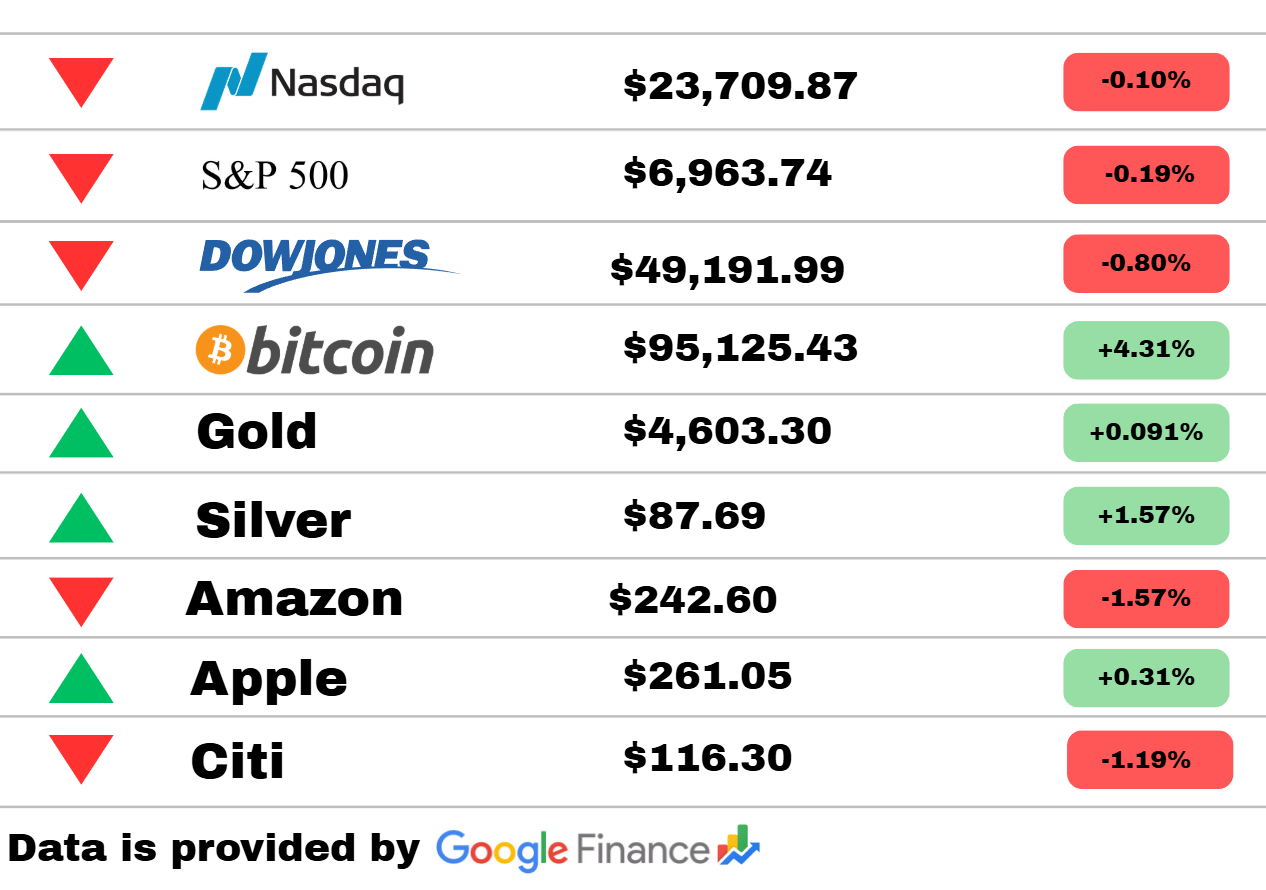

*Market data represents the most recent market close at 5:00pm ET

Market Update: Markets pulled back modestly today as equities paused following recent strength. The Nasdaq slipped 0.10%, while the S&P 500 declined 0.19%, and the Dow Jones fell a sharper 0.80%, reflecting pressure on industrials and financials.

Crypto told a very different story. Bitcoin surged 4.31%, ripping higher above $95K and clearly stealing the spotlight as risk appetite rotated away from traditional equities and into digital assets. The move reinforces strong momentum and renewed speculative interest across the crypto space.

Commodities continued to show resilience. Gold held steady with a modest 0.09% gain, maintaining its elevated levels, while **Silver added 1.57%*, extending its powerful breakout and remaining one of the strongest-performing assets across markets.

On the stock side, Amazon dropped 1.57%, weighing on tech sentiment, while Apple managed a 0.31% gain, providing some stability. Citi slid 1.19%, contributing to broader weakness in financials. Overall, today’s action highlights a rotation environment — equities cooling off, commodities staying firm, and crypto aggressively reclaiming leadership.

PRESENTED BY

Run ads IRL with AdQuick

With AdQuick, you can now easily plan, deploy and measure campaigns just as easily as digital ads, making them a no-brainer to add to your team’s toolbox.

You can learn more at www.AdQuick.com

U.S.

Trump heads to Detroit to refocus speech on the American economy

Donald Trump is set to deliver a speech centered on manufacturing, jobs, and economic nationalism in a key industrial city. The address is expected to highlight trade policy, tariffs, and domestic production. Detroit is being used as a symbolic backdrop for broader economic messaging.

