January 13, 2026

Welcome Back,

Happy Tuesday, everyone ☀️

Good morning — hope your day is off to a smooth start and your to-do list feels manageable today.

Here’s a quick thought to get things going: what happens if the thing you rely on most suddenly… pauses?

When money flows easily, it’s easy to forget how many systems are quietly working behind the scenes.

Today’s post looks at how relying on a single payment processor can quietly put your revenue at risk — and why a little redundancy can go a long way toward peace of mind and stability.

Because protecting your income doesn’t always mean earning more — sometimes it just means removing single points of failure.

— Ryan Rincon, Founder at The Wealth Wagon Inc.

Quote of The Day

“It is not that we have a short time to live, but that we waste much of it. Life is long if you know how to use it.”

— Seneca

Market Update

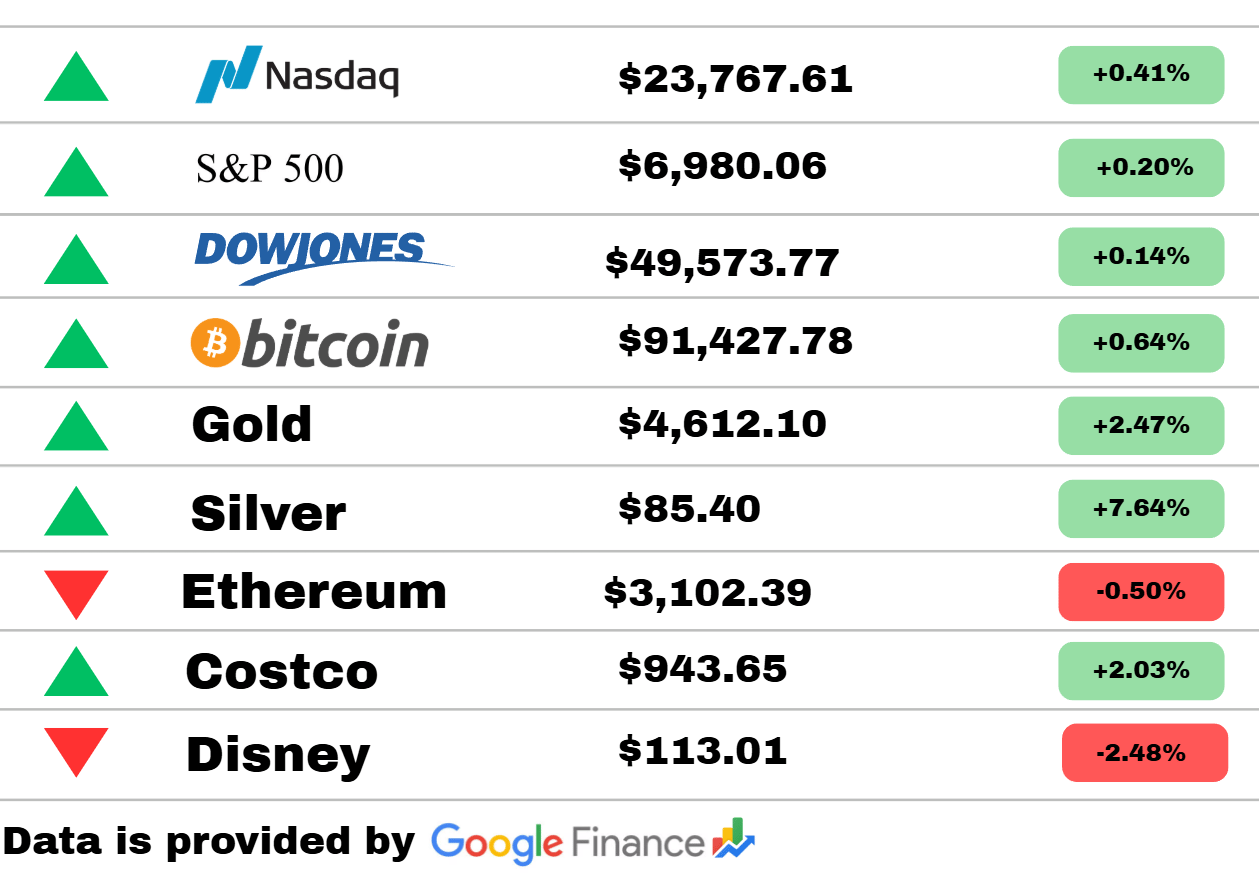

*Market data represents the most recent market close at 5:00pm ET

Market Update: Markets continued grinding higher today, showing steady confidence rather than explosive momentum. The Nasdaq led modestly with a 0.41% gain as tech remained supported, while the S&P 500 added 0.20%, signaling broad but cautious participation. The Dow Jones also inched up 0.14%, reflecting stability in blue-chip names.

Crypto showed mixed action — Bitcoin climbed 0.64%, pushing back above the $91K level and reinforcing its short-term strength, while Ethereum slipped 0.50%, hinting at rotation within digital assets rather than broad weakness.

Commodities were the clear winners once again. Gold surged 2.47% and Silver exploded higher by 7.64%, extending their breakout momentum and underscoring growing demand for hard assets amid shifting macro expectations.

On the equity side, Costco jumped 2.03%, continuing to benefit from defensive-consumer strength, while Disney dropped 2.48%, weighing on discretionary sentiment. Overall, today’s market action suggests a controlled risk-on environment, with capital flowing into commodities and selective equities rather than speculative excess.

PRESENTED BY

Run ads IRL with AdQuick

With AdQuick, you can now easily plan, deploy and measure campaigns just as easily as digital ads, making them a no-brainer to add to your team’s toolbox.

You can learn more at www.AdQuick.com

Economy

Nigeria’s ‘Special Economic Zones’ earnings hit $500m

