August 22, 2025

Welcome Back,

Happy Friday, friends!

Good morning 🌞—you made it to the end of the week, and that deserves a little victory dance (even if it’s just a subtle chair wiggle while sipping your coffee).

Here’s a question to kick things off: if you had three magic levers that could make your financial life easier, which would you pull first?

Well, here’s the good news—today’s post is all about The 3 Levers of Wealth Nobody Talks About (but absolutely should). They’re simpler than you think, and you don’t need a trust fund, a unicorn startup, or a winning lottery ticket to make them work for you.

So, let’s wrap up this week by exploring the moves that quietly build wealth in the background—so you can focus on living your life out loud.

— Ryan Rincon, Founder at The Wealth Wagon Inc.

Quote of The Day

“Risk comes from not knowing what you’re doing.”

– Warren Buffett

Market Update

*Market data represents the most recent market close at 5:00pm ET

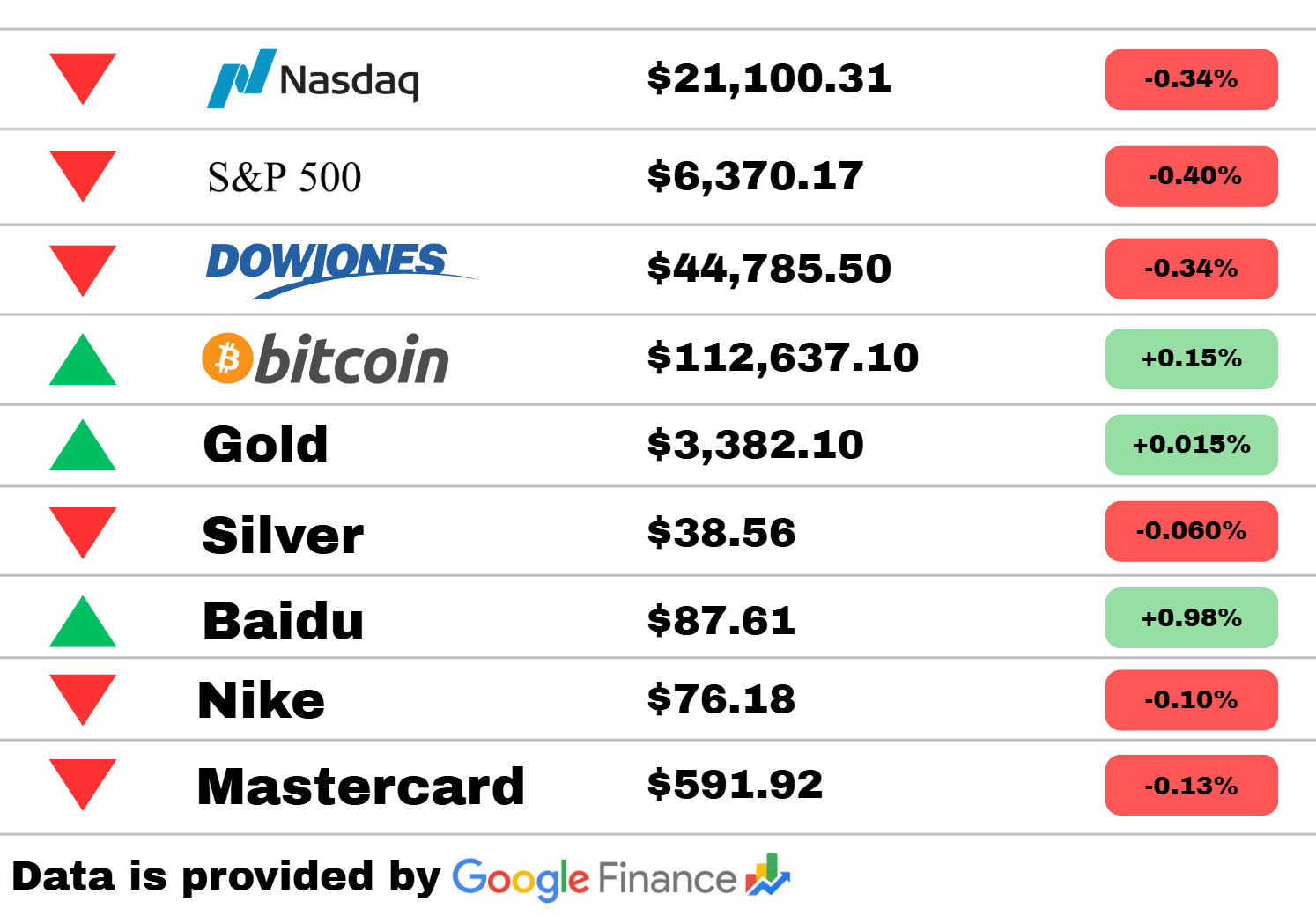

Market Update: The Nasdaq slipped 0.34%, and the S&P 500 wasn’t far behind with a 0.40% dip. Even the Dow Jones joined the slump, easing down 0.34% — not exactly the pep talk investors were hoping for.

Over in the world of digital gold, Bitcoin perked up a touch, climbing 0.15% and keeping its impressive six-figure price tag. Gold itself barely blinked with a 0.015% uptick, while silver slid slightly, showing that not every precious metal is feeling shiny these days.

Stock-wise, Baidu was the overachiever of the day, popping nearly 1%, while Nike and Mastercard took small steps backward — think minor scuffs rather than a full stumble.

Overall? The markets are treading water, waiting for a reason — any reason — to pick a real direction.

PRESENTED BY DELVE

Time to change compliance forever.

We’re thrilled to announce our $32M Series A at a $300M valuation, led by Insight Partners!

Delve is shaping the future of GRC with an AI-native approach that cuts busywork and saves teams hundreds of hours. Startups like Lovable, Bland, and Browser trust our AI to get compliant—fast.

To celebrate, we’re giving back with 3 limited-time offers:

$15,000 referral bonus if you refer a founding engineer we hire

$2,000 off compliance setup for new customers – claim here

A custom Delve doormat for anyone who reposts + comments on our LinkedIn post (while supplies last!)

Thank you for your support—this is just the beginning.

👉 Get started with Delve

U.S.