The quest to ‘Make America Fertile Again’ stalls under Trump

Efforts aimed at boosting U.S. birth rates have struggled to gain momentum despite political attention. Analysts say rising housing costs, healthcare expenses, and childcare burdens continue to outweigh policy incentives. The issue highlights the limits of cultural messaging without structural support.

Trump administration to end temporary protected status for Somalis

The administration plans to terminate protections that have allowed many Somali immigrants to remain in the U.S. legally. Officials argue conditions have changed, while advocates warn of humanitarian risks. The move could affect thousands of families already settled in American communities.

Politics

House Republican questions DOJ Powell probe

A senior House Republican criticized the optics surrounding a Justice Department probe involving Powell. Lawmakers say the investigation raises concerns about political influence and transparency. The issue is likely to fuel further oversight hearings.

Global conflict, domestic politics, and economic uncertainty dominate the day’s major developments. Lawmakers and diplomats face mounting pressure on multiple fronts. The pace of events reflects a volatile start to the year.

Musk v Starmer raises question of banning X in the UK

Tensions are rising over whether the UK could restrict or ban X following controversies involving AI-generated content. Government officials are weighing free speech concerns against public safety risks. The dispute underscores growing friction between tech platforms and national regulators.

Finance

Initial Obamacare enrollment drops as subsidies expire

Early enrollment numbers show a sharp decline as insurance subsidies lapse and premiums rise. Many households are reassessing coverage affordability. Experts warn participation may continue falling without policy intervention.

Two growth stocks with big catalysts in 2026

Investors are eyeing select companies with upcoming product launches, regulatory decisions, and expansion plans. Analysts say strong balance sheets and clear revenue drivers set them apart. The focus is on long-term growth rather than short-term market noise.

Vanguard total stock market ETF daily snapshot

The broad-market ETF reflects modest movement as investors digest economic data and policy signals. Diversified exposure continues to appeal to long-term investors. Market participants remain cautious but steady heading deeper into 2026.

Today’s Snapshot

Why Paying Yourself the “Same Amount Every Month” Can Increase Your Taxes and Reduce Flexibility

This is not about payroll mistakes.

This is not about underpaying yourself.

This is not about lifestyle inflation.

This is about rigidity — and how forcing smoothness into income creates avoidable tax and planning friction.

Most owners assume:

“Consistency is smarter and safer.”

In practice, consistency can be expensive.

The Core Issue: Taxes Are Calculated Annually, Not Monthly

Your income doesn’t get taxed evenly across the year.

It gets:

aggregated

stacked

phased

bracketed

Forcing flat monthly pay ignores how tax systems actually work.

And that mismatch creates inefficiency.

Where the Cost Quietly Shows Up

1. You Lock In Income Before the Year Is Clear

When you pay yourself a fixed amount:

you commit to income early

you remove optionality

you can’t respond to surprises

you lose timing control

If revenue drops later, you’ve already pulled income.

If revenue spikes, you may stack income unnecessarily.

Either way, flexibility is gone.

2. Fixed Pay Can Push You Into Worse Tax Years

Business income is rarely smooth.

Some years include:

large contracts

asset sales

windfalls

one-time gains

Fixed pay layered on top can:

push you into higher brackets

eliminate deductions

trigger surtaxes

accelerate phaseouts

You didn’t need more income.

You needed better sequencing.

3. It Reduces Distribution Strategy Options

Variable income allows:

selective distributions

income smoothing across years

better alignment with deductions

intentional tax planning

Flat pay removes those tools.

Once income is taken, it’s taxed.

You can’t “un-take” it later.

4. It Creates False Comfort (and Hidden Risk)

Consistency feels responsible.

But it can hide:

declining margins

tightening liquidity

seasonal dependency

rising expenses

Irregular distributions force awareness.

Fixed pay lets problems drift longer.

Why Advisors Rarely Push Back

Because “pay yourself consistently” sounds prudent.

it feels organized

it’s easy to explain

it reduces admin questions

it fits general advice

But general advice ignores nuance.

And nuance is where money is saved.

What Actually Works Instead

This isn’t about chaos.

It’s about intentional variability.

Common approaches:

modest baseline pay

variable distributions tied to performance

quarterly review adjustments

year-end planning flexibility

This keeps:

income controllable

taxes adaptable

cash responsive

options open

Consistency should exist in planning — not in withdrawals.

Thought Of The Day

Progress accelerates when self-awareness replaces autopilot, long-term vision beats urgency, and you choose intentional action over reacting to everything around you.

That’s All For Today

I hope you enjoyed today’s issue of The Wealth Wagon. If you have any questions regarding today’s issue or future issues feel free to reply to this email and we will get back to you as soon as possible. Come back tomorrow for another market update, and snapshot. I hope to see you. 🤙

— Ryan Rincon, CEO and Founder at The Wealth Wagon Inc.

Disclaimer: This newsletter is for informational and educational purposes only and reflects the opinions of its editors and contributors. The content provided, including but not limited to real estate tips, stock market insights, business marketing strategies, and startup advice, is shared for general guidance and does not constitute financial, investment, real estate, legal, or business advice. We do not guarantee the accuracy, completeness, or reliability of any information provided. Past performance is not indicative of future results. All investment, real estate, and business decisions involve inherent risks, and readers are encouraged to perform their own due diligence and consult with qualified professionals before taking any action. This newsletter does not establish a fiduciary, advisory, or professional relationship between the publishers and readers.