Nigeria’s special economic zones generated strong revenue growth as manufacturing, logistics, and export activity expanded. Officials credit improved infrastructure, tax incentives, and foreign investment interest. The zones are increasingly viewed as a model for broader industrial development.

China’s solar firms face monopoly accusations

China’s once hyper-competitive solar industry is now under scrutiny as regulators and rivals raise monopoly concerns. Consolidation has left a handful of major players dominating pricing and supply chains. The shift could reshape global solar markets and affect export pricing.

Australia, NZ dollars firm as greenback falters

The Australian and New Zealand dollars strengthened as domestic economic data surprised to the upside. A softer U.S. dollar added momentum to the move. Traders see regional resilience offsetting broader global uncertainty.

Finance

Marrying for health insurance? ACA costs force hard choices

Rising insurance premiums are pushing some Americans to consider marriage primarily for health coverage access. The situation highlights growing strain in the individual insurance market. Experts warn these financial pressures may distort personal decisions.

Gold price rises above $4,600 after Powell subpoenas

Gold surged as legal developments involving central bank leadership rattled markets. Investors rushed toward safe-haven assets amid policy uncertainty. Analysts say continued volatility could keep precious metals elevated.

XRP outperformance could extend into 2026

XRP has gained momentum as regulatory clarity and payment-use adoption improve. Analysts point to liquidity growth and institutional interest as key drivers. The trend suggests XRP may outperform broader crypto markets if conditions hold.

Science

This dead star with a glowing shock wave shouldn’t exist

Astronomers have observed a stellar remnant displaying energy patterns that defy current models. The discovery challenges assumptions about how stars collapse and dissipate energy. Researchers say it could rewrite parts of stellar evolution theory.

New gravity theory could explain cosmic acceleration

Scientists have proposed an alternative gravity model that removes the need for dark energy. The theory suggests cosmic expansion may result from overlooked gravitational effects. If validated, it would fundamentally alter modern cosmology.