Trump’s Ideal America Leaves No Room for Diversity

In former President Trump’s vision of America, diversity and inclusion take a back seat, sparking heated national debate. Supporters argue it preserves traditional values, while critics warn it marginalizes minority communities. The discussion reflects deeper divides as the country struggles with identity and polarization.

Canadian Tourism to U.S. Plummets

New data reveals a sharp decline in Canadian visitors to the United States this year, impacting travel and retail industries. Analysts point to stricter border rules, weaker currency values, and changing travel habits. Businesses reliant on cross-border tourism are bracing for continued revenue drops.

Tariffs Push U.S. Businesses Into ‘Survival Mode’

Many American businesses are reeling from tariffs introduced during Trump’s tenure, with small and mid-sized firms hardest hit. Reduced margins and higher costs are forcing some companies to cut jobs or close entirely. Economists caution that these pressures could slow broader economic growth.

World

Jaber Jehad Badwan / Wiki Commons

Gaza Offensive Could Be ‘Death Sentence’ for Hostages

Families of Israeli hostages are voicing fear as a planned Gaza City offensive approaches. While military leaders say the operation is critical to weaken militant networks, relatives worry it puts innocent lives in jeopardy. Diplomats are scrambling for alternative solutions as tensions escalate.

Xi Jinping’s Rare Visit to Tibet Signals Power and Control

President Xi’s visit to Tibet highlights Beijing’s assertion of control and signals unity in the region. The move, rarely seen by Chinese leaders, also responds to international criticism over human rights policies. Analysts see it as a strategic display of both domestic authority and global strength.

UK Councils Fight Government Over Asylum Hotels

Labour-led councils in the UK are launching legal challenges against the government’s use of hotels for asylum seekers. Local leaders argue the system is unsustainable and strains community resources. The dispute underscores mounting tensions over migration policy and resource allocation.

Science

Rare ‘Black Moon’ to Occur This Weekend

A rare celestial event, the “black moon,” will take place this weekend but won’t be visible to the naked eye. Scientists note it’s the second new moon in a single month, affecting tidal patterns and astronomical calculations. The event fascinates astronomers despite its invisibility.

Supernova Study Unveils New Insights

An international team of scientists has found silicon and sulfur elements in the core of a supernova. The discovery helps explain how heavy elements form and distribute throughout the universe. It also provides critical data for refining stellar evolution models.

Hidden Moon Discovered Orbiting Uranus

The James Webb Space Telescope has uncovered a previously unknown moon orbiting Uranus. Researchers believe the finding could reshape understanding of the planet’s complex satellite system. Follow-up observations are planned to analyze its composition and orbital patterns.

Technology

Google Unveils Full Pixel Hardware Lineup for 2025

Google introduced its latest Pixel devices at the “Made by Google” event, with upgrades spanning smartphones, tablets, and wearables. Enhanced AI capabilities and better device integration drew significant attention from tech enthusiasts. The ambitious lineup sets a new bar for the company’s ecosystem.

Gemini AI Coming Soon to Android Auto and Google TV

Google teased upcoming Gemini AI updates for Android Auto and Google TV, promising smarter voice controls and improved recommendations. The rollout, expected within weeks, is anticipated to deliver more intuitive user experiences. Early reactions from testers are highly positive.

Pixel 10 Will Flag AI-Edited Images

The new Pixel 10 phones will feature technology to detect and label AI-edited images. Google says the feature aims to promote transparency and combat misinformation. Privacy advocates, however, warn of potential risks in how the data might be used.

Business & Economy

Cracker Barrel Stock Tanks After Logo Controversy

Cracker Barrel’s unveiling of a redesigned logo has backfired, triggering backlash from loyal customers and branding experts alike. The negative response caused a sharp drop in stock value. The incident highlights the delicate balance brands must strike during modernization efforts.

Housing Market Shows Signs of Stabilizing

July housing data suggests home sales and prices are approaching an inflection point. Analysts believe this could ease pressure on buyers, though rising interest rates remain a concern. The shift may indicate a cooling market after years of rapid price growth.

Markets Suffer Losses Amid Economic Uncertainty

The Dow and S&P 500 faced another day of heavy losses, driven by earnings reports and economic uncertainty. Major retailers, including Walmart, reported weaker performance, fueling investor anxiety. Experts warn that volatility may persist as markets adjust to shifting consumer behavior and policy signals.

Today’s Snapshot

The 3 Levers of Wealth Nobody Talks About (But Everyone Should Pull)

You’ve probably heard the usual wealth-building advice:

Save more. Spend less. Invest early.

All good tips. But here’s the thing: wealth isn’t just about cutting lattes or dollar-cost-averaging into an index fund.

True wealth — the kind that buys freedom, security, and choices — comes from knowing how to pull the right levers at the right time.

Let’s talk about the three wealth levers that most people ignore — and how you can start using them today.

1. The Income Lever: Grow the Pie Before You Slice It

Most people obsess over budgets. They treat income like it’s fixed, then fight over the scraps.

But here’s the secret: growing your income is the fastest way to change your financial life.

Think about it:

Saving an extra $300 a month is great.

Earning an extra $3,000 a month? Life-changing.

How to Pull This Lever

Negotiate your paycheck – Even a 5-10% raise compounds massively over a decade.

Start a micro-side hustle – Freelance, consult, create digital products, or sell a skill online.

Level up your skills – Certifications, online courses, or even better networking can position you for higher-paying roles.

Quick mindset shift: Stop asking, “How do I save more?”

Start asking, “How do I make my skills too valuable to ignore?”

2. The Investing Lever: Get Your Money to Work Harder

If income is your offense, investing is your defense — the quiet engine that builds wealth in the background.

Here’s what most people miss: it’s not just about where you invest, but how you think about investing.

The Three Buckets

Safe & Steady:

Index funds, bonds, or stable dividend stocks.

Goal: protect and slowly grow your base.

Growth Plays:

Higher-risk equities, REITs, or sector-specific ETFs.

Goal: build real wealth over 5–10 years.

Asymmetric Bets:

Startups, angel investing, or even crypto (with caution).

Goal: risk a little for the chance to make a lot.

The trick? Never confuse your “safe” bucket with your “betting” bucket. Keep your foundation steady, then use calculated risks to accelerate growth.

3. The Ownership Lever: Stop Renting Your Life

Here’s the harsh truth:

Employees rarely build real wealth. Owners do.