Fueling research in nuclear thermal propulsion

Researchers are advancing nuclear thermal propulsion systems that could dramatically cut travel time to deep-space destinations. The technology offers higher efficiency than conventional rockets. Officials see it as a key step toward crewed Mars missions.

Today’s Snapshot

How Relying on One Payment Processor Quietly Puts Your Revenue at Risk

This is not about fraud.

This is not about high chargebacks.

This is not about shady industries.

This is about structural dependency — and how most businesses unknowingly hand control of their revenue to a single third party.

Most owners assume:

“If payments are processing, we’re fine.”

That assumption is fragile.

The Core Issue: You Don’t Control the Money Until It Settles

When a customer pays you, the money does not immediately belong to you.

It belongs to:

the processor

the acquiring bank

the card network

Until settlement clears, your revenue is conditional.

Most businesses forget this — until it matters.

Where the Real Risk Shows Up

1. Sudden Reserve Holds (Even for “Healthy” Businesses)

Processors can, and do:

impose rolling reserves

delay settlements

hold percentages of revenue

freeze accounts temporarily

Triggers include:

rapid growth

seasonal spikes

new product launches

unusually large transactions

changes in customer behavior

None of these mean you did anything wrong.

They just look risky to an algorithm.

2. Revenue Appears on Paper — But Not in Your Bank

This is where panic starts.

Books show:

strong sales

rising revenue

healthy margins

But the bank shows:

delayed deposits

partial settlements

missing cash

You didn’t lose customers.

You lost access.

Accounting says you’re profitable.

Reality says you can’t pay bills.

3. One Processor = One Point of Failure

When all payments flow through one system:

disputes compound

freezes cascade

support queues slow resolution

escalation paths disappear

You’re not a client.

You’re a ticket number.

And revenue pauses while you wait.

4. Switching Under Pressure Is Almost Impossible

Most owners think:

“If there’s an issue, I’ll just switch.”

In reality:

underwriting takes time

new processors require history

migrations disrupt customers

held funds don’t move with you

Once a freeze happens, leverage disappears.

You’re negotiating after dependency is exposed.

Why This Rarely Gets Addressed

Because everything works… until it doesn’t.

no warning emails

no red flags

no gradual degradation

no accountability

Processors don’t owe you continuity.

They owe themselves risk reduction.

What Actually Works (Without Creating Chaos)

You don’t need complexity.

You need redundancy.

Common low-friction moves:

maintain a secondary processor

route a small % of transactions elsewhere

test settlement timing regularly

avoid routing 100% of revenue through one provider

The goal isn’t optimization.

It’s survivability.

Redundancy doesn’t increase profit —

it prevents catastrophic interruption.

Who This Hurts Most

This shows up hardest for:

online businesses

subscription models

agencies and service firms

ecommerce brands

high-growth companies

Ironically, growth increases risk here.

Success looks suspicious to automated systems.

Thought Of The Day

Real momentum builds when clarity replaces chaos, ownership beats excuses, and you commit daily to choices that your future self will quietly thank you for.

That’s All For Today

I hope you enjoyed today’s issue of The Wealth Wagon. If you have any questions regarding today’s issue or future issues feel free to reply to this email and we will get back to you as soon as possible. Come back tomorrow for another market update, and snapshot. I hope to see you. 🤙

— Ryan Rincon, CEO and Founder at The Wealth Wagon Inc.

Disclaimer: This newsletter is for informational and educational purposes only and reflects the opinions of its editors and contributors. The content provided, including but not limited to real estate tips, stock market insights, business marketing strategies, and startup advice, is shared for general guidance and does not constitute financial, investment, real estate, legal, or business advice. We do not guarantee the accuracy, completeness, or reliability of any information provided. Past performance is not indicative of future results. All investment, real estate, and business decisions involve inherent risks, and readers are encouraged to perform their own due diligence and consult with qualified professionals before taking any action. This newsletter does not establish a fiduciary, advisory, or professional relationship between the publishers and readers.