Ownership is where compounding goes into beast mode.

Ways to Become an Owner

Equity in your job: Negotiate stock options or profit sharing.

Start a small business: Doesn’t have to be a unicorn — even a small online brand or consulting practice builds leverage.

Invest in other owners: Buy shares in businesses, whether through the stock market or private deals.

Build intellectual property: Courses, e-books, or even a personal brand are digital assets that keep paying you.

Think of ownership as planting trees. They don’t bear fruit overnight — but in five, ten, or twenty years? You’ll have a forest.

Why These Levers Work Together

Here’s where it gets fun:

These levers don’t just work individually. They multiply each other.

Use extra income to invest more.

Use investments to buy ownership stakes.

Use ownership profits to reinvest and build more income streams.

That’s how people quietly go from “doing okay” to generational wealth without flashy lottery wins or risky gambles.

Common Traps to Avoid

Even smart people fall into these traps:

Lifestyle creep: You earn more but somehow… have nothing left to invest.

Over-concentration: Betting everything on one job, one stock, or one market.

Analysis paralysis: Spending so much time “learning” that you never actually pull a lever.

Here’s your antidote: simplicity and action.

Take one step. Then another. Wealth is built brick by brick.

A 90-Day Action Plan

Want to make this real? Try this:

Month 1: Audit & Awareness

Track where your income, savings, and investments stand.

Identify one skill or opportunity to grow your income.

Month 2: Set Up the Machine

Automate a fixed % of income into investments.

Open a separate account for any side-hustle or equity-building income.

Month 3: Start the Ownership Journey

Negotiate equity at work or start a small project that could become an asset.

Make your first “growth” or “asymmetric” investment — even if it’s small.

The Real Payoff: Freedom

At the end of the day, this isn’t about the number in your bank account.

It’s about freedom.

The freedom to take a sabbatical without stress.

The freedom to say “no” to toxic clients or jobs.

The freedom to take care of family, travel, or fund causes you believe in.

Pull these levers consistently, and that kind of freedom stops being a dream. It becomes a timeline.

Final Thought

Most people think building wealth is about working harder.

It’s not. It’s about working smarter — and pulling the right levers in the right order.

Grow your income.

Invest wisely.

Own assets.

Do that for a decade, and you’ll look back one day and wonder why you ever stressed about saving $5 on coffee.

Fun Stuff

🕵️ Riddle Me This

I speak without a mouth, and hear without ears. I have no body, but I come alive with wind. What am I?

🏢 Guess the Company Trivia

This company’s original name was Backrub, and it started in a garage. Today, it’s one of the world’s most valuable businesses.

🤯 Wild & Wacky Business Fact

The inventor of the Pringles can was buried in one. Yes, Fred Baur’s ashes were partially placed in a Pringles can after his death in 2008. 😲

⚖️ Would You Rather…

Would you rather earn $1 million instantly but never work again, OR work your dream job forever but never make more than $80,000/year?

*Answers at the bottom

Thought of The Day

Life is a balance of patience and boldness. Sometimes you need to wait; other times, you need to jump. Wisdom is knowing which is which.

Answers

Riddle - Answer: An echo. 🌫️

Guess the Company - Answer: Google. 🔍

That’s All For Today

I hope you enjoyed today’s issue of The Wealth Wagon. If you have any questions regarding today’s issue or future issues feel free to reply to this email and we will get back to you as soon as possible. Come back tomorrow for another market update, and snapshot. I hope to see you. 🤙

— Ryan Rincon, CEO and Founder at The Wealth Wagon Inc.

Disclaimer: This newsletter is for informational and educational purposes only and reflects the opinions of its editors and contributors. The content provided, including but not limited to real estate tips, stock market insights, business marketing strategies, and startup advice, is shared for general guidance and does not constitute financial, investment, real estate, legal, or business advice. We do not guarantee the accuracy, completeness, or reliability of any information provided. Past performance is not indicative of future results. All investment, real estate, and business decisions involve inherent risks, and readers are encouraged to perform their own due diligence and consult with qualified professionals before taking any action. This newsletter does not establish a fiduciary, advisory, or professional relationship between the publishers and readers.